The VanEck Vectors Oil Services ETF (NYSEARCA:OIH) is a well-known investment vehicle for gaining broad exposure to the Energy – Equipment and Services sector of the stock market. This ETF is designed to mirror the performance of the U.S. listed oil services sector, which predominantly serves the upstream oil industry, encompassing segments such as oil equipment, oil services, and oil drilling. I've expressed my long-term bullish view on the energy sector before, and think this is a good fund to get access.

OIH was launched on December 20, 2011. This fund follows a passive management strategy, striving to mirror the results of the MVIS U.S. Listed Oil Services 25 Index, before deducting fees and expenses. The said index monitors the performance of U.S. companies that provide services to the upstream oil sector. The fund is sponsored by VanEck and it has amassed an impressive $2.3 billion in assets, making it one of the largest ETFs in this segment.

The ETF offers several advantages to investors, including low costs, transparency, flexibility, and tax efficiency. Moreover, it offers a convenient way to gain low-risk and diversified exposure to a broad group of companies in the energy equipment and services sector.

ETF Holdings: Diving into the Core of OIH

The ETF consists of 26 holdings. Top holdings include:

- Schlumberger NV (SLB): As the most significant holding of the ETF, SLB makes up approximately 19.56% of the total. It operates as the premier global oilfield services organization, offering technological, project management, and information solutions.

- Halliburton Co (HAL): Holding the second largest position in the ETF, HAL constitutes about 11.70% of the fund. It stands as one of the largest global providers of services and products to the energy sector.

- Baker Hughes Co (BKR): Representing close to 8.96% of the ETF, BKR is an energy technology firm that offers solutions to energy and industrial clients around the globe.

- Tenaris S.A. (TS): TS amounts to roughly 5.99% in OIH. The company is a prominent provider of tubes and related services for the global energy industry, along with some other industrial applications.

- TechnipFMC plc (FTI): Making up approximately 5.58% of the ETF, FTI is a well-respected global entity in subsea, onshore/offshore, and surface projects within the energy sector.

Peer Comparison: How Does OIH Stack Up?

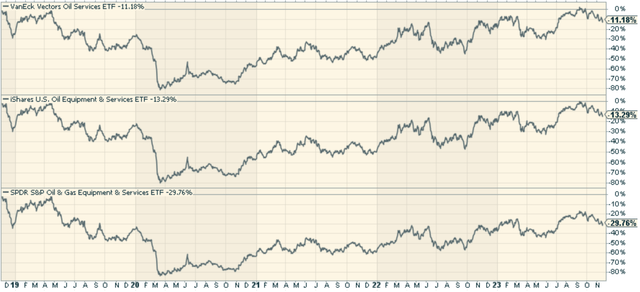

Two other prominent ETFs in the Energy – Equipment and Services sector are the iShares U.S. Oil Equipment & Services ETF (IEZ) and the SPDR S&P Oil & Gas Equipment & Services ETF (XES). IEZ follows the Dow Jones U.S. Select Oil Equipment & Services Index, managing $349 million in assets and carrying an expense ratio of 0.40%. On the other hand, XES mirrors the S&P Oil & Gas Equipment & Services Select Industry Index, oversees $410 million in assets, and has an expense ratio of 0.35%.

- ➤【 HIGH-PERFORMANCE CAR JUMP STARTER...

- ➤【 SMART CORDLESS INFLATOR WITH LCD SCREEN 】...

- ➤【 ESCORT YOUR SAFETY 】Thanks to the...

- ➤【 ALL-IN-ONE JUMP STARTER 】Say goodbye to...

- ➤【 WHAT YOU GET & WARRANTY 】YabeAuto YA70...

- 【UNIVERSAL FIT KIT】- The kit contains 23 types...

- 【TOP QUALITY】- These car retainer clips are...

- 【PREFECT FOR WHAT YOU NEED】 - Up to 680 pieces...

- 【BONUS ACCESSORIES】- We provide different size...

- 【WIDE APPLICATION】- Professional push clips...

- Powerful Car Jumper Starter - The Scatach 011 jump...

- Advanced Safety Features - Easy to opearte, and...

- Portable Design - This portable car battery...

- Respond to Emergencies - Portable power bank with...

- What will you Get ? - Scatach 011 Car Starter...

- 【What You Get】1*Tactical Molle Seat Back...

- 【Military Molle System - Lots Of...

- 【Durable and Long Lasting】 MOLLE seat back...

- 【Tactical Seat Covers Universal】 The size of...

- 【Guarantee】If you're not 100% satisfied with...

Comparatively, OIH boasts higher assets under management and a similar expense ratio. OIH has outperformed both funds on a relative basis, largely because of the large allocation to SLB which is up over 27% in the last three years.

Pros and Cons: Weighing the Investment Merits

Investing in the OIH ETF has its benefits and drawbacks. On the upside, the fund provides broad exposure to the energy equipment and services sector, which is poised to benefit from the increasing global demand for energy. The ETF's holdings are some of the largest and most established companies in this industry, offering potential for robust returns.

On the downside, the fund's heavy concentration in the top 5 stocks makes it susceptible to company-specific risks. Moreover, the fund's performance can be influenced by geopolitical tensions and global economic conditions that affect the energy market.

Conclusion: Is OIH the Right Investment for You?

Investing in OIH can bring diversification and potential for growth to your portfolio, particularly if you are bullish on the prospects of the energy equipment and services sector. In the short-term, the fund's performance may be influenced by volatility in oil prices and global economic uncertainties. But from a long-term perspective, as global energy demands continue to rise, the companies within this fund's portfolio could stand to benefit. If you are a patient investor with a knack for understanding the dynamics of the energy sector and can stomach the potential short-term volatility, the OIH ETF could be a worthwhile addition to your investment portfolio.