CreativeNature_nl

Global demand for liquefied natural gas (LNG) – natural gas that is supercooled into liquid form in order to be transported by ship – is expected to grow considerably. As the world's largest producer of natural gas, the U.S. will play a significant role in meeting that demand. This note provides an update on U.S. LNG projects and how midstream companies are positioned to benefit from growing U.S. LNG exports.

US LNG Export Capacity Will Ramp in Late 2024 and Into 2025

In 2023, the U.S. became the world's largest LNG exporter, surpassing Australia and Qatar for the first time. With ample natural gas reserves and an easy path to production growth, U.S. LNG export capacity is poised to increase substantially over the next few years.

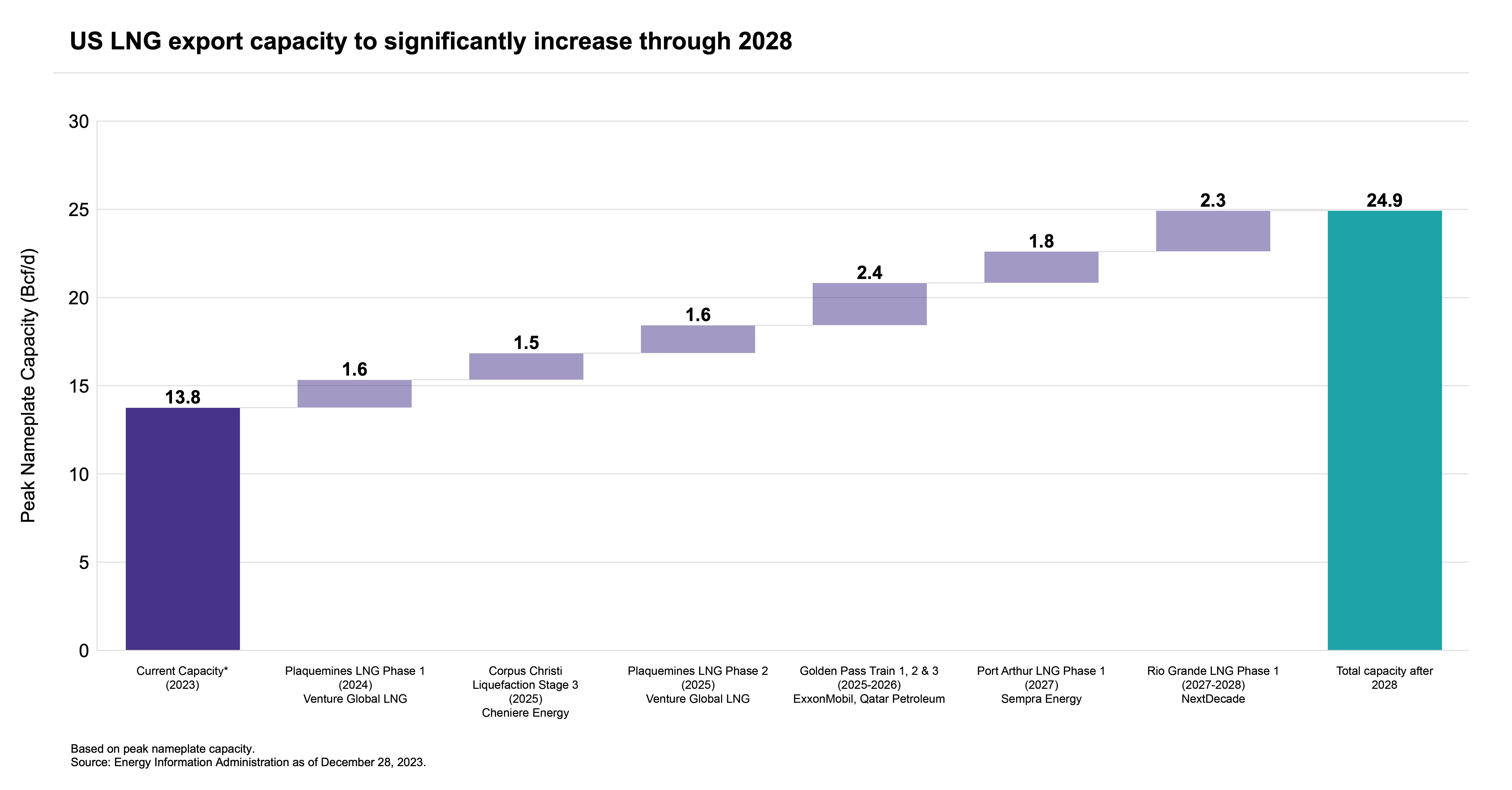

As shown in the chart below, the U.S. currently has ~13.8 billion cubic feet per day (Bcf/d) of operational liquefaction capacity. Another 11.2 Bcf/d is under construction. The projects under construction represent an 81% increase in U.S. LNG capacity by 2028. They are underpinned by long-term offtake agreements that typically extend for up to 20 years. This is a significant step change in capacity. Yet more LNG projects are likely to start construction this year.

More Projects Awaiting Green Light Continue to Strike Deals

Global LNG demand is expected to grow by upward of 60% through 2040 (read more). Customers are actively signing long-term offtake contracts or sales and purchase agreements (SPAs) with U.S. LNG projects under development. These agreements are critical for projects to reach a final investment decision (FID). That is the point at which a company commits to move forward with a project and starts construction. Reaching FID depends on securing financing and signing sufficient offtake agreements.

Several LNG projects are inking deals today that extend into the 2040s in pursuit of FID. The largest of these projects is Energy Transfer's (ET) 2.2 Bcf/d Lake Charles LNG project in Louisiana. Lake Charles has signed SPAs and heads of agreement for about half of its capacity. As discussed on the 3Q23 earnings call, ET is currently looking for equity partners with plans to retain an approximate 20% interest in the project. Last week, Japanese utility Kyushu Electric Power (OTCPK:KYSEY) (OTCPK:KYSEF) was reported to be in talks with ET to buy a 10% stake in Lake Charles alongside a 20-year offtake agreement. Beyond securing partners and SPAs, Lake Charles LNG has faced some regulatory hurdles. And it is waiting on an update from the Department of Energy (DOE) regarding its export license.

Other projects include Delfin LNG, a proposed 1.6 Bcf/d facility off the coast of Louisiana consisting of up to four floating LNG (FLNG) vessels. As of November, Delfin LNG was in the final phase toward reaching FID on three of its four FLNG vessels. NextDecade's (NEXT) Rio Grande LNG project is targeting a positive FID for additional capacity in 2H24. An expansion at Sempra's (SRE) Cameron LNG of 0.9 Bcf/d is also expected to move forward. Glenfarne's Texas LNG in Brownsville is also expected to start construction this year.

These projects have received approval from the DOE and Federal Energy Regulatory Commission. In the case of Delfin, approval has been made by the Maritime Administration. According to recent media reports, the Biden Administration is considering incorporating climate impacts into new LNG project approvals when determining if a project is in the national interest. However, details remain vague.

- ➤【 HIGH-PERFORMANCE CAR JUMP STARTER...

- ➤【 SMART CORDLESS INFLATOR WITH LCD SCREEN 】...

- ➤【 ESCORT YOUR SAFETY 】Thanks to the...

- ➤【 ALL-IN-ONE JUMP STARTER 】Say goodbye to...

- ➤【 WHAT YOU GET & WARRANTY 】YabeAuto YA70...

- 【UNIVERSAL FIT KIT】- The kit contains 23 types...

- 【TOP QUALITY】- These car retainer clips are...

- 【PREFECT FOR WHAT YOU NEED】 - Up to 680 pieces...

- 【BONUS ACCESSORIES】- We provide different size...

- 【WIDE APPLICATION】- Professional push clips...

- Powerful Car Jumper Starter - The Scatach 011 jump...

- Advanced Safety Features - Easy to opearte, and...

- Portable Design - This portable car battery...

- Respond to Emergencies - Portable power bank with...

- What will you Get ? - Scatach 011 Car Starter...

- 【What You Get】1*Tactical Molle Seat Back...

- 【Military Molle System - Lots Of...

- 【Durable and Long Lasting】 MOLLE seat back...

- 【Tactical Seat Covers Universal】 The size of...

- 【Guarantee】If you're not 100% satisfied with...

In the earlier stage, Cheniere (LNG) and Cheniere Energy Partners (CQP) announced both SPAs and integrated production marketing (IPM) agreements in support of a proposed expansion of Sabine Pass. Under an IPM, a natural gas producer, in this case, ARC Resources (ARX CN) (ARX:CA (OTCPK:AETUF)), sells gas to Cheniere based on a global LNG price less a fixed liquefaction fee, shipping costs, and regasification fee.

These projects could add meaningful capacity above and beyond the growth shown in the chart above. Among the public companies developing incremental LNG export capacity, LNG, NEXT, and SRE are included in the Alerian Liquefied Natural Gas Index (ALNGX).

Midstream Investing to Support LNG Export Growth

The Gulf Coast is home to all of the LNG export projects listed above. The natural gas supplies for these facilities will largely come from Texas and Louisiana, including the Permian (read more) and Haynesville (read more), respectively. The need to transport natural gas to LNG export facilities has created growth opportunities for midstream companies. These companies tend to see lengthy pipeline contracts (~20 years) with liquefaction customers. Growing demand from LNG facilities has underpinned new-build projects or expansions of existing pipelines, while also motivating asset-level acquisitions.

In 4Q23, Kinder Morgan (KMI) announced it was acquiring STX Midstream, a pipeline system that includes gas pipelines from West Texas to the Gulf Coast, for $1.8 billion. The acquisition is expected to help KMI capitalize on LNG-related opportunities alongside servicing other customers. Similarly, Williams (WMB) acquired natural gas storage and pipeline assets in Louisiana and Mississippi for ~$2 billion as they look to satisfy growing LNG and power generation demand. Several of the constituents in the Alerian Midstream Energy Select Index (AMEI) are positioned to benefit from growing LNG exports, including ET, KMI, LNG, NEXT, and WMB.

Bottom Line

With a constructive long-term outlook for global demand, U.S. LNG projects have continued to advance supported by significant customer commitments into the 2040s. Midstream companies are investing in natural gas infrastructure to benefit from the ongoing growth in US LNG exports.

Disclosure: © VettaFi LLC 2023. All rights reserved. This material has been prepared and/or issued by VettaFi LLC (“VettaFi”) and/or one of its consultants or affiliates. It is provided as general information only and should not be taken as investment advice. Employees of VettaFi are prohibited from owning individual MLPs. For more information on VettaFi, visit www.vettafi.com

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.