Justin Sullivan

Investment Thesis

In the ever-evolving landscape of technology, NVIDIA Corporation (NASDAQ:NVDA) stands poised not just to thrive but to redefine the essence of gaming and computing itself. Anchored by a relentless foothold in the gaming market, NVIDIA's journey toward long-term growth opportunities takes center stage.

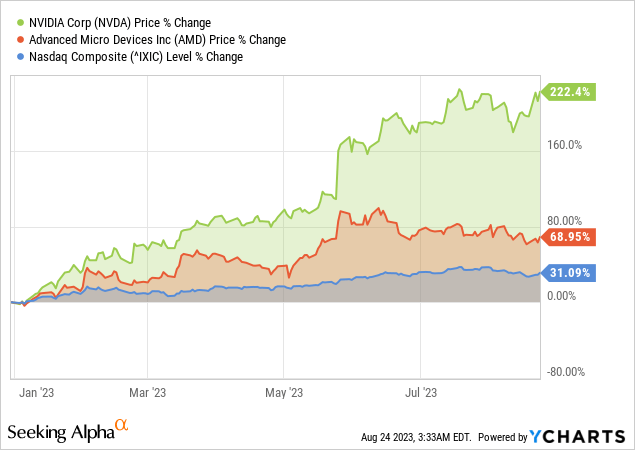

NVDA has strongly outperformed the market year to date with gains around 222%, and following the recent quarter beat, the hype is fueled for another run. I have previously expressed my concerns about NVDA's valuation and why the stock might get a reality check sooner or later. Undoubtedly, the stock still looks significantly overvalued to me, but the hype does not appear to be ending anytime soon, leading to my updated hold rating.

Data by YCharts

Gaming Dominance: Long-Term Growth Opportunities

At its core, NVIDIA stands to benefit significantly in the long term due to its strong positioning in the gaming market. The PC gaming industry has been robust, with an increase of 100 million gamers between 2019 and 2022. The trend is expected to continue as gaming becomes an essential entertainment medium worldwide, offering immersive storytelling, social interaction, and competitive environments.

Notably, NVIDIA's GeForce gaming division has outperformed the consumer PC market, showcasing a 1.4x increase in unit sales and a 20% CAGR in revenue from 2019 to 2022. NVIDIA's focus on innovation, such as the introduction of real-time ray tracing and AI-based features like DLSS (Deep Learning Super Sampling), has capitalized on gaming by enhancing performance and image quality.

Fundamentally, launching the 30/60 class of GPUs, especially targeting core gamers, allows NVIDIA to upgrade a substantial portion of its installed base. With only 18% of users enjoying the higher-performance GPUs, there's significant potential for growth. Moreover, NVIDIA's successful transition to the Ada architecture has fueled rapid adoption, demonstrating a 3x faster revenue ramp than prior generations.

Interestingly, NVIDIA's expertise in AI is also a major asset. The collaboration with Microsoft (MSFT) to accelerate AI models for Windows applications and the company's range of GPUs catering to diverse AI workloads positions NVIDIA as a leader in AI acceleration. Finally, the company's AI platforms, such as ACE for Games, showcase the integration of AI into gaming, enhancing user experiences by creating domain-specific characters within games.

NVIDIA's gaming segment has demonstrated remarkable performance, evident in its latest financial results. In the recent quarter, gaming revenue surged to $2.49 billion, marking an impressive 11% sequential increase and a substantial 22% year-on-year growth. This growth was primarily driven by the success of the GeForce RTX 40 Series GPUs, designed to cater to both laptops and desktops. The adoption of these GPUs resonated well with the market, leading to a robust expansion in revenue.

An area of particularly noteworthy growth within the gaming segment was laptop GPUs, which exhibited substantial traction during the back-to-school season. The emergence of RTX 4060 GPUs as a driving force behind this growth underlines their market popularity. In a striking shift, NVIDIA's GPU-powered laptops have surged in popularity, surpassing desktop GPUs in shipment volumes across several global regions.

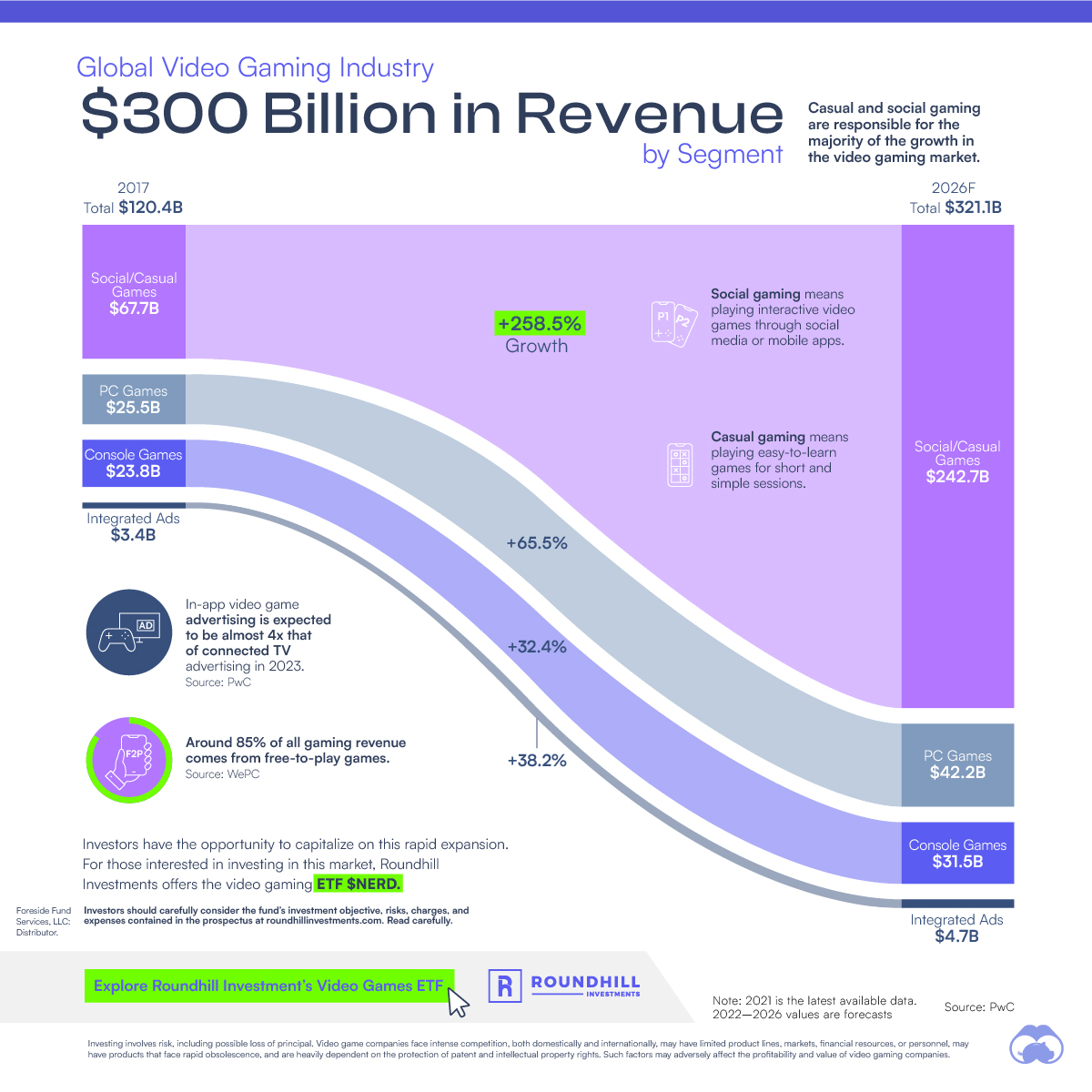

This shift is expected to influence the quarterly revenue distribution, with Q2 and Q3 being the stronger quarters due to the back-to-school and holiday laptop purchasing trends. At the broader level, as a key provider of essential gaming tools like GPUs, NVIDIA should benefit from the revenue generated by PC games expected at an annual rate of 65.5% by 2026.

visualcapitalist.com

Powering Profits: NVIDIA's Winning Strategy In The Gaming Hardware Market

Firstly, NVIDIA leverages the enthusiasm of high-end gamers, who upgrade their hardware every 2 to 2.5 years on average. This frequent upgrade cycle, driven by gamers' desire for the best experience and affordability, generates consistent revenue. Even at the lower end of the market, the replacement cycle is around 3.5 to 4.5 years, indicating a steady stream of upgrades.

Secondly, NVIDIA capitalizes on gamers' willingness to invest in high-end hardware. Gamers increasingly upgrade to higher-priced SKUs with each generation, showcasing the value they place on GPUs compared to other components. This trend results in higher average selling prices and boosts revenue growth.

Moreover, NVIDIA's robust product ecosystem enhances customer loyalty, including its client software GeForce NOW and regular driver updates. Gamers appreciate these tools' compatibility, stability, and optimized performance. This fosters brand loyalty and encourages ongoing hardware upgrades.

The company's unified architecture strategy benefits its gaming and data center segments. NVIDIA's consistent focus on CUDA cores as a foundation for gaming GPUs and AI hardware allows for efficient development and resource allocation. This synergy enhances the value proposition for customers and investors, as NVIDIA remains at the forefront of technological innovation.

In the face of potential economic challenges, NVIDIA's strategic product releases, such as those related to Diablo IV, Starfield, and Call of Duty, offer opportunities for gamers to upgrade, supporting stable growth even in uncertain market conditions.

Accelerated Path Τo Data Center Excellence

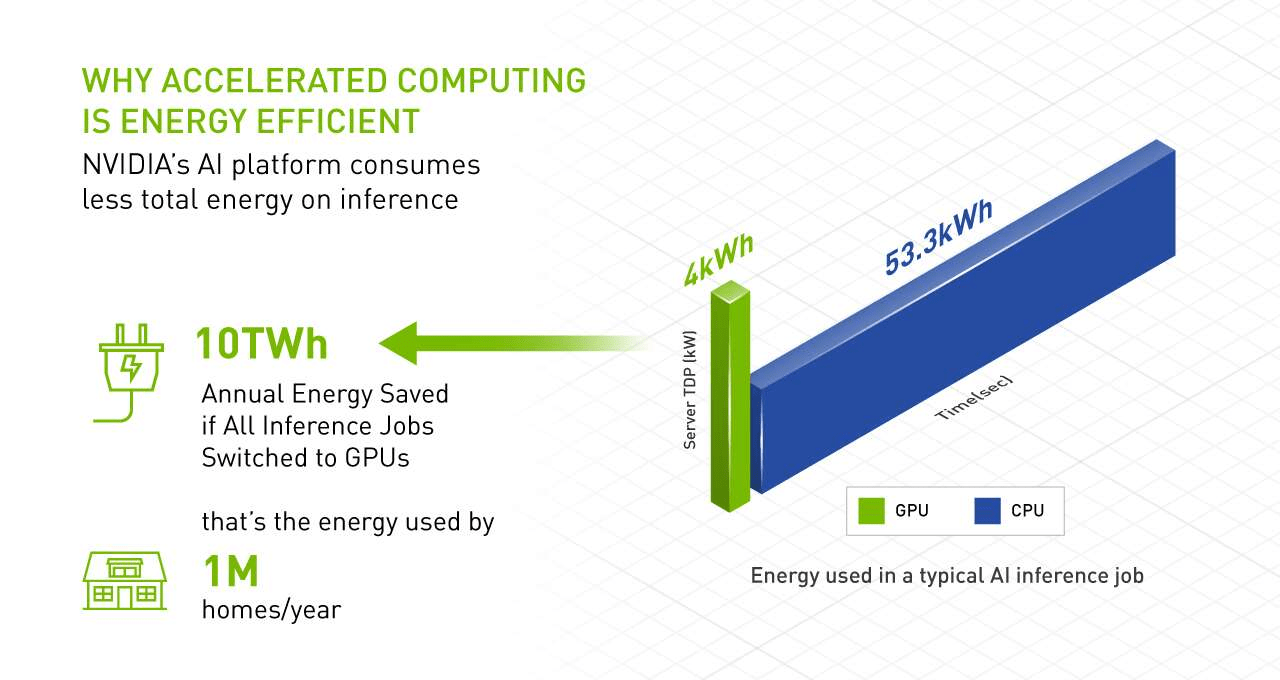

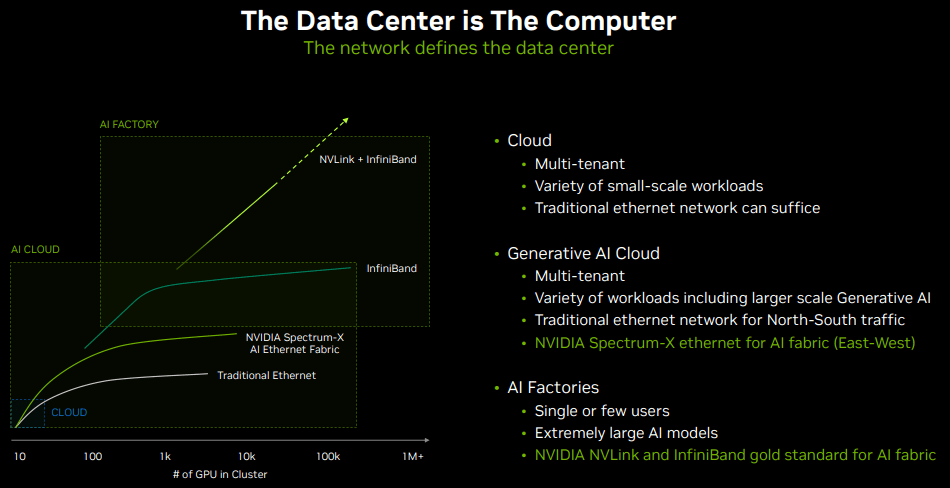

NVIDIA may continue to attain long-term value growth based on its fundamental focus on accelerated computing and its comprehensive approach to the data center ecosystem.

NVIDIA recognizes the significance of accelerated computing for enhanced performance and the next generation of computing. The company's focus on developing and optimizing technologies for accelerated computing has been evident over the years. The approach goes beyond just creating accelerators; it involves optimizing the entire data center ecosystem, including decoupling different components and integrating them efficiently for better overall performance.

Fundamentally, the end of Moore's Law has accelerated the adoption of accelerated computing. Traditional CPU-only servers are facing limitations in delivering substantial performance improvements. The critical transition allows NVIDIA to offer accelerated computing solutions that provide higher performance gains and better cost-effectiveness, making them an attractive alternative for organizations looking to upgrade their infrastructure.

nvidia.com

Unlike the PC era, where different companies handled different aspects, NVIDIA provides an end-to-end stack that includes hardware, software, and development platforms. The comprehensive approach ensures compatibility, smooth integration, and consistent performance across various components, appealing to various industries and use cases.

Further, NVIDIA's software ecosystem is a growing revenue contributor. The company's software offerings, such as NVIDIA AIE, Omniverse, and automotive software, cater to different industries and provide solutions beyond hardware. The diversification supports NVIDIA in capturing additional value from its customer base and expanding its revenue streams.

Interestingly, regarding supplier diversity, NVIDIA's strategy of sourcing chips from multiple foundries, including TSMC (TSM), Samsung (OTCPK:SSNLF), and potentially Intel (INTC), enhances its supply chain resilience and mitigates the risks associated with relying on a single provider (concentration risk).

Data Center Segment Achieves Staggering Revenue Growth

NVIDIA's Data Center segment has demonstrated exceptional performance, setting new records in revenue generation. With a revenue of $10.32 billion, the segment witnessed an astounding 141% sequential growth and an impressive 171% year-on-year expansion. The driving force behind this remarkable growth has been the soaring demand for Data Center computing solutions, which nearly tripled in revenue year-on-year.

The primary catalyst for this surge in demand has been the accelerated adoption of NVIDIA's HGX platform. Positioned as the powerhouse for generative AI and large language models, the HGX platform has garnered significant interest from cloud service providers and major consumer internet companies. This surge in demand underscores the critical role of NVIDIA's accelerated computing and AI platforms in the modern tech landscape.

HGX (Nvidia)

Potential Of Generative AI And Advanced Computing

NVIDIA's role in AI is pivotal, especially with generative AI's emergence and rapid adoption. Fundamentally, the company's GPU technology has been instrumental in powering AI workloads, and the emergence of generative AI, exemplified by innovations like ChatGPT, showcases the transformative potential of NVIDIA's solutions.

- Sturdy and Durable: This OROPY wall mounted...

- Sleek Industrial Design: With its simple...

- Optimized Space Utilization: Expand your storage...

- Convenience at Your Fingertips: Hang your daily...

- Versatile Functionality: This multi-functional...

- 【Industrial Clothing Rack】 The clothing racks...

- 【Sturdy & Durable】 Our clothes racks are made...

- 【Height Adjustable】 The height of the lower...

- 【Multifunction Closet Rack】 Wall clothes rack...

- 【Multi-Scene Use】 Dimension: 115” W x87.5”...

- 【Safer Size/Style】: Whole sconces are UL...

- 【Outstanding Details】: Our high-quality black...

- 【NOTE】: Our bar lighting wall sconce include...

- 【Wide Application】: Vintage wall light...

- 【Tips】: As the tube bulb is a bit special, it...

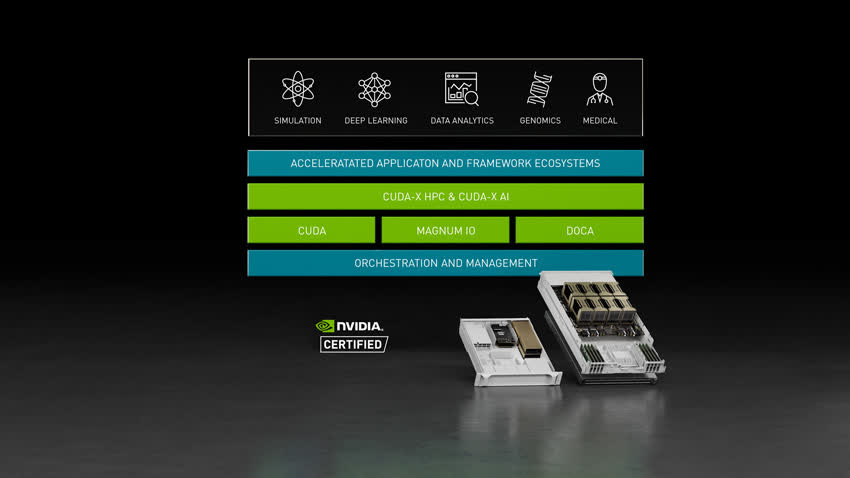

Critically, at the initial stages, AI researchers discovered that the math used in their neural networks aligned well with CUDA, leading to the integration of GPUs as a powerful computing platform for AI. This integration saw initial applications in image recognition and sentiment analysis. However, AI subsequently transitioned from recognition tasks to generative tasks, giving rise to transformative advancements.

Generative AI, driven by models like GPT (Generative Pre-trained Transformer), empowers machines to recognize and generate meaningful content, ranging from text to images. NVIDIA's role in the proliferation of transformer models has been crucial, with models like BERT and GPT taking center stage. NVIDIA's expertise in accelerated computing allowed for efficient training and deployment of these complex models, making them more productive and effective.

As generative AI continues to evolve, it creates new opportunities for businesses. It spawns new startups, introduces novel services, and even rejuvenates established products, as seen in the example of Microsoft's Office 365 becoming more engaging with the integration of generative AI.

Scaling Generative AI: NVIDIA's Innovative Solutions To Complex Challenges

However, the growth of generative AI comes with challenges. For example, Larger models require substantial computing power for training and inference, driving demand for advanced GPUs and optimized infrastructure. The size of models is driven by the need to capture human-like knowledge and make AI models more intelligent. Interestingly, sequence length, which affects an AI's memory and ability to retain context in conversations, requires additional compute resources and highlights the complexity inherent in advancing AI capabilities.

Hitting at the core problem, NVIDIA's ability to provide faster GPUs, optimized infrastructure, and innovative solutions positions it to cater to the increasing demands of AI scaling. For instance, NVIDIA's introduction of the GH200 Grace Hopper superchip platform, with its edgy features like the world's first HBM3e processor and enhanced memory and bandwidth capabilities, positions the company favorably for long-term growth.

This technology addresses the increasing demand for complex generative AI workloads, a rapidly expanding segment. Offering up to 3.5x more memory capacity and 3x more bandwidth than the previous generation enhances performance and efficiency for data centers and AI applications. As the company continues collaborating with leading system manufacturers to roll out GH200-based systems, projected for Q2 2024, it will likely capitalize on the trend sooner.

Regarding AI scaling and performance, NVIDIA is focused on developing GPUs that can efficiently handle the demands of AI models, such as transformers, which are widely used in natural language processing tasks. The goal is to significantly enhance computing capabilities while optimizing total cost of ownership (‘TCO') for businesses. Hopper offers 6x more compute performance at the transformer level and 3x to 4x more performance for complete training jobs than Ampere GPUs. This increased efficiency translates into cost savings for businesses operating at scale.

Further, the Transformer Engine within Hopper is optimized to work with 8-bit floating point (FP8) representation, making training much faster and more efficient. This optimization reduces the model size, improves throughput, and lowers memory requirements, contributing to lower costs and improved overall system performance.

Finally, NVIDIA addresses the challenge of scaling sequence lengths and model sizes by employing various strategies. The company's GPUs can be interconnected using technologies like NVLink and products like Grace Hopper, a GPU-CPU hybrid providing expanded memory capacity to handle larger sequences.

Networks for AI (Nvidia)

How Global Semiconductor Dynamics Could Impact NVIDIA's Future

NVIDIA could face long-term harm due to several specific risks and downsides emerging from the global semiconductor industry landscape, particularly in the context of growing self-reliance efforts by the Chinese chip industry and regulatory restrictions imposed by governments.

Specifically, the Chinese semiconductor industry's push for greater supply chain self-reliance could impact NVIDIA's long-term prospects. Chinese companies actively invest in research and development to reduce their dependence on foreign suppliers for advanced chips and technologies. This could lead to increased competition from domestic Chinese chip manufacturers, potentially eroding NVIDIA's market share and pricing power.

On the other hand, the U.S. executive order signed by President Biden to regulate certain U.S. investments in China, particularly in semiconductors and AI, could hinder NVIDIA's business opportunities in the Chinese market. This order could limit partnerships, investments, and collaborations between NVIDIA and Chinese companies, impacting its access to a significant market.

The massive orders (worth $5 Billion) of NVIDIA's high-performance chips by top Chinese tech companies indicate heavy reliance on NVIDIA's products for their generative AI systems. However, the growing trend of Chinese companies stockpiling chips due to fears of export restrictions and supply chain disruptions could lead to increased competition for chip supplies and potentially impact NVIDIA's ability to meet demand.

China's efforts to bolster its domestic semiconductor production and reduce reliance on imported chips could result in a more competitive landscape for semiconductor manufacturing equipment. If Chinese companies achieve their self-sufficiency goals, it could limit NVIDIA's opportunities to supply its cutting-edge technology to the Chinese market.

Therefore, geopolitical tensions and regulatory uncertainties between the U.S. and China could further trade restrictions and barriers, disrupting NVIDIA's global supply chain and limiting its ability to collaborate with Chinese companies.

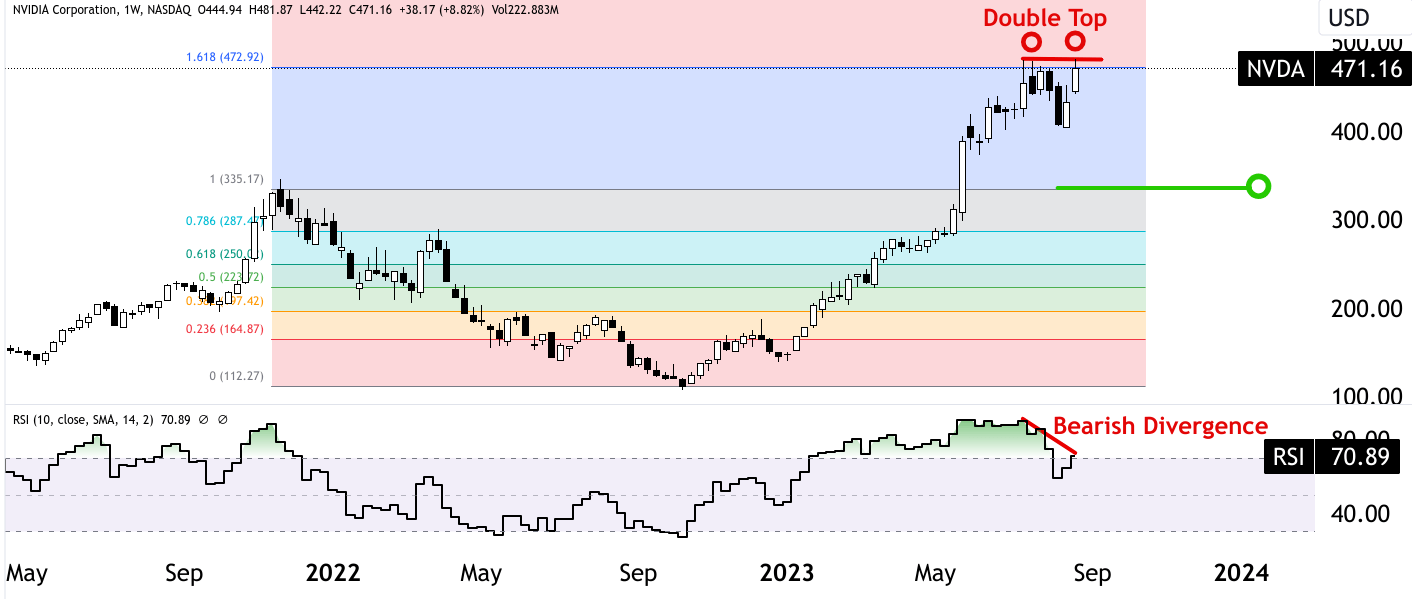

NVDA Will Likely Break To New All-Time Highs

The stock price (weekly timeframe) of NVIDIA experienced solid resistance at the 1.618 level of the Fibonacci retracement (at $481) along with a bearish divergence at overbought levels (above 70) as per the Relative Strength Index (RSI). A double top has also emerged at the same level ($481). From a technical perspective, the stock can return to around $336 and an RSI near 30, creating an optimum buying zone for new long positions. However, NVDA soared to new all-time highs, and its momentum might persist for the foreseeable future, rejecting any technical analysis.

Interestingly, the rationale lies in the daily price chart, where substantial gap-ups are created at the end of May 2023 and during the current week. To fill that gap, the price has to return to around $320 to sustain a further upward trajectory by creating a support zone near $336. Technically, ideal conditions for profit booking have emerged and make sense at current levels.

tradingview.com

Takeaway

In conclusion, NVIDIA's outlook is reaffirmed and is undeniably robust, marked by its prowess in gaming innovation, AI scaling, and accelerated computing. Despite potential challenges from geopolitical tensions, Chinese self-reliance efforts, and the overvaluation risk, NVIDIA's strategic positioning, continuous advancements, and diversified revenue streams signify a solid long-term growth trajectory.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.