SPHY owns a portfolio of mostly high-yield bonds in the United States. The fund currently offers an attractive 30-day SEC yield of 8.97%.Despite better long-term total return potential than treasury funds, there is still significant downside risk in 2023 due to a possible recession.

SPHY: More Patience Is Required (NYSEARCA:SPHY)

Introduction

High yield bonds often offer attractive bond interest to investors. But higher return usually also means higher risk. Should investors be thinking of investing in high yield bonds this year or should investors stay away from them? In this article, we will analyze SPDR Portfolio High Yield Bond ETF (NYSEARCA:SPHY) and offer our insights and suggestions.

ETF Overview

SPHY invests in high yield bonds. The fund has delivered better return over the long run than U.S. treasury funds. However, SPHY’s default risk is quite high especially when faced with economic headwinds. The fund’s price may also suffer dramatic declines if the market is in panic mode. Given that a recession may be on the horizon, significant downside risk remains. Investors wishing to buy SPHY should exercise patience and as there could be a better entry point in the near future.

Fund Analysis

Significant decline since the beginning of 2022

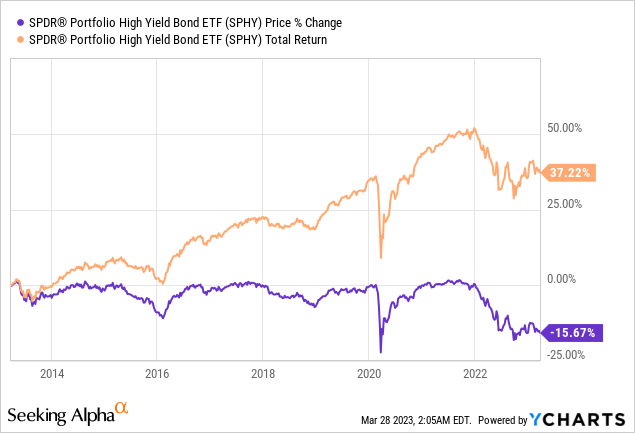

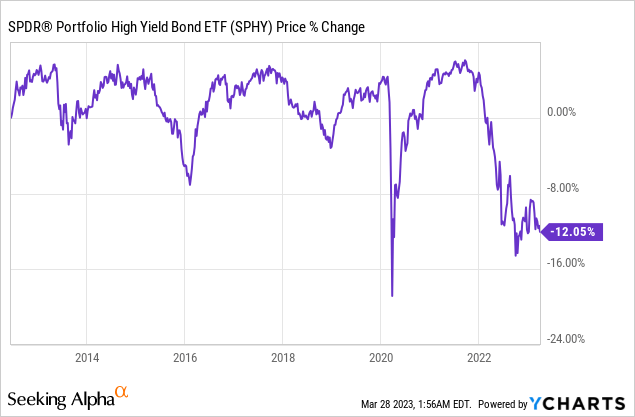

Whether they are treasuries or corporate bonds, high yield bonds or investment grade bonds, the bond markets suffered tremendous losses last year. This decline was due to the Federal Reserve aggressively hiking rates to combat inflation. As can be seen from the chart below, SPHY has declined over 12% since reaching the cyclical high in the second half of 2021.

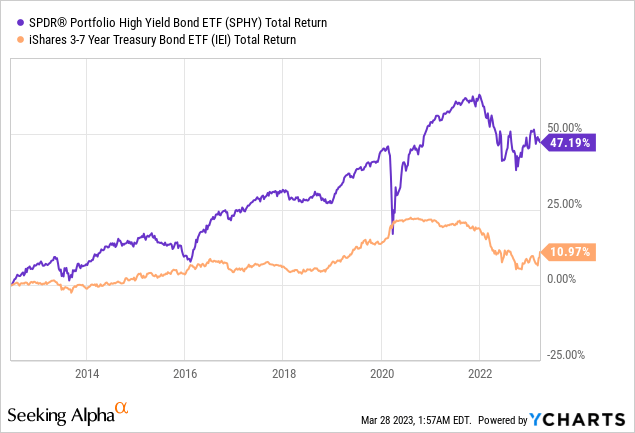

Despite the significant decline, SPHY still delivered positive total returns since 2023. As can be seen from the chart below, SPHY has delivered a total return of 47.19%. In contrast, iShares 3-7 Year Treasury Bond ETF (IEI) only delivered a total return of 10.97%. This difference was primarily due to SPHY’s higher 30 day yield of 8.79% than IEI’s 3.81%.

Reasons why we still think it is too early to buy SPHY

Despite a decline of about 12% in SPHY’s fund price and its attractive yield, we think it may still be too early to initiate a position in SPHY. Here are our three main reasons:

1) Continual economic headwinds will trigger credit defaults

We may be facing with higher default rate than last year due to the Federal Reserve’s tightening monetary policy. In fact, rating agency Fitch is forecasting a default rate of 3%~3.5% for high yield bonds in the U.S. and Canada this year. This rate is significantly higher than last year’s 1.3%. Credit defaults have the potential to swallow the net asset value of bonds. SPHY’s fund value will likely be impacted negatively.

2) Negative spike in SPHY’s fund price will likely occur if the market is in a panic mode

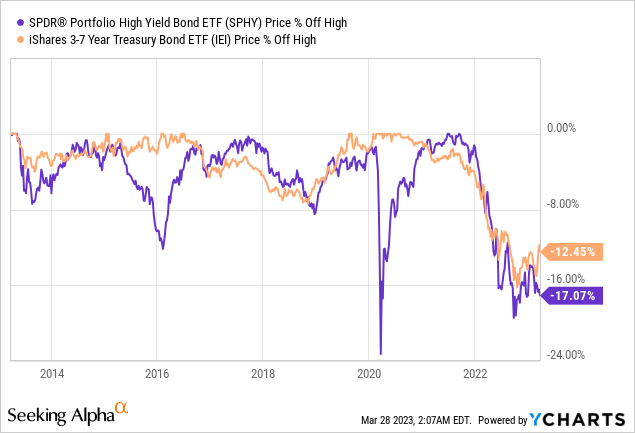

We know that the Federal Reserve is determined to keep the rate elevated beyond 2023 to combat inflation. This has the potential to tip the economy over to a recession. The broader market may be in a panic mode if recession fear mounts. In such a scenario, high yield bond funds may decline significantly. As can be seen from the chart below, SPHY’s fund price experienced a negative spike in 2020 due to the outbreak of the pandemic. In contrast, IEI’s fund price suffered zero decline in 2020. This is because many investors rotated their money out of riskier assets such as high yield bonds and into risk-free U.S. treasuries.

3) The spread is still not attractive enough

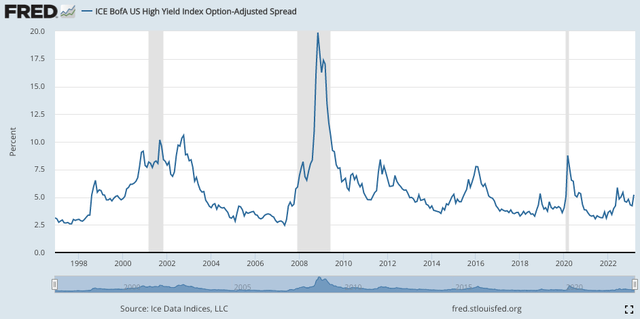

One metric we often refer to when evaluating whether it is a good time to buy high yield bonds or not is the high yield spread. For reader’s information, the high yield spread is calculated by taking the average yield of the ICE BofA High Yield Index and minus the 10-year treasury spread. As can be seen from the chart below, the current spread of a little over 5% is in the middle of its historical average in the past 25 years. However, in previous two recessions in 2008/2009 and 2020, this spread has overshot to as high as 20% and 8.5% respectively. Since we may be faced with a recession very soon, we think investors should pay close attention to the spread trend. If we observe a positive spike in the spread, it will likely constitute a better entry point. Right now we have not yet observed this happening.

Investor Takeaway

Although SPHY’s yield is attractive, we think there may be more downside as we believe an economic recession is not too far away. In an economic recession, we think the possibility of SPHY to decline further is very likely. Hence, we think investors still need a little bit of patience and should wait on the sidelines.

Enjoyed this article? Sign up for our newsletter to receive regular insights and stay connected.