fotograv

FedEx (NYSE:FDX) Express revenue and adjusted operating income dropped by 6% and 49%, respectively, in Q2 FY24. This decline was caused by the U.S. Postal Service’s [USPS] business shift from air to ground, as well as the weakness in industrial production. I believe USPS's strategy shift from air to ground will continue to pose growth challenges for FedEx in the near future. As a result, I recommend a ‘Sell' rating with a fair value of $230 per share.

Weak Growth of FedEx Express

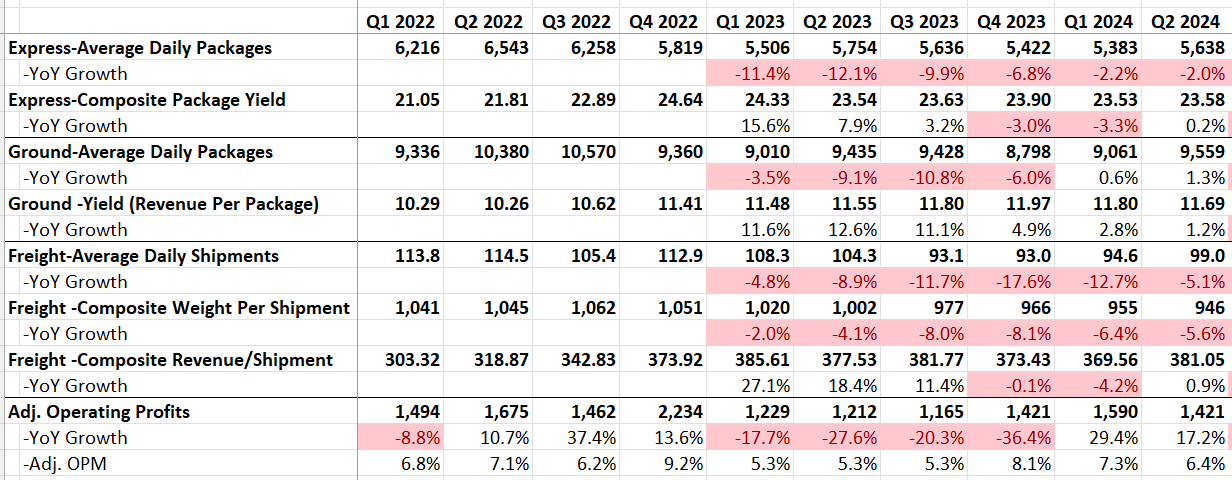

During Q2 FY24, FedEx Express revenue declined by 6%, and the profit dropped by 49%. Consequently, FedEx revised down their full-year revenue guidance from flat to a low-single-digit percentage decline year over year, leading to a drop in their stock price after the earnings report. More specifically, the Express average daily volume declined by 2% year over year. On the group level, their adjusted operating profit still increased by 17.2% year over year, attributed to their cost-cutting program.

FedEx Quarterly Results

During the earnings call, they attributed the weakness to several factors: weak industrial productivity, lower fuel demand surcharges, as well as USPS's lower volume. While some weakness could be attributed to cyclicality, I anticipate that the USPS's declining volume will persist in the near future.

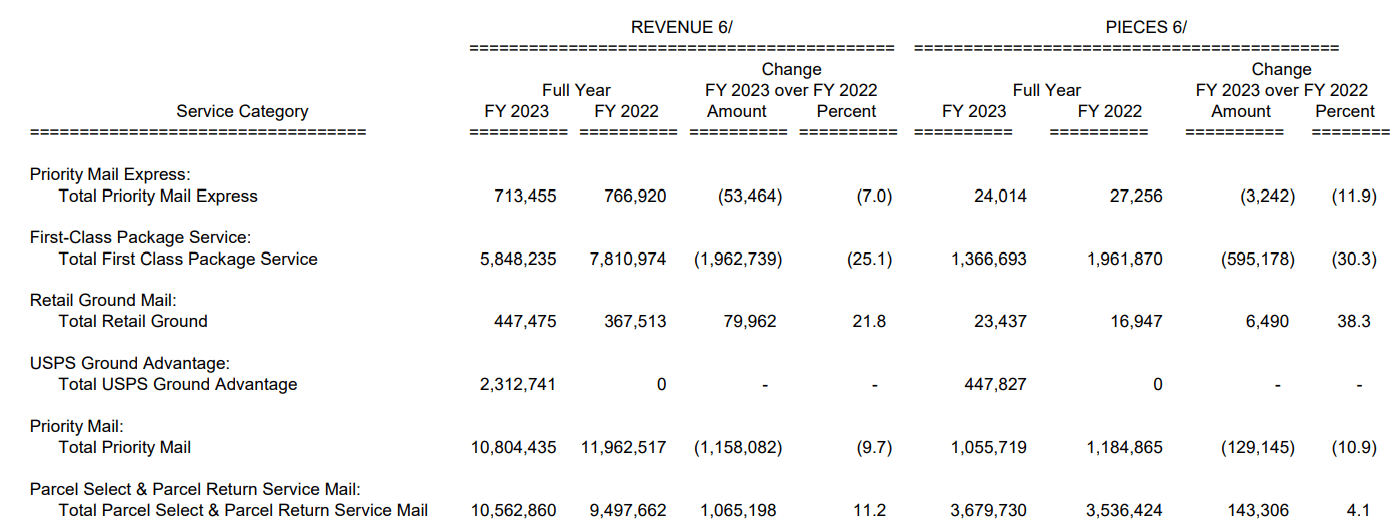

FedEx Express provides airport-to-airport transportation of USPS First Class Mail, Priority Mail Express, and Priority Mail. USPS has initiated a strategy shift from air to ground service in recent years to save costs. As illustrated in the table below, their First-Class Package Service revenue dropped by 25.1%, and volume declined by 30.3% in FY23.

USPS Financial Report

According to USPS's report to Congress, they plan to continue concentrating their services on ground shipping over air transportation in 2024. The contract between FedEx and USPS is set to expire on September 29, 2024, and it is worth noting that USPS is the largest customer of FedEx Express.

On the one hand, it makes strategic sense for USPS to shift from air to ground services to save costs, as they currently rely on third parties for their airport-to-airport services, which can be quite costly for USPS.

On the other hand, with an increased focus on ground services, USPS can actively manage their truckload efficiency and work towards their own ESG targets for carbon neutrality.

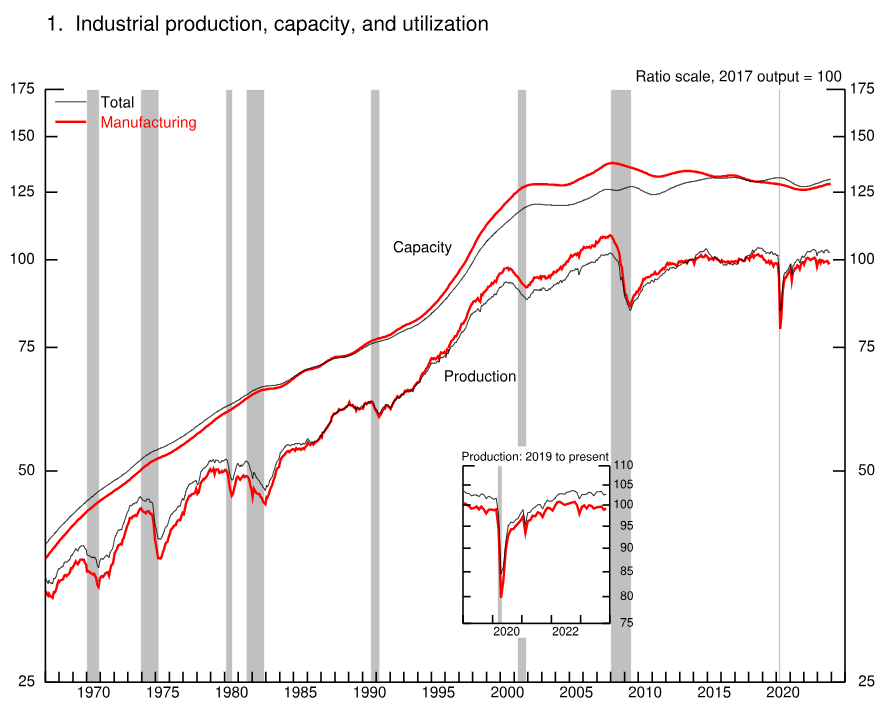

Regarding industrial production, it is inherently cyclical, and its growth is limited in the current high-interest economic environment. However, I don't believe industrial production would pose significant headwinds for FedEx's business. As shown in the chart below, industrial production has been relatively flat recently, with no signs of a significant dip in the near future. Therefore, I consider the weakness attributed to industrial production more of an excuse rather than a primary reason for FedEx's challenges.

Federal Reserve

Cost Cutting Program

FedEx has implemented a DRIVE program for cost-cutting, successfully reducing costs by $200 million in the quarter across their network and Express operations. The cost-cutting measures include transitioning to a single daily courier dispatch, implementing dock productivity initiatives, consolidating underutilized sorts, and maximizing the use of rail, as disclosed during the earnings call.

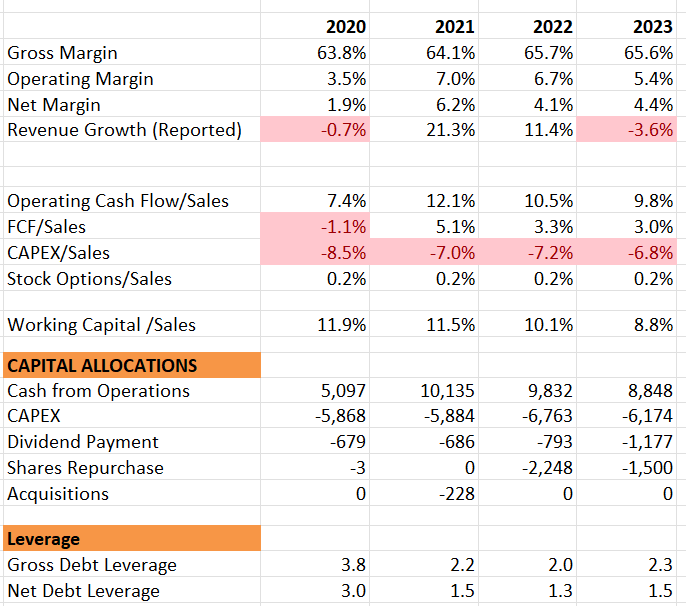

I believe the cost-cutting initiatives are crucial for this mature business. Firstly, they should be able to enhance their operating efficiencies to drive margins higher. While their core operating margin was 7.5% in FY19, it dropped to only 6% in FY23.

FedEx 10Ks

Secondly, FedEx named Raj Subramaniam as CEO, replacing founder Fred Smith in 2022. It is quite reasonable for a new CEO to clean the slate and prioritize operating efficiency and margin expansion.

Lastly, FedEx is redesigning their Air Network, and this initiative could help the company reduce its capital intensity. They spent 6.8% of group revenue on capital expenditure in FY23, and they aim to reduce that ratio to below 6.5% by FY25.

Financial Analysis and Outlook

- ➤【 HIGH-PERFORMANCE CAR JUMP STARTER...

- ➤【 SMART CORDLESS INFLATOR WITH LCD SCREEN 】...

- ➤【 ESCORT YOUR SAFETY 】Thanks to the...

- ➤【 ALL-IN-ONE JUMP STARTER 】Say goodbye to...

- ➤【 WHAT YOU GET & WARRANTY 】YabeAuto YA70...

- 【UNIVERSAL FIT KIT】- The kit contains 23 types...

- 【TOP QUALITY】- These car retainer clips are...

- 【PREFECT FOR WHAT YOU NEED】 - Up to 680 pieces...

- 【BONUS ACCESSORIES】- We provide different size...

- 【WIDE APPLICATION】- Professional push clips...

- Powerful Car Jumper Starter - The Scatach 011 jump...

- Advanced Safety Features - Easy to opearte, and...

- Portable Design - This portable car battery...

- Respond to Emergencies - Portable power bank with...

- What will you Get ? - Scatach 011 Car Starter...

- 【What You Get】1*Tactical Molle Seat Back...

- 【Military Molle System - Lots Of...

- 【Durable and Long Lasting】 MOLLE seat back...

- 【Tactical Seat Covers Universal】 The size of...

- 【Guarantee】If you're not 100% satisfied with...

Before the pandemic, FedEx could grow its revenue by mid-to-high single digits. Their revenue received a boost during the Covid period but experienced a 3.6% decline in FY23, primarily due to high comparable.

Their operating margin is also volatile, with operating leverage being the biggest driver for the fluctuation in margins. I believe their DRIVE program could potentially stabilize their operating margin going forward, as they can focus on a higher portion of discretionary cost management.

FedEx 10Ks

In terms of capital allocation, FedEx deploys cash towards dividends and share repurchases. Their debt leverage is manageable, and the net debt leverage was only 1.5x at the end of FY23.

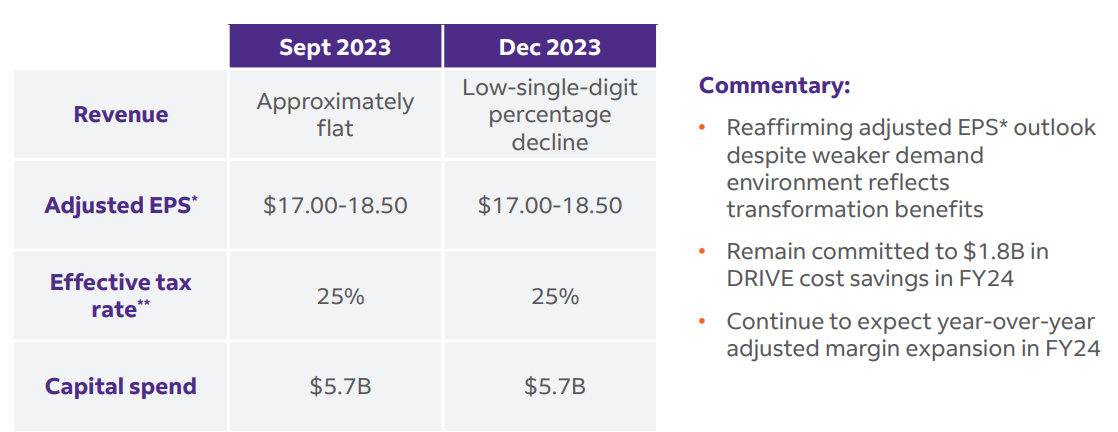

For the full-year guidance, they lowered the revenue to a low-single-digit decline but maintained EPS and capex guidance.

FedEx Q2 FY24 Presentation

I believe the weak guidance implies a challenging macro environment, coupled with the continuing volume decline from USPS in FY24. The effectiveness of their DRIVE program is evident, as even with a lowered revenue growth rate, they were still able to generate a similar adjusted EPS, which is notable.

Valuation

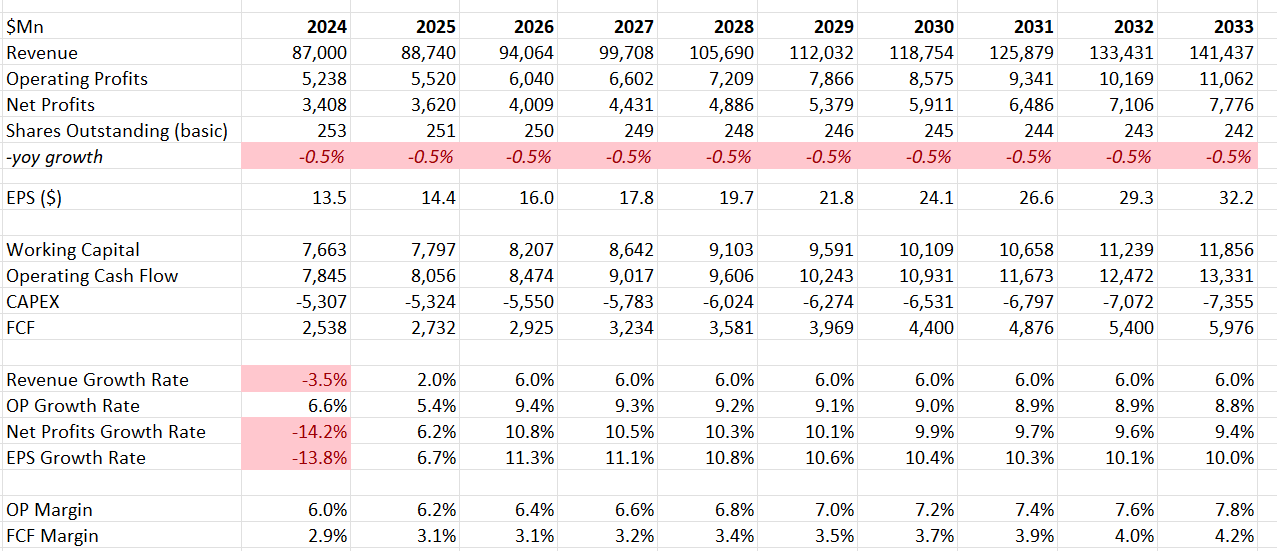

I assume 3.5% revenue decline in FY24, in line with their guidance. As discussed previously, I anticipate USPS will continue to create growth headwinds for FedEx, thus assuming only 2% topline growth in FY25. For the normalized revenue growth, the model is using 6%, aligned with their historical average.

FedEx DCF

I believe their DRIVE program and the new CEO could continue to drive their margin expansion. Additionally, FedEx can benefit from some operating leverage. Based on my calculations, I estimate a 20bps operating margin expansion annually in the model. The model uses a 10% discount rate, 4% terminal growth, and a 25% tax rate. The fair value is calculated to be $230 per share in the model.

Key Risks

Amazon’s own shipping service: Amazon (AMZN) has relaunched its own shipping service. This initiative has been long-awaited, as they had previously attempted it in select cities before pausing it in 2020. However, the relaunch aims to address their last-mile delivery mission. It is too early to determine the impact on FedEx, as it depends on how quickly Amazon expands their delivery network and the adoption rate among merchants.

Consumer Spending Shift from Goods to Services: During the pandemic, consumers overspent on physical goods. In the post-pandemic times, consumers are shifting back with fewer goods purchases. The consumption patterns could cause growth volatility for FedEx's package volumes. However, I believe it is short-term in nature.

Conclusion

Global industrial production might start to recover when the Fed begins to cut rates; however, I believe USPS's strategy shift will continue to pose growth headwinds for FedEx, and the contract renewal is uncertain at this moment. I am initiating with a ‘Sell' rating and a fair value of $230 per share.