Nearly halfway through 2021, it’s widely known that oil prices are rising, supporting energy’s status as the best-performing sector in the S&P 500. That’s particularly notable considering the sector’s rough go of things in 2020. Investors tapping into the energy rebound via exchange traded funds should remember that structure matters and how an ETF is structured leads to a variety of outcomes.

Source: Breaking Down the Excellent Energy Stocks in Invesco’s PXI ETF

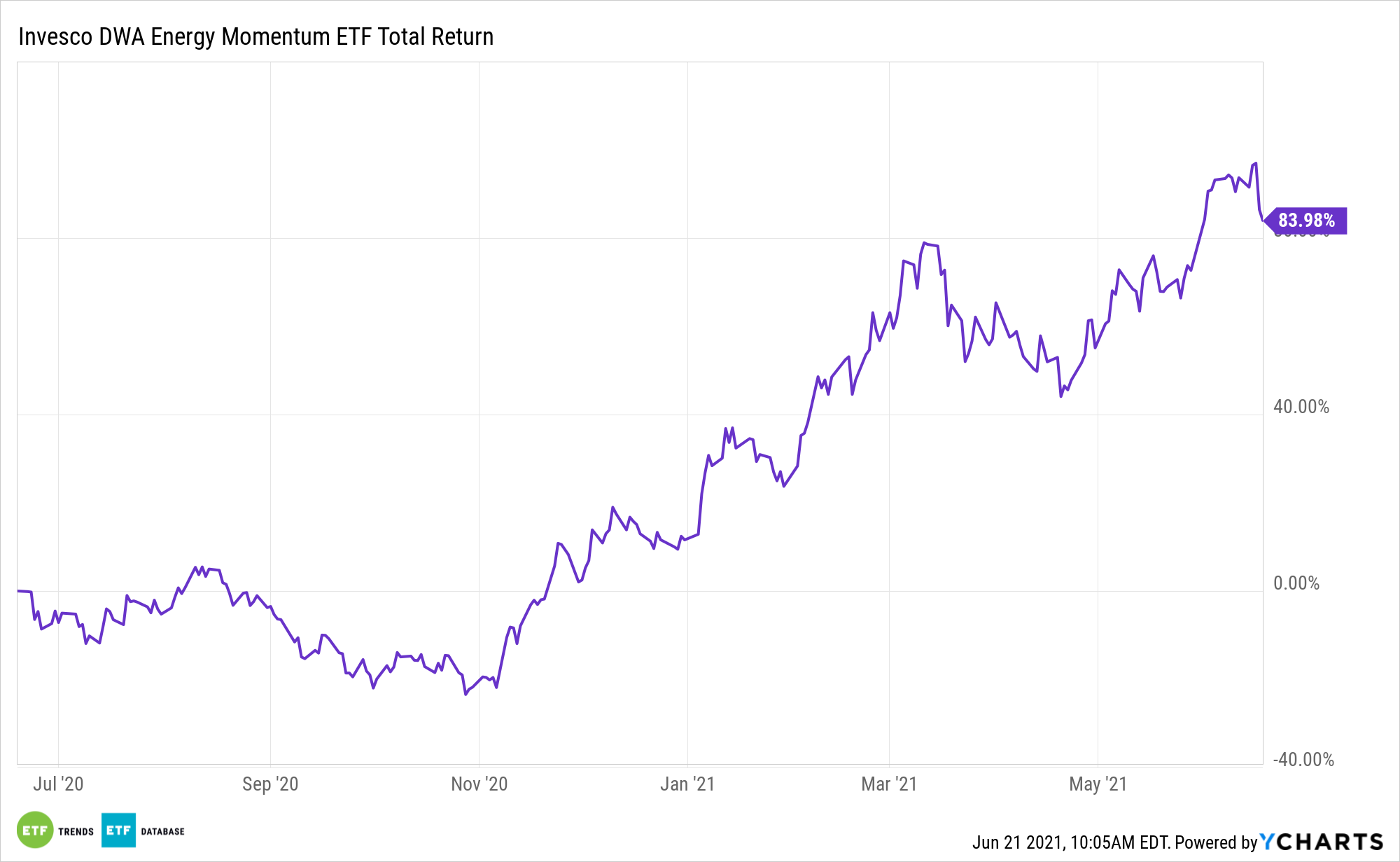

For example, the Invesco DWA Energy Momentum ETF (PXI) is higher by 76.52% year-to-date while the S&P 500 Energy Index is higher by “just” 47.47%.

PXI isn’t a cap-weighted ETF. Rather, it tracks the Dorsey Wright® Energy Technical Leaders Index, which is rooted in relative strength. Obviously, that methodology is bearing fruit this year relative to cap-weighted energy benchmarks.

PXI Can Keep On Rolling

With PXI’s stellar performance of late and some commodities market observers pondering crude’s near-term fate, it’s reasonable for investors to evaluate how much more upside the fund and the energy sector itself have ahead of themselves.

Many analysts see significant upside for crude over the next several years.

“We think in the next three years we could see $100 barrels again, and we stand by that,” notes Bank of America commodities strategist Francisco Blanch. “That would be a 2022, 2023 story. Part of it is the fact we have OPEC kind of holding all the cards, and the market is not particularly price responsive on the supply side and there is a lot of pent-up demand … We also have a lot of inflation everywhere. Oil has been lagging the rise in prices across the economy.”

Bank of America is bullish on several PXI components, including ConocoPhillips (NYSE: COP). The independent energy behemoth is keeping a lid on expenses. That prudence is benefiting investors because the oil and gas producer is resuming its share buyback plan. It’s also shopping its stake in Cenovus Energy (NYSE: CVE) and expects to use proceeds from that sale to fund more buybacks.

- ➤【 HIGH-PERFORMANCE CAR JUMP STARTER...

- ➤【 SMART CORDLESS INFLATOR WITH LCD SCREEN 】...

- ➤【 ESCORT YOUR SAFETY 】Thanks to the...

- ➤【 ALL-IN-ONE JUMP STARTER 】Say goodbye to...

- ➤【 WHAT YOU GET & WARRANTY 】YabeAuto YA70...

- 【UNIVERSAL FIT KIT】- The kit contains 23 types...

- 【TOP QUALITY】- These car retainer clips are...

- 【PREFECT FOR WHAT YOU NEED】 - Up to 680 pieces...

- 【BONUS ACCESSORIES】- We provide different size...

- 【WIDE APPLICATION】- Professional push clips...

- Powerful Car Jumper Starter - The Scatach 011 jump...

- Advanced Safety Features - Easy to opearte, and...

- Portable Design - This portable car battery...

- Respond to Emergencies - Portable power bank with...

- What will you Get ? - Scatach 011 Car Starter...

- 【What You Get】1*Tactical Molle Seat Back...

- 【Military Molle System - Lots Of...

- 【Durable and Long Lasting】 MOLLE seat back...

- 【Tactical Seat Covers Universal】 The size of...

- 【Guarantee】If you're not 100% satisfied with...

Bank of America also likes refiner Marathon Oil (NYSE: MRO). Marathon management previously noted that the company becomes cash flow positive when oil hits $35 a barrel, so with West Texas Intermediate (WTI) prices around $71, the company is working with a sizable buffer.

Citing earnings momentum, prudence on capital spending, and a new variable rate dividend plan, Bank of America also likes Devon Energy (NYSE: DVN).

ConocoPhillips, Marathon Oil, and Devon combine for about 8.1% of PXI’s weight, according to issuer data.

For more news, information, and strategy, visit the ETF Education Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.