Artificial Intelligence and even ChatGPT have become household terms. We are all enthralled by the power of AI and what the future of work, and indeed life, will look like in the months, years, and decades to come. Awe was underscored earlier this week at Apple’s Worldwide Developers Conference, where its Vision Pro headset was introduced.

Of course, there’s now another ETF for that. As Google searches get replaced by ChatGPT prompts, some firms could benefit big. But is there too much hope baked into the AI cake? Consider that the perceived leader in the space, Nvidia (NVDA) now trades at a whopping 38 times forward sales and a P/E north of 200.

I have a sell rating on the Roundhill Generative AI & Technology ETF (NYSEARCA:CHAT) due to its lofty expense ratio and concerns about a near-term peak in AI froth. There’s also seasonal weakness often seen in June among semiconductor stocks (which weigh significantly in CHAT).

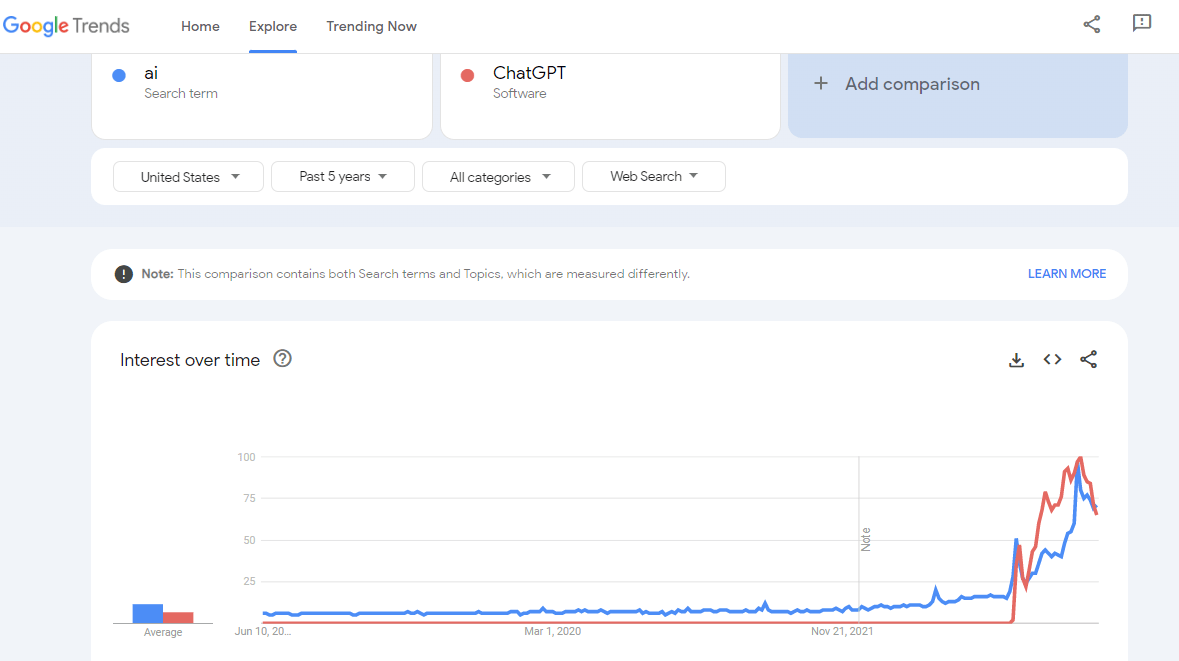

Main Street Enamoured by AI and ChatGPT: Google Search Trends

According to Roundhill, CHAT is the first ETF globally to focus on generative artificial intelligence technology, and its portfolio consists of companies pioneering what Roundhill believes to be one of the fastest-growing technologies in history. Generative AI models, a subset of the AI realm, can create new, unique content – including images, text, and audio) and can recognize patterns, learn them, and construct new information (not just data). Impacted industries are numerous, but the primary ones, per Roundhill, include software, art & design, entertainment, customer service, education, healthcare, and financial services, among others.

“Generative AI represents the next frontier of artificial intelligence technology, offering the potential to revolutionize industries such as entertainment, healthcare, and more. With CHAT, investors can gain exposure to this rapidly evolving field, potentially benefiting from what we believe will be the exponential growth of generative AI technology,” said Dave Mazza, Chief Strategy Officer at Roundhill.

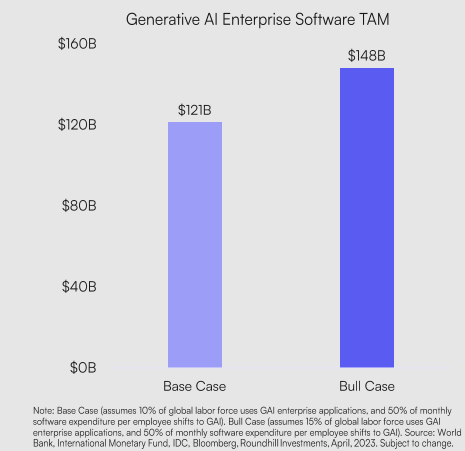

The issuer states that the total addressable market for generative AI enterprise software is estimated to be near $120 billion. Analysts at Goldman Sachs figure that AI has the potential to drive about $7 trillion in global GDP growth in the decade ahead.

Major AI Enterprise Software TAM

Roundhill

Just in the last six months, there have been more than 100 million sign-ups to the ChatGPT service. The user-friendly large language model is now the fastest-growing application of all time, according to Bloomberg.

ChatGPT Rockets in Popularity and Global Usage

Roundhill

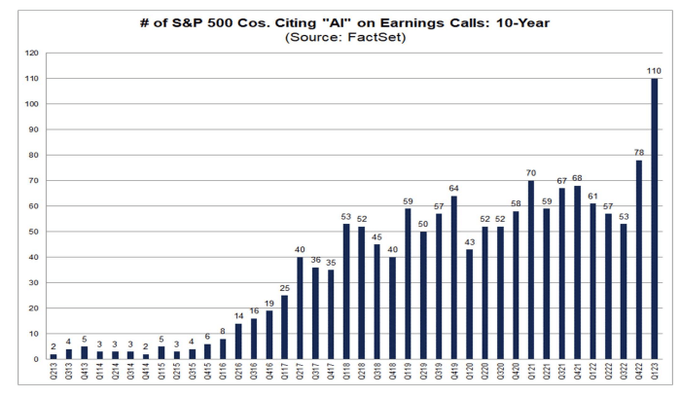

On Wall Street, the number of companies citing “AI” on earnings calls surged this past reporting season. Mentions soared to all-time highs as CEOs, like consumers, are gripped by all the techy buzz.

AI: The Talk of the Town and the Street

FactSet

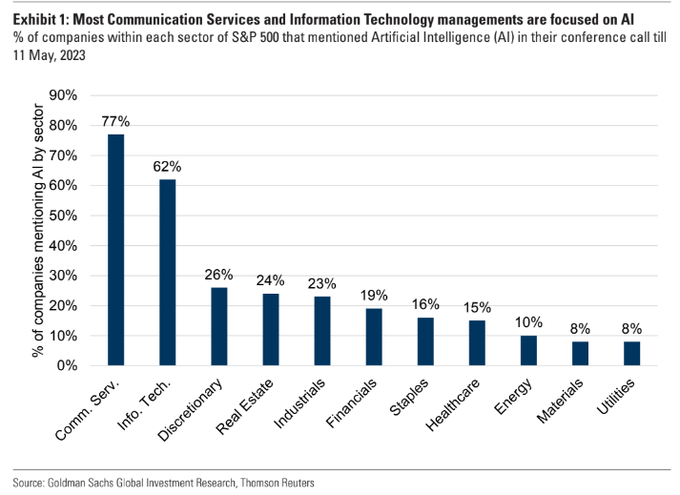

Goldman Sachs broke down the total count by sector. It was found that the Communication Services area, where Google and Meta Platforms are housed, had the most frequent AI mentions. Cyclical and defensive sectors used it less so, as you might imagine.

Comm Services, Info Tech Most Giddy on Gen. AI

Goldman Sachs

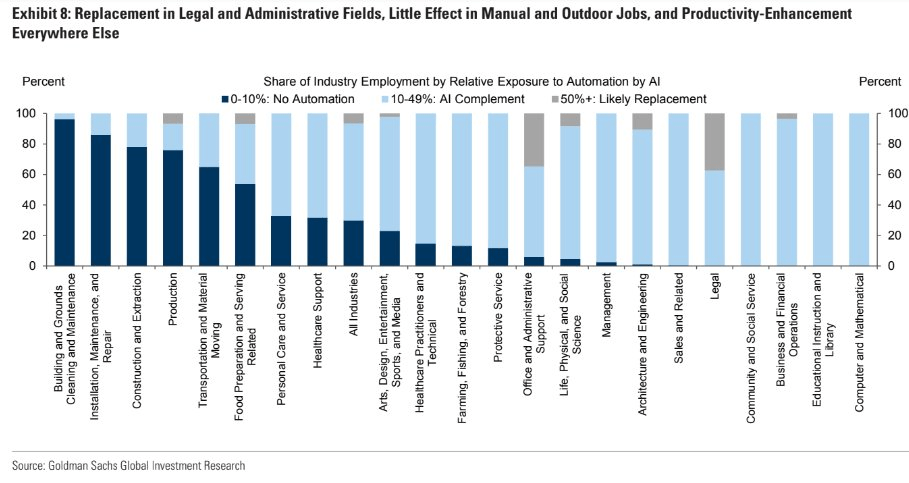

AI: Replacement in Legal and Administrative Fields, Little Effect in Manual and Outdoor Jobs, and Productivity-Enhancement Everywhere Else – Goldman Sachs

Goldman Sachs

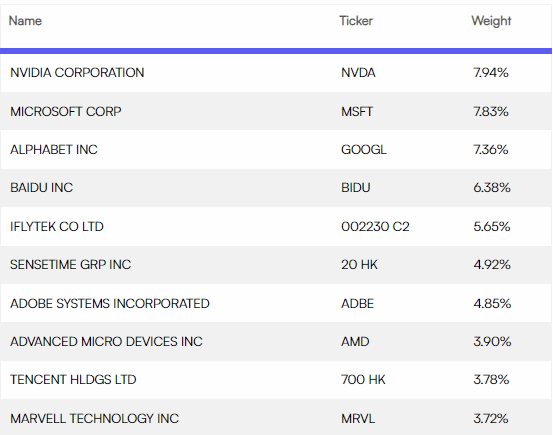

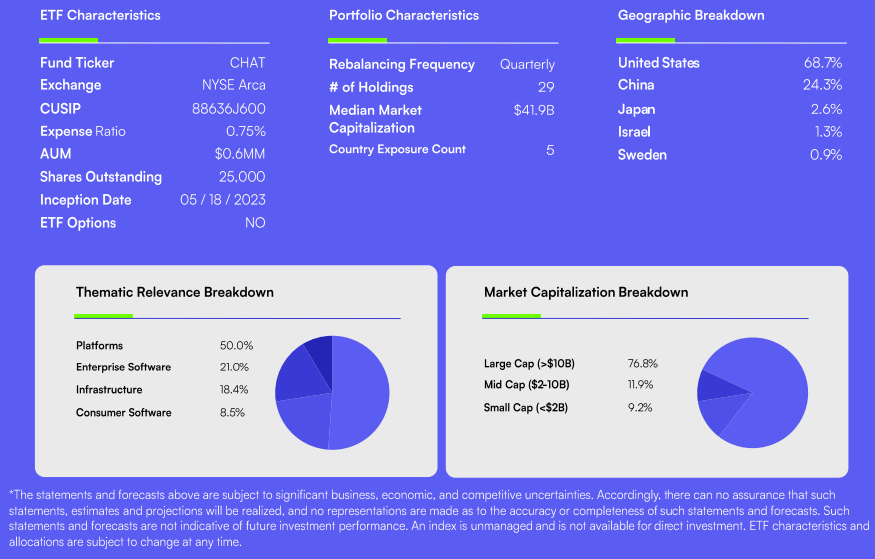

But let’s dive into the ETF itself and how it might fit into an investor’s portfolio. The top holdings are all the familiar suspects. In total, 57% of assets are in the top 10 holdings, with 69% in the Information Technology sector and 25% in Communication Services. The balance is Consumer Discretionary. According to Morningstar, 69% of the portfolio is US-based, 24% is China stocks, and 3% is comprised of Japanese equities. It is a concentrated fund with just 29 equity holdings. You can view more ETF characteristics below.

CHAT: Big-Cap Dominated Top 10 Holdings

Roundhill

CHAT: Global Diversification, Yet Concentrated, High Cost

Roundhill

Why a sell rating on CHAT? For one thing, a fund like this should not cost 0.75% annually. And investors can piece the allocation together for next to nothing while other tech-focused ETFs are cheaper. Something else to consider is that product launches like this often come near tops in niche cycles and may mark a high in euphoria. Specifically, I recently outlined a bearish view on the 3x long semiconductor ETF (SOXL), and many of the points made in that article buttress my cautious outlook on CHAT.

The Bottom Line

While there is little in the way of price action on CHAT, I don’t like the high fee and timing of this fund’s introduction. I would rather go with a slightly more diversified portfolio when aiming for AI exposure. Something like a mix of QQQ, XLK, and SMH can get you there at less cost.

Enjoyed this article? Sign up for our newsletter to receive regular insights and stay connected.