StockByM

The JPMorgan BetaBuilders Japan ETF (BATS:BBJP) is a pretty standard exchange-traded fund (“ETF”) that follows large-cap Japanese companies. There are two primary reasons to hold Japanese markets even after the pretty substantial rally in the Japanese markets, and they are both dependent on the continued ultra-loose monetary policy of the BoJ. We think that the BoJ is almost assuredly going to keep the loose status quo, at least for now, as it focuses on the matter of real wages growth.

With equity markets loving ample liquidity, Japan should remain a premier destination for funds as the inflation saga begins to draw to a close. The only things are that while BBJP gets the large-cap exposure for a broad Japan bet, there are other ETFs that do it even cheaper in terms of expense ratios.

BBJP Breakdown and Considerations

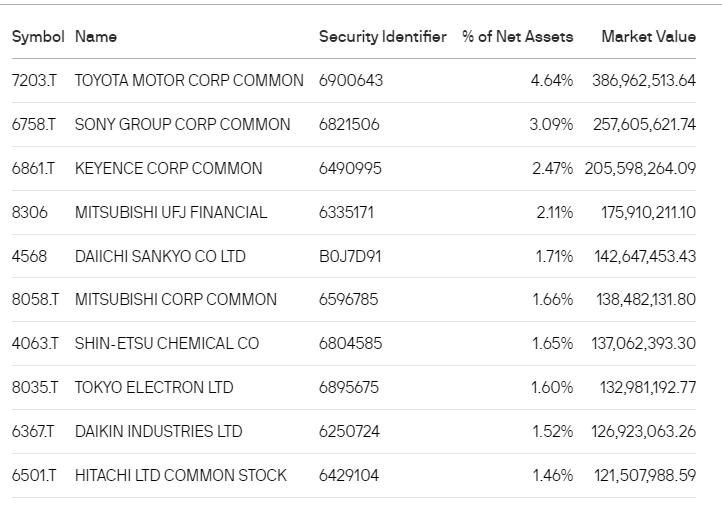

Let's have a look at BBJP holdings:

BBJP Top Holdings (JP Morgan AM)

The exposures are very representative of a value-weighted index of the Japanese market, so a lot of focus on finance (14%), producer manufacturing (14%), consumer durables (13%) and then a fair bit of technology exposures.

- INTERCHANGEABLE GRILL and GRIDDLE PLATES: From...

- 500°F MAX HEAT: Reach temperatures of up to...

- EDGE TO EDGE COOKING: No hot spots. No cold spots....

- SMOKELESS GRILL: The perforated mesh lid...

- FAMILY SIZED CAPACITY: The 14’’ grill and...

- Generous Capacity: 7-quart slow cooker that...

- Cooking Flexibility: High or low slow cooking...

- Convenient: Set it and forget it feature enables...

- Minimal Clean-Up: One-pot cooking reduces dishes;...

- Versatile: Removable stoneware insert can be used...

Sector Weightings (ETFDB.com)

BBJP is up almost 15% YTD, in line with the general growth we've seen in Japanese markets. The root reason is in part a matter of liquidity, which ends up being the best predictor of a market's returns and health, and is being driven by the continuation of the ultra-loose monetary policy in Japan under Ueda, who was expected to herald a hawkish change in policy.

The other reason why Japan benefits from the liquidity and the loose policy especially much is to do with the structure of their industry, which is highly export-oriented, and therefore benefits from a depreciated yen. The yen has retreated again to the recent lows, after the debt ceiling concerns and other concerns around the sustainability of U.S. rate hikes. This means major export industries like cars, whose manufacturing is largely domestic as well, will see a meaningful growth in profits as FX becomes a matter of sales growth in yen terms as well as a profit wedge. The same goes for the equipment manufacturing industry, which is pretty large in Japan, including companies like Hitachi (OTCPK:HTHIY), which carries alone a 1.5% weight in the BBJP, a highly diversified ETF with 274 holdings. While not a profit boost, the solvency and stability of the finance industry also benefits from the ample liquidity situation, where financial stability has been a concern in other geographies.

Bottom Line

Markets are becoming increasingly confident globally around the inflation situation, where important wholesale and producer indicators are showing quick abating in manufacturing prices. Commodities have also retreated to relatively stable levels, with the exception of oil, which has been subject to repeated supply cuts in the face of demand concerns. In other words, dangerous inflation from global supply considerations is less of a concern – indeed, the inflation does appear to have been largely transitory, although it's not over yet.

While aggressive inflation is less of a concern, Japan still has to manage the opposite issue of persistently weak demand conditions. In particular, the BoJ wants to make sure that given the inflation we've already seen, Japanese corporations feel that they are in a position to allow for growth in wages, where Japan has struggled historically with slow real wage growth. In order for this to happen, ultra-loose policy will continue, since some degree of persistent inflation in Japan would be a change for the better.

- 【Easier to Move】You can use these appliances...

- 【Save Space and Protect Countertops】The small...

- 【Strong Adhesive】The counter slider for...

- 【Easy to Use】28pcs 22mm/0.87in kitchen...

- 【Wide Application】The coffee slider for...

- ✔Update Dishwasher: This dishwasher cover in...

- ✔Size: This Magnet Sticker Dishwasher Covers...

- ✔Material: This dishwasher cover is made of Our...

- ✔Easy to Install and Remove: Dishwasher Magnet...

- ✔Widely applicable: This magnets are easy to...

The only reason the BoJ would want to change things up is to revalue the yen. However, a weak currency for an export-led nation is a positive thing. While it introduces some imported inflation and isn't good for outbound tourism, that seems a small price to pay.

There is no reason or indication for the BoJ to raise rates, as we've been maintaining from the beginning. Japanese markets should continue to benefit from ample liquidity and the FX situation. However, we prefer Franklin FTSE Japan ETF (FLJP) since it has a 0.09% expense ratio against the 0.19% for the JPMorgan BetaBuilders Japan ETF.