Thesis Summary

As the American financial system continues to be in distress, I see Block (NYSE:SQ) as a possible winner from this situation.

Block embodies some of the best aspects of decentralized finance and has a well-known crypto orientation.

The public is yearning for a secure and reliable alternative to traditional banking, and Block has both the reach and product to make this happen.

Since my last update on Block over a year ago, the company has reported another solid year of growth but SQ stock price is down over 30%, in great part due to the recent short-seller report.

Without going into specifics on the report, I find that, as is often the case in these situations, a lot of the claims made are over-blown, and they don't change the long-term appeal of the company, especially when looking at this investment from a “crypto perspective”.

In this article, I will focus on how Block could stand to massively benefit in the future due to its various crypto-friendly investments and services.

Block’s Latest Results

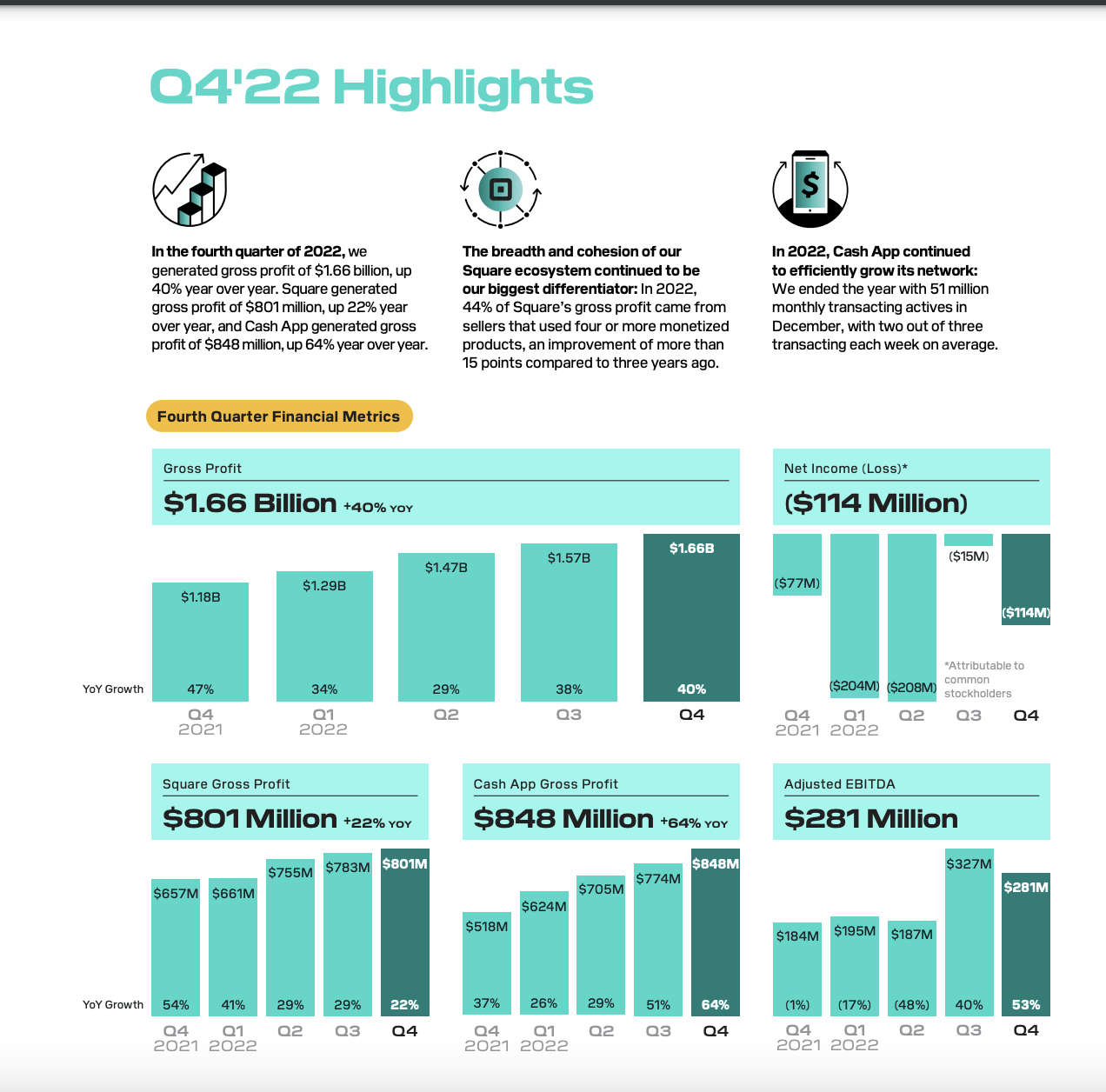

Let's begin by reviewing Block’s latest results for 2022.

Block Highlights (Investor Presentation)

’s revenues mainly come from two main sources: “Block revenues” and “Cash App revenues”.

Block revenues come from transaction fees on its payment processing and subscription fees charged to sellers who use Block’s payment platform. The company also offers various banking and loan-related services.

Cash App revenues come mainly from fees charged to users when using the Cash App card or when buying Bitcoin. Block also makes money from its Buy Now Pay Later program.

In spite of strong revenue growth, the company has failed to increase adjusted EBITDA noticeably. This can be attributed in part to impairment losses of Bitcoin holdings and increased marketing costs associated with its BNPL product.

Nonetheless, I believe SQ stands to benefit strongly from the coming crypto bull market, and has a lot of room for expansion in terms of increasing user profitability.

Block is Crypto First

One of the best things about Block is that it has made it very clear to users and investors that it is a crypto-friendly company. This is mainly due to the fact that Jack Dorsey, the CEO, is a firm believer in cryptocurrencies.

Block has a lot more exposure to crypto and Bitcoin than people think. On top of being one of the main platforms for buying/selling Bitcoin, SQ has a Bitcoin hardware wallet in the works. The company aims to make self-custody more accessible to everyone, a noble and hopefully lucrative endeavour.

Block also recently spoke about a personalized BTC mining kit.

Block, Inc. thinks it and developers can build better Bitcoin mining rigs. That's why it's considering building a “Mining Development Kit,” or MDK, it said on Tuesday.

Source: Decrypt

Though Block does also produce ASICs graphics cards, it is important to note that this initiative is mainly about creating a decentralized mining system by empowering the people rather than making profits.

The key thing to understand here is that SQ is positioning itself for a Bitcoin-centric future. So what could this future look like?

What can we expect moving forward?

With the current financial turmoil going on, a company like SQ willing to integrate Bitcoin into its operations has more potential than ever.

The current issues created by higher bond yields are not limited to Silicon Valley Bank (OTC:SIVBQ). Most of the US financial system is in a similar situation. In fact, Moody’s has already cut down its rating of the US banking system. Ultimately, the only way out of this situation will be to monetize the financial system’s losses, which could lead to a significant devaluation of the dollar in this already inflationary environment.

This is no longer speculation, but reality, with QE back on the table, and a flight into Bitcoin already underway. Most of the US ramps into crypto have shut down, like Silvergate (SI), Signature (OTC:SBNY) and SVB, and others are under attack, with Coinbase (COIN) being threatened with SEC fines just last week.

SQ not only remains one of the final ways to get money into Bitcoin but could also become a significant player in enabling Bitcoin use in actual day-to-day economic transactions.

SQ is already a well-established supplier of hardware and software for business sales systems. On the other hand, it has a strong presence with consumers through Cash App, with over 50 million users, and it has already integrated a way for users to buy Bitcoin. Add to that a hardware wallet, which will enable completely secure storage of Bitcoin, and you have all the right ingredients for mass Bitcoin adoption.

- Sturdy and Durable: This OROPY wall mounted...

- Sleek Industrial Design: With its simple...

- Optimized Space Utilization: Expand your storage...

- Convenience at Your Fingertips: Hang your daily...

- Versatile Functionality: This multi-functional...

- 【Industrial Clothing Rack】 The clothing racks...

- 【Sturdy & Durable】 Our clothes racks are made...

- 【Height Adjustable】 The height of the lower...

- 【Multifunction Closet Rack】 Wall clothes rack...

- 【Multi-Scene Use】 Dimension: 115” W x87.5”...

- 【Safer Size/Style】: Whole sconces are UL...

- 【Outstanding Details】: Our high-quality black...

- 【NOTE】: Our bar lighting wall sconce include...

- 【Wide Application】: Vintage wall light...

- 【Tips】: As the tube bulb is a bit special, it...

From one simple place, users would be able to acquire Bitcoin, transact with it nearly instantly through the lightning network, and even store their savings in a secure wallet. This certainly seems like a big improvement over holding bank deposits which are liable to bank runs and denominated in a currency of infinite supply.

Technical Analysis

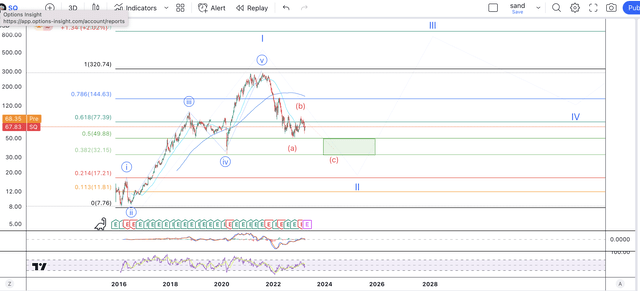

With that said, the technical picture for SQ suggests we could still see a deeper correction in the medium term.

Block TA (Author's work)

Ultimately, I see the rally SQ made into $300 as a completed impulse in a large wave I, and this puts us now in wave II, of which we have only completed the first left down. The A wave bounced exactly off the 50% retracement at $49. We are currently in a B wave bounce, though with the current sell-off, I am seeing pre-market due to the short report, this correction could be over soon.

Once this B wave completes, a final sell-off into the 61.8% retracement at $32 should ensue.

Takeaway

In conclusion, I am encouraged by Block and Jack Dorsey’s commitment to empowering crypto payments. Furthermore, the company has a solid business model with plenty of room to grow, and I am adding this to the LT crypto stock portfolio.

Crypto Spring Is Coming