After the market closed on February 21st, the management teams at Chord Energy (NASDAQ:CHRD) and Enerplus (NYSE:ERF) announced that the two companies would be combining together into a single firm in order to create additional shareholder value. This move translates to a rather hefty premium for shareholders of Enerplus, as Chord Energy was essentially absorbing the business in a stock and cash transaction that values the two companies, collectively, at around $11 billion. Based on the data provided by both enterprises, this deal looks rather appropriate. And while it is unclear if proposed synergies will be realized, even combining the companies as they are and not capturing the synergies should make investors bullish.

A ‘premier' player in the Williston Basin

Over the past year or so, much of the consolidation that has occurred in the oil and gas exploration and production space has occurred in the prolific Permian Basin. However, this latest deal does not involve that region. Rather, its emphasis is on the lesser-known but still very relevant Williston Basin. According to a press release issued after the market closed on February 21st, two sizable players in that basin, Chord Energy and Enerplus, have agreed to combine in a stock and cash transaction that places an enterprise value on the combined firm of around $11 billion.

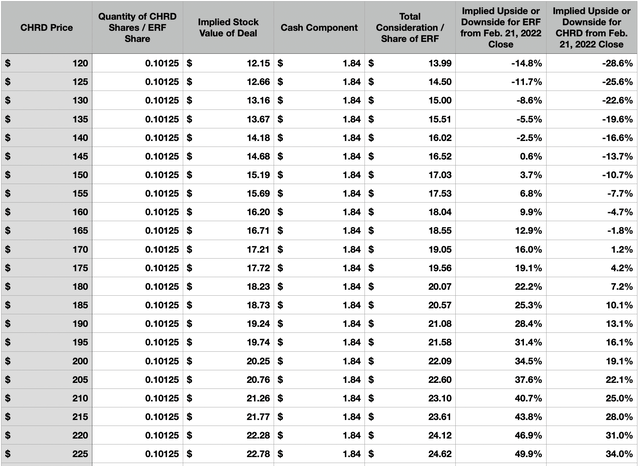

According to the press release, upon closing later this year, shareholders of Enerplus will receive 0.10125 of a share of Chord Energy for each share of Enerplus that they currently own. In addition to this, they will receive $1.84 per share in cash. When you do the math, this works out to roughly 90% of the transaction occurring in stock and the remaining 10% is done for cash. Based on the $167.96 price at which Chord Energy closed out on February 21st, this transaction works out to a price of about $18.85 for shareholders of Enerplus. That represents a premium of 14.8% over the $16.42 that shares of that business closed at on the same day. Investors in Chord Energy will end up with 67% of the combined company, with the remaining 33% going to shareholders of Enerplus.

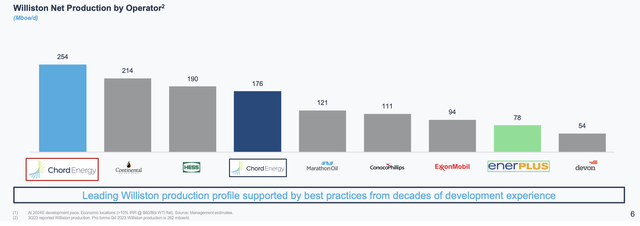

As with any transaction like this, there really are two reasons behind the maneuver. First and foremost, the goal is to create a larger and more powerful player in the areas in which it operates. In the Williston Basin, Chord Energy on its own is responsible for around 176,000 boe (barrels of oil equivalent) per day of output. Its competitor, Enerplus, is considerably smaller with output of only around 78,000 boe per day. Combined, however, the firm will be a true leader in the space, with 254,000 boe per day worth of output.

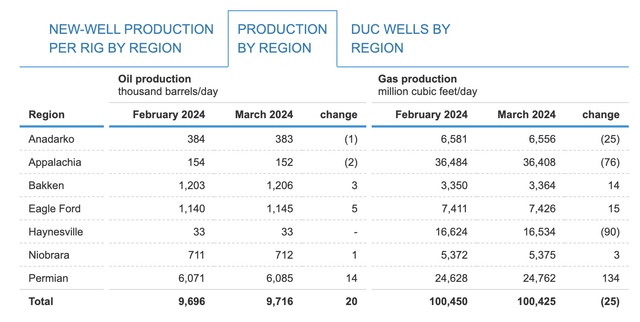

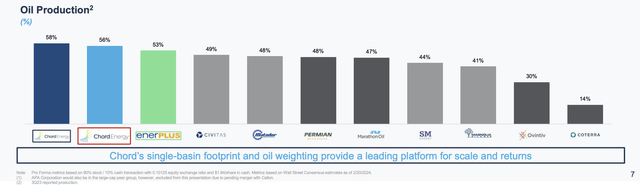

It's important to note they each basin in the US is a little different. Some, like the Permian Basin, are largely focused on oil output. Others, like Haynesville and Appalachia, are natural gas heavy. In the table above, you can see the seven major onshore oil and gas producing regions closely tracked by the EIA. Although the Williston Basin is not specifically listed, the Bakken is a major formation within it. Approximately 68% of the production there is in the form of oil. When it comes to Chord Energy specifically, its exposure is a bit lower. It stands at about 58% oil. Even lower is Enerplus at 53%. But once the two companies combine, we should see this figure come in at around 56%. That places it well above any other major producer dedicated to that region.

Chord Energy Federal Reserve Bank of Dallas

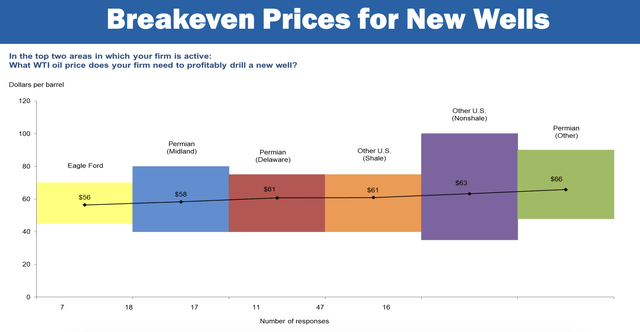

There are multiple reasons why any particular oil and gas region might be better than any other. At the end of the day, it usually comes down to location and cost of production. To some extent, both of these items can be intertwined. According to a presentation made earlier this year by the Federal Reserve Bank of Dallas, the breakeven price for a new well in the Midland portion of the Permian Basin is around $58 per barrel. In the Eagle Ford, it is even lower at $56. There is no breakdown for the Williston or Bakken. But the category described as ‘other US shale' has a price of around $61 per barrel. If this transaction is completed, the management team at Chord Energy believes that it will have around 1,824 drawing locations that it has legal access to where the breakeven price will be even lower than $60 per barrel. That's up from the 1,272 locations that the business, as a standalone enterprise, has today.

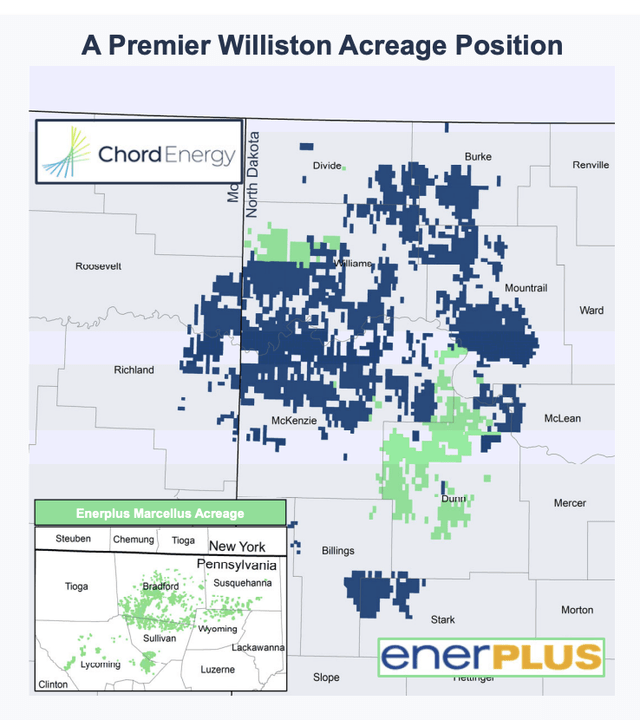

This brings me to the other reason why such a transaction makes sense. As you can see in the image above, there is a good deal of overlap in the assets owned between the two companies. This makes it easy to engage in the clustering of resources in order to bring costs down. Using the Funeral Home industry as an example, imagine two funeral homes that are 5 or 10 miles apart that share the same hearse. That's one less hearse that the funeral home operator needs to buy. Add on top of this the ability to exercise control over other partners in the supply chain, as well as the ability to cut out duplicative costs and, ideally, get more attractive financing, and there is ample opportunity for synergies.

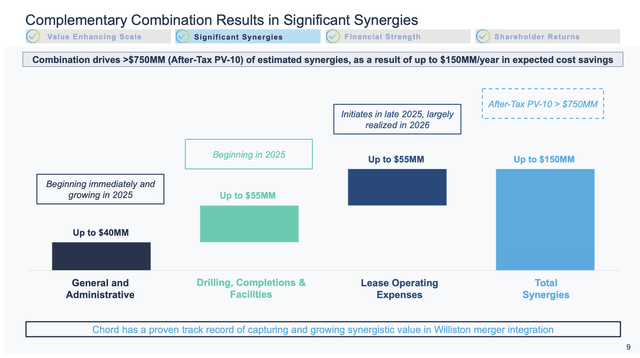

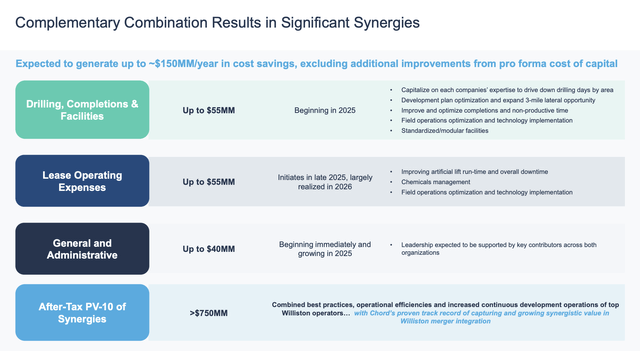

If all goes according to plan, Chord Energy believes that the combined firm will recognize around $150 million in annualized cost savings. Some undisclosed amount of this will occur this year. However, management believes that about $95 million of this will be recognized between this year and next year, while the remaining $55 million will be realized in 2026. About $40 million of these savings are forecasted to come from the general and administrative side. Cutting out extra departments at corporate, such as whittling the company down from two different accounting offices to one or from two different investor relations offices to one, will help tremendously. Drilling, completions, and facility changes will save another $55 million. And, at the operating level, there is the potential for another $55 million in savings. Management forecasts that the present value of these savings will be over $750 million.

- ➤【 HIGH-PERFORMANCE CAR JUMP STARTER...

- ➤【 SMART CORDLESS INFLATOR WITH LCD SCREEN 】...

- ➤【 ESCORT YOUR SAFETY 】Thanks to the...

- ➤【 ALL-IN-ONE JUMP STARTER 】Say goodbye to...

- ➤【 WHAT YOU GET & WARRANTY 】YabeAuto YA70...

- 【UNIVERSAL FIT KIT】- The kit contains 23 types...

- 【TOP QUALITY】- These car retainer clips are...

- 【PREFECT FOR WHAT YOU NEED】 - Up to 680 pieces...

- 【BONUS ACCESSORIES】- We provide different size...

- 【WIDE APPLICATION】- Professional push clips...

- Powerful Car Jumper Starter - The Scatach 011 jump...

- Advanced Safety Features - Easy to opearte, and...

- Portable Design - This portable car battery...

- Respond to Emergencies - Portable power bank with...

- What will you Get ? - Scatach 011 Car Starter...

- 【What You Get】1*Tactical Molle Seat Back...

- 【Military Molle System - Lots Of...

- 【Durable and Long Lasting】 MOLLE seat back...

- 【Tactical Seat Covers Universal】 The size of...

- 【Guarantee】If you're not 100% satisfied with...

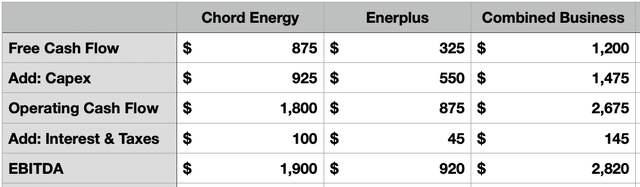

In terms of overall risk to shareholders, the combined enterprise will be quite low on the list. In addition to boasting stronger EBITDA margins, the firm also has lower leverage. By the end of this year, it's believed that the combined enterprise will have a net leverage ratio of around 0.2. That's well below the 0.7 that some of its larger rivals have. And it's also significantly below the 2 handle that the market sees as being overleveraged. This, combined with some of the other factors that I mentioned already, will result in a business that generates around $1.2 billion in free cash flow per year. It just so happens that both Chord Energy and Enerplus announced financial results for their 2023 fiscal years.

*$ in Millions for the 2024 Fiscal Year

**Interest & Taxes for Chord Energy Implied by Chord Energy's projection for $1.9 billion in EBITDA in 2024

Unfortunately, we don't know all the data from each firm individually for the fiscal year that we are in. And the free cash flow estimates provided by management are for the 2024 fiscal year. We do know, however, that Chord Energy is forecasting operating cash flow of around $1.8 billion this year and EBITDA of $1.9 billion. This assumes that WTI crude prices average $79 per barrel, while natural gas averages $2.50 per Mcf. Working backward, we end up with operating cash flow for Enerplus of approximately $875 million. We don't have an easy way to get an estimate when it comes to EBITDA. So if we merely use the same interest expense and corporate taxes that were paid for the 2023 fiscal year, we would get a reading on that front of approximately $919.8 million.

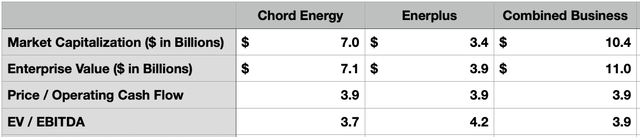

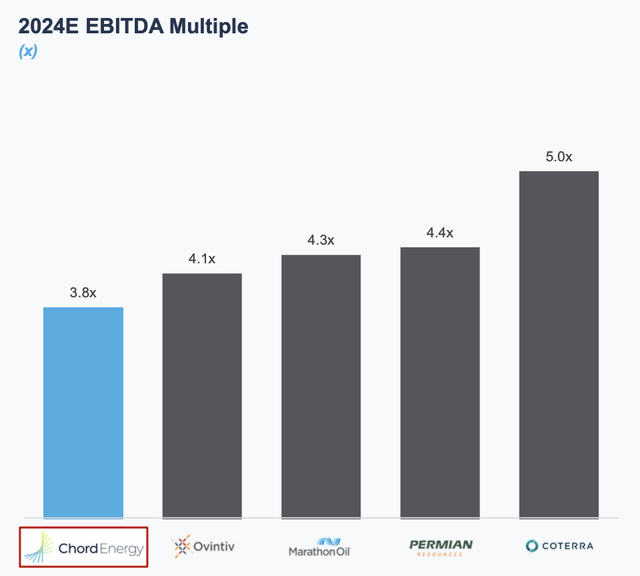

Using these figures, I was able to create the relative valuation for the two businesses as shown above. With a market capitalization of $7 billion and an enterprise value of $7.1 billion, Chord Energy is trading at a price to operating cash flow multiple of 3.9 and at an EV to EBITDA multiple of 3.7. By comparison, the $3.4 billion that is being paid for the equity of Enerplus, which translates to a $3.9 billion enterprise value, shows similar multiples. At the very least, this shows that the transaction is not a negative for the companies. And if synergies are realized, then the picture would look even more appealing. It is worth noting that, even without synergies, the company is priced lower than many of its peers. You can see this, using management's own pricing which is slightly different from mine, in the image below.

Takeaway

All things considered, I would say that this transaction between Chord Energy and Enerplus looks fine. More likely than not, there will be some cost savings that can be generated by the combined enterprise. But even if that's not the case, the trading multiples of both firms make this more or less a transaction of equals but of different sizes. Due to these factors and how cheap shares of both businesses currently are, I believe that a ‘buy' rating for both is appropriate at this time.