Main Thesis & Background

The purpose of this article is to evaluate the broader emerging markets equity market, with a specific look at the Schwab Emerging Markets Equity ETF (NYSEARCA:SCHE). This is a passive ETF for emerging markets (EM) exposure, and one I have dabbled with in the past.

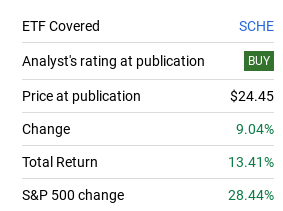

I actually covered this fund just over a year ago because – when I do take on EM holdings – it is through passive ETFs as a way to stay diversified within this theme. Back in 2023, I saw gains ahead for this fund, and I was right in hindsight. However, its under-performance compared to the S&P 500 is noticeable, so I am hesitant to take a victory lap on this call:

Fund Performance (Seeking Alpha)

With a fresh year almost halfway through and a double-digit gain in the bank for SCHE, I thought it was time to reassess if a “buy” rating is still appropriate. After some thought, I actually see a few headwinds that suggest to me this is not the best place to park new cash going forward. I see better opportunities elsewhere and believe developed markets offer a more attractive risk-reward. Therefore, I am downgrading my outlook to “hold”, and will explain why below.

China Has Fallen Harder, Not Rebounded

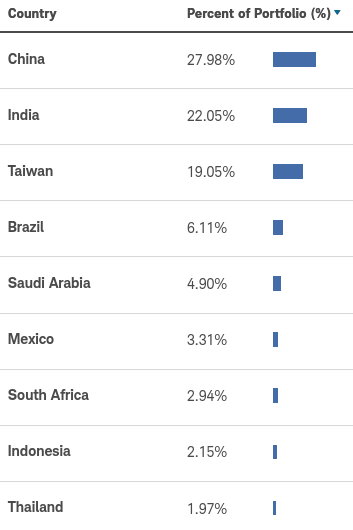

When looking at SCHE, one has to remember that while they are getting EM as a whole, that means a whole lot of China. This country continues to dominant EM indices (although that dominance has been waning) and represents almost 28% of total fund assets at the moment:

SCHE's Country Exposure (Schwab)

I will spend some time later in this review on why I don't love this exposure right now, but for the time being I just want to emphasize this has been a key reason for the under-performance. Yes, SCHE has delivered a pretty strong return over the past year. But the market as a whole has rallied hard. When I see developed markets – like the US through the S&P 500 – beating SCHE so handsomely, it makes me question why.

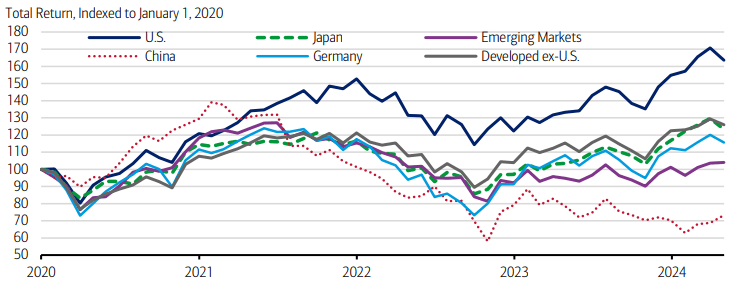

China is a big reason for that. The equity market there took it on the chin when the Covid-19 pandemic hit and immediately after it – just like everywhere else. But the difference has been in the rebound. After leading markets in early 2021, China has slipped behind most major exchanges due to a variety of factors. The conclusion here is China would have been a drag on portfolios over the last few years:

Multi-Year Returns (By Index) (Merrill Lynch Capital Markets)

As you can see, it is Chinese equities that are clearly under-performing the rest of the world. EM as a whole has seen much better performance in 2023 and 2024 which affirms my point that Chinese exposure is holding back SCHE. While that may or may not continue in the second half of the year, it is important to reflect on how this one nation's fortunes can impact this “diversified” ETF. This is something readers should weigh very carefully before deciding if they want to own this fund.

Developed Markets Doing Just Fine

Another reason I am downgrading my outlook on SCHE has to do with performance in other corners of the market. As we know, we don't invest in a vacuum. When you decide to buy any one thing, you are foregoing the opportunity to buy another. This opportunity cost is why I view EM so carefully. I want to be very confident that not only can SCHE perform well, but that the underlying EM securities have a chance of out-performing developed world equities. Otherwise, it is hard for me to make the case to buy them.

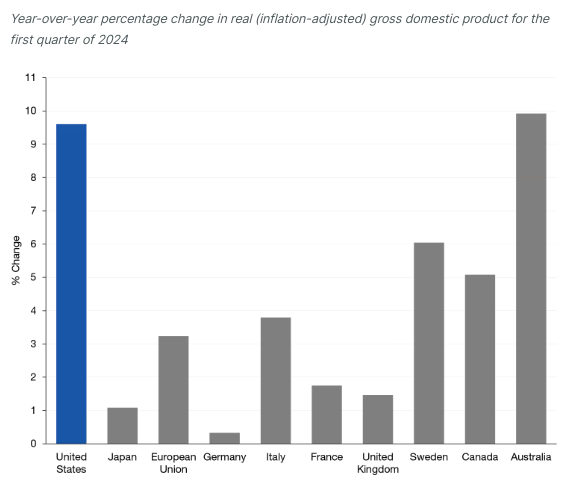

In this vein, I want to emphasize I like what I see in developed markets right now. I talk about this at length in a recent article, but suffice to say here that the rebound that started in 2023 has a good chance of extending itself. This is due to strong GDP growth in the US and elsewhere, as shown below:

YOY GDP Growth (By Country) (IMF)

My take on this is that the developed world – and the US in particular – is in a period of sustainable growth for the time being. This gives me a lot of confidence that my domestic holdings are going to continue to deliver for me. Further, while I want to make a non-US allocation in my portfolio, there are other areas I can turn to with less inherent risk than the emerging market world. I see Canada and the Euro-zone as two prime contenders, and Australia is also seeing some strong growth. This supports why I am downgrading my view on SCHE – the alternative option of developed markets seem more compelling by comparison.

Higher Rate Backdrop A Bigger Thorn For EM

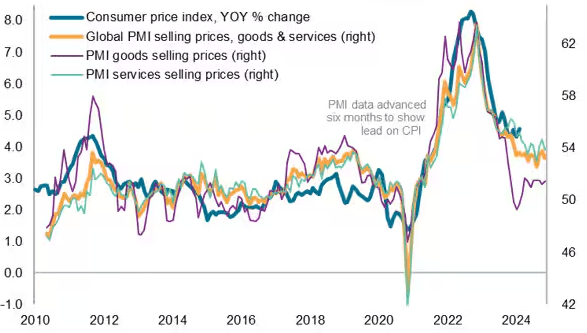

Another attribute to consider is how interest rates have remained elevated around the globe in 2024. This is due to inflation readings which have come down, but not as much as many central banks have hoped for:

Inflation and PMI Readings (Global) (S&P Global)

Of course, this has not stopped equity markets from roaring higher this year. And SCHE, while not rising as much as the S&P 500, has seen its share of gains as well. But the question is how long this can last. And I have concerns that this higher for longer rate environment is going to pressure EM more than their developed market counterparts.

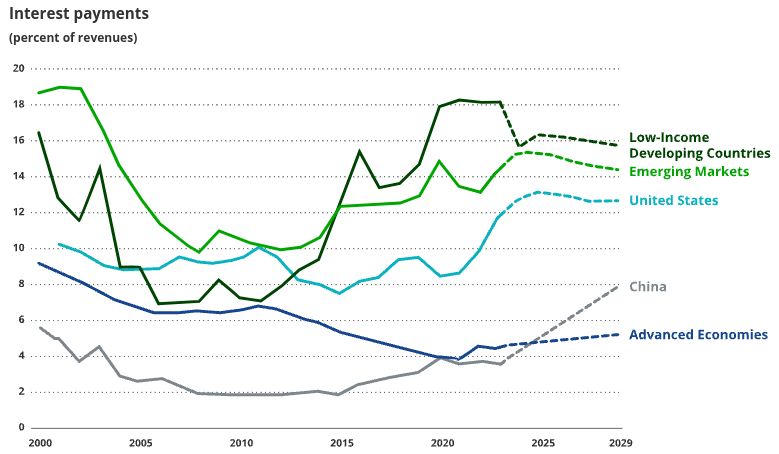

The reasoning is straightforward. While the US is well-known for running extensive deficits, they are not alone. Developed or advanced economies actually spend a lower amount of their government revenues on interest expenses than their emerging market peers – with the US being a clear exception. Still, even the US spends less on interest than the average EM nation. This is likely due to the USD being the reserve currency, keeping treasury yields lower than they otherwise would be:

Interest Payments as a Percent of Revenues (VanEck)

The conclusion I draw here is that elevated interest rates remain more of a headwind for EM than developed nations. This doesn't mean that developed economies (or governments) are out of the woods. Not at all. But it does mean in relative terms, this makes the inflationary reality (and corresponding higher borrowing costs) more of a problem for the countries that make up SCHE's portfolio. This is a key reason why I would pass on buying the fund now.

China & Taiwan: Not Making Calming Headlines

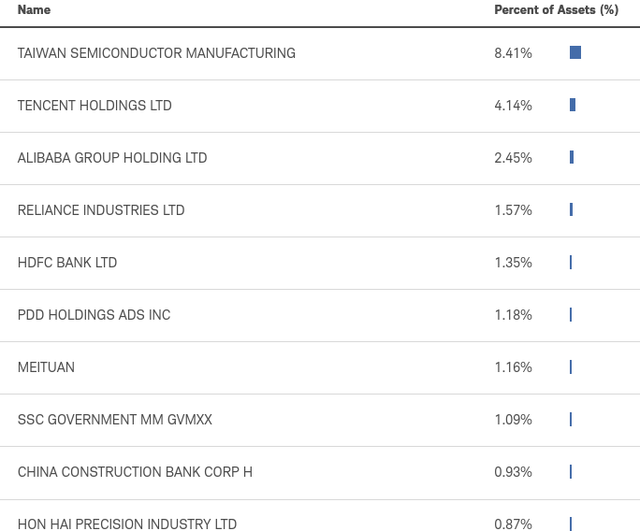

I already mentioned the high amount of Chinese exposure in this particular fund. When we couple this with Taiwanese companies, that equates to almost half of total assets for SCHE. Further, we see a number of companies from these two nations residing in the top 10 holdings, not surprisingly

Top Holdings (SCHE) (Schwab)

So why does this concern me? The answer is multi-fold, but it all boils down to one thing – Chinese and Taiwanese tensions remain very high and near a boiling point in my view.

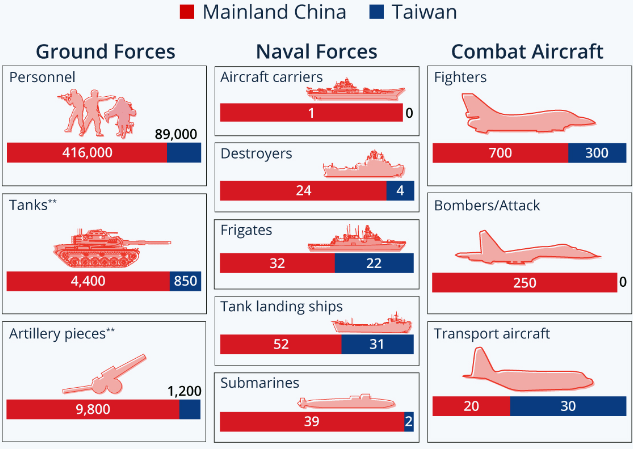

Let's examine what has been going on in the East. Over the past few years, China's military has been increasing activities around Taiwan – a territory the Chinese Communist Party believes it has a claim over. This is a position the government in Taiwan rejects – and that is where the tension stems from. Who truly rules and governs Taiwan? The people who live there, or the government in Beijing? The answer depends on who you ask, and that uncertainty is not great for the investment landscape.

The troubling reality of this is it is not an isolated geopolitical issue. If the US (or any other Western nation) makes an action or gesture towards that region, it is often met with a formal response from Chinese officials. Take just this past week as an example. The US military sent a vessel in transit through the Taiwan Strait, which led to the Chinese military criticizing the move, calling it “publicly hyped”, as reported by the Associated Press.

What I am getting at here is that tensions in the region remain high, remain global, and remain a challenge for those wanting to invest in either China or Taiwan. The risk is likely greater for Taiwanese companies, but the environment is clouded as a result of this dynamic in either jurisdiction. The fact is this is an uneven match-up, China vs. Taiwan, and will either be an overhanging cloud for a long time or a global military affair. I say this because the two sides are so unbalanced that Taiwan would surely have to rely on the US, NATO, or some global coalition to even the odds:

Military Forces in the Taiwan Strait (US Department of Defense)

This is simply a risk I don't want to take right now, and SCHE has more exposure to this risk than any other fund I cover. Suffice to say, I have no qualms with downgrading my outlook on the fund as a result of this analysis.

Bottom-line

SCHE has had a nice pop since last year, but I don't see the good times rolling in the second half of 2024. Am I an outright bear? Not really, as EM as a whole has seen strong economic growth and China may get a boost from some government stimulus in the near term. But plenty of risks remain, including tensions between China and Taiwan, as well as elevated borrowing costs for many lower-income countries. This suggests to me that developed markets are the safer play in the months to come. As a result, I am shifting my stance to “hold” for SCHE and would caution my followers to approach any new positions very selectively at this time.