Unlike 2022 and 2023, when rate hikes dominated the landscape, this year is expected to bring a change in scenery from the Federal Reserve, where rate cuts are soon to be the primary theme.

However, given the outcome of the January FOMC meeting and attendant Powell presser, the timing and magnitude for an easing in policy is still uncertain.

In addition, economic data, such as the most recent jobs report, has also challenged the money and bond markets’ most optimistic expectations, creating an environment for continued elevated volatility.

While the potential for ongoing bond market volatility certainly presents challenges, we are also finding many interesting opportunities for fixed income investors.

For advisors seeking the flexibility to capitalize on bond market opportunities and adjust exposures as conditions change, Model Portfolios can provide cost-effective access to the expertise of our asset allocation and fixed income teams.

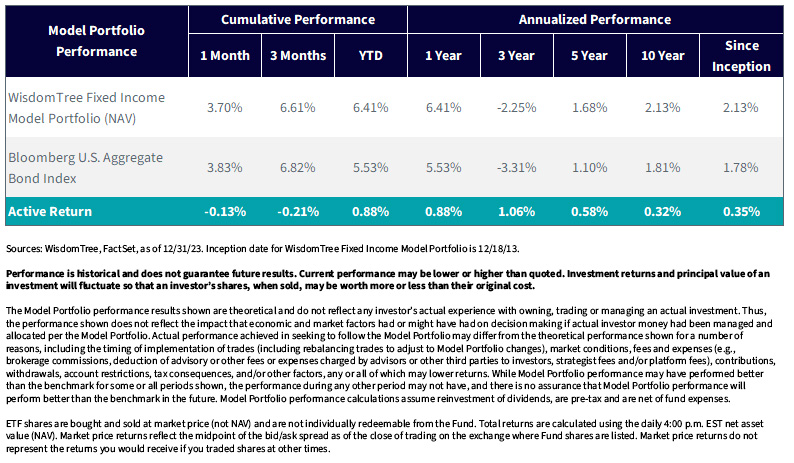

Our WisdomTree Fixed Income Model Portfolio recently passed its 10-year anniversary since inception. To mark the occasion, we wanted to provide an update on our current outlook and positioning, and look back on performance since inception.

Positioning within our Fixed Income Model Portfolios

Below we summarize the current positioning and some of the recent changes within our WisdomTree Fixed Income Model Portfolio, which is dynamically managed based on the top-down and sector-specific views of our Model Portfolio Investment Committee.

WisdomTree Model Portfolio Investment Committee—Fixed Income Positioning

Given the inverted nature of the yield curve, we remain allocated to short-duration bonds, including Treasury floating rate notes.

No products found.

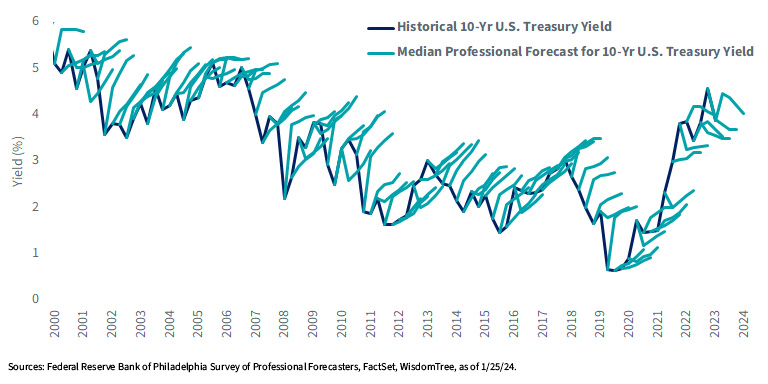

However, using a barbell approach, we continued to add duration in a deliberate manner in 2023. After spending much of the past few years shorter in duration than our benchmarks, we are now closer to a “neutral” stance, which we feel is prudent given the level of ongoing interest rate volatility and the inherent difficulty in predicting shorter-term movements in interest rates (see below).

10-Year U.S. Treasury Yield: Historical vs. Median Professional Forecast

Another opportunity we see in fixed income markets is securitized assets, specifically agency mortgage-backed securities (MBS). While investment-grade and high-yield corporate credit spreads tightened well inside of their historical averages last year, we believe yields on agency MBS relative to Treasuries offer attractive value. Therefore, we rotated from high-yield corporates into MBS, while maintaining a modest over-weight allocation to quality high-yield credit.

A 10-Year Track Record of Performance

Since its launch in December 2013, the WisdomTree Fixed Income Model Portfolio has delivered on its objective, outperforming the Bloomberg U.S. Aggregate Bond Index since inception and over the past 1-year, 3-year, 5-year and 10-year periods.

Financial advisors can learn more about the WisdomTree lineup of fixed income and multi-asset Model Portfolios by visiting our Model Adoption Center.

No products found.

WisdomTree Fixed Income Model Portfolio Performance