The Vanguard S&P 500 Growth ETF seems like a good ETF to ride the recovery and bull run because of its significant exposure to tech stocks. Strong financial results and better-than-anticipated economic conditions support the upward trend and give hope that the worst is over. The downside risk is low because the US economy is unlikely to experience a hard landing and severe recession in 2023.

VOOG: Now Is The Time To Buy For Huge Long-Term Gains (NYSEARCA:VOOG)

The Vanguard S&P 500 Growth ETF (NYSEARCA:VOOG) offers one of the best buying opportunities for investors with a three- to five-year time horizon because growth stocks have already bottomed out and fundamentals are beginning to support the development of a recovery trend. Given its extensive exposure to the information technology sector, VOOG is the ideal ETF to benefit from the recovery in 2023 as well as potential gains in the years ahead. Its low expense ratio and high liquidity ratio, among other things, make it a more reliable ETF to hold over time than its competitors.

The Worst is Behind Us

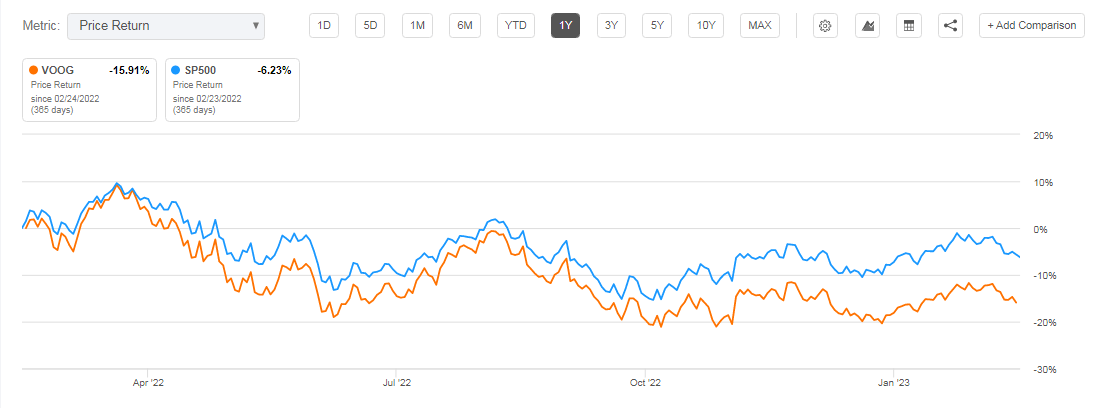

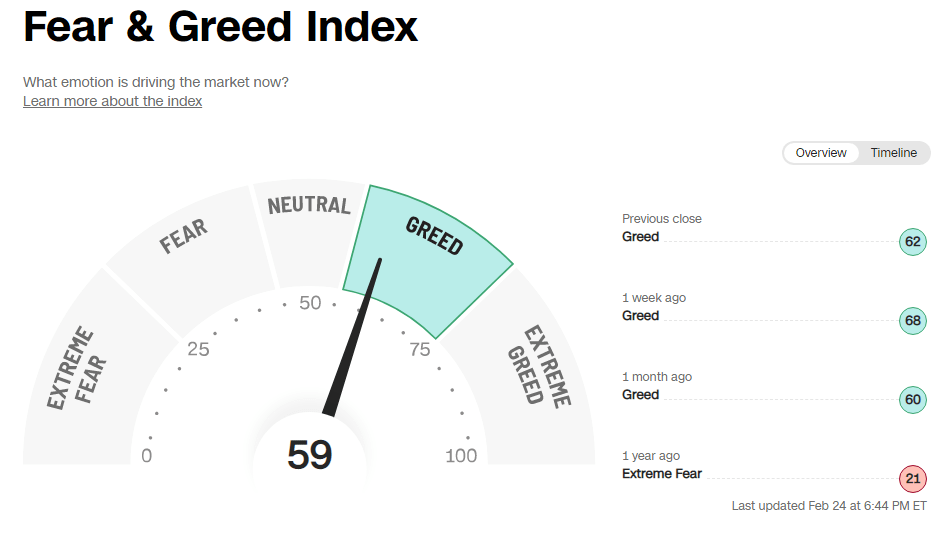

With an impending recession and interest rate hikes, 2023 began with one of the most pessimistic forecasts for the S&P 500 and growth stocks in the previous two decades. Furthermore, Morgan Stanley strategists predicted that the stock market would reach new lows in the first half of 2023 due to a sharp drop in earnings. The firm predicts that the S&P 500 will earn $195 per share in 2023, down from $218 per share in 2022. But in my opinion, the stock market bottomed out in October 2022, and the current uptrend in stock prices is not a bear market rally because investor confidence has been reestablished by a surprise change in fundamental factors.

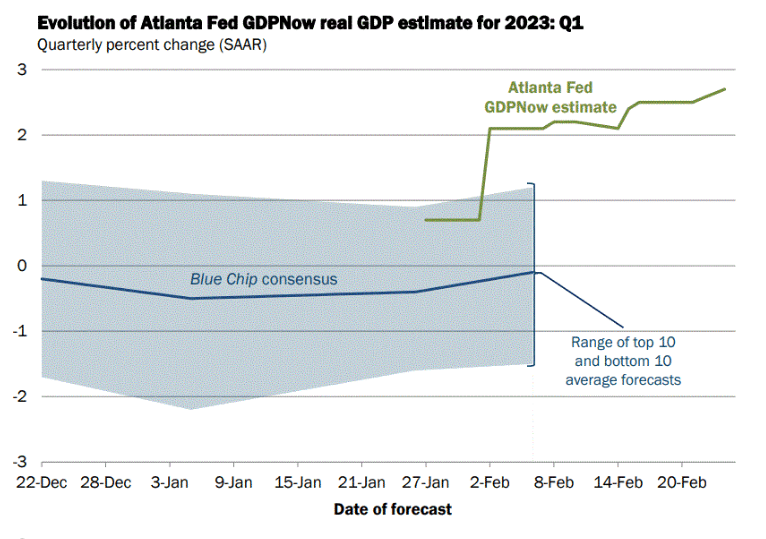

For instance, the most recent economic data from the United States and other important regions like Europe and China indicated that the economy would perform better than expected in 2023. Strong retail sales data, a slowing inflation rate, and a strong labor market in the US gave reason to believe that the economy wouldn’t suffer a severe downturn. According to Jim Cramer of CNBC, a hard landing is supposedly impossible when there has been such rapid job creation. While a severe recession is less likely due to the robust labor market, it also highlights the need for further rate increases to rebalance the labor market and prevent prices and wages from rising. According to Lotfi Karoui, a strategist at Goldman Sachs, there will be three more rate increases in 2023, but they won’t cause the economy to contract; rather, they’ll slow growth. In February, the US PMI Composite Output Index soared to its highest level in the last thirteen months. A PMI score of 50 or higher indicates that the US manufacturing sector is expanding. US GDP forecasts have also been significantly revised upward in recent weeks. For example, the Atlanta Fed raised its first-quarter US GDP forecast several times in the past few weeks to 2.7% from an initial estimate of less than 1%.

Apart from the United States, the European Commission predicts that economic activity will not contract in the first quarter, preventing the bloc from experiencing the much-anticipated recession. China’s government has loosened its strict COVID-related policies, which is likely to result in an increase in consumption and business activity. This is reflected in Fitch’s revised growth forecast, which now calls for 5.0% growth compared to the previous 4.1%. Overall, global GDP growth is expected to outperform previous expectations, which is great news for multinational corporations.

Tech Exposure Gives Edge to Vanguard S&P 500 Growth ETF

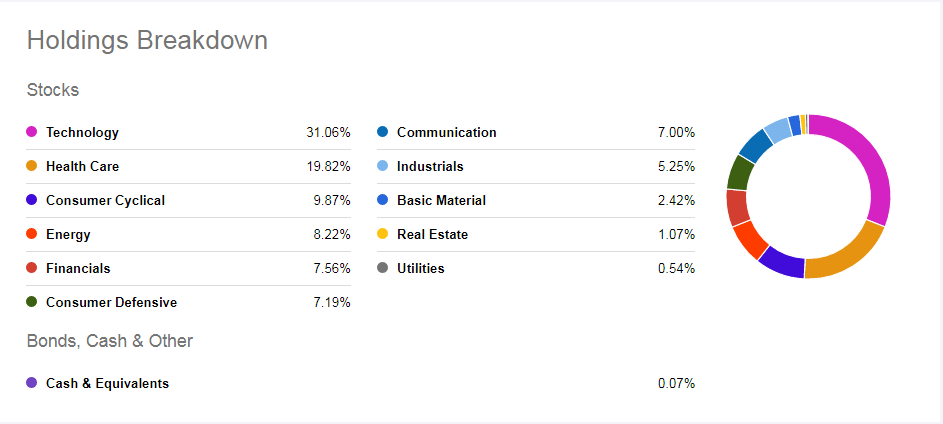

One of the best ETFs to buy and hold during a recovery phase is the Vanguard S&P 500 Growth ETF due to its significant exposure to the information technology sector and diversification into other important growth sectors. Nearly 31% of VOOG’s holdings are in the technology sector, including its top ten holdings: Apple (AAPL), Microsoft (MSFT), Nvidia (NVDA), and Visa (V). Tech stocks are gaining from a better-than-expected economic outlook as well as strong fourth-quarter financial results and fiscal 2023 projections. According to FactSet data, the technology sector outperformed all other S&P 500 sectors in the fourth quarter, with 82% of companies exceeding expectations. The Technology Select Sector SPDR ETF (XLK), which provides broader coverage of the technology sector, has gained approximately 18% year to date, outperforming the S&P 500’s mid-single-digit percentage gains.

Since the beginning of the year, Apple’s stock has increased 18% as fundamentals in China have become stronger. China is one of Apple’s key markets and manufacturing hubs. As a result of COVID-related restrictions in the world’s second-largest economy, the company has faced severe financial and supply chain pressure in the past year. According to Apple CEO Tim Cook, COVID-19 challenges significantly impacted supply of the iPhone 14 Pro and iPhone 14 Pro Max. Foreign exchange headwinds are also likely to ease for the technology titan, as the dollar has fallen significantly since last October. Microsoft has also exceeded its expectations for the December quarter and anticipates positive year-over-year growth in 2023.

With outstanding fourth-quarter results and a better-than-expected outlook, Nvidia in particular stunned investors. The company forecasts first-quarter sales of $6.5 billion, significantly higher than the $6.05 billion in the previous quarter and exceeding analysts’ expectations of $6.35 billion. Goldman Sachs analyst Toshiya Hari upgraded Nvidia to “buy” following the results, noting that the stock will continue to outperform due to a positive estimate and a potential expansion in its multiple. Since the start of the year, shares of NVDA have increased by a whopping 62%. Meanwhile, payment technology companies such as Visa and Mastercard (MA) are expected to post double-digit earnings growth in 2023. Cisco (CSCO) expects revenue to rise between 11% and 13% year on year in the March quarter and full-year earnings to range between $3.73 and $3.78 per share, up from its previous estimate of $3.51 to $3.58 per share.

Growth stocks from the consumer discretionary and communication services sectors have also outperformed the overall market index so far in 2023. Although the healthcare sector has underperformed so far in 2023, the fundamentals appear to be sound, with top-rated healthcare growth companies expected to generate robust financial growth. For instance, UnitedHealth Group (UNH), one of VOOG’s top ten stock holdings, exceeded fourth-quarter forecasts. The company now expects adjusted net earnings per share to stand between $24.40 and $24.90 in 2023, up from the last year’s earnings of $21.18 per share. Eli Lilly (LLY) exceeded expectations in the fourth quarter, and it anticipates 2023 EPS to be in the range of $7.90 to $8.10, up from $6.90 in 2022.

Quant Ratings and Valuations

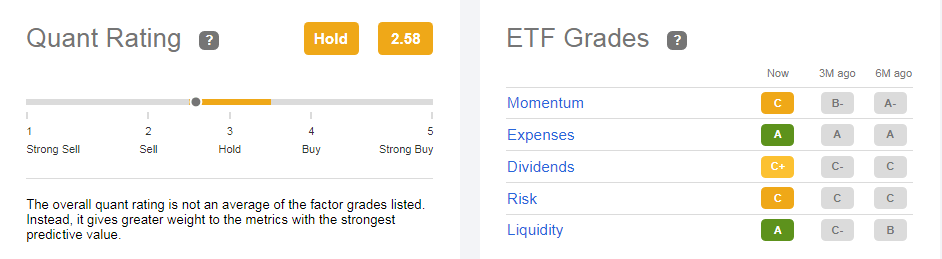

Even though VOOG has a hold rating and a low quant score, a number of indicators are still sending out strong signals for long-term investing. Expenses, in particular, play a significant role in overall returns when investing for the long term. The expense ratio of 0.10 for the growth ETF is quite low when compared to the median ratio of 0.48% for all ETFs. The second most important factor is high volume, which is one of the most important indicators of security’s strength. In the past three months, it has averaged $31.51 million in daily dollar volume, which is about 1600% more than the median of all ETFs.

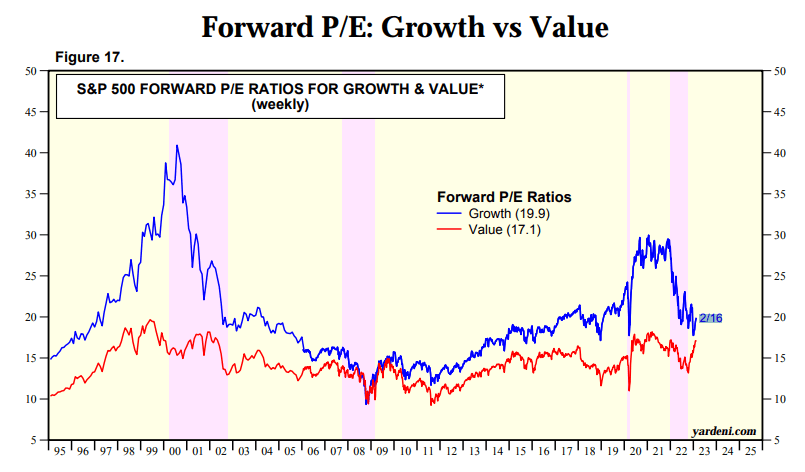

Growth stock valuations appear appealing because they significantly decreased in 2022 as a result of a sharp decline in share price rather than a decline in earnings. Earnings of tech stocks increased by slightly more than 3% year on year in 2022, and better-than-expected economic trends suggest that tech companies will perform well in 2023. Growth stocks are currently trading at around 19 times forward earnings, which is significantly lower than both pre-pandemic and five-year average levels.

In Conclusion

It appears that now is the best time to invest in growth stocks because they have already bottomed out and future indicators are painting a more promising picture. History also shows that after every bear market, stocks experience a long bull run, and those who buy stocks near the bottom of the selloff reap big returns. The downside risk appears to be limited from here because the risk of a steep earnings drop and a severe recession has been mitigated by a string of positive economic data. Overall, VOOG’s high beta and exposure to tech stocks position it to outperform the broader market index during a recovery and a bull run.

Enjoyed this article? Sign up for our newsletter to receive regular insights and stay connected.