A few months ago, I wrote a cautious article on the Eaton Vance Short Duration Diversified Income Fund (NYSE:EVG). I was primarily concerned about the ‘return of principal' characteristics of the fund, as the EVG fund was clearly paying more in distribution than it was earning.

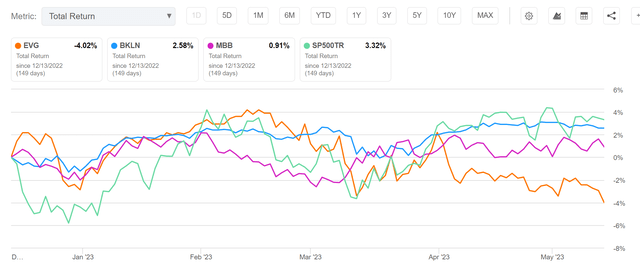

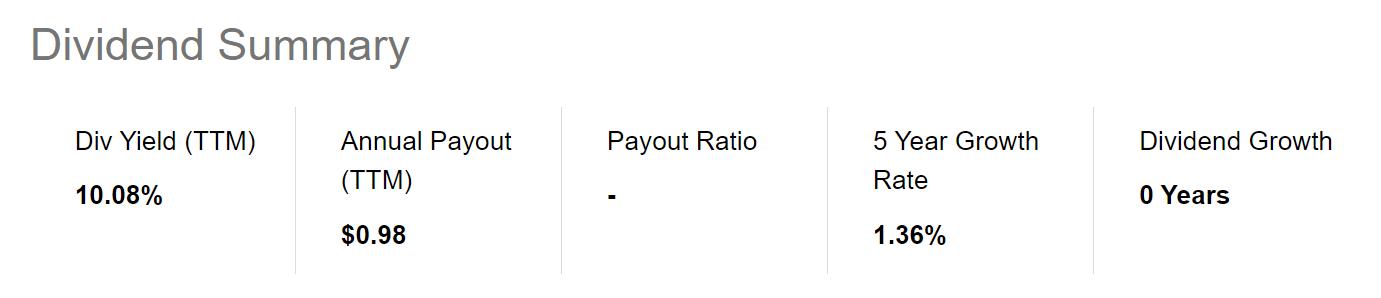

Since my article, the EVG fund has returned -4.0% in total returns (8% price decline, ~4% distribution), underperforming the senior loan asset class as modeled by the Invesco Senior Loan ETF (BKLN) and the MBS asset class as modeled using the iShares MBS ETF (MBB) which have returned 2.6% and 0.9% respectively (Figure 1).

Figure 1 – EVG has underperformed BKLN and MBB (Seeking Alpha)

The EVG fund's poor performance in the last few months have justified my caution. However, with an impending recession, unitholders may have more problems to worry about in the coming months.

Distribution Cut Predictable

Two key characteristics of ‘return of principal' funds are amortizing NAVs and shrinking distributions. As I warned in my initiation article:

If investors look a little deeper, they will notice that the fund has not been earning its distribution, as it only generates an average annual total return of 4.3% from 2012 to 2021 versus a 9%+ distribution yield. Instead, investors have been paid back a portion of their own principal in the monthly distribution. Over the long run, this is unsustainable.

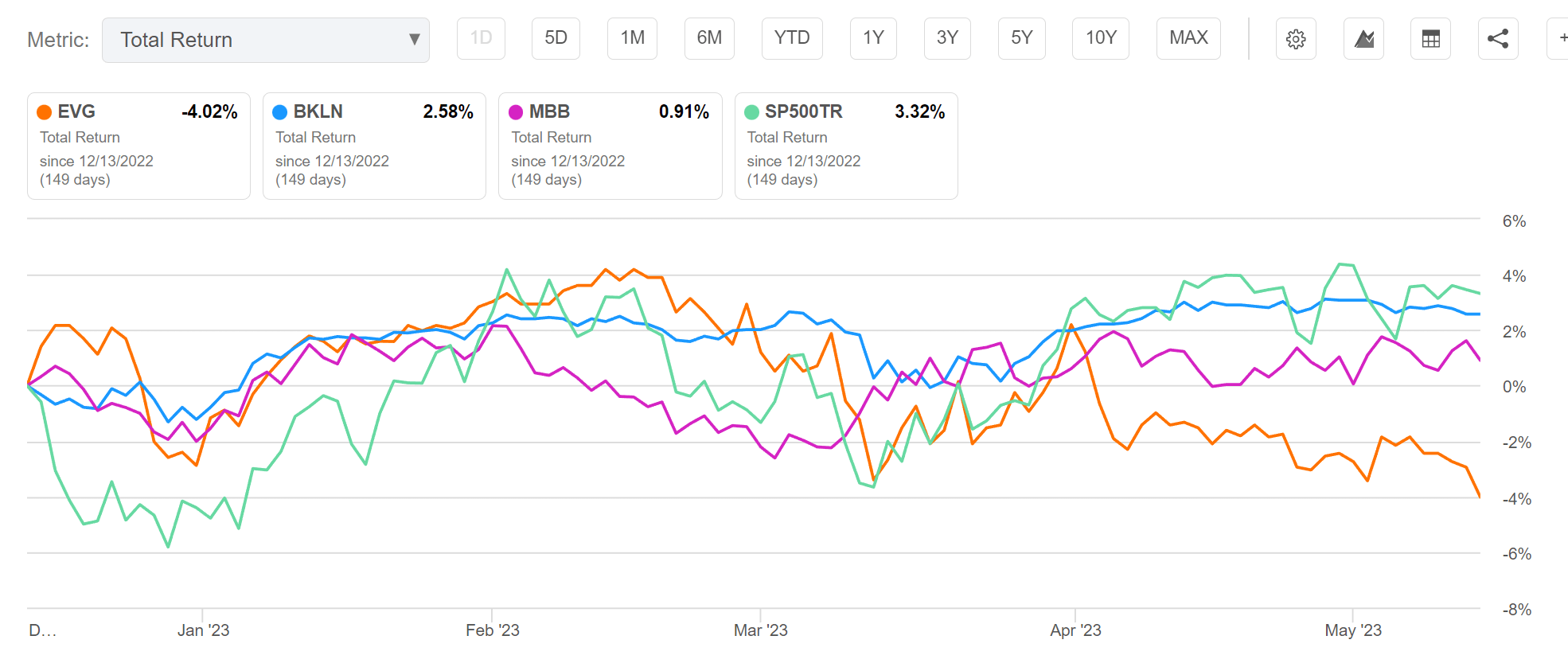

Sure enough, in the past few months, the EVG fund has consistently cut its unsustainable distribution, from $0.0896 in December to $0.0757 recently in May, or a cut of 15.5% (Figure 2).

Figure 2 – EVG has shrinking distribution (Seeking Alpha)

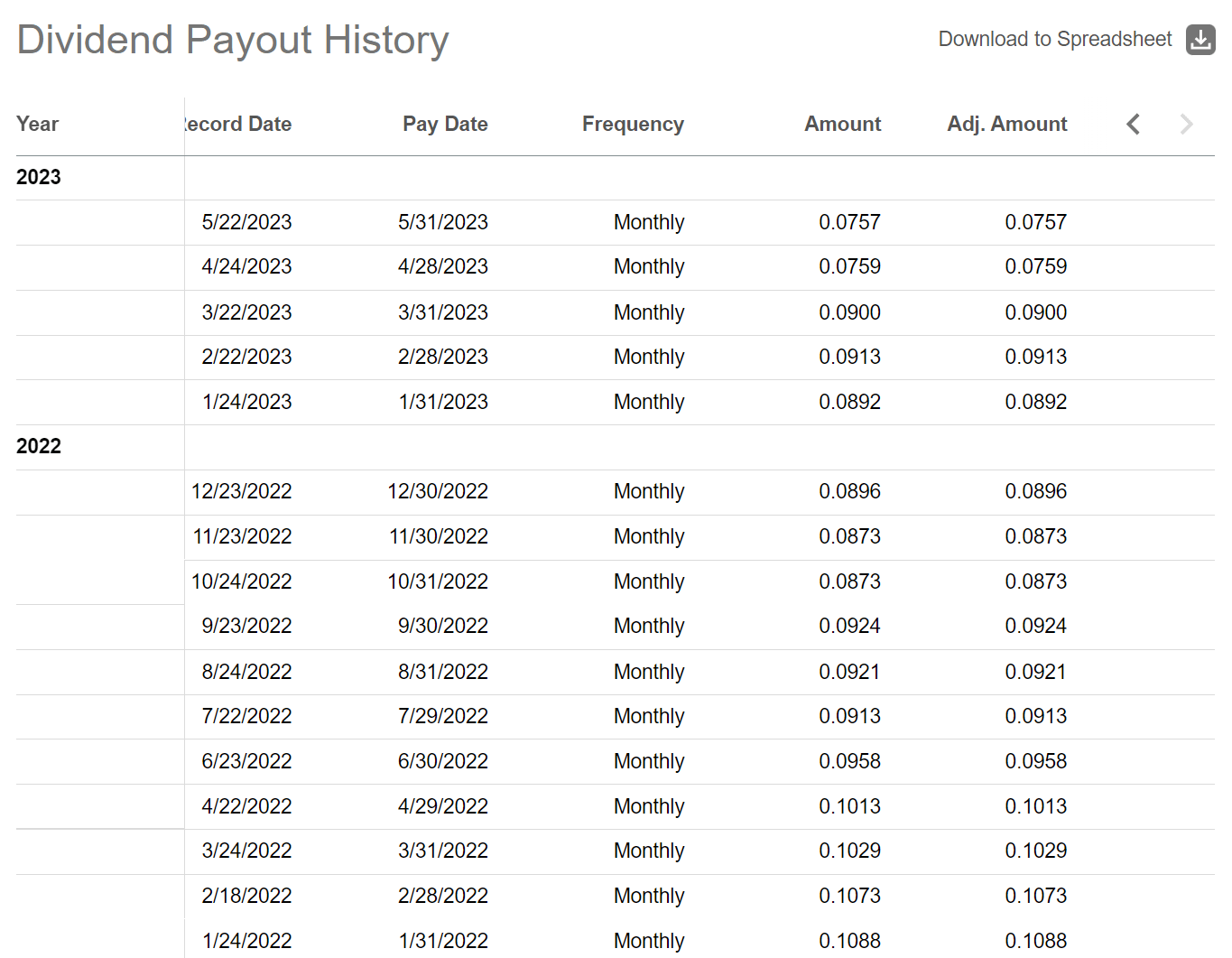

The trailing 12 month distribution rate is now $0.98, however, due to the fund's decline in price, the yield actually went up to 10.1% (Figure 3). On NAV, the EVG fund's distribution rate is 9.2%.

Figure 3 – EVG distribution yield (Seeking Alpha)

So for long suffering EVG unitholders, not only have they suffered an 8% decline in the market value of their holdings, their monthly income has also been cut by 15.5%. Talk about a double hit to the pocketbook!

Unfortunately, things may be about to get worse for EVG unitholders, as tightening lending standards could push the U.S. economy into a recession.

Tighter Lending Standards Could Lead To A Recession

In recent months, the economic fundamentals have certainly weakened for the U.S. economy. For example, in March, we finally saw the lagged effects of the Federal Reserve's 2022 interest rate increases, as several large regional banks failed due to tens of billions in unrealized securities losses (mark-to-market losses on fixed income securities) combined with deposit flight (as higher interest rates made money market funds exponentially more attractive than bank deposits).

Faced with a higher cost of funding, banks have been aggressively tightening their lending standards for businesses and consumers. According to the Fed's recent Senior Loans Officer Opinion Survey (“SLOOS”), 46 percent of U.S. banks plan to further raise their lending standards on commercial and industrial loans to large firms due to worries about loan losses and deposit flight.

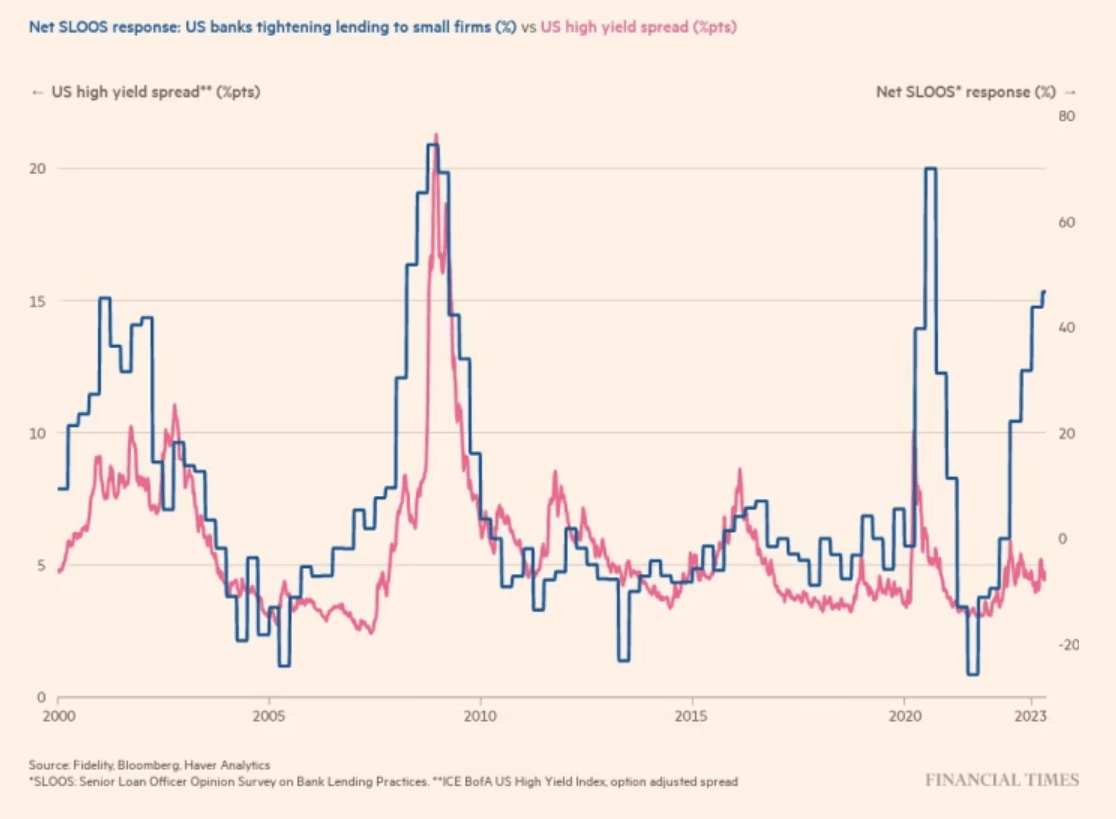

Historically, responses on the SLOOS survey tend to lead high yield credit spreads, as tighter lending standards raise the cost of funding for risky firms (Figure 4).

Figure 4 – SLOOS survey lead high yield credit spreads (Financial Times)

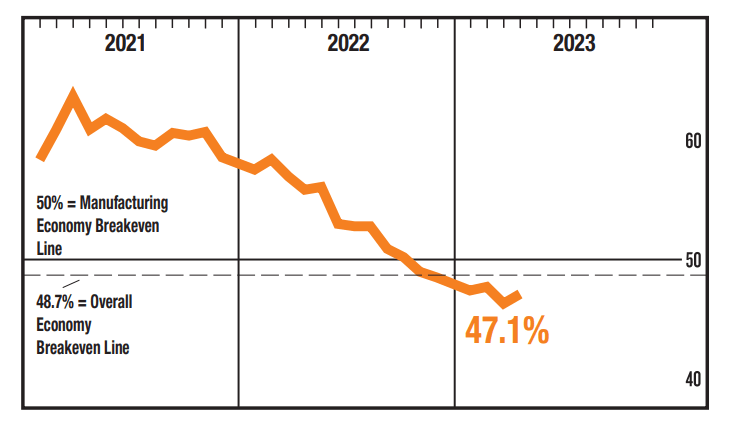

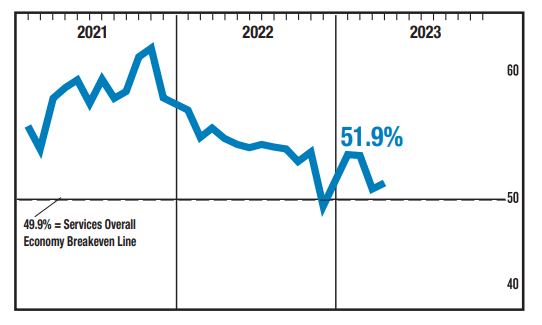

Already, U.S. manufacturing activity has been in contraction since late 2022 (Figure 5) while services activity have slowed down dramatically in recent months (Figure 6).

No products found.

Figure 5 – ISM Manufacturing PMI has been contracting since late 2022 (ismworld.org)

Figure 6 – ISM Services PMI have slowed dramatically (ismworld.org)

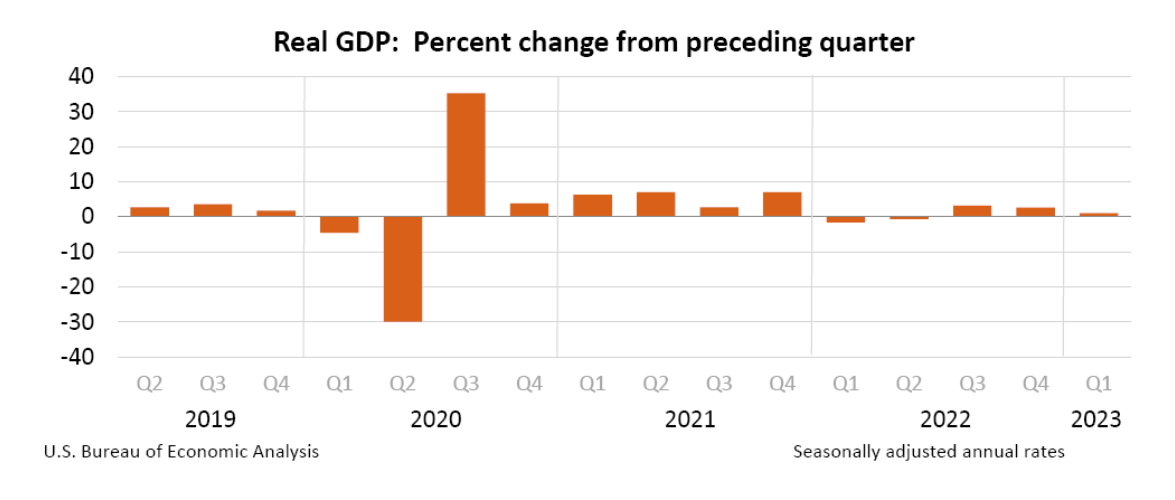

With U.S. real GDP only growing by 1.1% in Q/2023, it would not take much in terms of tightening of lending standards to push the U.S. economy into a recession (Figure 7).

Figure 7 – U.S. Real GDP growth has slowed to 1.1% rate in Q1/2023 (BEA)

EVG Has Large Exposures To High Yield Credits

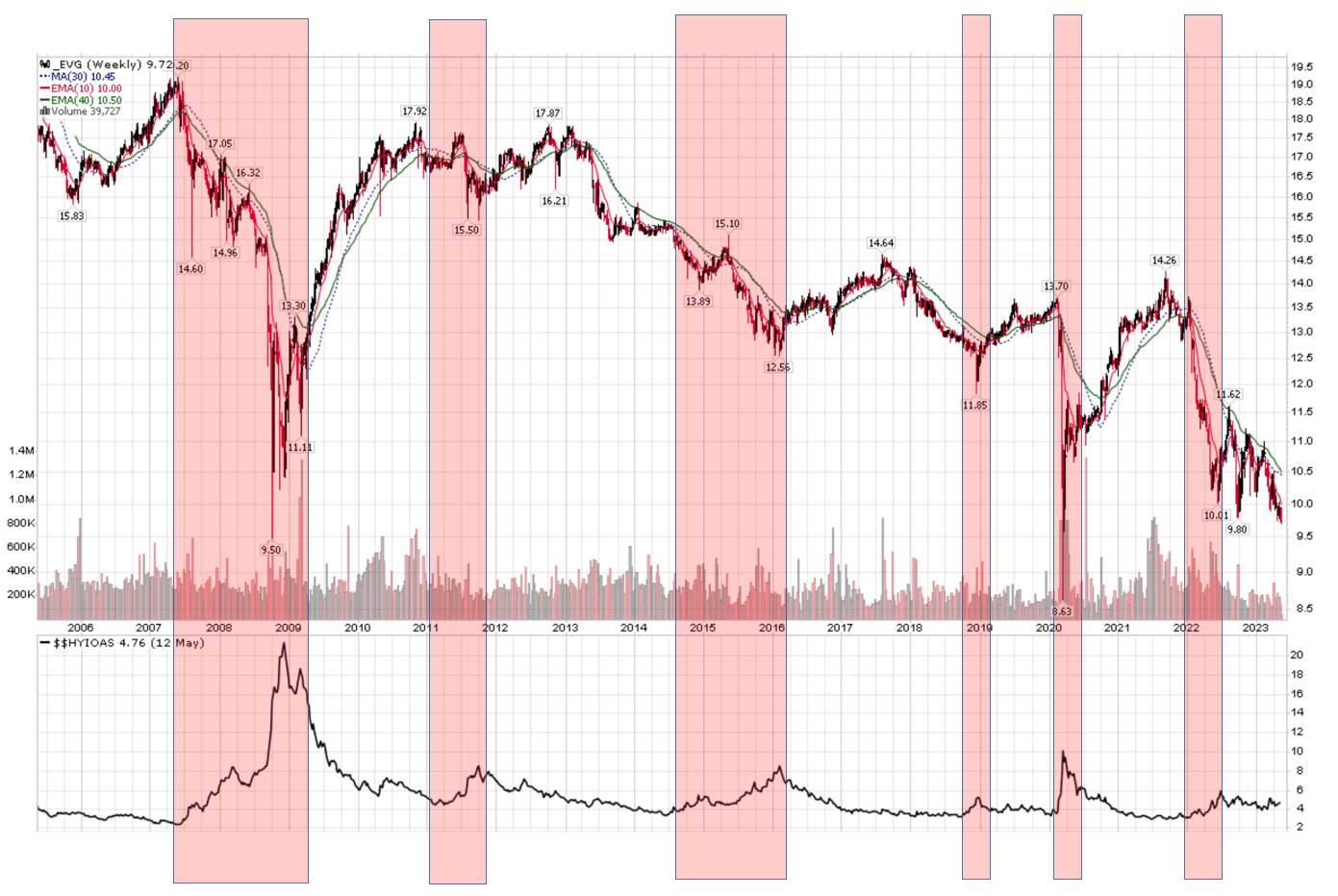

Historically, when high yield credit spreads widen, the EVG fund's NAV tends to tumble (Figure 8).

Figure 8 – EVG's NAV is inversely proportional to high yield credit spreads (Author created with price chart from stockcharts.com)

No products found.

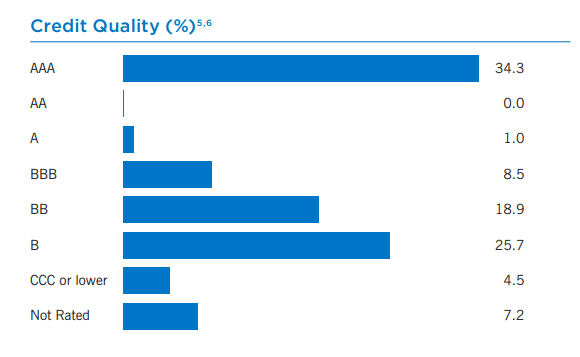

This is because the EVG fund has more than half of its portfolio invested in securities that are rated non-investment grade (<BB rated) that are susceptible to widening high yield credit spreads (Figure 9).

Figure 9 – More than half of EVG's portfolio is rated non-investment grade (eatonvance.com)

Conclusion

With the U.S. economy about to enter a recession, things may be about to go from bad to worse for long-suffering EVG unitholders. In addition to amortizing NAV and shrinking distributions, EVG unitholders may soon suffer from mark-to-market declines in NAV due to widening credit spreads. I recommend investors avoid the EVG fund.