CatLane/E+ via Getty Images

Investment Thesis

For decades, Germany has been a strong industrial and export nation. It was the world's leading exporter (and was replaced by China in 2009). A prerequisite for this success was access to cheap energy since Europe itself has hardly any oil and gas. Those days seem to be over for the time being. German companies will thus find it challenging to remain competitive internationally. This could lead to relocations abroad, which will cost jobs and prosperity at home. This could lead to a substantial decrease in domestic and intra-European consumption (many of the points in this article apply to all of Europe). In this article, I will explain why Germany´s economy and the leading index (NASDAQ:DAX) are facing dark times. The DAX and its smaller side indices (MDAX, SDAX) are good short candidates.

I want to mention briefly that I am German and have lived there for the longest time of my life, so I am familiar with German characteristics.

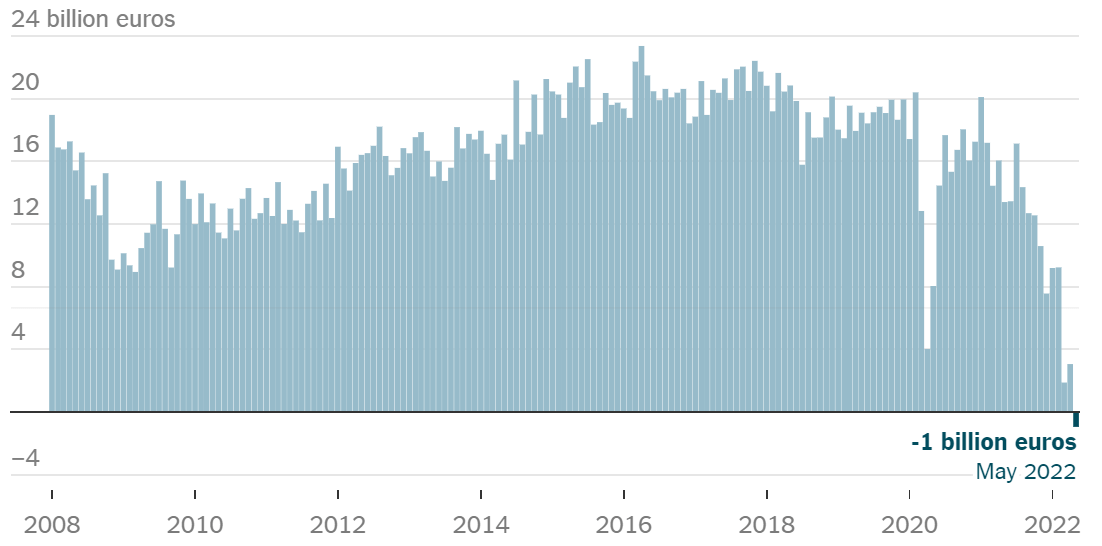

Imports now exceed exports

In May, for the first time in three decades, import costs exceeded exports, thus causing a trade deficit. Exports fell by 0.5% compared to the previous month, while imports rose by 2.7%. This news caused much stir in Germany because of the clear symbolic meaning.

nytimes.com

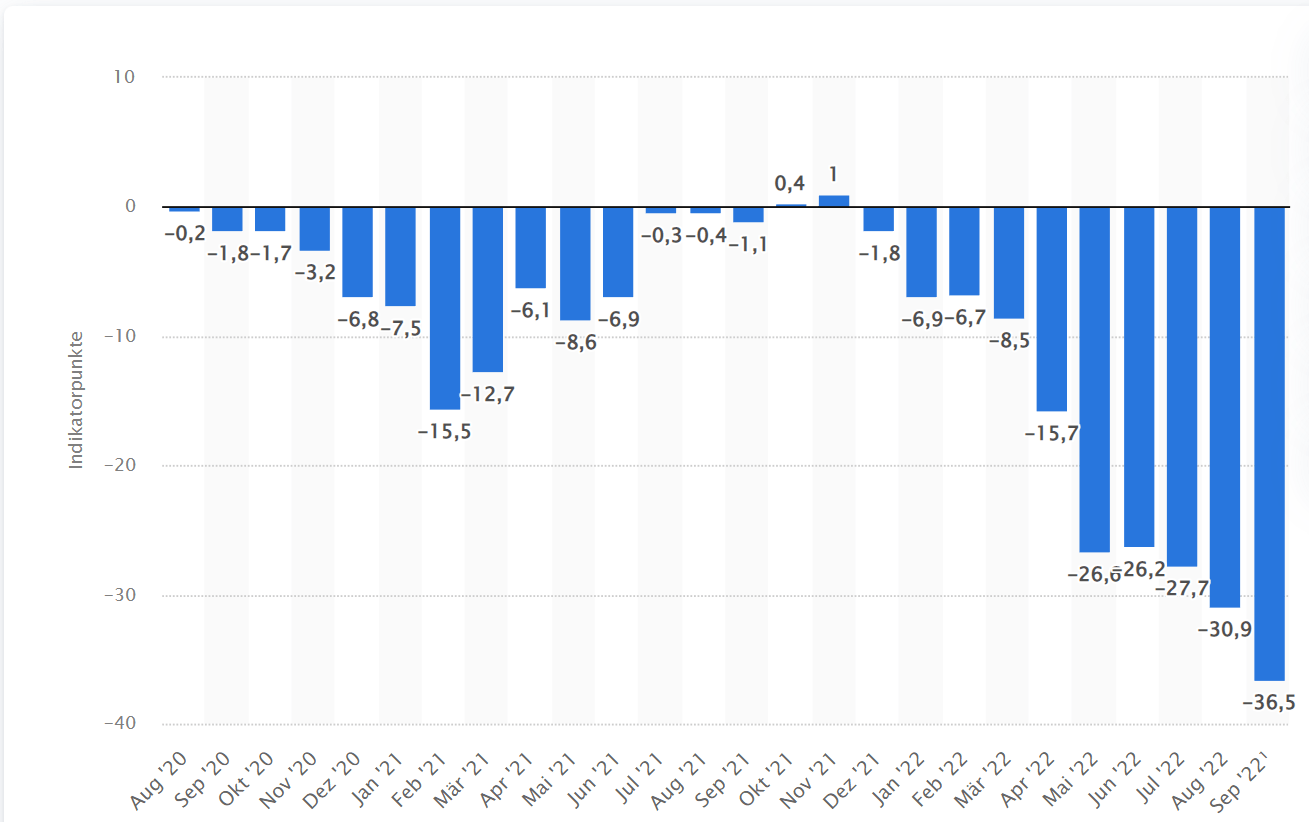

Uncertainty leads to caution

Germans have a traumatic relationship with inflation and insecurity. Very early in the Covid pandemic, citizens began hoarding essential goods and deferring spending. What may make sense for each individual could be a disaster for the economy. Today, the situation is different; the current reluctance to consume is not so much due to fear, but because it is hardly financially possible for many people. The costs for heating and electricity have risen sharply, and the uncertainty about further price increases means that many people are likely holding back financially. 16% of the people are at risk of poverty. One of the largest local banks recently warned that 60% of people have to spend their entire income on everyday expenses and cannot save. According to this bank, the limit for this is even a relatively high 3600€ monthly income.

The “consumer confidence index” fell to a new historic low in August. This index asks households about their expected consumption behavior over the next 12 months and how they assess their own income development.

statista.com

Blackouts are more likely than ever

Blackout warnings have even entered the mainstream. The government and individual municipalities are making plans for the blackout. The police shall prepare for this case. A sufficient supply of energy in winter does not seem to be guaranteed. And amid this existential crisis, the German government has also decided to shut down the last three nuclear power plants at the end of the year. What company will make significant investments in the face of this uncertain outlook?

Google Trends

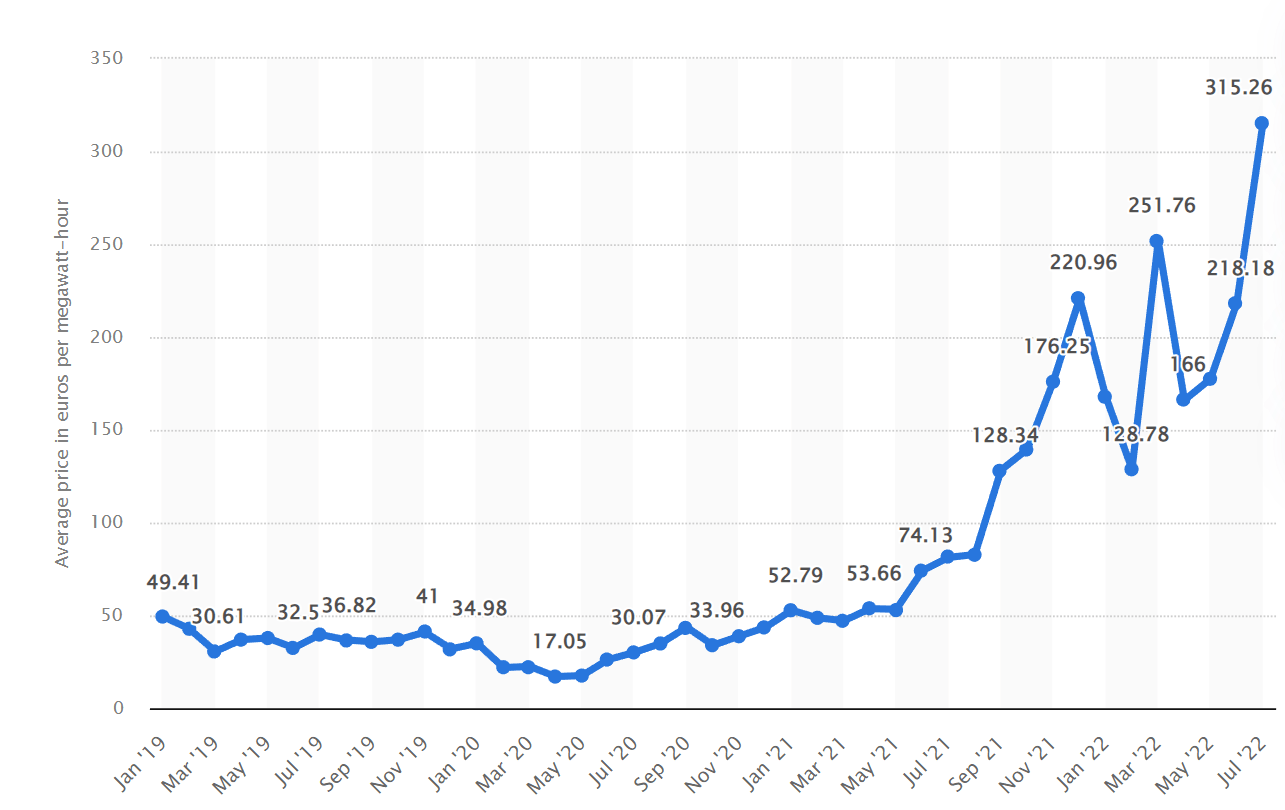

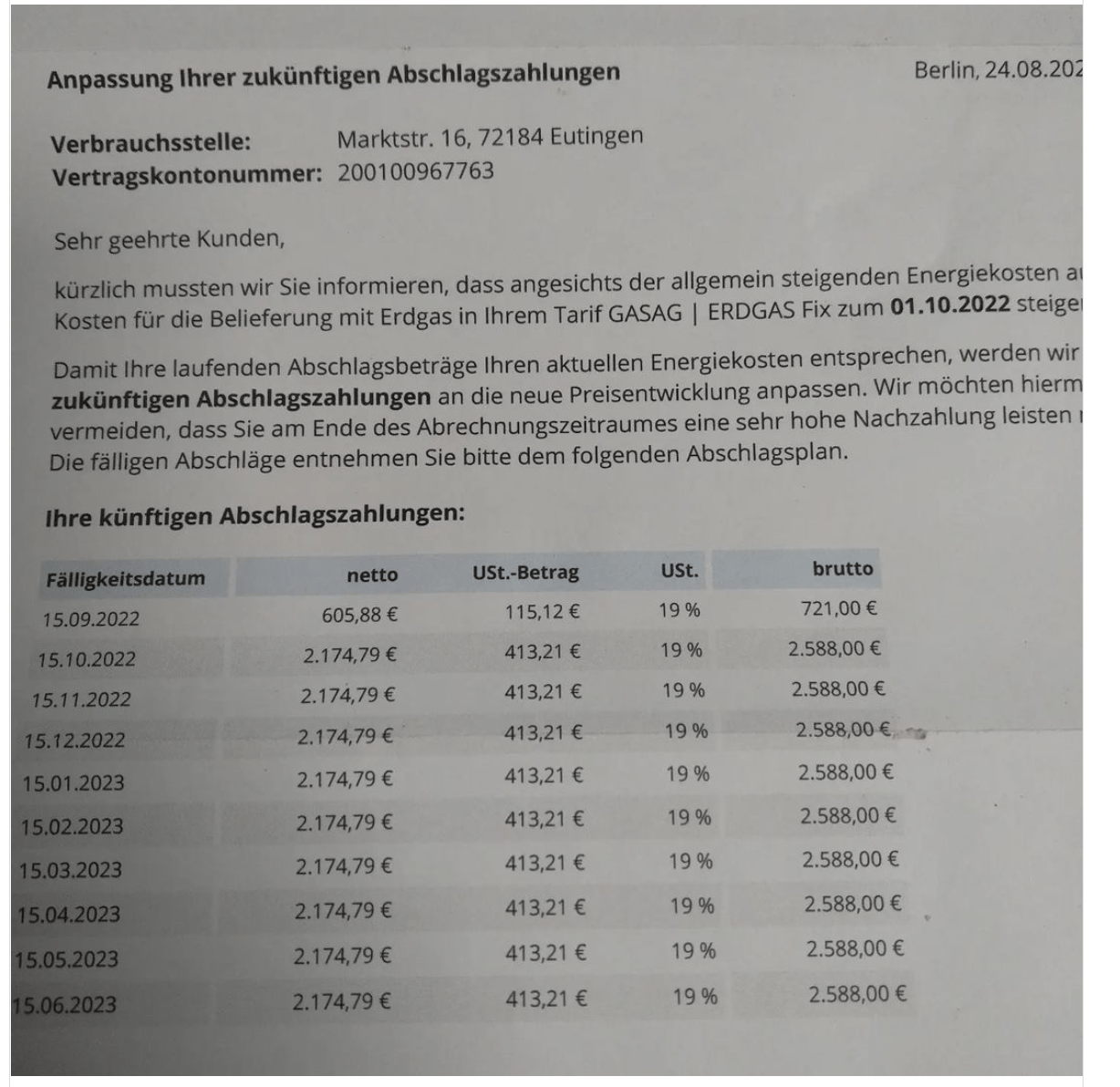

No longer competitive as a production location

I think the answer to the last question is very few. On the contrary, one in four companies sees the current crisis as an existential threat. There are currently more and more reports of small energy-intensive businesses like bakeries having to close. They say their costs are increasing so much that they feel they cannot pass these costs on to customers, as they receive feedback that customers are also already at the limit of their financial possibilities. Electricity prices have increased tenfold compared to 2020. The second picture below is from a bakery showing their updated gas bill. The cost increases from 721 euros to 2588 euros.

statista.com

And all this while India and China purchase Russian energy even at a discount. How can products made in Germany compete with that? Even if they are somewhat better in terms of quality, the price ultimately plays a decisive role for the consumer. Especially the energy-intensive industry such as chemicals and metal production can no longer keep up. As a result, companies are already beginning to abandon their production facilities or scale back production.

With a tenfold increase in gas and electricity prices, which we had to accept within a few months, we are no longer competitive in a market that is 25% supplied by imports. We see an urgent need for political action to get energy prices under control immediately.

ArcelorMittal is partly closing plants in Germany and Spain

Destatis

The war in Ukraine puts an end to the German economic business model as we knew it — a model which was mainly based on cheap energy imports and industrial exports into an increasingly globalized world. (…) A survey of 3,500 companies recently carried out by Germany's Chambers of Industry and Commerce (DIHK) found that 16% were either scaling back production or partially discontinuing business operations due to rising energy prices.

Dependence on the global economy

At this point, it is pretty clear to me that domestic consumption will come under intense pressure. In my opinion, we are only at the beginning of this. Many private consumers and small businesses purchase their energy under long-term contracts, and as soon as these expire and are renegotiated, there will likely be further massive price increases. At this point, a vicious cycle will begin. Less money will be available for consumption, which will cause even more companies to get into trouble, leading to job layoffs and, thus, even less consumption and more closures.

- INTERCHANGEABLE GRILL and GRIDDLE PLATES: From...

- 500°F MAX HEAT: Reach temperatures of up to...

- EDGE TO EDGE COOKING: No hot spots. No cold spots....

- SMOKELESS GRILL: The perforated mesh lid...

- FAMILY SIZED CAPACITY: The 14’’ grill and...

- Spacious 7 quart manual slow cooker serves 9 plus...

- Set cooking time to high and get a hot meal in no...

- Keep food at an ideal serving temperature for as...

- One pot cooking means there are less dishes to...

- All Crock Pot Slow Cooker removable stone inserts...

The two most important trading partners for exports are the USA and China. The importance of China has increased massively since the year 2000. However, this is not the whole truth because Europe is not listed in statistics as a single country. If you take all EU countries together, the EU is the most important trading partner.

In 2018, Germany’s main trading region for the exchange of goods continued to be Europe, which accounted for 68.5% of German exports and also for 68.5% of German imports.

By far the most important export goods are automobiles with over 9%. And here, too, it has to be said that the German industry is facing massive competition from the turn towards electromobility that has been taking place for some years now. It is as if the game starts again at zero, and all the previous technical innovations of the combustion engine no longer play such a role. Instead, from now on, battery technology and the digital networking of the car. Whether Germany can retain its leading position in automotive is questionable, especially given the problems mentioned above with energy prices. Companies like Volkswagen (OTCPK:VWAGY), Mercedes (OTCPK:MBGAF), and BMW (OTCPK:BMWYY) still produce a lot in Germany and are enormously important for the domestic economy and the performance of the DAX index.

Large companies like these will not go bankrupt quickly, but it is enough if more and more companies move their production to non-European countries, which is very tempting with lower energy and labor costs. This would result in a loss of prosperity in Europe and, thus, a decline in German exports to Europe.

Currently, the export numbers, for example, don't look so bad. But that's also because we're still just coming out of the pandemic, where the economy has recovered strongly. I think the downturn, which is what we are heading for, in my view, is starting right now and is likely to last at least as long as the European energy crisis has not found a solution, and no one knows what that solution is going to look like.

Sector exposure

So the DAX seems to be very dependent on exports of its industrial goods, and we see that also in the sector breakdown. One of the European problems is the low weighting of technology companies, as there are only a few of them.

Fidelity

So if, at the same time, demand within Europe is weakening, production is becoming more expensive for German companies, and competitiveness compared to Asia is declining, I don't know how all these problems will be solved. It looks like the biggest German companies are heading for a huge crisis – in the worst-case scenario, American and Chinese competitors could overtake the German automotive industry within the next few years.

Valuation and the market perception

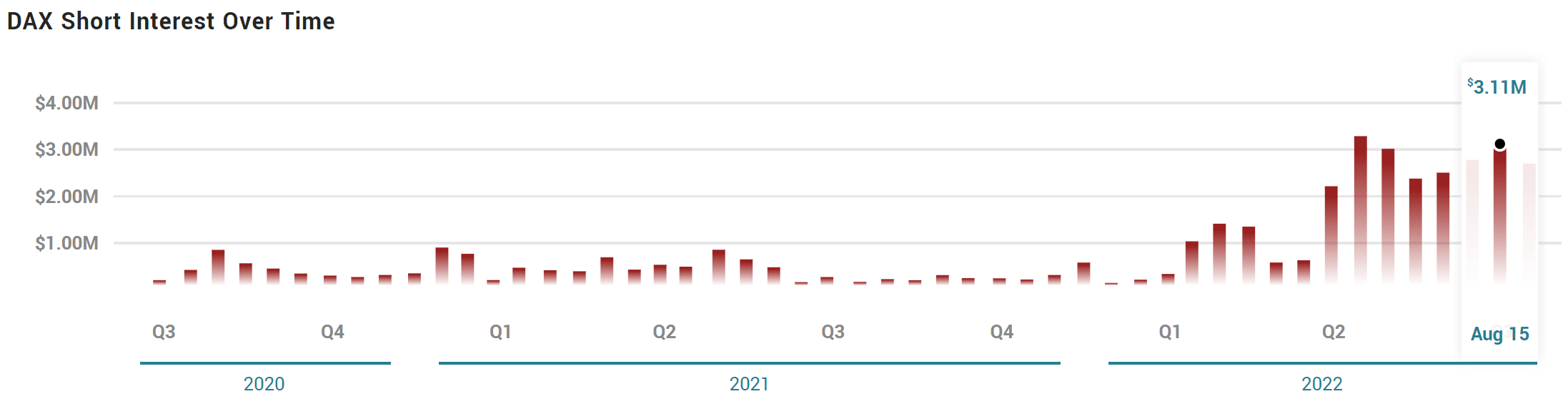

Of course, the market has already partially priced in these problems, so the DAX fell by 31% this year. The average P/E ratio is currently 10.7. According to the Seeking Alpha Quant rating, this ETF is a strong sell with very poor ratings in momentum and asset flows. In recent months, the short interest in the Dax has also increased massively.

Seeking Alpha

marketbeat.com

- 【Easier to Move】You can use these appliances...

- 【Save Space and Protect Countertops】The small...

- 【Strong Adhesive】The counter slider for...

- 【Easy to Use】28pcs 22mm/0.87in kitchen...

- 【Wide Application】The coffee slider for...

- ✔Update Dishwasher: This dishwasher cover in...

- ✔Size: This Magnet Sticker Dishwasher Covers...

- ✔Material: This dishwasher cover is made of Our...

- ✔Easy to Install and Remove: Dishwasher Magnet...

- ✔Widely applicable: This magnets are easy to...

Of course, the valuation is already low, but only slightly lower than the historical average. And I have to say that the outlook has rarely been this bad. I don't think the full extent has been priced in yet. Possible blackouts and industry closures to save gas have never been an issue. Nor is it clear to what extent we are facing a global recession, which would hit the enormously essential exports. However, there is much suggesting that a global recession is imminent. But even if not, a recession within Europe, the most important sales market, is as close to certain.

Risks to my thesis

The first risk is that I, the author, am wrong in some of my assumptions. Perhaps I see the development too negatively or forget important points. Of course, I do not have full insight into political developments. In addition, there could be solutions to the energy crisis, which ensure that electricity and gas prices again settle at a lower level. It is also not clear how an end of the war in Ukraine would affect the markets. In the longer term, there could also be an improvement in relations with Russia and a possible resumption of trade relations, which would be very good for German companies that had to stop their exports to Russia. Furthermore, weak Euro is support for export-oriented companies, as their products become cheaper for foreign countries. In addition, it should be noted that when shorting shares, there is theoretically unlimited risk in the event of a sudden sharp rise in prices. When borrowing shares for short selling, there is a fee, which can be up to several percent p.a. for not very liquid shares. The exact costs everyone should check with their broker before acting in this direction.

Conclusion

There is a lot to say about the current European, and especially the German, downturn. It is a complex issue, and I have tried summarizing some crucial points in this article.

So what to do with it now? I am short on the DAX, although the valuation is already low. Another option is to be short on the smaller indices, especially the MDAX (mid-sized companies) and the SDAX (small companies). These have similar P/E ratios but are more dependent on German economic development and less linked to global exports.