Author's note: This article was released to CEF/ETF Income Laboratory members on January 6th, 2022.

The KraneShares CSI China Internet ETF (KWEB) is exactly what it says on the tin: a China Internet index ETF.

KWEB's prospective returns are quite high, as the fund's underlying holdings are growing quite rapidly, and as the fund is trading at historically low prices. Strong growth at a cheap price is a potent combination, and quite rare under current market conditions.

KWEB's risks and potential losses are even higher, due to political, regulatory, and economic risk. China is cracking down on its technology sector, and KWEB's holdings are suffering as a result.

KWEB is a high-risk high-return investment opportunity, but one whose risks are materially higher than its prospective returns, in my opinion at least. As such, I would not be investing in KWEB at the present time.

KWEB Overview

KWEB is an index ETF administered by KraneShares, a small investment management firm focusing on Chinese and Asian markets. KWEB tracks the CSI Overseas China Internet Index, an index of Chinese companies focusing on internet and internet-related activities, products, and services. The index includes stocks traded on both Hong Kong and U.S. exchanges. It is a market-cap weighted index. KWEB's index seems quite simple, and effective at tracking the performance of Chinese internet companies.

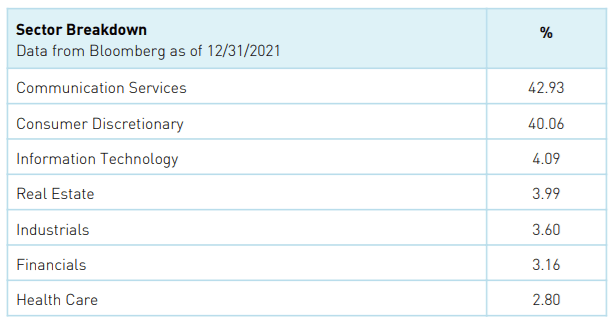

KWEB's industry exposures are, at first glance, a bit odd, with the fund massively overweighting the consumer discretionary and communications industries, while underweighting tech stocks. Industry classifications are somewhat porous, and it seems that many Chinese stocks that could conceivably be classified as tech, are instead classified in those sectors. As an example, Tencent (OTCPK:TCEHY), the fund's largest holding, is classified as a communications company, due to its social media and internet communications applications (WeChat). Alibaba (BABA) is classified as retail, due to its online retail marketplace. KWEB's industry classifications are consistent with its index, although not at first glance.

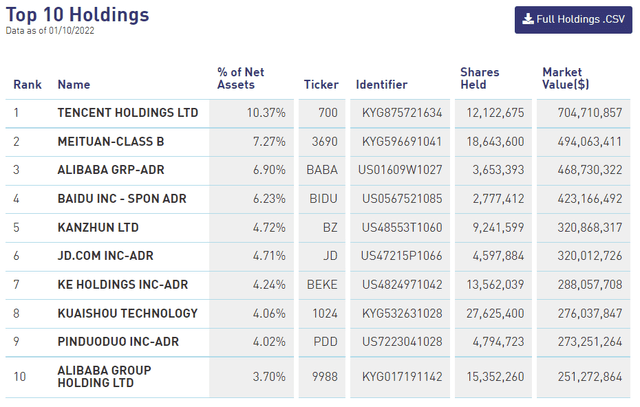

KWEB invests in 55 different companies, with the top ten of these accounting for 55% of its value. The fund's larger holdings include well-known Chinese tech mega-caps like Tencent, Alibaba, Baidu (BIDU), and JD.com (JD).

KWEB's holdings are reasonably well-diversified for a niche industry fund, but it is still a niche industry fund. This makes KWEB a relatively risky investment, whose performance is strongly dependent on the performance of a specific industry, and of a couple specific holdings. Expect significant losses and underperformance if the fund's top holdings, including Tencent and Alibaba, underperform. Broader equity indexes, including the S&P 500, are more diversified, and significantly less risky as a result. Due to this, allocations to KWEB should be kept relatively small. I would not go above 5%.

KWEB's holdings provide investors with several key benefits and drawbacks. Let's have a look at these, starting with the benefits.

KWEB – Benefits and Investment Thesis

Strong Growth and Potential Returns

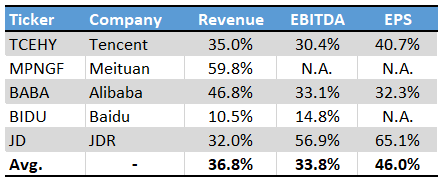

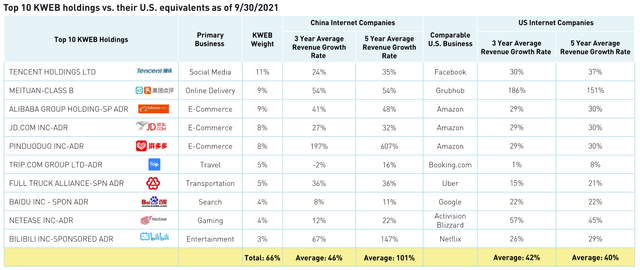

KWEB focuses on Chinese internet companies, most of which have seen strong revenue, earnings, and cash-flow growth for years. The following are 5Y growth rates in select financial metrics for KWEB's largest holdings.

As can be seen above, the fund's holdings have all seen strong growth these past five years. Importantly, growth tends to be higher than that of comparable U.S. companies, although performance does vary.

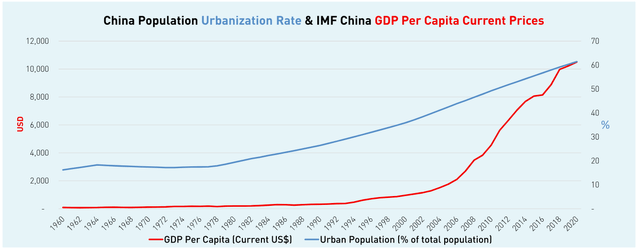

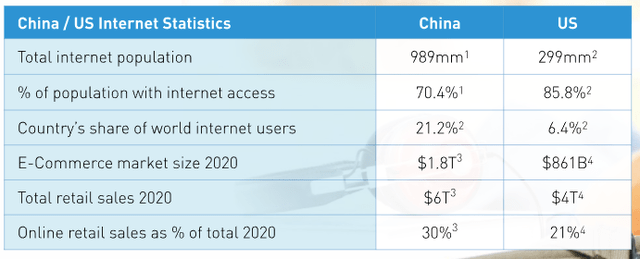

KWEB's holdings have seen strong financial growth for the past few years due to the booming Chinese economy, increased urbanization rates, and higher internet penetration.

China is still growing quite fast, although less so than in the past, which should boost growth rates moving forward, especially considering the country's relative lack of internet penetration and economic size / strength. China is still a developing country, and so should see developing country growth rates moving forward.

Strong growth should lead to strong capital gains and market-beating returns, assuming market sentiment and valuations remain roughly the same. This is a big assumption, but reasonable.

Cheap Price

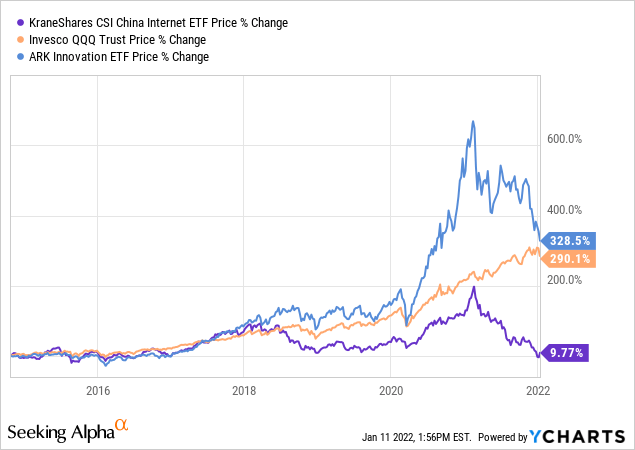

KWEK's holdings have seen strong growth for years, but the same is true for many other stocks and funds. U.S. technology stocks, for instance, have seen roughly comparable growth rates, while being more mature, safer, investments. Innovation growth stocks and funds, including the ARK Innovation ETF (ARKK), offer even stronger growth rates and potential returns, although risks are higher too.

- INTERCHANGEABLE GRILL and GRIDDLE PLATES: From...

- 500°F MAX HEAT: Reach temperatures of up to...

- EDGE TO EDGE COOKING: No hot spots. No cold spots....

- SMOKELESS GRILL: The perforated mesh lid...

- FAMILY SIZED CAPACITY: The 14’’ grill and...

- Spacious 7 quart manual slow cooker serves 9 plus...

- Set cooking time to high and get a hot meal in no...

- Keep food at an ideal serving temperature for as...

- One pot cooking means there are less dishes to...

- All Crock Pot Slow Cooker removable stone inserts...

What sets KWEB apart from these other funds, is the fund's comparatively low price. U.S. growth stocks saw skyrocketing share prices from 2019 to early 2021, but have seen comparatively low returns since, as market sentiment has cooled. Chinese growth stocks followed a broadly similar pattern, but suffered much greater underperformance and losses once market sentiment cooled. KWEB is currently trading at historical lows, unlike most U.S. equities.

KWEB offers investors strong growth and potential returns at a historically low price, a solid combination, and a reasonable investment thesis. The fund, however, has one significant drawback. Let's have a look.

KWEB – Risks and Drawbacks

KWEB trades at historical lows for a reason, and that reason is political risk. China's government embarked on an aggressive economic restructuring plan last year, meant to re-orient its tech sector to be more aligned with Chinese government goals. Video games, social media, and most consumer apps were de-emphasized, hard tech, such as semiconductors, renewable energy, and manufacturing R&D, was incentivized. The larger tech companies and tech moguls were chastised, in what most analysts referred to as a ‘crackdown‘. Regardless of the merits of these policies, the market reaction was sharp, and swift: stocks plummeted.

China's tech crackdown has slowed down, but it remains in effect, and there are no signs the government plans to backtrack on its strategy. China’s tech crackdown is a significant negative for KWEB and its shareholders for three key reasons.

First, the plan is directly reducing the revenues, earnings, and cash-flows of most of the country's larger tech companies. Different companies are impacted by different policies. Video game companies, for instance, were harmed by the country's decision to cap the hours children are allowed to play online video games, as well as the freeze on the development of new titles. Gig economy apps, including ride share and food delivery apps, were harmed by the country's decision to allow unions in the sector, as well as other pro-labor policies. As mentioned previously, different companies were impacted by different policies, but most suffered negative effects.

Second, is the fact that both Chinese and U.S. regulators are considering de-listing Chinese stocks from U.S. exchanges. This would prevent U.S. investors from buying and selling Chinese stocks, at least easily. Although de-listing does not mean U.S. investors lose their shares or their investment, it does make it difficult for U.S. investors to buy shares in these companies, which reduces demand, and hence share prices. Investors in Chinese stocks could experience significant losses if these were to be de-listed from U.S. exchanges, which is a very real risk.

Third, is the fact that Chinese political risk has turned market sentiment bearish, reducing stock prices, and causing significant capital losses for shareholders. Further losses are a distinct possibility, especially if the country's regulatory situation were to worsen.

China's regulatory environment has directly lead to decreased revenues and earnings for its tech giants, has turned market sentiment bearish, and could lead to further, even greater losses if Chinese stocks are de-listed from U.S. exchanges. The situation is incredibly negative, and quite risky. Although I think that the situation is likely to improve, if only due to underlying economic growth, the risks are simply unacceptably high.

Conclusion – Not a Buy

KWEB invests in Chinese internet companies.

- 【Easier to Move】You can use these appliances...

- 【Save Space and Protect Countertops】The small...

- 【Strong Adhesive】The counter slider for...

- 【Easy to Use】28pcs 22mm/0.87in kitchen...

- 【Wide Application】The coffee slider for...

- ✔Update Dishwasher: This dishwasher cover in...

- ✔Size: This Magnet Sticker Dishwasher Covers...

- ✔Material: This dishwasher cover is made of Our...

- ✔Easy to Install and Remove: Dishwasher Magnet...

- ✔Widely applicable: This magnets are easy to...

Prospective returns are quite high, as these are cheap, high-growth stocks.

Potential loses are quite high too, as the Chinese government is cracking down on its tech sectors.

In my opinion, although the fund does offer investors a compelling investment thesis, risks and potential losses are simply too great to warrant an investment. As such, I would not be investing in KWEB at the present time.