After nearly two years of zero rates in the front end of the curve, the rise in treasury yields has finally brought back the attractiveness of cash parking instruments like the Schwab Strategic Trust – Schwab Short-Term U.S. Treasury ETF (NYSEARCA:SCHO). The fund now exhibits a 30-day SEC yield of 2.41%, and given its low duration of 1.9 years it will absorb any incremental front end moves with a more stable NAV.

Until this point in time it was more effective and less risky to just keep cash as such rather than utilize a cash parking vehicle such as short term treasuries ETFs or short duration corporate bonds ETFs. The violent shift up in the yield curve has finally brought back attractive 30-day SEC yields to these instruments, and their low duration will ensure a greater NAV stability going forward even if the curve moves slightly higher in the short term.

An investor can either choose to park spare funds in a vehicle such as SCHO, or take a more active management approach and buy treasury notes and bills outright via their brokerage accounts.

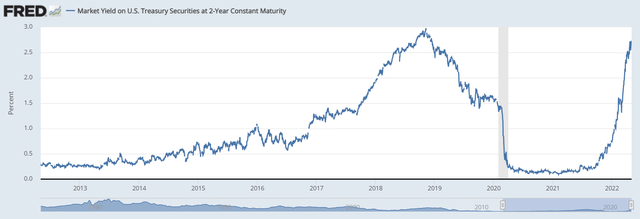

Interest Rate Environment

2-year yields are nearing highs not seen in over a decade:

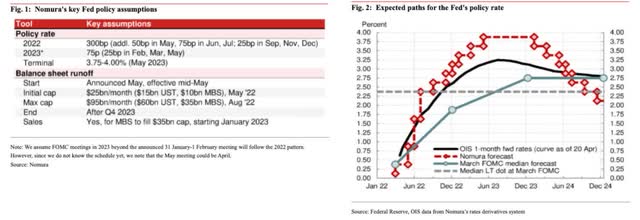

Some banks are now even penciling in Fed Funds rates close to 4%:

Holdings

- New Store Stock

- Rivan, Maria (Author)

- English (Publication Language)

- 208 Pages - 04/14/2020 (Publication Date) -...

- Elevate Your Vision : An Enhanced Vision Board...

- Experience a new level of quality with our...

- Our vision board kit for women offers hand-picked,...

- Whether it’s a gift vision board for teens,...

- At Lamare, our mission is to help women plan and...

- National Geographic Special - 2017-1-20 SIP...

- English (Publication Language)

- 128 Pages - 01/20/2017 (Publication Date) -...

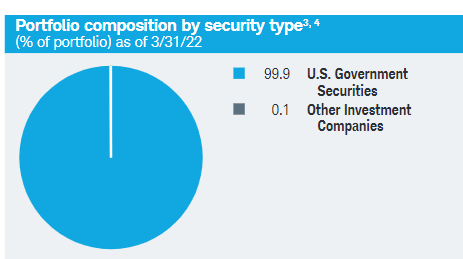

The fund is composed entirely of treasuries:

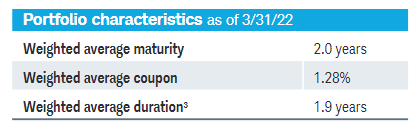

The portfolio duration and weighted average maturity are very short:

This means that the NAV of the fund is more stable than longer duration funds and the roll effect takes place faster – as bonds mature, the fund is able to buy market yielding treasuries, thus providing NAV stability. The ETF has no credit risk since the entire portfolio is composed of government guaranteed securities.

- Amazon Kindle Edition

- Baldacci, David (Author)

- English (Publication Language)

- 487 Pages - 04/16/2024 (Publication Date) - Grand...

- Amazon Kindle Edition

- Hannah, Kristin (Author)

- English (Publication Language)

- 472 Pages - 02/06/2024 (Publication Date) - St....

- Amazon Kindle Edition

- Elston, Ashley (Author)

- English (Publication Language)

- 348 Pages - 01/02/2024 (Publication Date) - Pamela...

As a retail investor you can choose to just buy via your brokerage account short-dated Treasury instruments outright and just roll them. This way of parking cash is advantageous from the standpoint of no management fees paid but it requires active management (i.e. following maturity dates, utilizing brokerage platforms to buy new term securities, etc.).

Performance

As interest rates have risen, the fund has experienced a NAV loss in the past year:

However, longer term, the fund NAV has been fairly stable given the ETF's short duration profile. The fund price/nav fluctuates in a tight +/- 2% range for the past decade. This is a good illustration of the benefits of a low duration fund that exposes the roll effect, i.e. bonds maturing in a tight window.

Conclusion

For almost two years investors looking to park spare cash and obtain some sort of yield had to just settle for cash. With an aggressive Fed looking to bring down inflation and a yield curve that has shifted up substantially, a retail investor finally has alternatives to just holding cash. SCHO is a short term Treasuries ETF that now exhibits a 2.41% 30-day SEC yield and given its maturity profile has a stable NAV. A retail investor looking to park spare cash would do well to consider SCHO. We rate it a Buy.