This article first appeared in “Trend Investing Investing Group” on April 18, 2023, but has been updated for this article.

Tesla, Inc.'s (TSLA) Master Plan Part 3 detailed version was released on April 5, 2023. It is one of the most important reports of our time. This is because it shows how the world can transition 100% to a clean renewable energy future. Investors can profit by understanding the plan and its implications for the world over the next few decades.

Tesla Master Plan Part 3 (“the Plan”)

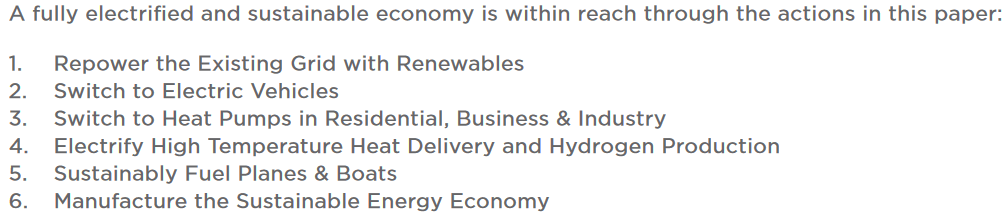

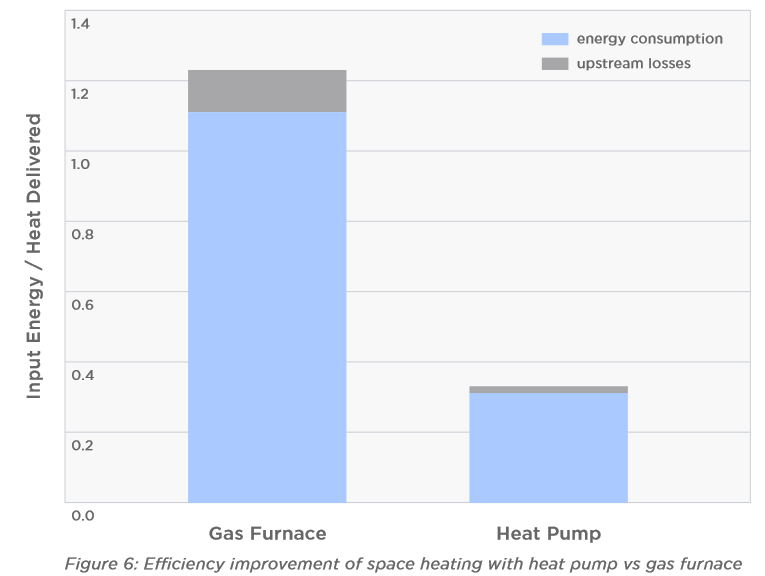

According to the Plan, the world will need 30 TW of renewable power (mostly solar and wind, some hydro, geothermal, etc.), perhaps including nuclear, and 240 TWh of battery storage. It would cost about US$10T, which is 10% of the world's 2022 GDP. Because electrification for transport and heat pumps are much more efficient, we would only need to produce 1/2 as much energy as compared to using fossil fuels.

Tesla states:

“Electric vehicles are approximately 4x more efficient than internal combustion engine vehicles…..heat pumps use ~3x less energy than gas furnaces….”

Tesla Master Plan Part 3 – Summary of key requirements needed for the world to move to 100% clean sustainable energy, including electric transportation

Tesla Master Plan 3

Tesla Master Plan 3

We view three key points to the plan – Clean renewable energy production, energy storage, and efficient energy use (EVs, heat pumps).

Clean renewable energy production

Master Plan 3 includes re-powering the existing grid with renewables (solar, wind, geothermal, hydro, etc.), switching to electric vehicles (“EVs”), switching to heat pumps, and some use of green hydrogen (mostly for high-temperature applications).

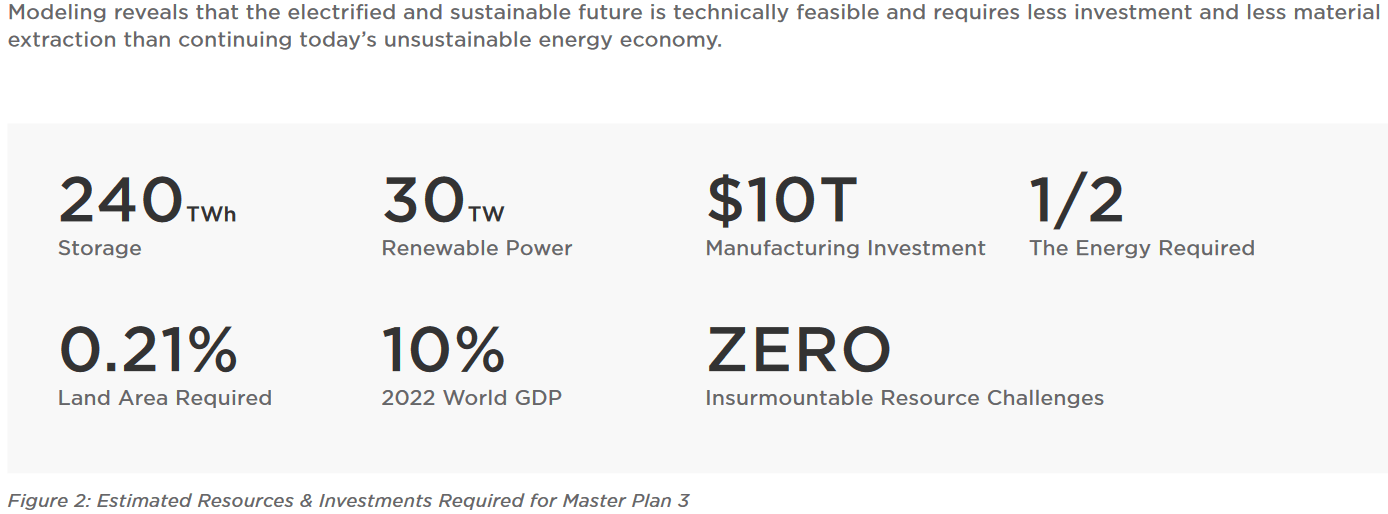

The Plan lists the various energy production options and their costs. Solar and onshore wind come out on top.

Master Plan 3 comparison of energy production types – Solar and wind come out on top; hydro & nuclear for longer life span

Tesla Master Plan 3

Note: Red ovals done by the author for emphasis.

Note: Tesla states: “….all the generation technologies considered in the sustainable energy economy. Installed costs were taken from studies for 2030-2040 from NREL and the Princeton Net-Zero America study.”

- April 2023 – Wind & solar power now the clear champions on cost. “….record growth in wind and solar, which reached a 12% share of the global electricity mix, up from 10% in 2021. Together, all clean electricity sources (renewables and nuclear) reached 39% of global electricity, a new record high. Solar generation rose by 24%, making it the fastest growing electricity source for 18 years in a row. Wind generation grew by 17%.”

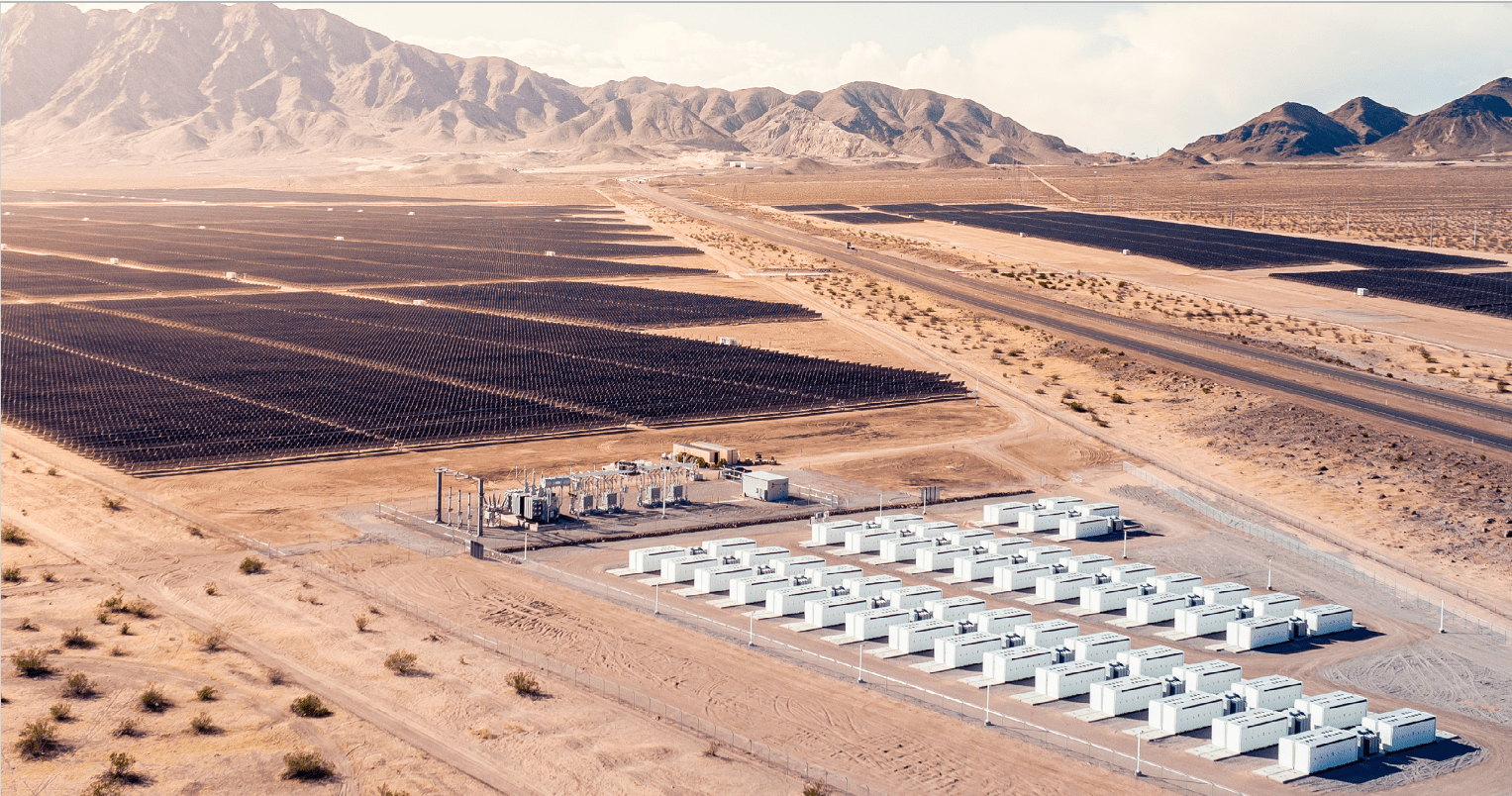

Energy storage

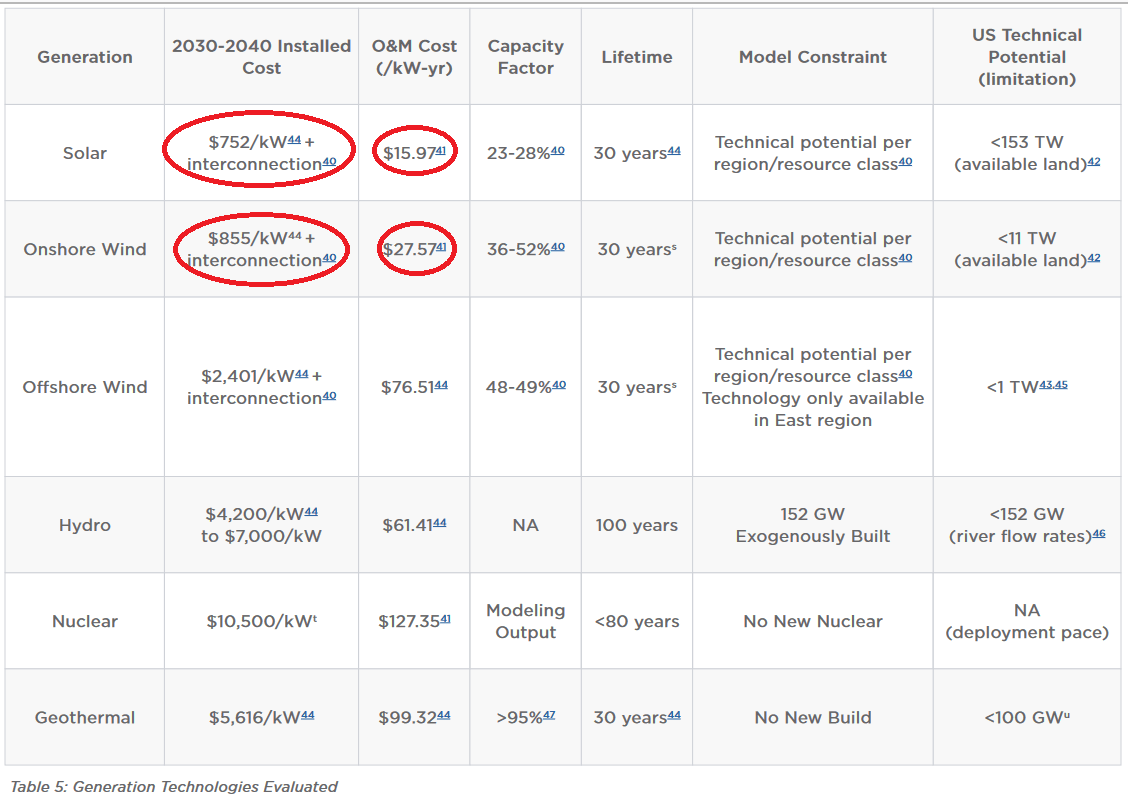

To achieve 100% clean renewable energy, we need to develop a massive amount of energy storage. The Plan lists the various energy storage options and their costs.

Master Plan 3 reports that we need 240 TWh of energy storage globally to support both energy production and EVs (of which EVs will need 112 TWh). Given that in 2022 the world produced only about 700 GWh of lithium-ion batteries this is a big challenge. 240 TWh of capacity is 342x the current 700 GWh production volume for 2022; but note not all energy storage is by lithium-ion batteries.

Lithium-ion batteries come out on top for being the cheapest to run per operating and maintenance costs (“O&M” /kWh-yr), but they do have some limitations in terms of operating over a longer time duration as they can lose charge. This means there is also a place for other energy storage options such as vanadium redox flow batteries (“VRFBs”), especially given that they can charge and discharge simultaneously and are well suited for large-scale grid storage. Master Plan 3 focuses entirely on lithium-ion batteries as the choice for battery energy storage.

Master Plan 3 comparison of energy storage types – Lithium-ion batteries come out on top

Tesla Master Plan 3 – page 19

Note: Red oval done by the author for emphasis.

Note: Tesla states:

“For stationary applications, the energy storage technologies in Table 4 below, which are currently deployed at scale, are considered. Li-ion means LiFePO 4 /Graphite lithium-ion batteries. A range of conservative future installed costs are listed for lithium ion given the volatility in commodities prices (especially lithium). While there are other emerging technologies such as metal-air (Fe <-> Fe 2 O 3 redox couple) and Na-ion, these are not commercially deployed and therefore not considered.”

Efficient energy use (EVs, heat pumps)

The electric transport sector will mostly use lithium-ion batteries and it is estimated to need 112 TWh of the total 240 TWh of energy storage needed for the global renewable energy transition.

Electric Vehicles (“EVs”)

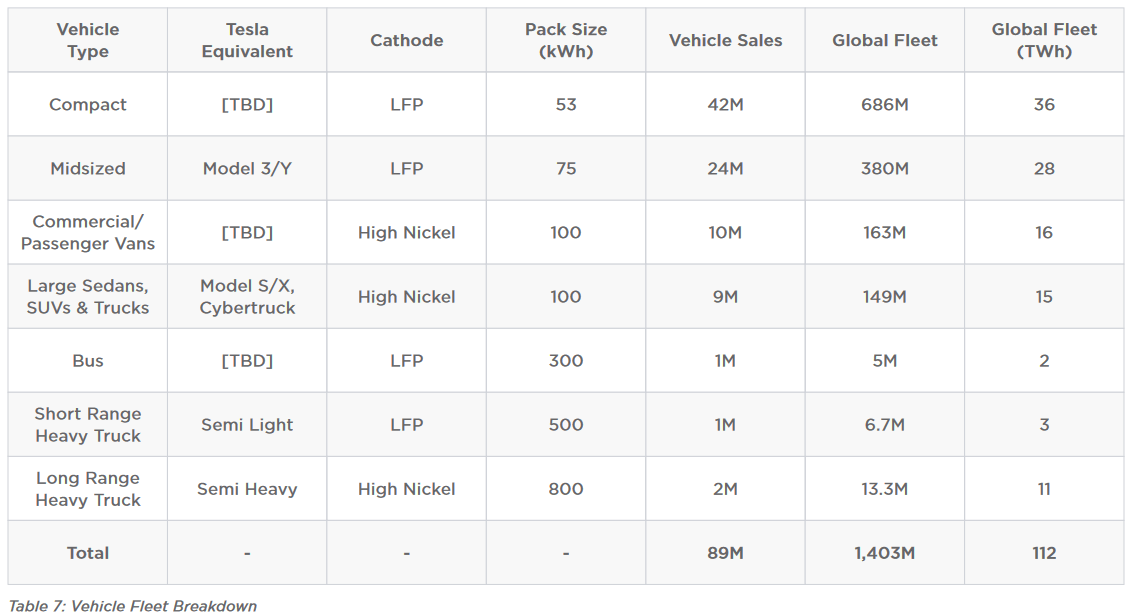

It is important to note that the quoted numbers refer to the ‘potential global fleet' and not Tesla. For example, the Plan sees the global compact electric car market potential at 42m, using an average 53 kWh battery pack with LFP chemistry. The total compact fleet's battery requirements would be ~36 TWh (686m x 53 kWh). Based on the chart below LFP cathodes will take 61.6% share, with high nickel cathodes the rest.

The above shows there is a huge opportunity in the compact electric vehicle segment, and in terms of battery chemistry for cathodes, it slightly favors LFP (lithium, iron, phosphate) over NMC (nickel, manganese, cobalt).

Master Plan 3 global fleet breakdown on how it can be electrified showing vehicle type, cathode chemistry, battery size, vehicle sales, total global fleet, total global fleet battery size (TWh)

Tesla Master Plan 3 – page 22

Note: Tesla states:

“Today there are 1.4B vehicles globally and annual passenger vehicle production of ~85M vehicles, according to OICA. Based on pack size assumptions, the vehicle fleet will require 112 TWh of batteries….. Standard-range vehicles can utilize the lower energy density chemistries (LFP), whereas long-range vehicles require higher energy density chemistries (high nickel). Cathode assignment to vehicle segment is listed in the table….High Nickel refers to low to zero cobalt Nickel Manganese cathodes currently in production, under development at Tesla, Tesla's suppliers and in research groups.”

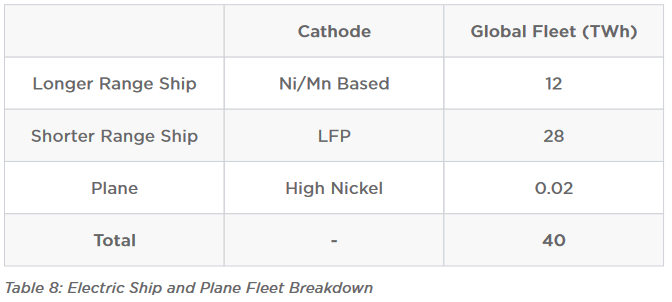

Electric ships and electric planes

The Master Plan 3 sees a much bigger market for electric ships than electric planes, the same applies for their respective battery requirements. That is 40TWh for electric ships and just 0.02TWh for electric planes.

Regarding electric ships and electric planes Tesla states:

With 2.1PWh of annual demand, if ships charge ~70 times per year on average, and charge to 75% of capacity each time, then 40TWh of batteries are needed to electrify the ocean fleet. The assumption is 33% of the fleet will require a higher density Nickel and Manganese based cathode, and 67% of the fleet will only require a lower energy density LFP cathode. For aviation, if 20% of the ~15,000 narrow body plane fleet is electrified with 7MWh packs, then 0.02TWh of batteries will be required.

Master Plan 3 Electric ships and electric planes breakdown

Tesla Master Plan 3 – page 23

Heat pumps

Tesla states on page 7 of the Plan that “heat pumps use ~3x less energy than gas furnaces.” This increased energy efficiency is the key reason to use heat pumps.

Tesla already uses heat pumps in their cars and potentially plans to soon produce and sell HVAC systems.

Heat pumps use ~3x less energy than gas furnaces and are a great way to achieve better energy efficiency

Tesla Master Plan 3

- New Store Stock

- Rivan, Maria (Author)

- English (Publication Language)

- 208 Pages - 04/14/2020 (Publication Date) -...

- Elevate Your Vision : An Enhanced Vision Board...

- Experience a new level of quality with our...

- Our vision board kit for women offers hand-picked,...

- Whether it’s a gift vision board for teens,...

- At Lamare, our mission is to help women plan and...

- National Geographic Special - 2017-1-20 SIP...

- English (Publication Language)

- 128 Pages - 01/20/2017 (Publication Date) -...

Areas Of Opportunity For Investors

Clean renewable energy production

Based on Master Plan 3, the two key areas of opportunity are solar and wind-producing companies, as these two areas have the cheapest operating costs and highest growth forecasts. Not surprisingly then the chart below forecasts solar and wind energy growth to far outperform all others. The chart is USA only, but the lesson applies globally.

Investors should consider to invest in the following:

- Solar and wind energy stocks.

- Solar and wind exchange-traded funds, or ETFs, such as Invesco Solar ETF (TAN) and First Trust Global Wind Energy (FAN).

- Renewable energy ETFs such as iShares S&P Global Clean Energy Index ETF (ICLN) and Global X Renewable Energy Producers ETF (RNRG).

Solar and wind energy are forecast to grow the fastest from now to 2050 (source)

EIA

Energy storage

Based on Master Plan 3, the major area of opportunity is lithium-ion batteries, suppliers, and raw material providers (miners – see below section).

Investors should consider to invest in the following:

- Invest in the quality lithium-ion battery manufacturers (especially those making LFP batteries) – Contemporary Amperex Technology Co (CATL) (SHE:300750), BYD Co. (SHE:002594) (HK:1211) (OTCPK:BYDDY, OTCPK:BYDDF), Gotion High-tech (SHE:002074), and others (Panasonic, LGES, SK Innovation, etc.).

- Invest in lithium-ion battery cathode and anode producers. The leaders are Chinese but some others include Umicore (BR:UMI) (OTCPK:UMICY, OTCPK:UMICF), and POSCO (KRX:005490) (PKX).

- Invest in lithium-ion battery-related ETFs – Amplify Lithium & Battery Technology ETF (BATT), Global X Lithium & Battery Tech ETF (LIT).

Efficient energy use (EVs, heat pumps)

Investors should consider to invest in the following for EVs:

- The top two leading global electric car manufacturers – Tesla and BYD Co.

Investors should consider to invest in the following for heat pumps (this may be the subject for another article):

- Tesla (car heat pump and potentially soon HVAC system) and other companies producing heat pumps, especially in the USA where there are IRA subsidies.

Raw materials (Mining and Processing)

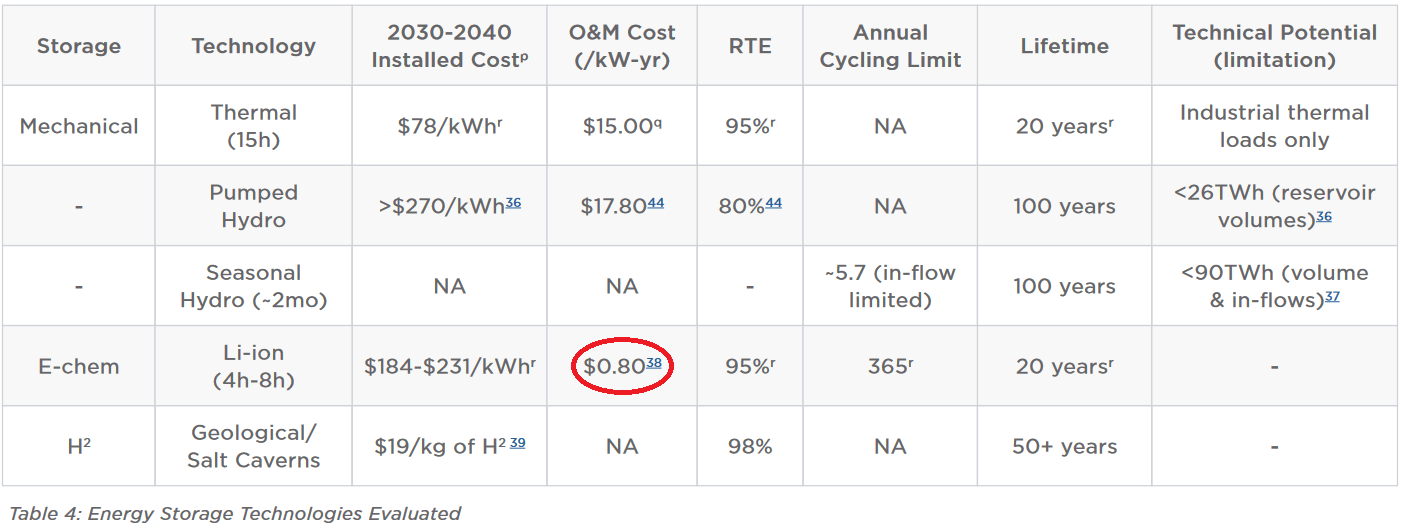

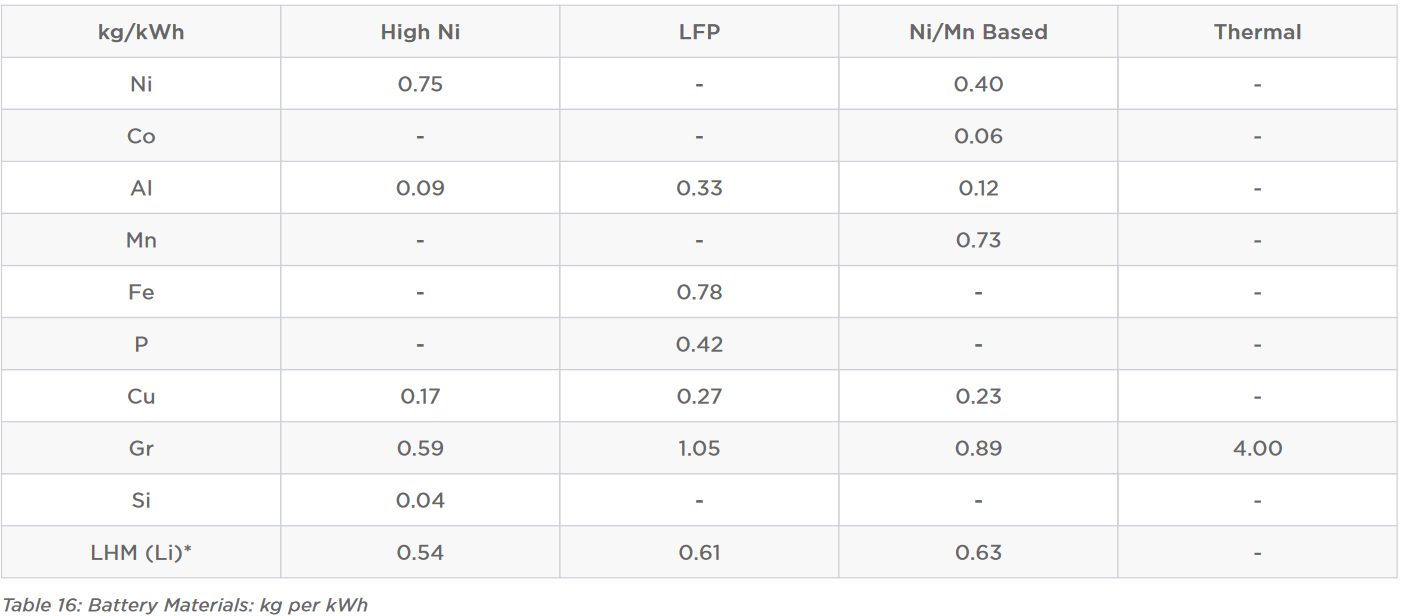

Master Plan 3 states:

Materials that require significant capacity growth are: For mining: nickel, lithium, graphite and copper. For refining: nickel, lithium, graphite, cobalt, copper, battery grade iron and manganese.

Note: Bold emphasis by the author.

On pages 31 and 32, the Plan outlines the amount of materials needed for the planet to 100% transition to renewable energy. For example, lithium is quoted at a range of 0.54 to 0.63kg/kWh, depending on the battery cell chemistry. If we use 0.6kg/kWh (the industry uses 0.8 to 1.0kg/kWh) and assume 2/3rds of the world's needed 240 TWh of energy storage is done via lithium-ion batteries, then we need 2/3 x 240TWh x 0.6kg/kWh of lithium carbonate equivalent (“LCE”). That works out to be 96 million tonnes of LCE. Trend Investing forecasts that by the end of 2031 we will be producing about 5 million tonnes pa LCE. At that rate, it would take a bit under 20 years of 5mtpa LCE production to achieve the Plans goals (slightly less allowing for what has already been achieved to date). That aligns quite well with the planet becoming 100% renewable before 2050. It also bodes very well for lithium demand.

Battery materials needed to achieve Master Plan 3 (kg per kWh)

Tesla Master Plan 3

Investors should consider to invest in the following for nickel, lithium, graphite, and copper:

- Miners that produce several EV metals – Glencore (LSE:GLEN) (OTCPK:GLNCY, OTCPK:GLCNF), Vale S.A. (VALE), Eramet (FRA:ERA) (OTCPK:ERMAF), Advanced Metallurgical Group NV (AMS:AMG), BHP Group (BHP), Rio Tinto (RIO), Zijin Mining Group (HK:2899), and others.

- Miners that lead their sector – Albemarle (ALB) and SQM (SQM) (lithium), Syrah Resources (ASX:SYR) (graphite), Freeport-McMoRan (FCX) (copper), Vale (nickel).

- Leading global refiners – Jiangxi Ganfeng Lithium (SHE: 002460) (lithium).

- ETFs – Proshares S&P Global Core Battery Metals (ION) and also see the various Sprott ETFs (Sprott Energy Transition Materials ETF (SETM), Sprott Lithium Miners ETF (LITP), Sprott Nickel Miners ETF (NIKL), and Sprott Junior Copper Miners ETF (COPJ)). Global X Copper Miners ETF (COPX) is a good one to cover the larger copper miners, you can see the top holdings here.

Risks

- Master plan 3 is flawed or is never adopted by the world.

- Disruption by new technologies – Hydrogen vehicles or sodium-ion batteries etc.

- Sovereign risks.

- The usual company risks – Management, liquidity, debt, and currency risk.

- The usual stock market risks – Dilution, lack of liquidity (best to buy on local exchange), market sentiment.

Further reading

Tesla Master Plan 3 – ‘Sustainable Energy for All of Earth'

Tesla

Tesla

Conclusion

Tesla Master Plan 3 is one of the most important reports of our time. The Plan gives a detailed analysis on the global need for clean renewable energy production (mostly solar, wind), 240TWh of energy storage (mostly lithium-ion batteries), and efficient energy use (EVs, heat pumps). It also briefly touches on the key critical raw materials needed.

- Amazon Kindle Edition

- Baldacci, David (Author)

- English (Publication Language)

- 487 Pages - 04/16/2024 (Publication Date) - Grand...

- Amazon Kindle Edition

- Hannah, Kristin (Author)

- English (Publication Language)

- 472 Pages - 02/06/2024 (Publication Date) - St....

- Amazon Kindle Edition

- Elston, Ashley (Author)

- English (Publication Language)

- 348 Pages - 01/02/2024 (Publication Date) - Pamela...

Trend Investing views the best way to play the energy transition and EV boom is via the following:

- Invest in solar and wind companies or ETFs.

- Invest in the leading EV and battery companies globally or ETFs.

- Invest in heat pump companies (need a new article to cover this).

- Invest in the key raw material miners (and refiners) led by lithium, as this remains the choke point to supply the energy transition. Tesla lists the key materials needed as nickel, lithium, graphite, and copper. It says rare earths will be phased out and not needed.

As usual, all comments are welcome.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Thematic Investing Whitepaper: Mobility (EV/AVs And Lithium/Battery Technology)