Thesis

BAE Systems plc (OTCPK:BAESY) orders have greatly improved over the last few years and is a significant beneficiary of the recent wars and increased geopolitical risks. BAESY's top customers increased spending considerably, the company is well positioned to capitalise on existing and future technologies through its products, customers and a good balance sheet and is relatively fairly valued.

Introduction

BAESY is a defence company based in the United Kingdom, providing aerospace, defence and security solutions worldwide. Over the last few years, we have seen new conflicts and wars as well as increased geopolitical risks. In the last two years, two major conflicts have started, and the global defence spend increased to $2.2 trillion in 2023 and is expected to continue to grow. BAESY is very well positioned to capitalise on this, and we believe geopolitical risks will remain high for the foreseeable future.

Sustained Growth

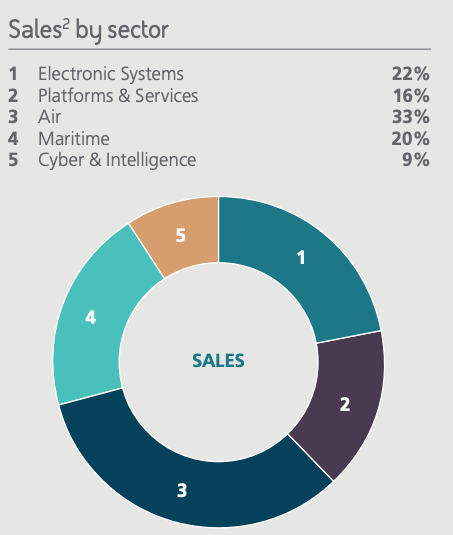

In our opinion, BAESY will see sustained growth over the coming years. Sales by sector according to the 2022 full-year results are as per below:

BAE Systems Annual Report 2022

These are broad categories, but nonetheless recent conflicts have highlighted their importance. Electronic systems include the design and implementation of electronic warfare, systems that enable precision strike missions, surveillance capabilities and space electronics. The Air sector is the largest sales sector and includes aircraft technology and ammunition, advanced training and simulation services and radars. This includes their Typhon production, support and upgrades for Typhoon and Hawk and support to the Kingdom of Saudi Arabia. Lastly, Maritime, which accounts for 20% of sales, includes design and manufacturing of submarines and warships, ammunition and radars as well as a significant portion of business in Australia.

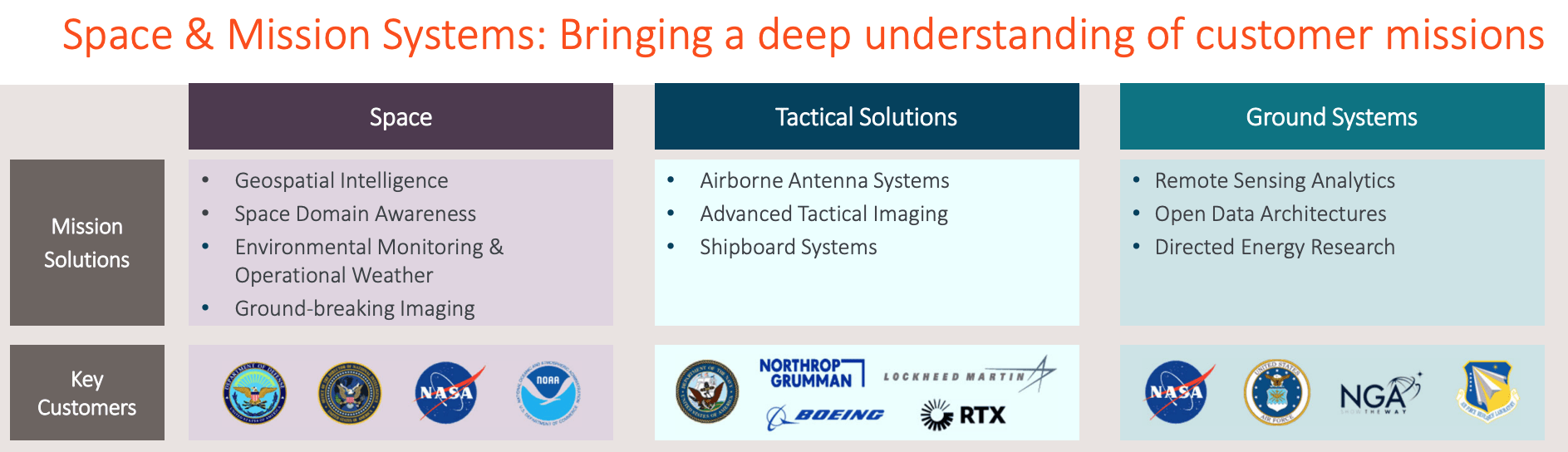

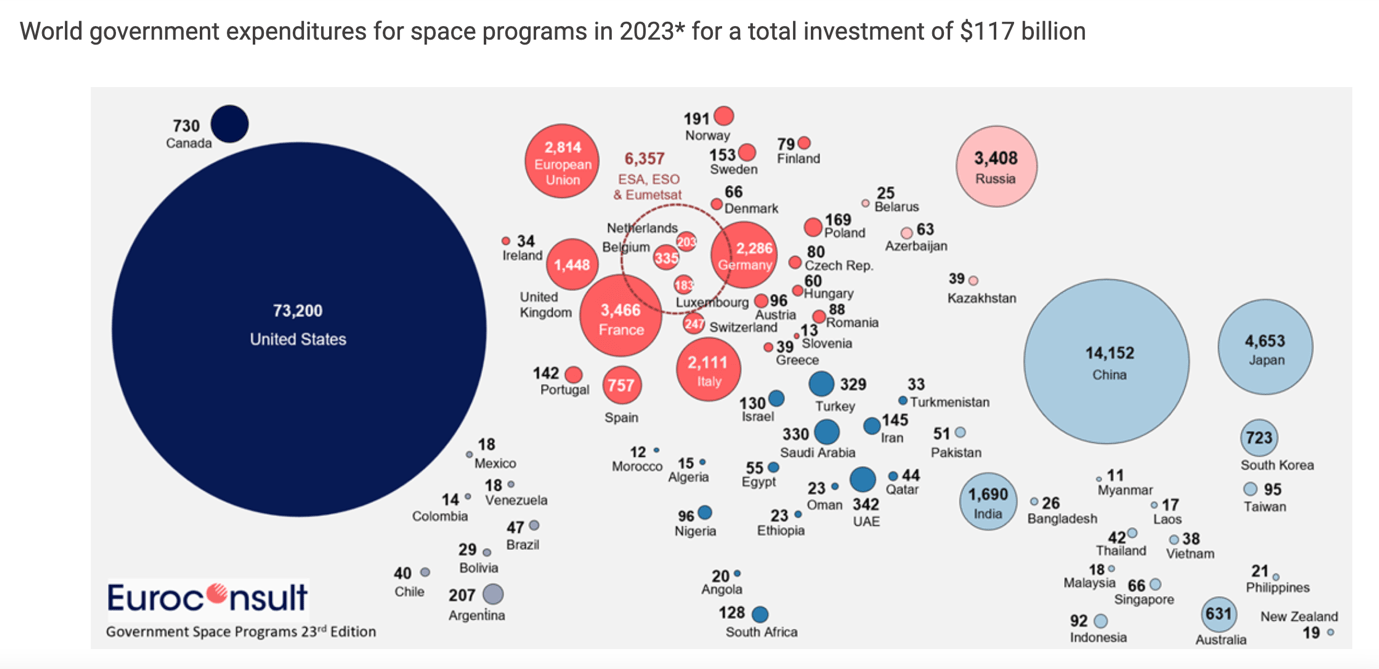

In February 2024, BAESY acquired Ball Aerospace for $5.5 billion through cash and debt, forming a new division, the Space and Mission Systems. This move will further establish BAESY with key clients as they acquire capabilities to manufacture spacecrafts, various components for national defence, civil space and commercial space applications. This will be a growth path for BAESY as space expenditure has increased materially and is expected to continue to grow with the United States being the leader in space programs investment and this area is a high-priority area for the US Department of Defence. As we can see below, the new Space and Mission Systems division offers key solutions to both governments and corporations, further establishing BAESY's position in this area.

BAE Systems

We believe the fact that Ball Aerospace has its HQs in the United States and a good history of deliverables in the region will help BAESY grow in this space. In addition, space militarisation and the establishment of space military units by key players such as the United States, China and Russia makes this another defence frontier that BAESY will be able to capitalise on following this acquisition.

Euroconsult

This in combination with the fact that BAESY is well entrenched globally will continue to drive growth for the company. The top four global defence customer destinations are the United States at 44%, United Kingdom at 20%, the Kingdom of Saudi Arabia at 11% and Australia at 4%.BAESY's sectors and customers will continue to provide a growth path for the company. This is evident from the order backlog and defence budget trajectories for the sectors and customers we mentioned above.

Firstly, defence budgets globally have increase substantially over the last few years. In 2018, the global military expenditure in USD was at $1.80 trillion increasing by 3.3%; 4.3%, 6.7% and 6.7% for the subsequent four years, reaching a total of $2.21 trillion. Spending is expected to increase in 2024 due to the increased geopolitical risks. These risks include the ongoing war in Ukraine, the conflict between Israel and Hamas in the Middle East, and increased tensions between the West and China. However, there are many more conflicts that are ongoing in the world.

Looking at BAESY's top customers (United States, United Kingdom, The Kingdom of Saudi Arabia and Australia) there is a similar trend. The United States military budget increased by 14% since 2020 with the most recent $95 billion aid bill for Ukraine, Israel and Taiwan passed by the senate last week. The United Kingdom's military spending increased by 22% between 2020 and 2022, the Kingdom of Saudi Arabia by 16% and Australia by 17% respectively. The cumulative increase in military spending for BAESY's top four customers was around $124 billion, and the biggest increase came from the United States, accounting for 79% of this increase. This trend will continue as conflicts are on the rise and this is already reflected in BAESY's performance and improved forward guidance management provided.

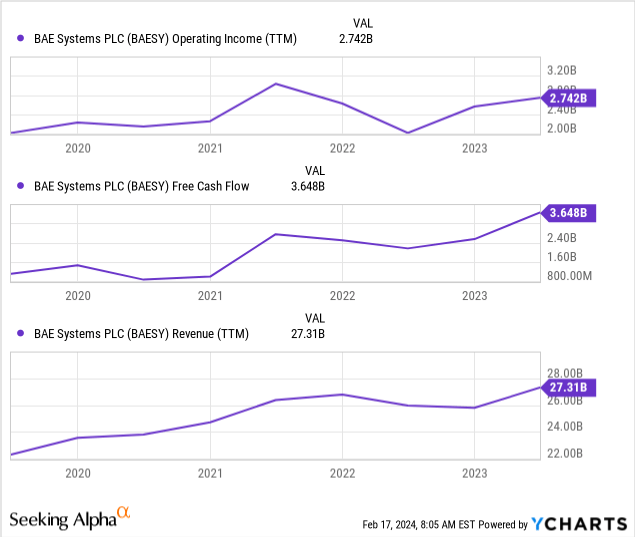

Revenues, operating income and free cash flow are all higher when compared to just a few years ago.

Data by YCharts

This has specifically accelerated since the Ukraine war started and is evident in BAESY's order backlog. The order backlog went from £45.2bn in 2020, to £44.0bn in 2021 and then jumped by 34% to £58.9bn in 2022. This is also reflected by the order intake, which jumped by 73% between 2021 and 2022. The order intake and backlog reflects the increased defence budgets and is a good indicator that BAESY will be able to continue to grow, as often these orders lead to multiple extensions and/or expansions. This leads back to the sectors we discussed for BAESY as current orders only reflect current orders. The expected lifetime value of these programmes is much greater as it includes F-35, submarines, frigates, Typhoon support, US combat vehicle production and electronic warfare technology. An example of recent contract expansion was with the United States military for retrofitting infantry military vehicles.

Every single one of these programmes has the potential to further expand, which provides good visibility of value creation for the years to come and, as a result, sustained growth. This is further supported by BAESY's 2023 half-year results. Order backlog has increased to £66bn and order intake was £21bn, which was 17% higher than the first half of 2022.

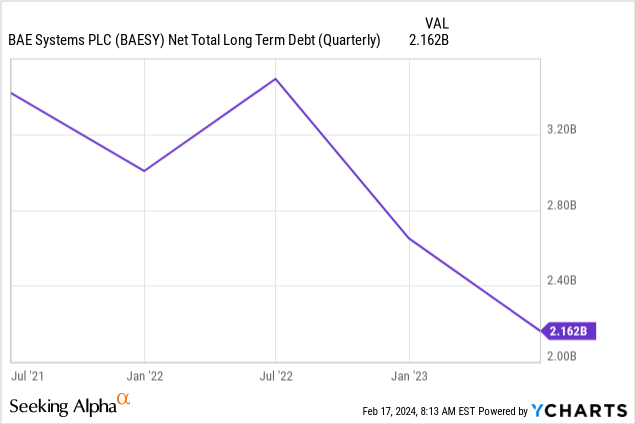

Finally, in our opinion, another element of sustained growth for BAESY is the evolution of the company's balance sheet. Looking at the company's balance sheet, it has significantly improved over the last few years, as we can see from the net total long-term debt chart below.

Data by YCharts

The current net debt figure is 1.3x the unlevered free cash flow, which is materially lower than the levels in 2020 which was at 2.7x the unlevered free cash flow. In GBP, net debt went from £2.7bn in 2020 to £1.8bn as of June 2023 and to £1bn as at December 2023. Deleveraging the company ensures that the company is able to capitalise on added value acquisitions, such as the Ball Aerospace we mentioned above, that will lead to unlocking shareholder value.

2023 Preliminary Results

- New Store Stock

- Rivan, Maria (Author)

- English (Publication Language)

- 208 Pages - 04/14/2020 (Publication Date) -...

- Elevate Your Vision : An Enhanced Vision Board...

- Experience a new level of quality with our...

- Our vision board kit for women offers hand-picked,...

- Whether it’s a gift vision board for teens,...

- At Lamare, our mission is to help women plan and...

- National Geographic Special - 2017-1-20 SIP...

- English (Publication Language)

- 128 Pages - 01/20/2017 (Publication Date) -...

Lastly, on 21st of February, BAESY shared their preliminary 2023 end of year results. The results further reinforce the notion of strong, sustained growth for the company. Sales and EBIT grew by 9% year-on-year and underlying EPS increased by 14% benefiting from the ongoing share buybacks. The order intake for 2023 was at £37.7bn and the order backlog is at a record high of £69.8bn. The balance sheet position also strengthened as net debt stood at £1bn, a reduction of £0.8bn from June 2023 further adding to BAESY's ability to leverage their balance for any acquisitions to add shareholders value. Fundamentally, the company is performing really well, and management further signalled their confidence by increasing the full-year dividend by 11%. The 2024 full-year guidance was low double-digit growth in sales and EBIT and mid to high single digit growth in EPS.

Overall, 2023 was a strong year for BAESY with good growth, stronger balance sheet and free cash flow generation. In addition, we believe the Ball Aerospace acquisition was a smart move from management as this will be a growth opportunity for the business as space is already playing an increasingly important role for governments and commercially. In our opinion, the strong fundamentals, strong balance sheet position and record order backlog are all signs that the company will continue to grow and unlock shareholder value.

Relative Valuation

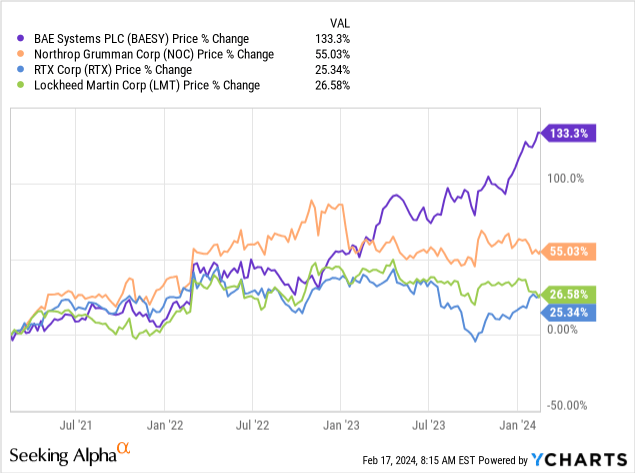

Given the recent conflict in Ukraine, defence companies have rallied and are expected to continue to do well as governments around the globe continue to spend more on defence. BAESY's price has outperformed its competitors by a wide margin as per below.

Data by YCharts

Even after BAESY's outperformance, the company does not look significantly overvalued relative to its peers.

| OTCPK:BAESY | NOC | RTX | LMT | |

| P/E Forward | 21.3 | 18.4 | 21.6 | 16.3 |

| P/S Forward | 1.5 | 1.7 | 1.5 | 1.6 |

| ROA (%) | 6.3 | 4.4 | 2.0 | 13.2 |

| ROE (%) | 17.7 | 13.4 | 4.8 | 86.0 |

Source: Seeking Alpha

Comparing the price multiples and the return on assets (ROA) and returns on equity (ROE) the company seems to be undervalued relative to RTX and overvalued compared to NOC and LMT.

Relative to RTX, BAESY trades at similar price multiples, however, it offers higher ROA and ROE indicating that BAESY's superior profitability. NOC trades at lower price multiples but offers lower ROA and ROE and LMT trades at a discount as it offers higher ROA and ROE but trades at a lower price to earnings multiple.

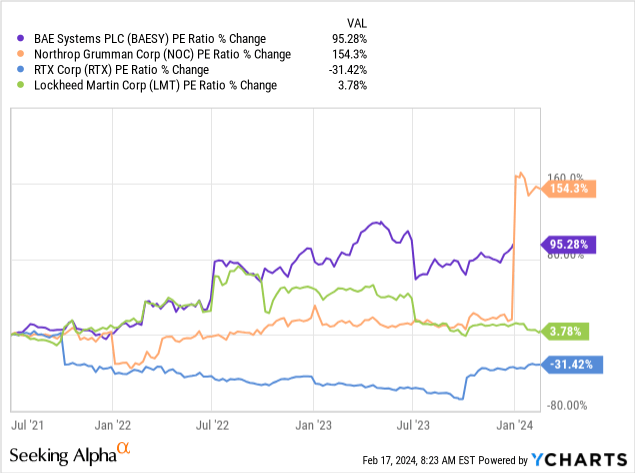

Looking at price multiples relative to its peers, we can see that over the last three years BAESY and NOC had multiple expansions, LMT was relatively flat and RTX multiple contracted.

Data by YCharts

Risk

In our opinion, the greatest risk that BAESY faces is one of dependence on customers and specifically the United States. The United States accounts for c.44% of BAESY's sales and has a defence budget that is more than the next 10 countries combined. We do not expect this dependence to change any time soon, as the United States accounts for roughly 40% of global military spending. Nonetheless, it is a risk as relationships can quickly change.

- Amazon Kindle Edition

- Baldacci, David (Author)

- English (Publication Language)

- 487 Pages - 04/16/2024 (Publication Date) - Grand...

- Amazon Kindle Edition

- Hannah, Kristin (Author)

- English (Publication Language)

- 472 Pages - 02/06/2024 (Publication Date) - St....

- Amazon Kindle Edition

- Elston, Ashley (Author)

- English (Publication Language)

- 348 Pages - 01/02/2024 (Publication Date) - Pamela...

Even though BAESY is in the “West camp” and is less likely to be left out or sanctioned by the United States, United States politics might impact BAESY given 2024 is an election year. Donald Trump (one of the two leading presidential candidates for the 2024 elections) made a remark on NATO's defence spend. BAESY is headquartered in the United Kingdom, which is part of NATO. NATO set a target of 2% of GDP to be spent on defence and many countries do not meet this target, hence Trump's comments.

The United States is second in defence spending relative to GDP behind Poland, with the UK meeting this target at 2.1% of GDP being spent on defence. In our opinion, the United States and United Kingdom will continue to have close ties and will not materially interfere with BAESY's operations. However, regardless of how remote this risk is, shareholders need to account for a low probability high-impact risk such as this one. The all-time high United States national debt, presidential elections, increased polarisation and politics can impact BAESY's relationship with the United States Department of Defence.

Conclusion

BAESY is well positioned to capitalise on sustained growth in defence budgets around the globe. As we discussed above, BAESY's top four customers increased their defence budgets by a combined $124bn since 2020, order backlogs increased to £69.8 billion and the company deleveraged over recent years. Relatively, the company is fairly valued and is in a good position to continue to sustainably grow in the near future. BAESY is a buy.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.