Strategy

Deutsche X-trackers Harvest CSI 300 China A-Shares ETF (NYSEARCA:ASHR) uses a plain vanilla model of investing in the 300 largest Chinese stocks. The only caveat is that it excludes any holdings that directly supply the Chinese Military, as per U.S. federal guidelines. The fund is rebalanced semi-annually and is able to hold China A-shares through the subadvisor, Harvest Global Investments.

Proprietary ETF Grades

- Offense/Defense: Offense

- Segment: Non-U.S. Equity

- Sub-Segment: China

- Risk (vs. S&P 500): Low

Proprietary Technical Ratings*

- Short-Term (next 3 months): A

- Long-Term (next 12 months): A

* Our assessment of reward potential vs. risk taken

(Rating Scale: A=Excellent, B=Good, C=Fair D=Weak, F=Poor)

Holding Analysis

ASHR holds a basket of 300 of China's largest companies by market cap. The fund has a financial sector lean representing 21% of the portfolio. Industrials make up 16%, while consumer staples and IT each account for another 15%.

Individually, the fund's largest holdings* are Kweichow Moutai Co Ltd at 5.8% Consumer staples), Contemporary Amperex Technology Co Ltd (Industrials) at 3.3% and Ping An Insurance Group (Financials) at 2.8%.

*All holdings are listed on foreign exchanges and not available in the U.S.

Strengths

An investment in ASHR is an investment in China. In my time as a trade analyst for the U.S. government, the assumption was that unless proven otherwise, a Chinese company was a government entity. ASHR invests in 300 of the largest publicly traded companies in China. I'll let you draw your own conclusions. The real question here is whether China is investment-worthy.

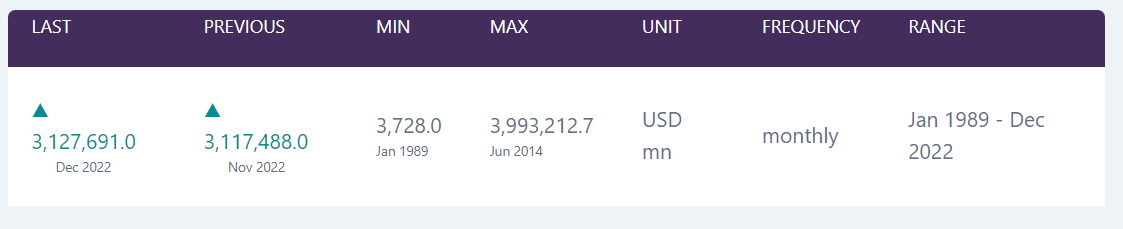

While the U.S. is struggling to decide what to do with the debt ceiling, China is sitting on $3 trillion in foreign exchange reserves.

China's Foreign Exchange Reserves (CEIC Data)

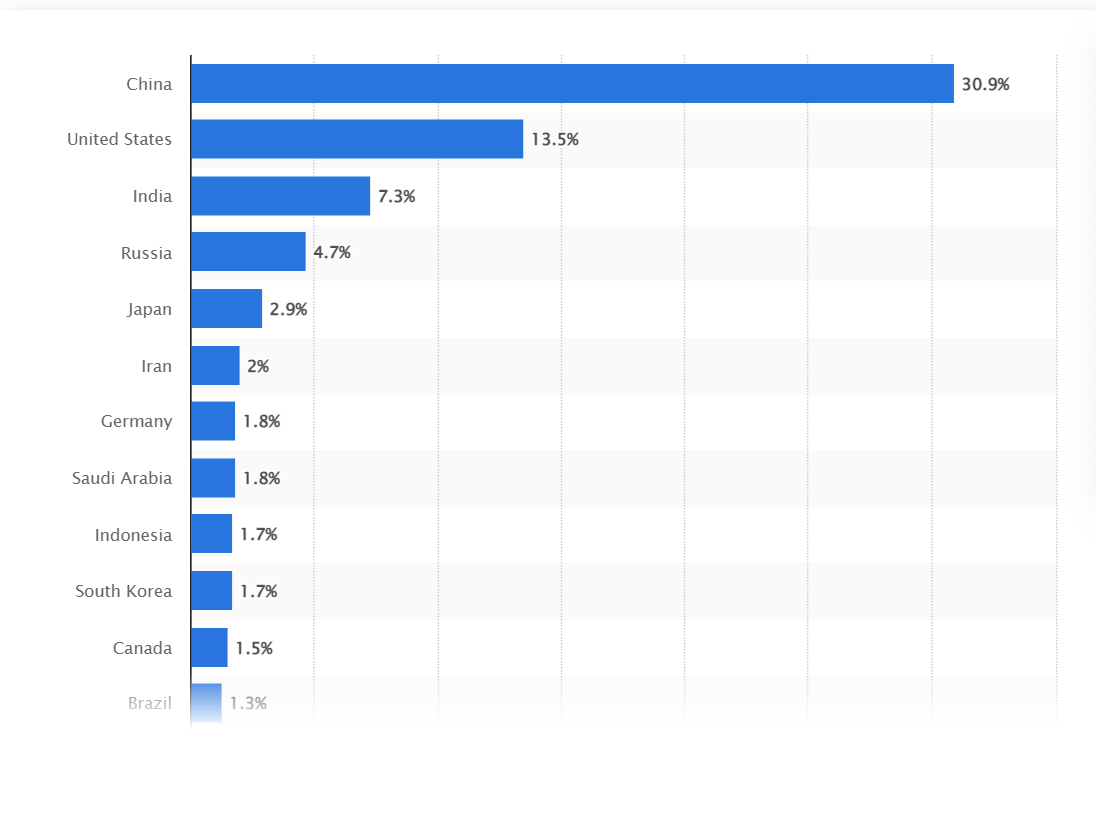

In poker terms, they are the big stack at the table. No one, not even the U.S., can dictate to them what to do. When the Chinese government decides to focus on a sector, they have the capital reserves, the strength of 1.8 billion people and a centrally run government to ensure they succeed. China is the largest producer of greenhouse gases, producing nearly 31% of the global total.

China, the world leader in carbon gas emissions (Statista)

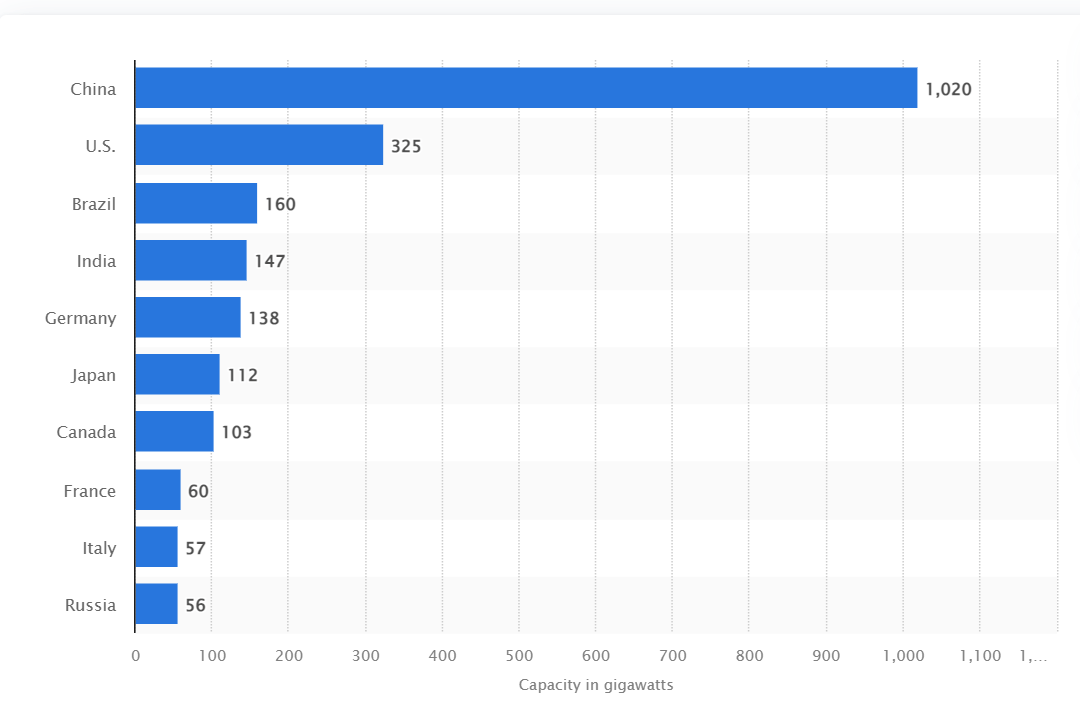

So what did they do to combat this? China became the world leader in green energy production.

World's largest producers of green energy by gigawatts (Statista)

Weaknesses

- INTERCHANGEABLE GRILL and GRIDDLE PLATES: From...

- 500°F MAX HEAT: Reach temperatures of up to...

- EDGE TO EDGE COOKING: No hot spots. No cold spots....

- SMOKELESS GRILL: The perforated mesh lid...

- FAMILY SIZED CAPACITY: The 14’’ grill and...

- Spacious 7 quart manual slow cooker serves 9 plus...

- Set cooking time to high and get a hot meal in no...

- Keep food at an ideal serving temperature for as...

- One pot cooking means there are less dishes to...

- All Crock Pot Slow Cooker removable stone inserts...

Ask the Soviet Union how centrally planned governments work. They collapsed because they tried to compete with the U.S. militarily. China has the good sense not to do that, but rather compete economically. World power is no longer gained through guns and bombs, but through trade and treaties.

Where China struggles here though is its failure to allow the invisible hand of the free market to determine what is the right direction to go in. It is not a supply and demand based economy, but an economy where the demand is determined by a small cadre of people.

China runs the risk of overplaying its hand, as it did with the real estate market. I'll never forget travelling to China for work. We were in a relatively small province, and all we could see for miles and miles were giant brand new high-rise apartment buildings sitting empty. It was stunning.

China, in many respects, is like a massive cargo train. Once it gets going, it is nearly impossible to stop it or change directions.

Opportunities

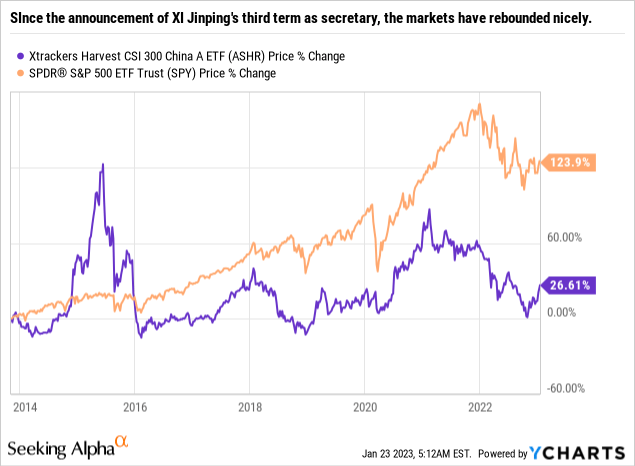

Anyone who has played poker knows that the player with the biggest stack gets to dictate how the betting goes. They can afford to bet on losing hands, because once in a while even a pair of 2s comes up a winner simply because of intimidation. In late October of 2022, China's 20th national congress appointed Xi Jinping for an unprecedented third term as Secretary. Many analysts believe he has secured the title in perpetuity. Since that announcement, markets seem to have stabilized and even rebounded. ASHR has risen by almost 28% since the beginning of November, and the S&P has done even better.

Data by YCharts

Threats

As mentioned above, the USSR's biggest failure was its investment in tanks over cars, and military technology over economic development. China's prosperity has come at a time when they have avoided military conflict. They have threatened, but not acted, except when they threw sticks and bricks at India. Since 1949, Taiwan has acted as an independent country, while China has considered them a rogue member of the People's Republic of China (PRC). Since that time, for the most part they have yelled a lot but not really taken any action. However recently they seem to have ratcheted up the rhetoric, leaving military analysts scrambling to figure out if this is just more of the same, or an actual call to arms by the PRC.

If it is a call to arms, it would be the largest marine invasion in the history of mankind, with absolutely no winners. However the PRC is aware of this as well, and hopefully cooler heads will prevail.

- 【Easier to Move】You can use these appliances...

- 【Save Space and Protect Countertops】The small...

- 【Strong Adhesive】The counter slider for...

- 【Easy to Use】28pcs 22mm/0.87in kitchen...

- 【Wide Application】The coffee slider for...

- ✔Update Dishwasher: This dishwasher cover in...

- ✔Size: This Magnet Sticker Dishwasher Covers...

- ✔Material: This dishwasher cover is made of Our...

- ✔Easy to Install and Remove: Dishwasher Magnet...

- ✔Widely applicable: This magnets are easy to...

The potential invasion of Taiwan is low hanging fruit, and not imminent. The real threat to the immediate future of China, is the COVID outbreak. The government is reporting 80% of the population has had COVID. That's almost 1.5 billion people. Even at a mortality rate of 1%, that's 15 million dead. That will have a serious impact on the short-term productivity of the country.

Conclusions

ETF Quality Opinion

Funds with simple-to-understand models are always more attractive. ASHR has a very simple model, and that should appeal to investors, especially less sophisticated or very busy ones. The holdings within ASHR are all blue-chip giants with deep pockets and strong earnings reports.

ETF Investment Opinion

China can be a very controversial topic for investors. Some people love the financial might of the country, while others disdain the lack of transparency. Either way it is hard to argue that it is at the top of the economic food chain. Thus the top companies in ASHR become apex predators. Always bet on the sharks. We rate ASHR a Hold only because we are concerned about the effects of COVID in the short term, and the ongoing tensions in the South China Sea with Taiwan. If those two resolve themselves amicably, we will have to revisit this fund.