iShares U.S. Healthcare ETF is not recommended for long-term holding due to diminished long-term earnings growth and rich valuation.IYH has better downside protection than the S&P 500 index and has performed in line with the index in the past.The long-term growth outlook for IYH is weaker than the S&P 500 index, making it less attractive for investors.

Introduction

Back in 2019, we have written an article on iShares U.S. Healthcare ETF (NYSEARCA:IYH). At that time, we held the view that IYH was a good long-term holding for investors with a long-term investment horizon. It has been over 4 years now since that article was written. Therefore, we think it is time to revisit this fund and provide our insights and recommendations.

ETF Overview

IYH owns a portfolio of large-cap healthcare stocks in the United States. The fund usually provides better downside protection than the S&P 500 index. However, its long-term earnings growth has been diminished significantly than two decades ago, making it less attractive. In addition, its current long-term earnings growth outlook also appears to be much inferior to the S&P 500 index. IYH's valuation relative to its historical average is also quite rich. Hence, we do not think it is a good fund to own right now.

Fund Analysis

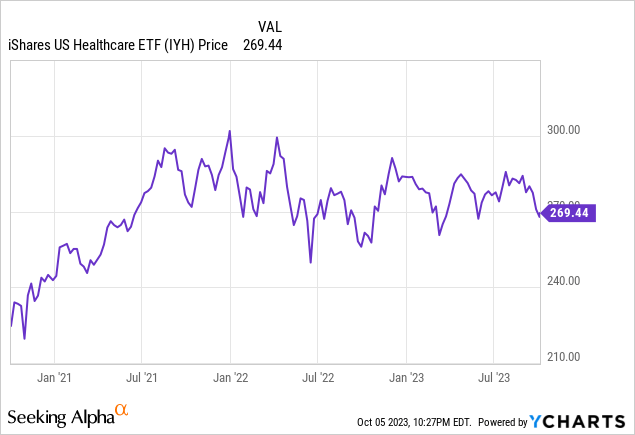

IYH has been in rangebound in since mid-2021

Last year was a challenging year for equities. The S&P 500 index has declined by about 25% for the entire year last year. In contrast, IYH held up very well. It registered a loss of only 5.6%. However, 2023 was a totally different story. The S&P 500 index rebounded and registered 11% return year-to-date. In contrast, IYH declined by about 5%. Overall, the fund has been in rangebound since mid-2021 trading between $250 and $285 per unit.

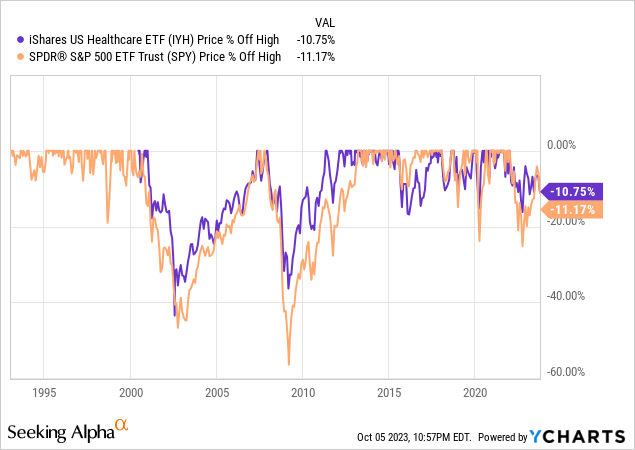

IYH has better downside protection than the broader market

Healthcare sector is often perceived by investors as a defensive sector. This is because people still need to access healthcare services and products even during economic recessions. Therefore, revenues and earnings of stocks in IYH's portfolio are usually less impacted in an economic recession than many other stocks. This also explains why IYH's fund prices tend to decline less in past economic recessions. As can be seen from the chart below, IYH's fund price declined by about 35% during the Great Recession in 2008/2009. In contrast, the S&P 500 index declined over 55%. That is about 20 percentage points difference. During the initial outbreak of COVID-19 in 2020, IYH only declined by about 30% whereas the S&P 500 index declined by about 34%.

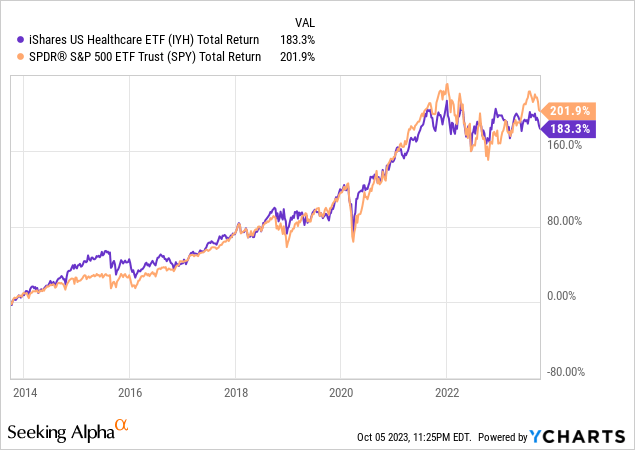

IYH has performed inline with the S&P 500 index in the past

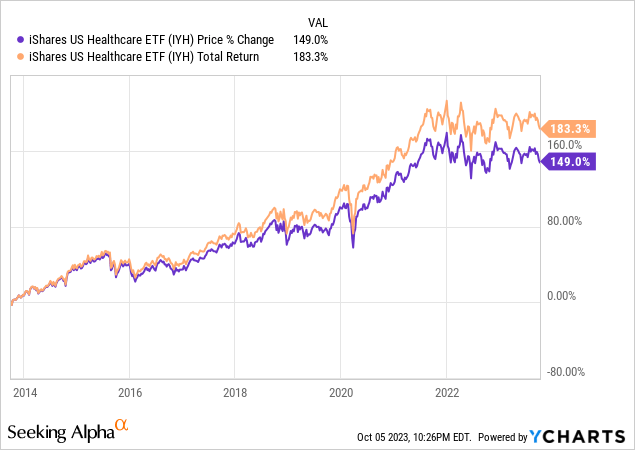

IYH has performed quite well in the past. As can be seen from the chart below, the fund has generated a total return of 183.3% in the past 10 years. In contrast, the S&P 500 index has delivered a total return of 201.9%. As the chart below shows, IYH's total return closely tracks the S&P 500 index most of the time in the past 10 years. Therefore, its long-term return appears to be comparable to the S&P 500 index.

But, long-term growth rate appears to be diminishing

However, we believe IYH's long-term return will trail the S&P 500 index in the future. While IYH should benefit from an aging population and surging healthcare demand in the future, its long-term earnings growth forecast is diminishing. Here, we will demonstrate this by looking at the long-term growth outlook of the S&P 500 healthcare sector. We believe IYH's portfolio of large-cap healthcare stocks has significant overlap with the S&P 500 healthcare sector, which also consists of large-cap healthcare stocks. Therefore, examining the S&P 500 healthcare sector will give us some helpful insights.

- New Store Stock

- Rivan, Maria (Author)

- English (Publication Language)

- 208 Pages - 04/14/2020 (Publication Date) -...

- Elevate Your Vision : An Enhanced Vision Board...

- Experience a new level of quality with our...

- Our vision board kit for women offers hand-picked,...

- Whether it’s a gift vision board for teens,...

- At Lamare, our mission is to help women plan and...

- National Geographic Special - 2017-1-20 SIP...

- English (Publication Language)

- 128 Pages - 01/20/2017 (Publication Date) -...

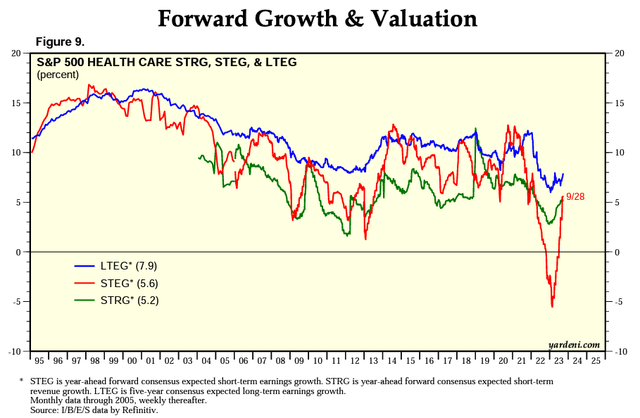

As can be seen from the chart below, the long-term earnings growth rate has been gradually declining from the peak of above 16% reached in 2000/2001 to only 7.9% today. In other words, its long-term earnings growth has halved since 23 years ago.

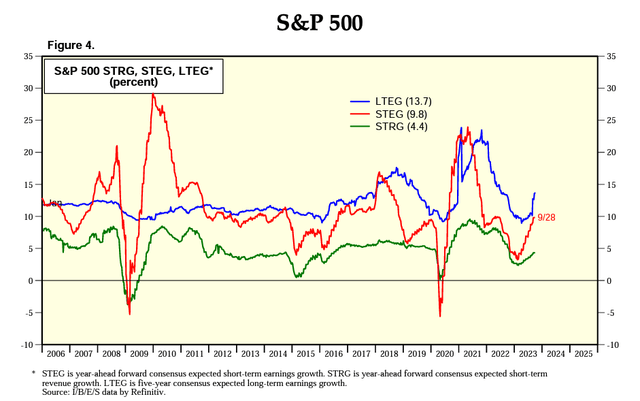

Now, let us take a look at the S&P 500 index's long-term earnings growth outlook. As can be seen from the chart below, the index's long-term earnings growth rate stayed relatively within the range of 10%~15% since 2006. Its current long-term earnings growth rate of 13.7% is also significantly higher than healthcare sector's 7.9%. Therefore, the trend we have observed here suggests that IYH's long-term performance will likely be inferior to the S&P 500 index.

Valuation may be rich when compared to its long-term earnings growth rate

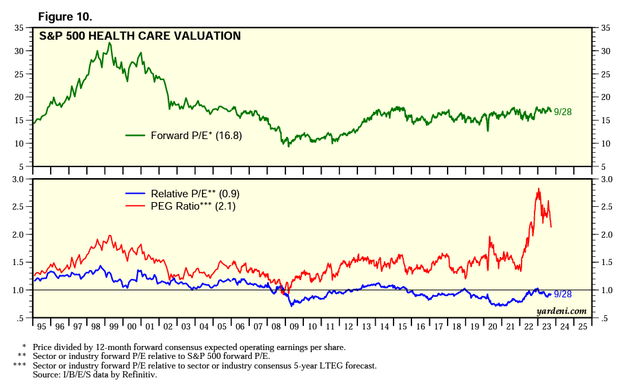

Let us now evaluate IYH's valuation. We will look at the historical forward P/E ratio of the S&P 500 healthcare sector. As can be seen from the chart below, the average forward P/E ratio of health care stocks in the S&P 500 index is about 16.8x. In the past two decades, the average forward P/E ratio of these stocks typically swung between 13x and 17x. Therefore, its current valuation of 16.8x is towards the high end of this valuation range. Its forward P/E ratio relative to the S&P 500 index of 0.9 suggests that its valuation is lower than the S&P 500 index. However, given its inferior long-term earnings growth outlook, its valuation relative to the S&P 500 is also not cheap.

Investor Takeaway

- Amazon Kindle Edition

- Baldacci, David (Author)

- English (Publication Language)

- 487 Pages - 04/16/2024 (Publication Date) - Grand...

- Amazon Kindle Edition

- Hannah, Kristin (Author)

- English (Publication Language)

- 472 Pages - 02/06/2024 (Publication Date) - St....

- Amazon Kindle Edition

- Elston, Ashley (Author)

- English (Publication Language)

- 348 Pages - 01/02/2024 (Publication Date) - Pamela...

While IYH may provide better downside protection in market turmoil, its long-term growth outlook appears to be weaker than the S&P 500 index. Given that its valuation is also not cheap relative to the S&P 500 index, we think the risk and reward profile of owning IYH is not attractive. Hence, we think investors should wait on the sidelines.