BlackRock Health Sciences Term Trust (NYSE:BMEZ) is a closed-end fund, or CEF, focused on healthcare and biotech stocks. This is a huge fund with $1.69 billion under management. It features a 1.32% gross expense ratio and it uses a few tricks to try and generate outperformance beyond what's available through lower-cost simple exchange-traded funds, or ETFs:

- The fund employs a call-writing overlay. The managers choose how many calls to write and how far out in time and out-of-the-money.

- The fund also invests in venture-stage companies that are still private. The managers hope to capture an illiquidity premium when these venture investments mature and move from private to public.

The first tactic probably adds or detracts value depending on management skills. Theoretically, the latter should work. In practice, there are times when private companies are valued above public companies. In general, this isn't the case and the companies get a higher multiple. My theory of late is that there isn't so much a public premium as a margin premium. Companies I have in my portfolio that can be margined tend to trade at higher multiples. Maybe it's just a function of the market ignoring micro and small-caps (which often can't be margined) over the last few years. However, I do think this tactic will probably add value over time.

The Trust has an annualized distribution rate (this is around ~8% on money invested at the current discount to NAV) of 6% of NAV. That's impressive given its illiquid investments. Over time, this means the fund increasingly consists of private investments (currently 7.5%) unless its investments go public. Historically, the investments have gone public at a good clip, and it's not exactly been easy in life-sciences lately.

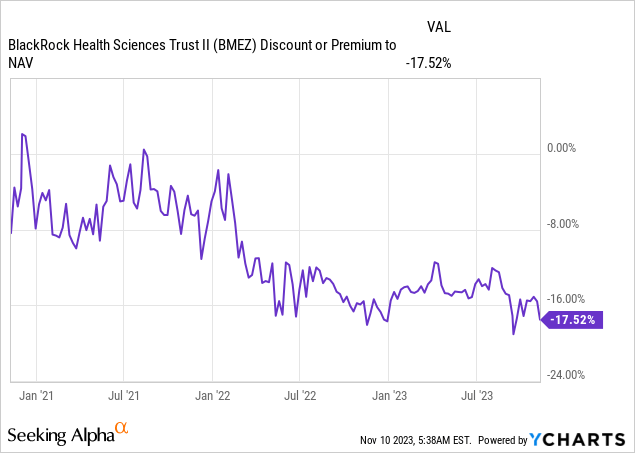

BMEZ also has a contingent, limited-term structure and it likely dissolves in January 2032. It also trades at an attractive 17.52% discount to NAV, which provides a bit of a tailwind for investors.

Data by YCharts

If the discount disappears in early 2032, that means you likely capture 21% of the upside over the next ~8 years. That's a ~2.6% tailwind per annum. Not bad.

There are a few things that make this fund attractive beyond the discount to NAV.

It is the 3rd largest holding of Saba Capital management. Saba is a strong absolute returns hedge fund, headed by Boaz Weinstein, that does a lot of closed-end fund arbitrage/activism. CEF arbitrage is where you buy cheap closed-end funds (like this one) and sell the portfolio against it or, alternatively a proxy hedge (like another ETF). You profit when the spread narrows. Of course, you lose if the spread widens. What's great is that the strategy requires you to put very little capital down because the short and long positions cancel each other out. Meanwhile, you have added a return stream to your portfolio.

Weinstein is currently pressuring BlackRock about its CEF governance:

On the close-end fund side, if the managers were just thinking about the investor, they could literally press a button, turn it into an ETF, which they also – those same managers, Blackrock is selling ETFs by the cartload. If they change their closed-end fund into an open-ended fund, because it didn't give investors an exit at NAV for five, six, seven years, it would immediately go to NAV, just like all ETFs are arbitrageable if they're trading different than NAV.

So they could change it to an open-ended fund. They could tender for shares at no discount. They could liquidate the fund and offer investors the chance to go into almost the exact same products, whether it's New York munis or – or junk loans or – or energy equities, MLPs. There's 500 closed-end funds. And there's thousands of mutual funds and thousands of ETFs. So the ability to go from 84 to 100, you're talking about a 20% return and maybe it's the recapture of a loss that the investor, of course, if they knew enough, would want it every time.

And the only thing standing in your way is the manager that feels like they have some God-given right for that capital to be permanent capital. And if they tender for shares, that means less AUM and less fees for them. And so there's a huge – there's really a huge problem where the manager is putting their own interests and the board is putting the manager's interests ahead of the shareholders, and that's where we come in.

Weinstein thinks large asset management firms (like Templeton and BlackRock) are often left alone by activists because activists need them in other campaigns. If they go activist at, for example, Apple (AAPL) to demand buybacks (like Carl Icahn once did), this works better if BlackRock gives the company a phone call, and behind-the-scenes works if the noisemaking activist has some good points. The 0.01% activists voting stake doesn't scare the CEO or board, but BlackRock's 6.68% is listened to carefully.

BlackRock has already initiated buyback campaigns across its swath of closed-end funds, but BMEZ hasn't really stepped on the gas. BMEZ repurchased around $73 million of its shares so far. Not a lot given this is a billion+ fund. It did increase distributions recently to the current 10% annualized level, which is actually creating less value for remaining shareholders compared to a buyback at the current discount.

Data by YCharts

- Sturdy and Durable: This OROPY wall mounted...

- Sleek Industrial Design: With its simple...

- Optimized Space Utilization: Expand your storage...

- Convenience at Your Fingertips: Hang your daily...

- Versatile Functionality: This multi-functional...

- 【Industrial Clothing Rack】 The clothing racks...

- 【Sturdy & Durable】 Our clothes racks are made...

- 【Height Adjustable】 The height of the lower...

- 【Multifunction Closet Rack】 Wall clothes rack...

- 【Multi-Scene Use】 Dimension: 115” W x87.5”...

- 【Safer Size/Style】: Whole sconces are UL...

- 【Outstanding Details】: Our high-quality black...

- 【NOTE】: Our bar lighting wall sconce include...

- 【Wide Application】: Vintage wall light...

- 【Tips】: As the tube bulb is a bit special, it...

The private investments can't really explain away the discount. These make up around 7.5% of the fund and they've already been discounted (in some cases severely) from what BlackRock put in. You can still quibble with the marks, given how badly biotech is doing lately. If you mark them all to 0, the discount is still around 10%, which is not outstanding, but it isn't bad, either.

private holdings BMEZ (Blackrock)

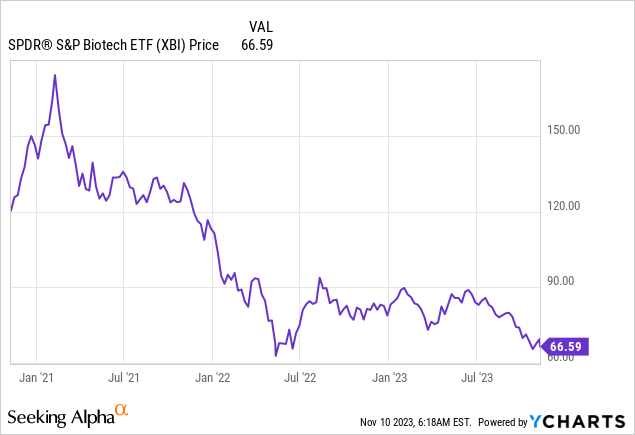

It seems quite attractive to me to go long this fund at this discount and short one or a set of biotech ETFs against this fund, like the iShares Biotechnology ETF (IBB), SPDR S&P Biotech (XBI), ARK Genomic Revolution ETF (ARKG), or another one. This will always be a proxy hedge. Shorting the individual names in the fund will work better, but this is also very time-consuming and very costly. As always, fully study and understand the risks of shorting before opening any position.

Here are the top 10 names as per Seeking Alpha data:

top 10 BMEZ holdings (Seekingalpha.com)

If I buy the fund, it won't be to capture the full discount. I'd short a biotech ETF against it and wait until the discount narrows to something more reasonable, like 5%-12%. This represents a gain of between 5.2% and 13.6%.

The hedge won't be perfect, both sides can likely work against you at times. For example, when private biotech is strongly underperforming public biotech. However, the biotech ETF also has very low distributions. Meanwhile, the closed-end fund distributes 8% annualized. Significant carry that helps sustain a position like this while waiting for Weinstein to convince BlackRock, or for them to see the light independently, and step up the buyback or initiate a tender offer. All these actions could help narrow the discount to NAV.

The biggest risk is the discount widening or having to wait a very long time for the discount to close. The first risk is not avoidable, but somewhat mitigated by the distributions. The latter is always painful and carries a real opportunity cost. Because a hedged strategy doesn't require a lot of capital (the short offsets the long), it isn't as horrible as waiting with a regular long position.