“I just dropped in to see what condition my condition was in” (By Kenny Rogers & The First Edition, 1967) When reviewing the current state of the global economy and investment markets , we recommend focusing on market signals and weeding out market noise.

Source: A Quarterly Economic and Market Outlook in 10 Charts or Less

We believe the five primary economic and market signals that may provide perspective on where we go from here are GDP growth, earnings, interest rates, inflation and Central Bank policy.

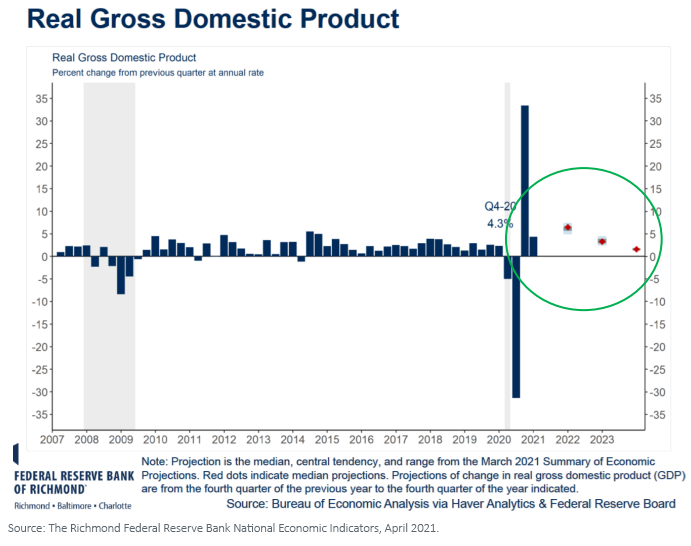

GDP Growth

Global growth is expected to accelerate over the course of 2021. The current Wall Street Journal Economic Forecast Survey calls for a U.S. Q1 GDP growth rate of 4.9% and a Q2 estimate of a whopping 7.0%. The Richmond Federal Reserve Bank is also calling for strong growth over the next 2–3 years.

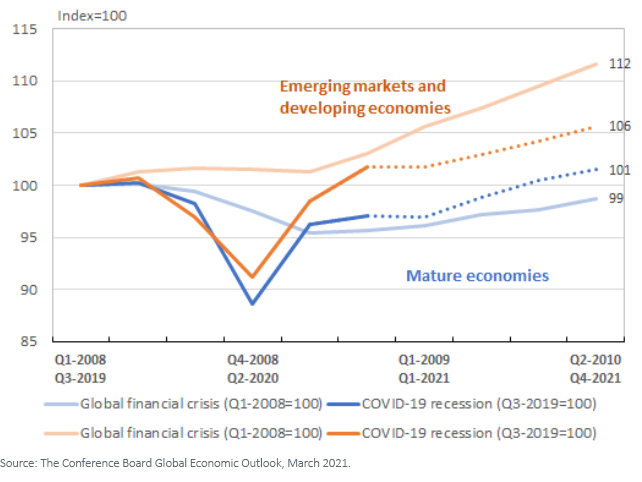

Economic growth outside the U.S. is expected to be even higher, especially in emerging and developing economies.

Translation: A positive environment for “risk-on” assets and supportive of our “emerging markets” investment theme for 2021.

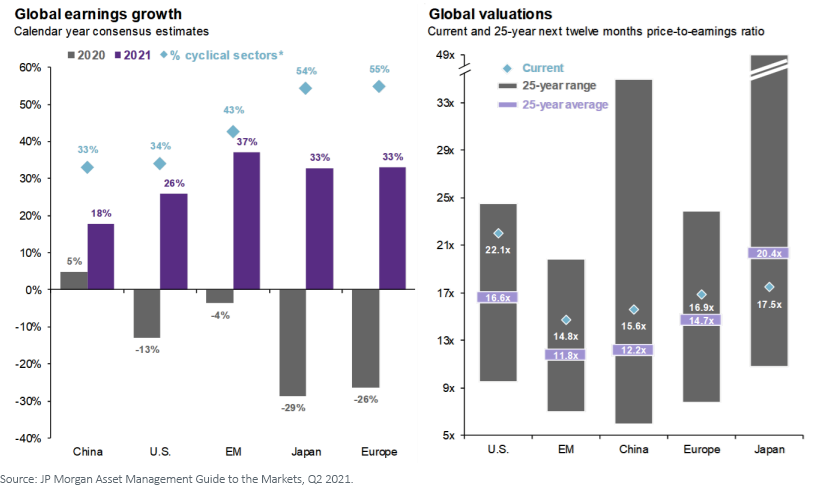

Earnings

Earnings growth is expected to be strong as we move through 2021, especially in cyclical sectors, as the global economy re-expands.

Translation: A positive environment for “risk-on” assets and supportive of our strategic global diversification philosophy, as well as our 2021 investment theme of “cyclical rotation” (i.e., factors that tend to perform well during expansionary economic regimes—small cap, value and EM).

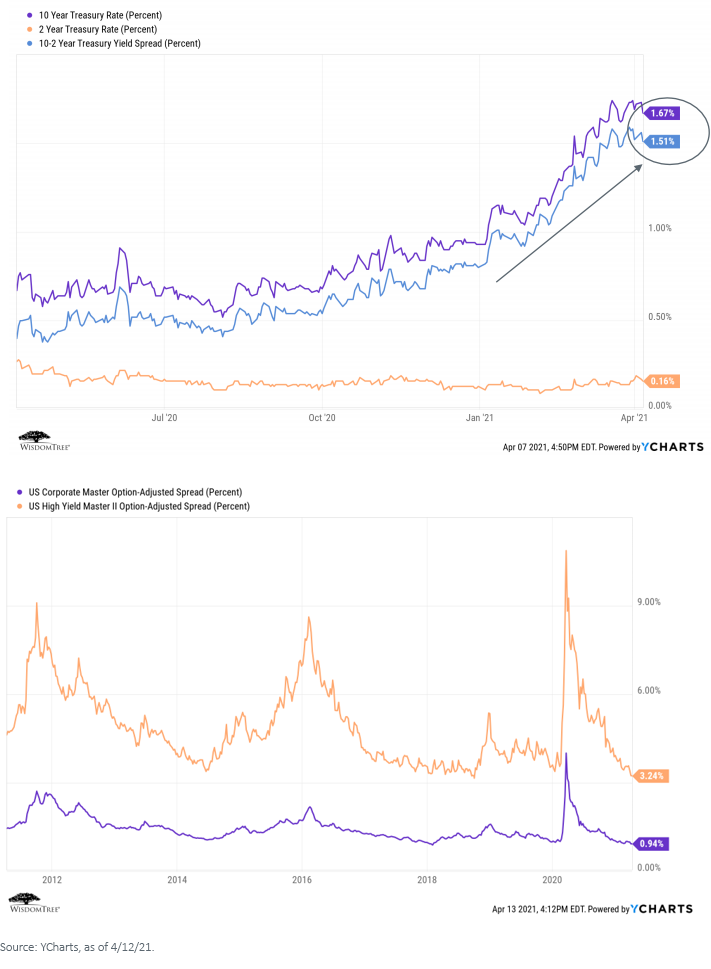

Interest Rates and Spreads

We maintain our outlook that (a) rates will grind higher from here as the economy improves and inflation picks up and (b) the yield curve will continue to steepen, but (c) we remain in a generally “lower for longer” rate environment. In addition, credit spreads are at tight levels we have rarely seen over the past 10 years.

This will continue to make fixed income a difficult place to generate yield in a risk-controlled manner.

Translation: We maintain our positioning of being under-weight in duration and over-weight in credit, with a focus on quality security selection, especially in high yield. This also plays into our “quality and income” investment theme for 2021.

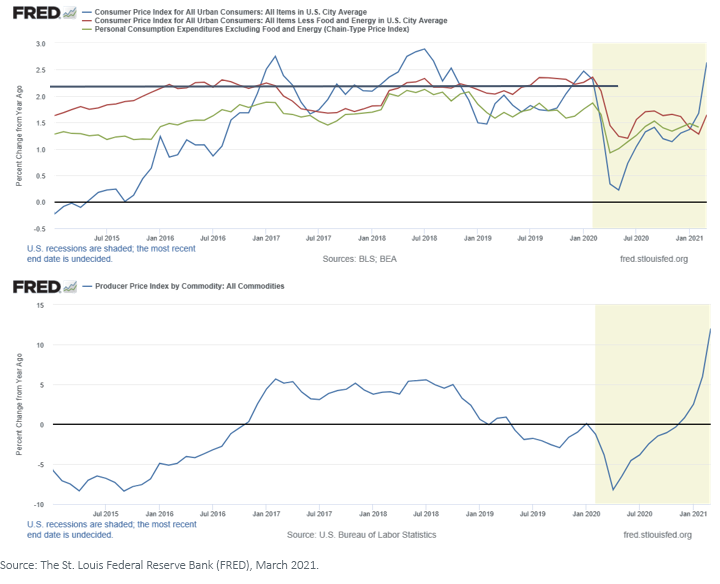

Inflation

While the “headline” inflation levels remain under control, there are distinct signs that inflation is reappearing, especially in input costs (as measured by the Producer Price Index). This will be reflected in higher inflation rates as we move through 2021.

- New Store Stock

- Rivan, Maria (Author)

- English (Publication Language)

- 208 Pages - 04/14/2020 (Publication Date) -...

- Elevate Your Vision : An Enhanced Vision Board...

- Experience a new level of quality with our...

- Our vision board kit for women offers hand-picked,...

- Whether it’s a gift vision board for teens,...

- At Lamare, our mission is to help women plan and...

- National Geographic Special - 2017-1-20 SIP...

- English (Publication Language)

- 128 Pages - 01/20/2017 (Publication Date) -...

Translation: A generally positive environment for “risk-on” assets and very supportive of our “reflation” investment theme for 2021.

Central Bank Policy

While the U.S. Fed continues to signal that it will remain “accommodative” into the foreseeable future, we are beginning to see increased divergence of opinion as to when it will be appropriate to begin raising rates again. James Bullard, president and CEO of the St. Louis Fed and a voting member of the Federal Open Market Committee (FOMC), recently went on record saying that the Fed “may” consider “tapering” once the U.S. COVID-19 vaccination rate reaches 75% (which is expected later this summer).Original Post>

Outside the U.S., we see an increasing number of central banks (especially in emerging markets) moving to raise rates as inflation fears pick up.

Translation: A generally positive environment for “risk-on” assets, though this increasing divergence of global central bank policy bears watching.

The “Known Unknowns”

While the market signals we follow generally point to a constructive and “risk-on” economic and market environment for the rest of 2021, conditions are always subject to exogenous events. The ones we can identify but not foresee the outcomes to we refer to as “known unknowns.”

- Amazon Kindle Edition

- Baldacci, David (Author)

- English (Publication Language)

- 487 Pages - 04/16/2024 (Publication Date) - Grand...

- Amazon Kindle Edition

- Hannah, Kristin (Author)

- English (Publication Language)

- 472 Pages - 02/06/2024 (Publication Date) - St....

- Amazon Kindle Edition

- Elston, Ashley (Author)

- English (Publication Language)

- 348 Pages - 01/02/2024 (Publication Date) - Pamela...

As we write this, the known unknowns we can identify include:

- The outcome of ongoing additional infrastructure/fiscal stimulus

- The impact of anticipated increases to taxes and regulation in the U.S.

- The longer-term impact of massive increases in U.S. governmental debts and deficits

- The future direction of the relationships between the U.S. and China, Iran and Russia

- The evolution of both COVID-19 variants and vaccination rates/effectiveness

Summary

When focusing on what we believe are the primary market signals, the “condition our condition is in” seems healthy, and we maintain our position that 2021 will enjoy a generally positive economic and market environment. But there are some significant known unknowns out there that could dramatically influence global conditions, either positively or negatively.

So, while we are optimistic in our outlook for 2021, we continue to recommend focusing on a longer-term time horizon and the construction of “all-weather” portfolios, diversified at both the asset class and risk factor levels.