CNYA provides access to locally available equities in China, with a focus on financial and industrial sectors.The ETF has exposure to consumer staples and specific companies such as Kweichow Moutai and a lithium-ion battery manufacturer, which may drive secular resilience.But structural risks, including the housing sector and geopolitical tensions, continue to pose challenges for the Chinese economy and the ETF’s outlook.We think the risks that remain are too numerous and too serious to want to take the risk on China at current multiples, despite some strong constituent companies in CNYA.

The iShares MSCI China A ETF (BATS:CNYA) tracks allocations in China primarily in financial exposures and industrial, meant to give access to investors to locally available equities denominated in Yuan, not always accessible to foreign investors. It’s diversified with 557 holdings, and therefore broad comments about China’s ailing economy address how the ETF could possibly move from here. There is further stimulus in China, and some data actually looks good in industrial output and retail sales, but we think optimism in China is premature as the impact of geopolitical ramifications and tensions mount between China and the West can still meaningfully worsen the Chinese economy and business outlook.

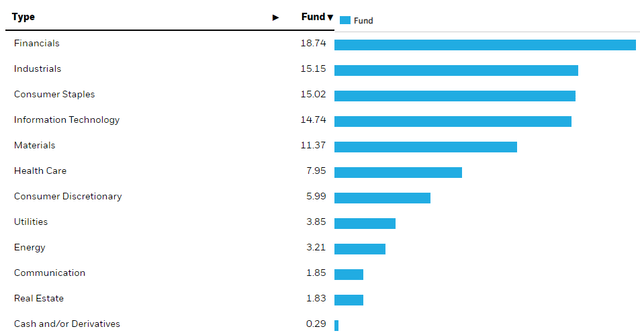

CNYA Breakdown

It is a value-weighted ETF dominated by issues on local Chinese exchanges, not ADRs. That means that there aren’t too much of the tech exposures that are typical in Chinese ETFs. It is a lot of industrial exposures that would be traditionally less accessible to foreign investors, as well as some financial exposures. There is also meaningful exposure to consumer staples.

Some of the specific exposures to discuss are Kweichow Moutai at 5.9% exposure, which is a growing beverage company. At 2.4% exposure is a lithium ion manufacturer. After those allocations exposures become smaller and can be addressed by their sector. There is a 5% allocation to money-market instruments in the US.

Across the financial exposures and the industrial exposures, there are meaningful risks related to the housing sector and its systemic impact on credit in China. Construction is the plurality of Chinese GDP, and credit is tied up in real estate which is experiencing meaningful distress as developers are in financial distress to the point of bankruptcy in some high-profile cases. Problems in real estate and development in particular have both an impact on financial systems as well as on demand levers by directly impacting national income and household wealth. They continue to threaten CNYA financial exposures both on the insurance and investment side as well as with lenders. China has responded with some measures to improve credit conditions by intervening in the functioning of credit outlays, but besides some additional cuts to interest rates and borrowing conditions by mandate, not too much else has been done probably to avoid moral hazard among developers who had speculated too aggressively.

At the beginning of the year, China looked alright with the end of COVID-zero and a wave of revenge travel boosting the economy, but that died off quite quickly and disappointed markets. But the slump has now been punctuated with a sign of hope as travel in the summer months and both monetary and fiscal stimulus from the government have shown some recovery in retail and industrial output as well as mitigating further declines in unemployment, with youth unemployment being particularly disconcerting. The Yuan recovered after losing a fair bit of value from the problems in selling industrial outputs in global markets at expected levels – remember that last year’s levels were quite affected by COVID-zero policies especially in industrials, so the performance is still not great.

Bottom Line

We think structural risks remain. Dramatic policy effects haven’t taken place and the financial system is still a concern. Furthermore, major fiscal stimulus still hasn’t happened yet, although China is already budgeting for some. While this may eventually happen as China wises up, the issues of deglobalisation and geopolitical tensions remain a more secular problem for Chinese industrial output. They could also cause more punctuated issues that could more seriously impair capital overnight, such as capital controls or other means if economic nationalism heats up.

There is also a demographic problem. Low youth employment combined with one of the most rapidly ageing populations in the world is going to create a dependency burden. And more immediately, there is the Yuan problem that affects the value of all these CNYA stocks in USD terms. China may take action to devalue their currency further in order to restore output, while somewhat unlikely, although still possible especially as other major APAC currencies like the Won and the Yen are weak too, eating into China’s export share with the West. More realistically, continued monetary accommodation will continue to pressure the Yuan, and this monetary accommodation absolutely cannot stop given the situation in housing and construction and its systemic importance for the Chinese economy. It will negatively affect the Yuan as well as profits of major financial allocations in CNYA through lower NIMs and higher reserves. Credit crunch also affects loan volumes.

CNYA gives relatively exclusive access to a market, so the 0.6% expense ratio makes some sense. Some exposures look good, including those in beverages and other consumer staples. However, with real employment risks and real capital impairment risks related to the geopolitical situation, even if remote, the 14x PE is not low enough in our view. The economy could fare badly, the Yuan will likely be under pressure, and geopolitical issues affect the financial systems in China, directly affecting the GDP as well as access to securities by foreign investors. While there are some signs of abating declines, further exogenous developments as well as a still unresolved story considering just endogenous factors just don’t make these multiples compelling. We’d have to see around 30% further declines before we’d consider taking on China.

Enjoyed this article? Sign up for our newsletter to receive regular insights and stay connected.