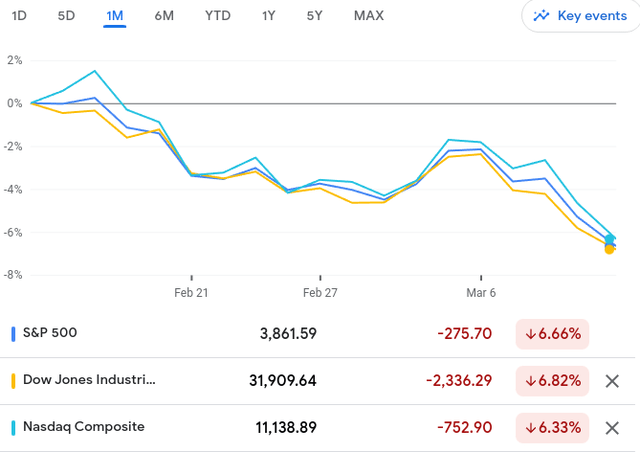

The new year started off strong, and investors welcomed a broad relief rally. I met this with relief too, but also with a mix of skepticism. As a result, I suggested locking in some gains and taking some chips off the table post-January. While stocks continued up briefly, they have come well off their recent highs. This justified the move to cash. Now, with the market indices down about 6-7% in a month, I see merit to putting some of that cash back in the market.

The Case For Putting Cash Back To Work

Main Thesis & Background

The purpose of this article is to discuss the broader equity market and re-cap a bearish review I had in early February. At that time, I suggested using January's rally as an opportunity to take some short-term wins and live to fight another day. While it is hard to time the market, I saw multiple headwinds that left me thinking a bigger cash allocation was going to be a timely shift. This is especially true since cash savings rates are starting to move in the 4-5% range. This means we are getting paid a reasonable return to be patient.

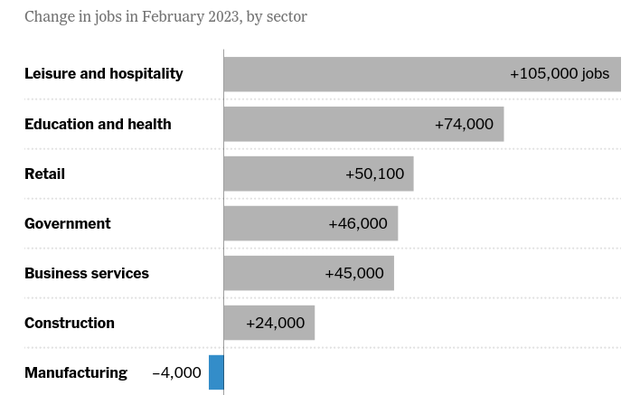

Now that five weeks have passed, that shift was vindicated. Stocks have moved well off their highs and have seen an uptick in volatility. In fact, over the past month the three major indices are down almost 7% collectively:

Of course, there are valid reasons for this move and we may see more downside to come. But I think will this sell-off there is now a better argument to be made to put some of that protected cash back in to the market.

I will use this review to explain why, and also touch on two key stocks that I think may be strong options for defensive investors who want to do more than just index investing.

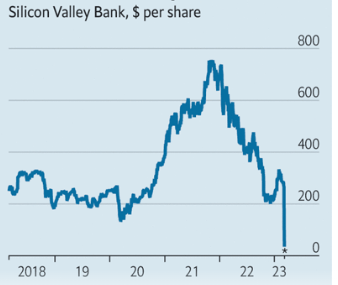

Bank Failures Are Not That Rare

To begin, I want to touch on the biggest news story to come out of last week. Any macro-review in the near term should focus on this as it was a primary driver of recent volatility. This is the collapse of Silicon Valley Bank (SVB), which has seen been taken over by the Federal Deposit Insurance Corporation (FDIC). Needless to say, this was a move that hammered investors in SVB, and also the broader Financials sector as a whole:

Now, I am not going to make an argument that this is in any way good for the market. It isn't – and the Financials/Banking sector will likely see more volatility ahead as a result of it. This means investors should approach the sector carefully, because it is not clear now exactly how much this will spread to other lenders. Buying in now, during this time of uncertainty, could result in a big win, but it also comes with disproportionate risk. This is important to keep in mind.

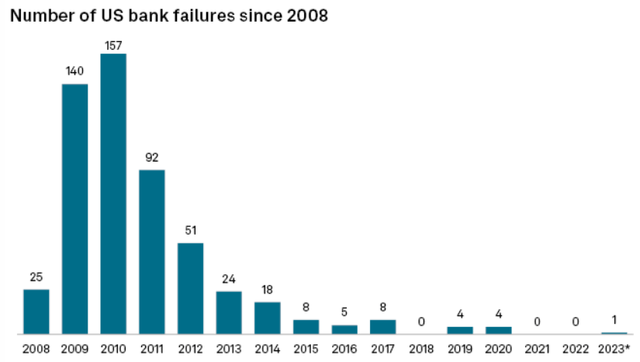

But I will use this review to remind readers that bank failures are not as rare as they may seem. Yes, SVB's is very large. That makes it unique and something to carefully monitor. But while we have not seen a bank failure in the two preceding calendar years, this is actually not the norm. In fact, going back fifteen years we see a large number of bank failures the market has had to contend with:

I will reiterate I am not making light of this development. A bank failure of this size is likely to have more of an impact than many of the other failures referred to in the above graphic. Further, this wound is still very fresh. So while the impact will undoubtedly fade with time – we could be relatively far off from that happening.

The broader conclusion I draw is that while this is a negative development, it is not “rare” by any stretch, and is a risk the financial markets are used to seeing play out. I don't believe SVB's failure is going to bring down other, more stable banks that are well capitalized as a result of consistent stress testing. In short, I would use the selling this has induced as an opportunity.

US Earnings Estimates Still Beat The World's

My next thought on the broader U.S. equity markets has to do with how they compare to the rest of the world. As a U.S. and international investor, I tend to move outside America's borders when I see relative value and/or have micro-concerns about the U.S. that I don't see elsewhere. At this juncture, macro-issues like inflation, central bank rate hiking, and slowing economic growth are shared throughout much of the world. Even in China, where growth expectations have soared as the nation ended its strict lockdowns, these expectations are met with some skepticism since we don't know if or when those lockdowns may resume.

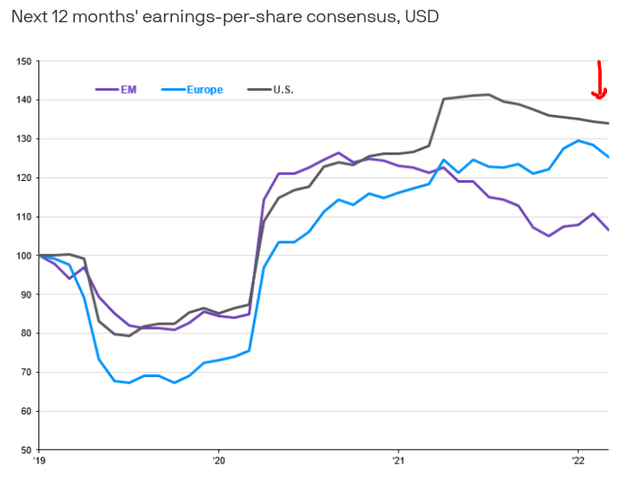

With this in mind I see the U.S. corporate world holding up reasonably well. Earnings and expectations have been revised downward, to be sure, but that is consistent with what we've seen across the globe:

What I draw from this is the U.S. remains a world leader in term of corporate earnings. Is there merit to diversifying overseas? Absolutely – that is something I do and will continue to do. But when I am looking at where to put money right now, I think the U.S. wins the day.

Business Activity Showing Signs Of Life

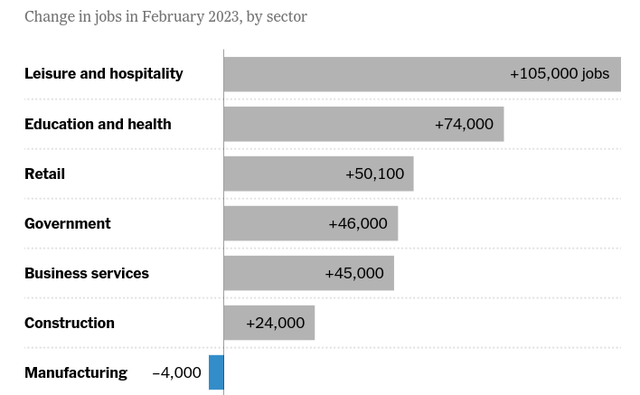

Digging deeper in to the U.S. economy, there are two other signs that I view positively besides resilient earnings. These are the labor market and economic activity measures. The first saw some news this week with a better than expected jobs report in terms of job creation:

This suggests the American worker continues to find success in finding employment and will support both retail spending and outstanding credit balances. This trend is at-risk for reversal if growth stagnates and/or the Fed moves too aggressively with rate hikes (or may have already). But, for now, the labor market continues to be a strong point for the economy as a whole.

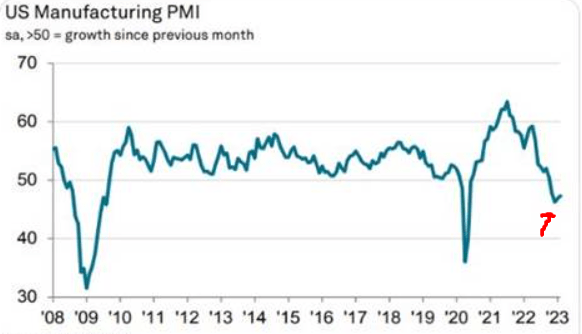

A second factor is business/economic activity. This is a gauge on whether or not we are nearing a recession. At this juncture, it is difficult to forecast. Many had already expected a recession to occur and now the expectation for one keeps getting pushed back. A reason behind this is the PMI measure has ticked higher recently, showing an increase in manufacturing activity in the country:

What we are seeing is classic American resilience. Despite global challenges and a restrictive Fed, the American economy keeps humming along. While I see things getting more difficult in the second half of the year, these signals of strength give me confidence that buying on dips remains a good strategy here.

Defensive Stock #1: Waste Management

- New Store Stock

- Rivan, Maria (Author)

- English (Publication Language)

- 208 Pages - 04/14/2020 (Publication Date) -...

- Elevate Your Vision : An Enhanced Vision Board...

- Experience a new level of quality with our...

- Our vision board kit for women offers hand-picked,...

- Whether it’s a gift vision board for teens,...

- At Lamare, our mission is to help women plan and...

- National Geographic Special - 2017-1-20 SIP...

- English (Publication Language)

- 128 Pages - 01/20/2017 (Publication Date) -...

Perhaps index investing is not for you. Or maybe even with the positives I highlighted, one wants to have more defensive exposure. I concur with that mindset, and it supports why I personally hold two names that I feel confident holding in any business cycle. The first is Waste Management (WM) because I truly believe that “trash is cash”.

There are a number of reasons I view this company (and stock) as defensive and see a legitimate buy thesis here. The first is the most obvious – this is a necessity service that Americans just can't do without. We have a huge market for trash removal in this country and WM is one of the biggest players. Second, the revenue stream is domestic, which means that geo-political risks outside U.S. borders are not really relevant for the company. Of course, this also means it won't benefit from stronger growth in other corners of the world, but there are plenty of other ways to play that. WM is a defensive names perhaps because of its lack of foreign exposure. This supports why it is one of the few individual names I own.

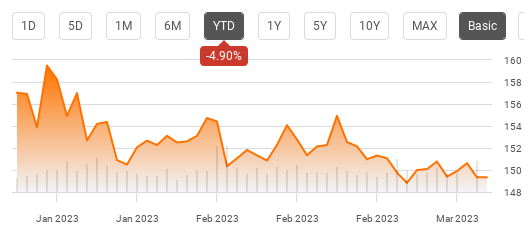

In addition to these fundamental points there are two other short-term reasons I like this stock right now. One, the stock is down for the year. This may sound counter-intuitive but the premise is I believe in buying quality companies for the long-term when the market is punishing them. WM fits that bill at the moment:

Two, the company recently announced a solid dividend hike of almost 8% back in March. While the current yield is not “high”, this growth gives me comfort:

Ultimately, I view WM as a play I want to have right now. It is domestically-oriented, a reasonable dividend stock, and about as defensive as it gets. Given the recent pullback, I'm a buyer at these levels.

Defensive Stock #2: McDonald's

Another defensive name I own and plan on adding to is McDonald's (MCD). This is a strong dividend play too in terms of growth of time and also has the added benefit of often performing better when the economy is challenged. As people worry about costs, they move to cheaper dining options. As MCD's has been there for decades to help consumers on that journey.

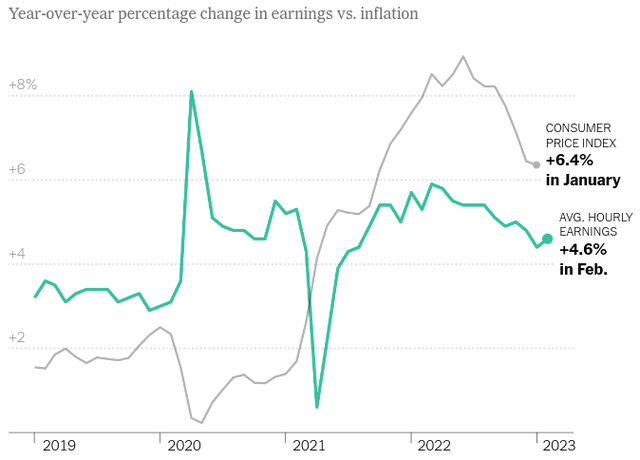

There are obvious reasons for considering companies that cater to the cost conscious buyer. For example, I discussed above how the strength of the labor market is exceeding expectations. That is true, but even those figures show some difficulty when we consider inflation. For example, wage growth is high on a historical basis, but still pales in comparison to inflation:

What this says to me is that the company is there to service those workers who may be earning more, but continue to feel inflation's pinch. That is critical is this environment.

- Amazon Kindle Edition

- Baldacci, David (Author)

- English (Publication Language)

- 487 Pages - 04/16/2024 (Publication Date) - Grand...

- Amazon Kindle Edition

- Hannah, Kristin (Author)

- English (Publication Language)

- 472 Pages - 02/06/2024 (Publication Date) - St....

- Amazon Kindle Edition

- Elston, Ashley (Author)

- English (Publication Language)

- 348 Pages - 01/02/2024 (Publication Date) - Pamela...

Further, the company continues to innovate as best it can in a highly saturated market. Recent company announcements show a roll-out of a new MCD-branded lemonade and also new varieties of its chicken sandwiches:

For me this tells me the company is not being static – despite its basic concept and menu options. I see its lower-end focus, dividend history, and brand name status as a critical defensive hold when the market's outlook is cloudy. So I will continue to hold and look to add in the days ahead.

Bottom-Line

We have seen a lot of negative headlines of late. This is certainly causing investor anxiety. Fortunately, I was one to look at the early 2023 bull-run with some skepticism and welcomed the sell-off that resulted since I had built up my cash position. This leads me to being in the enviable spot of having options now. Do I continue to hold for a 4-5% APY in my savings/CD accounts or look to get more creative now that the market has sold off?

I think a combination of both makes sense. I will be building to my positions that I previously had taken some profit in (such as the S&P 500 and NASDAQ). I also like the idea of adding to my favorite defensive names, which are WM and MCD. However, there are plenty of reasons why more pain could be ahead, so keeping a reasonable cash cushion on-hand continues to make sense. As a result, I feel the time has come to start adding, and will look to get even more aggressive in the weeks and months ahead if we see continued weakness.