The Healthcare sector traditionally performs relatively well during recessionary periods.RYH is an equal-weighted ETF of the Healthcare stocks in the S&P 500. It has the best long-term relative chart of any sector in the index.RYH also has a relative Buy signal right now, and technically appears to be in a good relative zone for ownership.

RYH: A Good Option For Equity Exposure With An Uncertain Economic Outlook (NYSEARCA:RYH)

Introduction:

This is another interesting period for the market. One month removed from a series of early 20th century style bank runs, that for all of us we've probably only experienced by watching It's A Wonderful Life every holiday season, we're now in the midst of a Federal Reserve that continues to raise interest rates in order to fight inflation while some forward economic data suggests we're heading into recession.

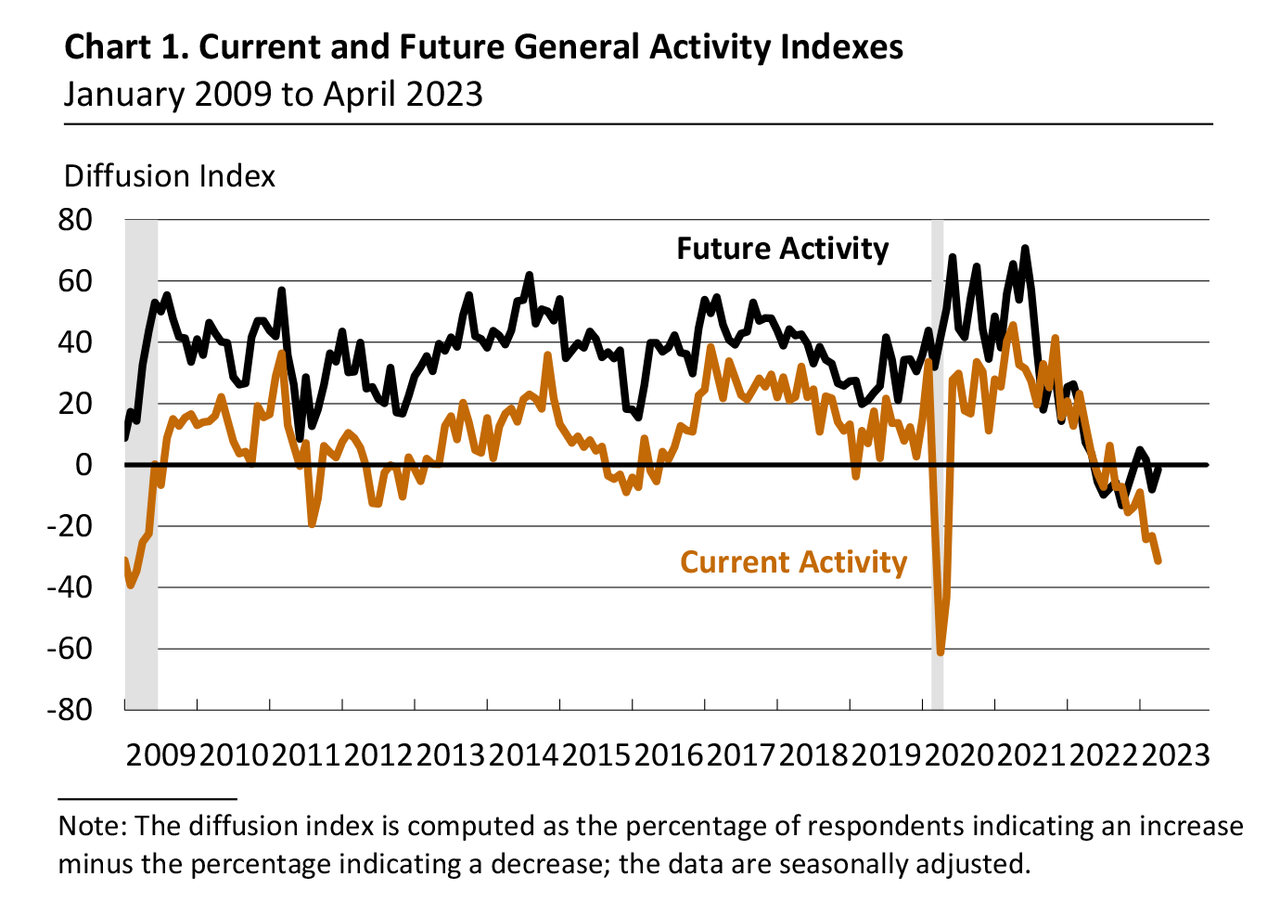

The Federal Reserve Bank of Philadelphia has been taking an economic survey for a long time that historically has been a very good indicator of the future outlook. The release of the April 2023 Manufacturing Business Outlook Survey, to be blunt, looks terrible. The current activity index is already well into the recession zone, and the future activity index is even lower than the covid lockdown collapse. This is just one of many economic datapoints, but it's certainly not the only one flashing danger signals on the economy.

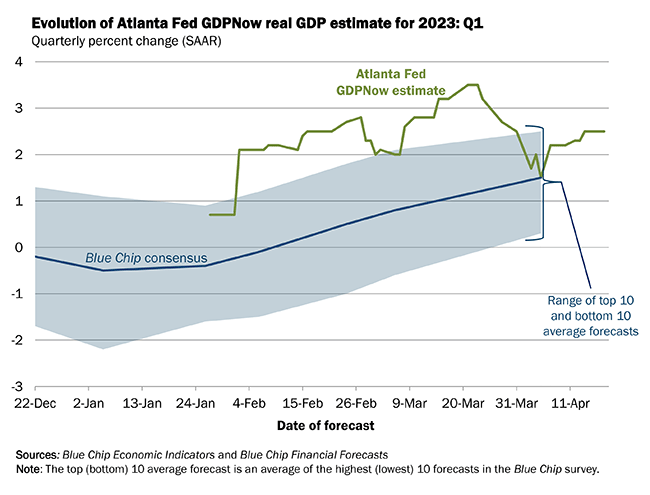

That doesn't mean every sign is screaming recession. If they were then the equity market would most likely be struggling a lot more than it is today. For example, from another Federal Reserve Bank in Atlanta, we have the GDPNow real GDP forecaster. The latest estimate is actually at 2.5% which has turned up since the end of March.

What is an investor to do in a situation like this? If you're convinced it's a recession in the near future, then it's pretty clear you want to be in Cash or U.S. Treasuries. If one is not convinced that's the result in the near term, then the option of having equity exposure enters the picture. What kind of exposure though should one take with such an uncertain setup?

If you're inclined to have some equity exposure right now, then I suggest considering (NYSEARCA:RYH) Invesco S&P 500® Equal Weight Health Care ETF. Healthcare is a traditional sector that the market shifts to when concerned with the economic outlook, but it also is the strongest relative sector chart over a long period of time in the S&P 500. I think the combination of both of these traits make having exposure to this sector an attractive option. Let's take a closer look.

Healthcare's Relative Performance During Recessions:

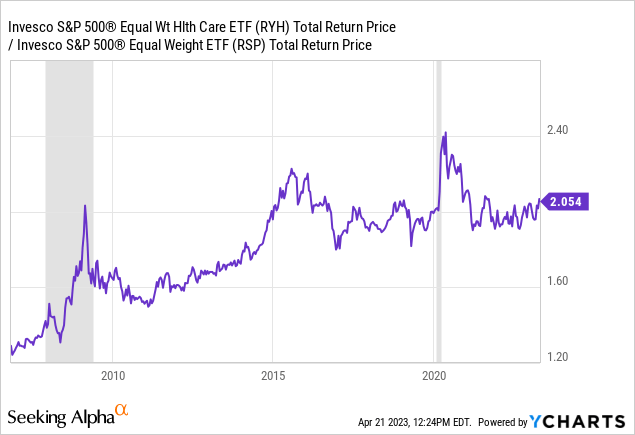

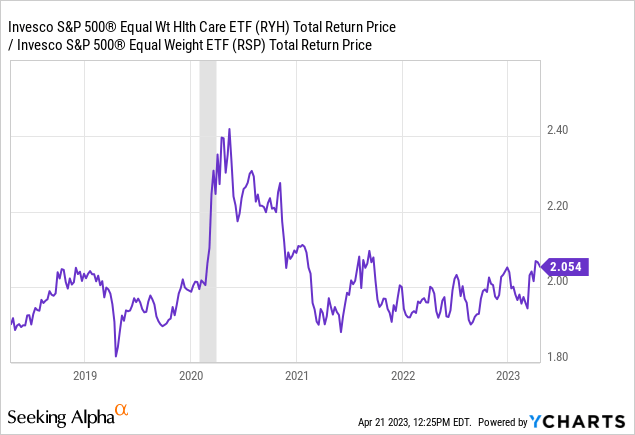

Suggesting that Healthcare is a go-to investment choice when market participants are concerned about a recession is not a radical argument. It's pretty much markets 101 analysis that Healthcare, Consumer Staples, and Utilities tend to be the sectors that investors flock too with such a setup. Above you can see the ratio between the equal weighted Healthcare RYH versus the equal weighted S&P 500 ETF (RSP). The equal weighting avoids any noise caused by excessive market caps tipping the scale. The grey areas denote recessions. Clearly Healthcare outperforms relatively during those periods.

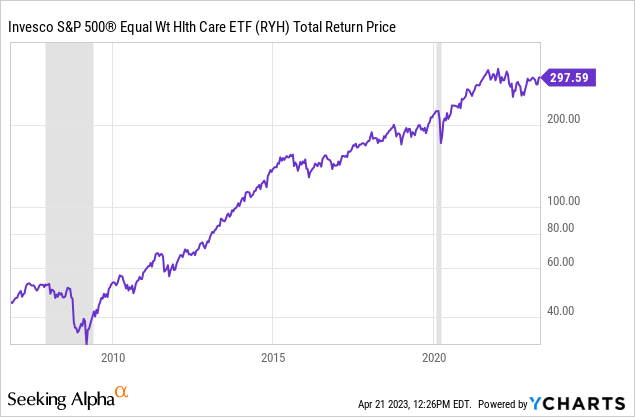

The above is the same ratio showing just the last five years so that you can see the magnitude of the move during the pandemic lockdown collapse. If a recession hits, then RYH will outperform relatively. That doesn't mean though that it will be up in absolute terms during a recession. You can see RYH's total return price below which includes the effect of dividends.

All boats decline if the tide goes out during a recession. This is not a hedge against that risk. I consider this exposure something in-between pure equity or a hedge against recession. If the Philly Fed survey is correct, then RYH will be a relative winner as it won't decline to the same degree as the rest of the S&P 500. If you have certainty that we're in recession, then it will be better to either directly hedge or move to cash or U.S. Treasuries. The benefit here is the other scenario where we slow but stay out of a true recessionary period. Let's see why I think Healthcare could keep up with the rest of the market if we don't fall into recession.

Long-Term Relative Position for Healthcare Sector:

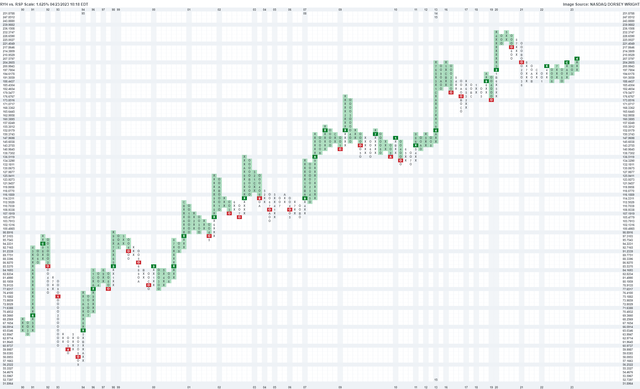

If you've read any of my articles in the past, then you know I like to use Point & Figure technical analysis as a tool in my process. Part of that includes establishing pre-determined sector signals for each portion of the S&P 500 all on an equal weighted basis. As I mentioned before, Healthcare is not only currently in a relative Buy signal on my system, but it also has the best long-term relative chart of any sector by a country mile. It has been steadily making higher highs and lows in this ratio since the early 90's.

The above P&F chart shows the ratio since 1990. The green colored boxes depict relative Buy signals for Healthcare. As you can see, it's in a Buy signal currently and the ratio is curling up. There's also a very long-term uptrend line you can draw on this chart which we touched last year. I use these charts to frame reality versus the narrative. One can consider many reasons for or against a particular investment, but that above chart shows what has been happening for a very long time. I believe you have to respect this relative performance until proven otherwise.

We've already determined that if recession does hit, then that relative chart will likely launch higher as the rest of the market suffers to a greater degree. However, I believe it also suggests that even in periods of slow growth without recession, RYH will keep up with the broader market if not surpass it. Years like 1994 and 2011 I would classify as somewhat similar to this forecast, and you can see on the chart above how RYH did relatively in those periods. At a minimum the relationship does not suggest RYH will trail the equal weighted S&P 500, and I think that's the most important element of this exposure. If we have a recession, RYH will outperform. If we don't fall into recession, RYH is likely to keep up and even has a chance to still outperform.

Valuation & Risks:

- ➤【 HIGH-PERFORMANCE CAR JUMP STARTER...

- ➤【 SMART CORDLESS INFLATOR WITH LCD SCREEN 】...

- ➤【 ESCORT YOUR SAFETY 】Thanks to the...

- ➤【 ALL-IN-ONE JUMP STARTER 】Say goodbye to...

- ➤【 WHAT YOU GET & WARRANTY 】YabeAuto YA70...

- 【UNIVERSAL FIT KIT】- The kit contains 23 types...

- 【TOP QUALITY】- These car retainer clips are...

- 【PREFECT FOR WHAT YOU NEED】 - Up to 680 pieces...

- 【BONUS ACCESSORIES】- We provide different size...

- 【WIDE APPLICATION】- Professional push clips...

- Powerful Car Jumper Starter - The Scatach 011 jump...

- Advanced Safety Features - Easy to opearte, and...

- Portable Design - This portable car battery...

- Respond to Emergencies - Portable power bank with...

- What will you Get ? - Scatach 011 Car Starter...

- 【What You Get】1*Tactical Molle Seat Back...

- 【Military Molle System - Lots Of...

- 【Durable and Long Lasting】 MOLLE seat back...

- 【Tactical Seat Covers Universal】 The size of...

- 【Guarantee】If you're not 100% satisfied with...

There are many variables that go into the market and each individual investment opportunity. I.e., is there any chance here that something very different exists in the fundamental setup versus previous periods? I'm a value investor at the core despite my use of technical analysis in my process. The first question I always have is if this investment looks good on a valuation basis.

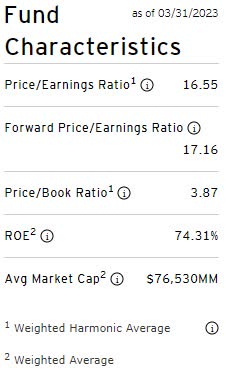

Let's first take a look at the stated forward Price/Earnings [P/E] ratio for each ETF as stated by the sponsor.

RYH:

Note that the fund data for RYH is based off of end of month prices back on 3/31/23. Hence, this isn't perfect, but it gives you a solid idea of how it's trading on a trailing and forward basis. Now let's look as to how it compares to the total index.

RSP:

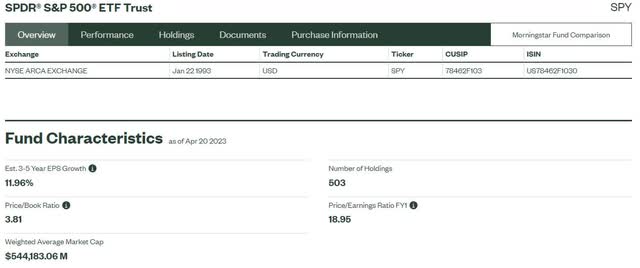

On an equal weighted basis, RYH looks a bit more expensive than the total index. This doesn't surprise me as it includes the more traditional value sectors of Energy and particularly Financials right now which look very cheap on a forward P/E basis. However, the separation is not as much as one might expect given Healthcare's traditionally higher growth rate. Let's also see how the market-cap weighted index State Street SPDR® S&P 500® ETF Trust (SPY) is trading considering it is what most people turn to when seeking equity exposure.

SPY:

Note that the SPY data is as of last week April 20th, so these comparisons are not perfect as we have a time variance, but not surprisingly there is enough of a valuation gap between SPY at almost 19x, and the equal-weighted RYH and RSP that we can safely assume the latter two are both cheaper than the cap-weighted despite the time issue. There just hasn't been that much change in pricing this month to conclude otherwise. Thus, while the healthcare sector as represented by RYH isn't definitively cheap on an absolute basis, it is again relatively more affordable than the traditional and most popular SPY variant. This is another reason to expect it to fair better in either a decline or rally looking forward.

The primary risk of course is that there is a recession and the whole market declines to a degree that RYH can't escape the downdraft. There are always other fundamental risks which for this sector usually encompass political issues. I tend to refrain from trying to quantify risks associated with judicial or political decisions. I think one is more likely to form a narrative based on their personal biases that won't help in the investment making decision. Which is why for these kinds of decisions in particular I weigh more heavily on long-term relative performance. I'm not going to be swayed by what some political risk may do to this sector until the market actually shows it in this ratio that something has fundamentally changed. Until then I'm following those consistent higher highs and lows.

Conclusion:

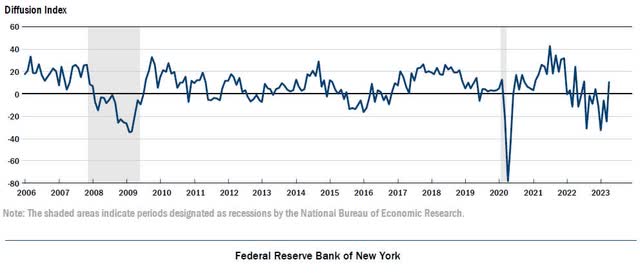

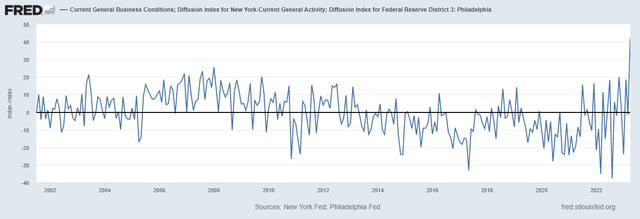

There is rarely certainty in the market, but we don't usually face a quandary such as this with historically reliable indicators forecasting economic outcomes to such a wide degree. I discussed the Phily Fed survey at the start of this article, so it seems fitting to add in the New York Fed's economic survey since it measures activity from a geographically contiguous area.

Up until just this April's report, the New York Federal survey had been forecasting the same economic condition as the Philadelphia survey. Note how it too was in the zone normally suggesting a recession, but now it's shot back up well over the zero line suggesting positive GDP growth again. The spread is the largest between the two surveys dating back to 2001 and not by a small amount.

The above chart shows the NY Fed survey minus the Philadelphia Fed survey. Yes, this is another unusual time in regards to what we should expect of forward economic activity. In this regard the Healthcare sector looks uniquely positioned to either outperform if we tip into recession, but also keep up with the rest of the market if indeed the economy maintains positive growth. It makes for a good option for those who wish to maintain some equity exposure. Good luck investing, everyone.