Reviewing 2023 results for the major asset classes reflects a long list of winners, with one conspicuous downside outlier: commodities. Amid widespread gains in global markets last year, the red ink in raw materials stands out. Does that create the setup for a rebound in 2024?

I considered the possibility a month ago, but nothing much has changed by last week’s close. At the risk of beating a dead horse, let’s update where we stand regarding everyone’s favorite unloved asset class.

The year ahead is, of course, a blank slate and no one has a clue how events will unfold. That’s always true and it should keep us humble when attempting to forecast short-term trends. Nonetheless, when an asset class moves decisively against the broad trend elsewhere, it’s worthwhile to consider the possibilities from an asset allocation perspective.

For portfolios with little or no exposure to commodities in particular, there’s a case for raising/adding commodities as a hedge against unforeseen trouble. The year ahead could be another losing run for raw materials writ large, of course. But after 2023’s slump, a fair amount of the risk of further loss has, in theory, faded, on the assumption that mean reversion tends to prevail in commodities pricing through time. The worst-case scenario, I’m guessing, is that commodities more or less flat line this year. The risk-reward calculus, in short, looks relatively attractive if you’re inclined to think that one or more surprises in 2024 could ignite prices for commodities.

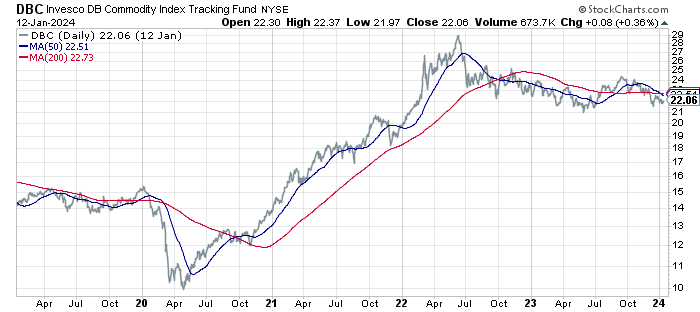

For some perspective on recent trends, let’s take a quick run through a handful of commodities ETFs, starting with a broad brush portfolio via Invesco DB Commodity Index Tracking Fund (DBC). The fund lost 6.2% in 2023 and is essentially flat so far this year.

The Economist notes that “abundant supply [in key commodities] suggests a sedate first half of the year.” What could lift prices? An upside demand surprise in the year ahead is a possible trigger. Another is inflation that remains sticky or posts an unexpected rebound. Stronger-than-forecast global growth is another. “Liberum, a bank, calculated that a one-percentage-point rise in its forecast for annual global GDP growth would boost commodities demand by 1.5%.”

Weather and geopolitical risk are also on the short list as factors that could drive commodities prices higher, although marginal demand and monetary (liquidity) aspects tend to play bigger role, advises Tressis chief economist Daniel Lacalle.

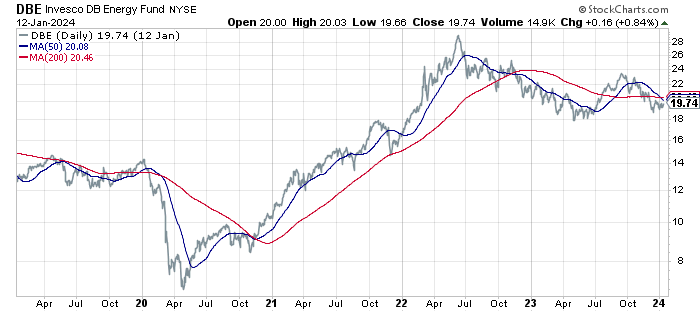

Speaking of geopolitical risk, there’s no shortage bubbling around the world these days, but energy prices overall (DBE) continue to reflect weakness.

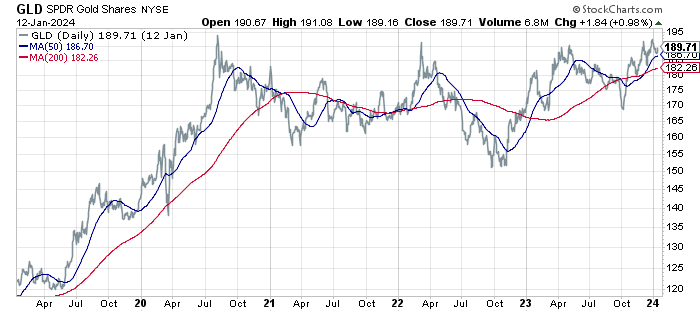

Gold (GLD) can be a beneficiary of geopolitical risk and so that may explain why this precious metal has rallied over the past year.

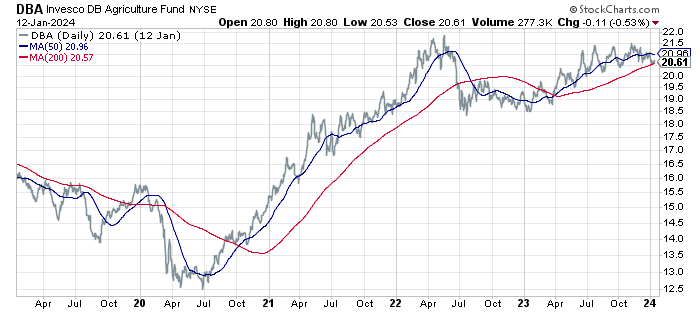

The recent price trend for agricultural commodities (DBA) is also bullish, although the fund’s 2023 strength has faded in the new year.

- ➤【 HIGH-PERFORMANCE CAR JUMP STARTER...

- ➤【 SMART CORDLESS INFLATOR WITH LCD SCREEN 】...

- ➤【 ESCORT YOUR SAFETY 】Thanks to the...

- ➤【 ALL-IN-ONE JUMP STARTER 】Say goodbye to...

- ➤【 WHAT YOU GET & WARRANTY 】YabeAuto YA70...

- 【UNIVERSAL FIT KIT】- The kit contains 23 types...

- 【TOP QUALITY】- These car retainer clips are...

- 【PREFECT FOR WHAT YOU NEED】 - Up to 680 pieces...

- 【BONUS ACCESSORIES】- We provide different size...

- 【WIDE APPLICATION】- Professional push clips...

- Powerful Car Jumper Starter - The Scatach 011 jump...

- Advanced Safety Features - Easy to opearte, and...

- Portable Design - This portable car battery...

- Respond to Emergencies - Portable power bank with...

- What will you Get ? - Scatach 011 Car Starter...

- 【What You Get】1*Tactical Molle Seat Back...

- 【Military Molle System - Lots Of...

- 【Durable and Long Lasting】 MOLLE seat back...

- 【Tactical Seat Covers Universal】 The size of...

- 【Guarantee】If you're not 100% satisfied with...

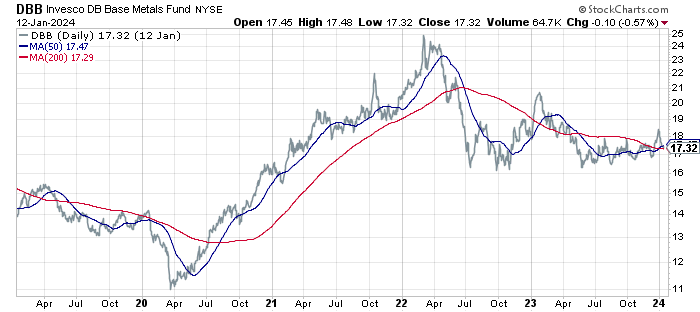

Meanwhile, base metals (DBB) continues to flatline, extending a tight trading range that prevailed during the second half of 2023.

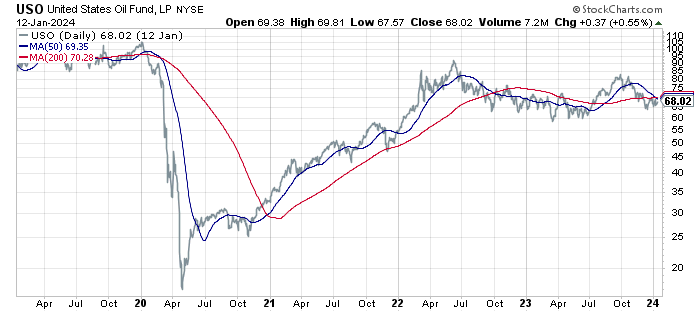

The potential for price spikes from attacks on commercial shipping in the Red Sea remain topical, notes ING. “For commodity markets, the increased tension poses supply risks, with energy markets most vulnerable. However, for oil and LNG [liquified natural gas], we are not seeing any fundamental impact on supply yet.”

Indeed, crude oil (USO) continues to trade in a range after last summer’s rally reversed.

The US Energy Information Administration expects more of the same for the year ahead. “We forecast average annual crude oil prices in 2024 and 2025 will remain near their 2023 average because we expect that global supply and demand for petroleum liquids will be relatively balanced over the next two years.”

The outlook for commodities in general, in short, looks more or less neutral. But the fact that the crowd appears all-in on this forecast makes the asset class all the more intriguing as a contrarian play for 2024.

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.