Believe it or not, silver has performed as a stronger immediate hedge idea than gold during wars and black swan geopolitical events over the last 15 years. Silver is easier for small retail investors to buy with its lower price and widespread availability both at local jewelers (as coins/bullion) and now through ETFs in your brokerage portfolio. Taking the evidence a step further, ProShares Ultra Silver ETF (NYSEARCA:AGQ), a 2x leveraged play on silver bullion prices, has produced even greater rewards for holders in times of stress and fear for the financial markets.

Considering we are facing a mountain of geopolitical friction in the world during March 2023, events thought unimaginable years ago like (1) Russia using a nuclear bomb in Europe as it fights Ukraine, (2) a major China/U.S. military or economic trade conflict breaking out over Taiwan independence in the near future, alongside (3) new Israeli threats of military action against Iran’s nuclear development program, are just the easy-to-understand risks you might want to hedge against this year. Any one of these three evolving headaches for the world could erupt overnight, with little to no warning.

And, if the prospect of World War 3 doesn’t keep you up at night, a bombing run by Israel against Iran could completely upend already tight energy supplies globally, spike inflation, and totally disrupt the financial markets as central banks would be hamstrung, stuck raising interest rates even higher on record debt levels worldwide. Remember, Iran could easily retaliate by attempting to close the Strait of Hormuz for oil shipping traffic and/or attack U.S. ships and bases with its precision drones and suicide speedboats.

I know the popular belief currently on Wall Street is silver and gold are dead money until the Federal Reserve pivots to lower interest rates and new money printing. However, history says there is more to the precious metals story than one nation’s credit and banking policy. Sure, the two metals are “stores of value” (hedges against regular fiat money deprecation), but they are also flight-to-safety assets. When major geopolitical disruptions appear, especially without much warning, small investors to the largest hedge funds can and do rush into precious metals.

Silver History Lesson

The best way to explain silver and AGQ upside potential is to go through some past geopolitical crisis examples. I will review the 2011 U.S. Treasury debt rating downgrade, 2016 Brexit shocker in Europe, 2020 pandemic shutdown mess for the world, and 2022 Russian invasion of neighboring Ukraine.

Treasury Downgrade and Budget Battle – 2011

The most disruptive budget or debt ceiling battle in Congress occurred in the summer of 2011, and may be replayed in 2023. When Republicans become fixated on efforts to cut spending and balance the budget, government shutdowns (when budgets are not passed) and debt default fears (on increased ceiling fights) come to the forefront. We could easily get into the same trouble as 2011, when Standard & Poor’s decided to wake up financial markets to the rotten realities of America’s sovereign debt problem (which I personally believe is the worst roadblock to honest U.S. economic growth today).

On August 5th, S&P downgraded U.S. Treasury debt from the safest “AAA” bond rating in the world, to a notch below it “AA+”, meaning the risk of repayment default was now something to seriously contemplate.

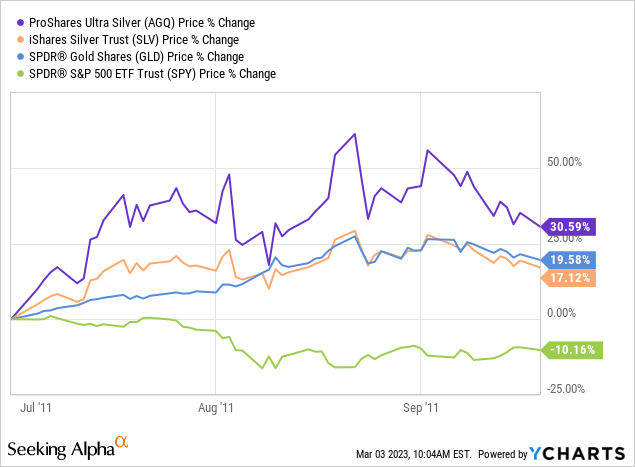

For silver and gold, the 2011 budget stalemate risk to Treasuries was discounted weeks in advance and a few weeks after the rating downgrade through higher metals pricing. Measured from late June to early September, AGQ jumped +50% higher vs. a -10% loss in the SDPR S&P 500 Trust ETF (SPY), drawn below. At the same time, the 1x zero-leverage bullion products of iShares Silver Trust (SLV) and SPDR Gold Trust ETF (GLD) climbed about +20% between July 1st and September 1st, 2011.

YCharts – AGQ vs. Various ETF Price Changes, July to September 2011

United Kingdom Brexit Vote – 2016

It was widely expected by the world’s trading markets that a messy UK/EU divorce would be voted down, as the risks of a cut and run decision by Europe’s leading financial center in London could prove devastating to both sides long term. Nevertheless, the Brexit referendum on June 23rd, 2016 in the United Kingdom won with a slim majority vote (52%/48%), shocking analysts and investors globally.

Fast forward seven years later, 54% of national respondents now believe Great Britain leaving the European Union was a mistake, with support plummeting under 35%. What a difference the breakup reality makes vs. the confident (and misplaced) feelings by the general population England would be better off financially as a more-independent political entity. National pride and patriotic passions outsmarted prudent and collective reasoning.

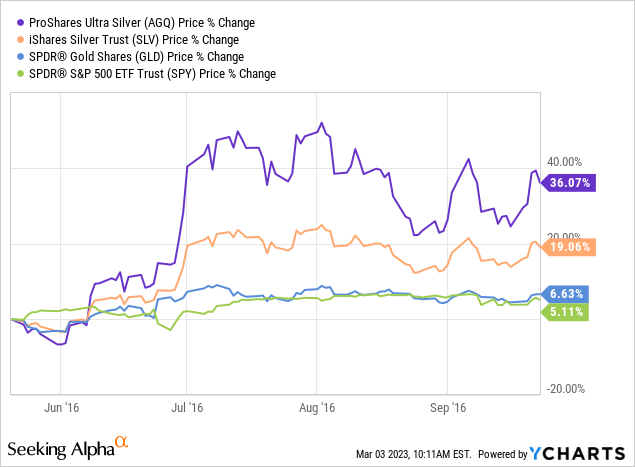

While not directly a U.S. event, silver is an international commodity and store of value. Below you can review AGQ performance before and after the Brexit vote. “Poor man's gold” rose better than +50% between the start of June and beginning of August 2016. Silver outperformed gold by a wide margin, while the S&P 500 rose a minor +3% over the same span (not the whole length of graph pictured).

YCharts – AGQ vs. Various ETF Price Changes, May to September 2016

COVID Pandemic – 2020

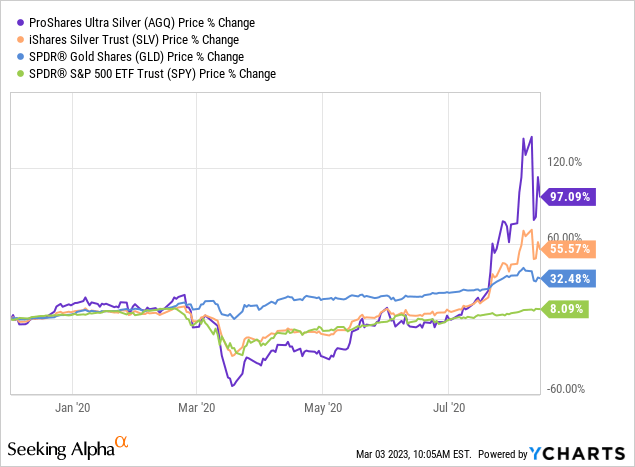

The next major event to rock the globe was the COVID-19 pandemic, which shocked investors and government leaders like never before in a modern health emergency. Silver was actually under intense accumulation as fear of this novel virus mushroomed into late-February. Then, western governments decided to shut down their economies, which led to panic cash raising, including a monster selloff in silver and equities. Gold was able to survive better as the ultimate flight-to-safety idea.

In the end, central banks resorted to record and experimental money printing efforts to offset the closed economy, which was initially projected to last 2-4 weeks, but turned into a larger and longer fiasco. “Unlimited QE” was the Fed response, meaning it could buy whatever financial assets it wanted, giving new cash directly to banks and Wall Street firms to prevent the financial system from collapsing.

As you would expect, gold and silver spiked higher in the end, because of extreme and previously unheard of levels of paper currency/money creation. If you had bought AGQ in December 2019, before the pandemic appeared, and held until August 2020, a DOUBLE in price was achieved. If you had purchased in late March at silver's panic selling low, gains of +200% were outlined! Yes, silver and gold again proved a great place to hide during this crisis, while U.S. equities were flat to lower over most of the graph. (The S&P 500 did generate a small +8% price advance over the whole period drawn).

YCharts – AGQ vs. Various ETF Price Changes, December 2019 to August 2020

Russian Invasion of Ukraine – 2022

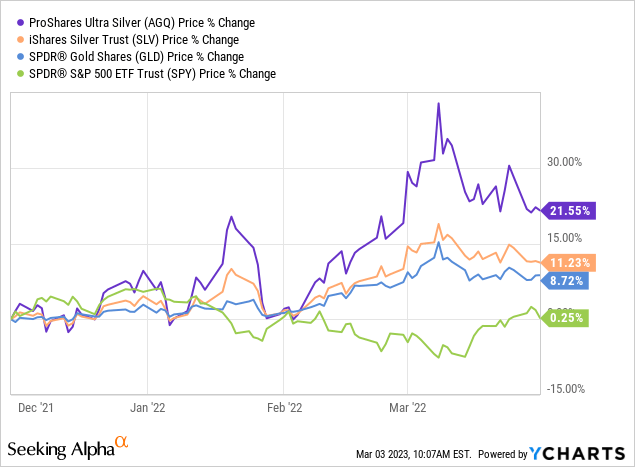

The Russian invasion of Ukraine turned into a high-risk probability by December 2021, as Russia amassed troops for months along their shared border. The large-scale incursion and fighting deep inside Ukraine began on February 24th, 2022.

Had you entered AGQ on the first hints of war in early December or waited until early February, leveraged silver gains of +40% were still attainable into early March. Silver slightly outpaced gold gains around +10% over the late 2021 to March 2022 span, with U.S. equities flat to lower. Without doubt, the main precious metals did their job as a short-term geopolitical hedge. Months later, gold and silver would zigzag lower in price. But during the heat of a new crisis, both provided excellent hedge characteristics for portfolios.

YCharts – AGQ vs. Various ETF Price Changes, December 2021 to Early April 2022

Technical Reasons to Buy

- New Store Stock

- Rivan, Maria (Author)

- English (Publication Language)

- 208 Pages - 04/14/2020 (Publication Date) -...

- Elevate Your Vision : An Enhanced Vision Board...

- Experience a new level of quality with our...

- Our vision board kit for women offers hand-picked,...

- Whether it’s a gift vision board for teens,...

- At Lamare, our mission is to help women plan and...

- National Geographic Special - 2017-1-20 SIP...

- English (Publication Language)

- 128 Pages - 01/20/2017 (Publication Date) -...

Interestingly, the first week of March has opened a technical trading-based buy window to accumulate a stake in AGQ. Why? The February dive in silver prices can be argued as a retest of the advance off last summer’s important bottom (in U.S. dollars). Concerns are now widespread higher inflation and interest rates for longer will be the 2023 experience. Many traders and investors have dumped silver/gold holdings, believing their only function is simply as a monetary asset. If tighter Fed policy is approaching, you automatically sell precious metals. That may be a huge mistake if another black swan, political or military crisis appears in coming weeks.

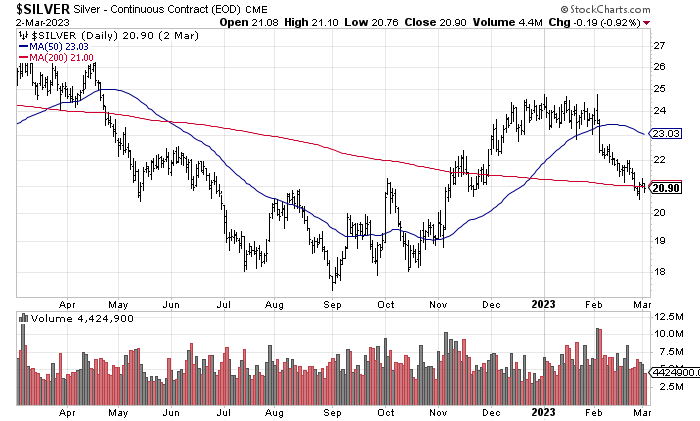

Silver’s price around US$21 an ounce today is testing the 200-day moving average (drawn below), which would turn higher for trend on any silver price advance in March. If silver can eclipse $23 in March or April, my view is multiyear highs above $30 could materialize quickly from its super-low valuation.

StockCharts.com – Nearby Silver Futures, 1 Year of Daily Price & Volume Changes

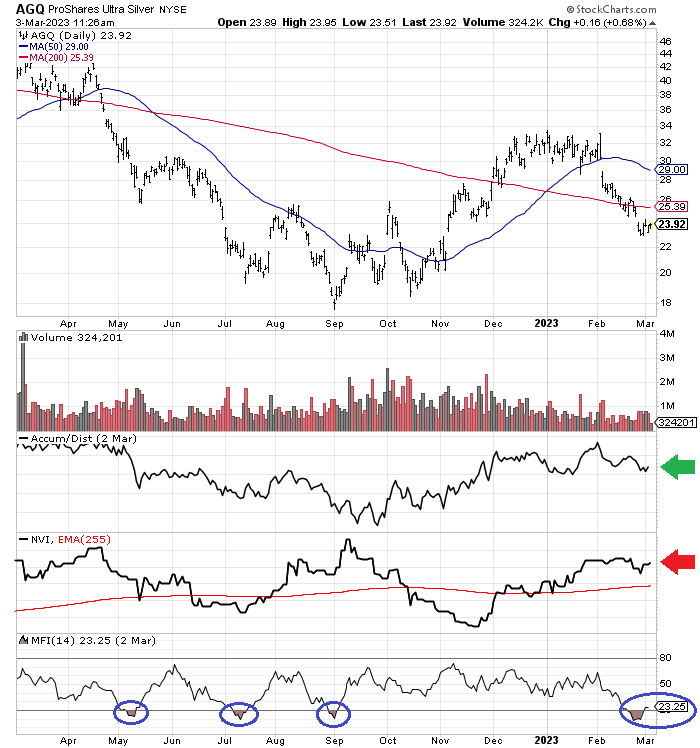

For AGQ specifically, its chart is looking quite bullish, when a number of underlying momentum indicators are thrown into the mix. The Accumulation/Distribution Line (marked with a green arrow below) has been uncharacteristically strong during the February-March price decline. Plus, the Negative Volume Index (marked with a red arrow) is holding up reasonably well, similar to the August-September bottom in silver.

Lastly, a clearly oversold 14-day Money Flow Index reading (circled in blue) has cleaned out numerous traders and those disregarding a bright future for leveraged silver in a geopolitical crisis. Previous sub-20 scores in the MFI have signaled short-term price bottoms.

In combination, the technical readout from these three indicators is the most bullish in the last 12 months. So, now may be the perfect time and place to contemplate adding AGQ to your portfolio.

StockCharts.com – ProShares Ultra Silver ETF, 1 Year of Daily Price & Volume Changes, Author Reference Points

Final Thoughts

I have written extensively since last summer on silver’s extreme undervaluation position vs. other assets, with my iShares Silver August effort here a good place to find a recap of its bullish long-term setup.

Risks to weigh include AGQ carrying a hefty 1.5% management fee yearly to create its leverage through swaps with banks and futures contracts. Plus, it suffers from the time decay of forward contango on futures contracts and swap instruments (where nearby delivery agreements are traded at higher than spot quotes). If you buy and hold this ETF for a number of years, your 2x leverage will effectively dip closer to 1x under most future circumstances (using history as a guide).

I suggest simple silver bullion holdings as a better strategy for 5-10 year holding periods, because of the time decay inherent in leveraged contracts and volatility exaggeration of minor silver swings.

In addition, if silver prices continue to dip like February, holding a 2x leveraged product will not be fun, and you will lose a dramatic amount of wealth (at least on paper assuming you refuse to sell). The whole risk picture argues AGQ should be a very minor part of portfolio construction, although an important one to hedge against trouble in the world and/or future money printing experiments on society by central banks.

- Amazon Kindle Edition

- Baldacci, David (Author)

- English (Publication Language)

- 487 Pages - 04/16/2024 (Publication Date) - Grand...

- Amazon Kindle Edition

- Hannah, Kristin (Author)

- English (Publication Language)

- 472 Pages - 02/06/2024 (Publication Date) - St....

- Amazon Kindle Edition

- Elston, Ashley (Author)

- English (Publication Language)

- 348 Pages - 01/02/2024 (Publication Date) - Pamela...

Yet, as a hedge against a recession and Fed pivot scenario to new money printing (which I strongly believe will happen this year, sooner or later) and a play to counterbalance enormous geopolitical risks in the world during 2023, AGQ may be one of the smartest risk-adjusted buys today for your portfolio. If we do experience a major spike in silver, just remember to lighten your position as AGQ quotes rise (locking in gains).

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Global X launches Europe’s first pure-play silver mining ETF