Kevin Dietsch/Getty Images News

Introduction

Following an expected 0.25% rate hike, Jerome Powell gave a standard speech that didn't seem to shock market participants. The Fed's chairman basically repeated his thesis from the previous press conference with slight adjustments to the current situation. So almost no pivot mood whatsoever.

Powell wanted to be a hawk, but frankly, it doesn't actually seem to matter anymore. It doesn't look like the market believes in longer-term high rates from the Fed.

Key takeaways:

- If the economy performs broadly in line with those expectations, it will not be appropriate to cut rates this year

- It would be very premature to declare victory or to think that we've really got this

- We can now say, for the first time that the disinflationary process has started

- It's important that the markets do reflect the tightening that we're putting in place

- It would be very premature to declare victory

2% nonsense

Powell also stated: “My base case is that the economy can return to 2 percent inflation without a really significant downturn or a really big increase in unemployment.” I just wonder how that would work out. In my opinion, the Fed has only two options: shatter the economy with even more restrictive policies, or watch the economy slow down with current policies. Both options lead to a recession. The only difference is how much consumer demand will fall and how much the rate will have to be cut in the future. The Fed will simply not go for softening right now without signals that it is not only preferred but necessary in my view. They started this cycle of hawkishness partly because of the arguable drop in confidence in the Fed a year earlier. And now, if they abandon this rhetoric, it may well destroy the credibility of the Fed.

No one will argue with the fact that a recession will help destroy inflation, which is replaced by deflation. But Powell wants the economy to expand and inflation to fall. Moreover, he “is seeing progress in bringing down inflation without weakening of labor conditions.” The problem is that inflation is still growing at a pretty rapid pace. Why? Because of the labor market strength, which seems to be the only reason for economic acceleration right now.

PCE Index (MoM) (Investing)

And why is the labor market so strong if the Fed keeps hitting the economy with a sledgehammer? Because historically it needed time to cool down after the monetary tightening. And as soon as high interest rates begin to affect the labor market, it will likely crumble because we have the weakest consumer in 2 decades.

Tradingeconomics

Another elephant in the room: the economy is already showing worrisome signs. Purchasing Managers' Index (both Manufacturing and Services) shows the contraction of business activity in the US.

Data by YCharts

At the same time, existing home sales are down 32% YoY.

Data by YCharts

So, to be clear: we are not in a recession yet because the labor market is strong and the wages keep growing, which keeps the demand high. However, as the economy feels more pressure from high interest rates, there will be less and less jobs being added. This will make a very, very weak consumer stop spending and start saving, which will trigger a massive fall in demand.

Fed Funds Effective Rate (blue line) Vs Unemployment rate (red line) (FRED)

Thus, it is unclear to me how a 2% inflation without a substantial economic downturn is a ‘base case'.

The debt market agrees

Don't believe me, let the market speak for itself. We are now facing the deepest inversion in 43 years. That reflects the depth of the recession that traders expect and the certainty that it will happen.

- New Store Stock

- Rivan, Maria (Author)

- English (Publication Language)

- 208 Pages - 04/14/2020 (Publication Date) -...

- Elevate Your Vision : An Enhanced Vision Board...

- Experience a new level of quality with our...

- Our vision board kit for women offers hand-picked,...

- Whether it’s a gift vision board for teens,...

- At Lamare, our mission is to help women plan and...

- National Geographic Special - 2017-1-20 SIP...

- English (Publication Language)

- 128 Pages - 01/20/2017 (Publication Date) -...

Data by YCharts

There is still a huge demand for bonds at the far end of the curve (10+ years) as investors rush to lock in good returns as they probably expect they won't be able to get them anywhere else due to the recession. Thus, the outflow from short-term bonds to long-term bonds continues. Would such behavior be appropriate if a recession were not the baseline scenario over the year's horizon? Of course not. The one not talking about it right now is the Fed though. So who is right: Powell, who marked inflation as ‘transitory' in 2021, or thousands of institutional investors that were right almost every single time for the last 50 years?

Market reaction

As usual, Powell's performance gave the markets an impulse, most likely due to the covering of short positions.

Data by YCharts

The most interesting thing is that the expectations of market participants have shifted towards easing monetary policy by the end of the year, although the chairman of the Fed did not give any signals for this, except for the statement about the “early stages of disinflation”. I recommend not using the FedWatch Tool meeting probabilities data to predict year-end rates though, as these expectations are based on Fed Funds futures, which are highly volatile and do not provide a complete picture of what is happening.

FedWatch tool

3 reasons to sell SPY right now

Moving on to the outlook for NYSEARCA:SPY, it actually hasn't changed much after the FOMC meeting. I believe that $410-$420 is a great time to take profits for the following reasons:

- 66% (332) of stocks in SPY ETF are trading above the 200-day average, which normally could be treated as a bullish sign if we had a positive sentiment. Selling at the local highs of this indicator would've be a good decision during 2022.

Percent Of Stocks Above 200-Day Average (Barchart)

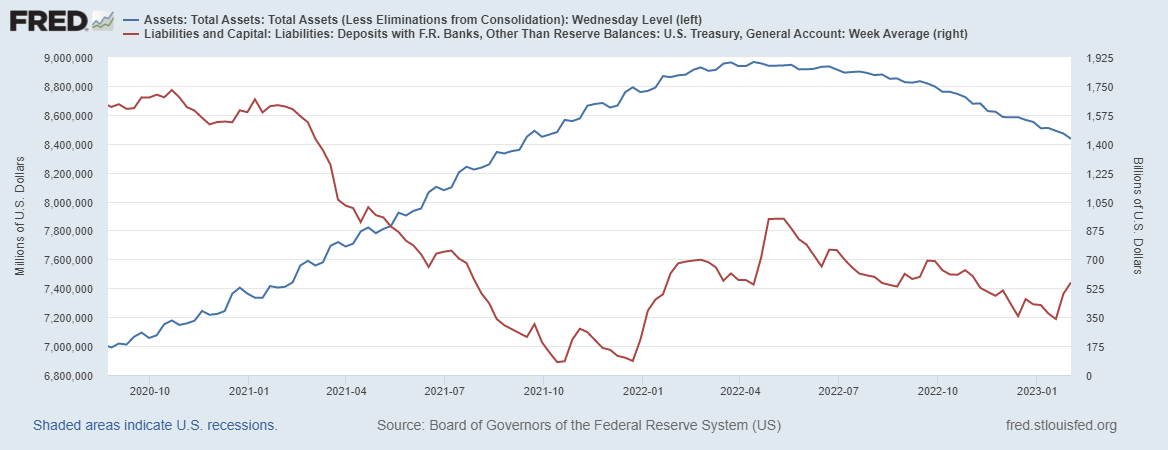

- Liquidity will likely be withdrawn from the markets at a record pace. So far, the US Treasury is throwing firewood into the system, but the closer we are to accepting the national debt ceiling, the closer Treasury is to borrowing money again. Thus, we will have the Fed, which will sell bonds for $95 billion a month, and the US Treasury, which will issue (sell) bonds for $200-300 billion a month. In total, 300-400 billion per month will be extracted from the system. If liquidity is withdrawn, it will be almost impossible to grow.

FRED

- This reporting season is unlikely to please investors. We have already seen the earnings misses from Apple (AAPL), Alphabet (GOOG)(GOOGL), and Amazon (AMZN). Typically, these giants set the mood for the entire IT sector, which makes up 23.9% of all SPY assets.

- Amazon Kindle Edition

- Baldacci, David (Author)

- English (Publication Language)

- 487 Pages - 04/16/2024 (Publication Date) - Grand...

- Amazon Kindle Edition

- Hannah, Kristin (Author)

- English (Publication Language)

- 472 Pages - 02/06/2024 (Publication Date) - St....

- Amazon Kindle Edition

- Elston, Ashley (Author)

- English (Publication Language)

- 348 Pages - 01/02/2024 (Publication Date) - Pamela...

CNBC

Conclusion

Powell, as always, said the same thing he said before. Most of this has already been repeated throughout the year, 90% of the entire speech can be cut and nothing would change. The Fed appears to understand perfectly well what is happening, but it is not worth waiting for any signals from it yet in my view. 2% inflation without a ‘substantial downturn' is a perfect example of how the Fed is still trying to make some kind of verbal intervention, but the attempts seem to be in vain, it just looks implausible.

Thus, the outlook for SPY stays absolutely unchanged in my view, and I recommend selling the rally.