MBIA Inc. (NYSE:MBI) made the news last year when the insurance regulators allowed for a massive cash release of more than $500 million to be upstreamed from the insurance subsidiaries to MBIA Holding Corp. The company then decided to pay a one-time dividend to shareholders, while keeping some cash. We believe that the current capital position of National, one of the two insurance subsidiaries, is strong enough to suggest that more releases of liquidity might come soon, benefiting shareholders. We believe there is an overall upside potential between 10% and 60%.

The GoodCo and the BadCo: a story in two parts

MBIA Corp is the parent company of two insurance subsidiaries that were once actively underwriting risk. They were some of the many players offering financial guarantees to securities, from bonds to mortgage-backed securities to CDOs, prior to the Great Financial Crisis. After suffering massive losses as many of the insured assets became payable under the policies, the two companies were put under close watch of regulators and are currently in runoff, meaning they are not underwriting any new business but just slowly shutting down. However, this doesn’t mean that there is no value left for shareholders, as the recent dividend demonstrated.

The two subsidiaries are National Corp and MBIA Corp. The upstreamed liquidity generated from the former, which remains in much better shape than the latter. The two entities have indeed radically different profiles: National is to be considered the “GoodCo”, having more than enough liquidity to meet expected payments, while MBIA Inc is the “BadCo”, as no liquidity will ever be upstreamed to the parent from it.

To put in numbers these assessments, the first useful metric to compare is “Claims Paying Resources”, which is a non-GAAP measure that estimates the overall resources that can be used to pay arising claims. This includes cash and investments, but also unearned premiums and existing reserves.

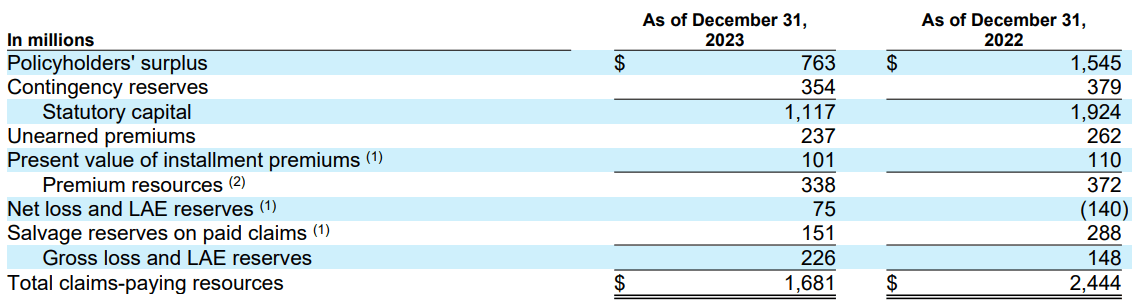

CPR – National (SEC Filings – 10K)

National’s CPR is around $1.7 billion and is mostly a result of a strong policyholders’ surplus (assets minus liabilities at the insurance co level), and strong reserves.

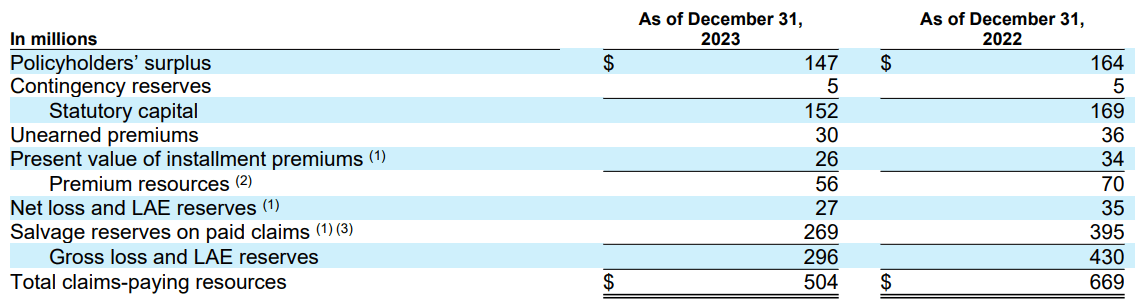

CPR – MBIA Corp (SEC Filings – 10K)

On the other hand, MBIA Corp has roughly $500 million of CPR, or around ⅓ of National’s. So since any recovery for shareholders is strictly dependent on this number, just on an absolute basis we understand National is the largest slice of the pie. However, we need to adjust this figure for the actual total exposure that each company has relative to its claims. This is done by comparing the CPR with the Gross Par insured, which is a gross estimate of the maximum losses the entity could theoretically incur.

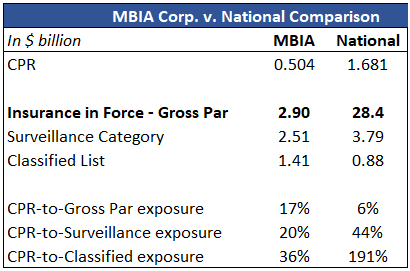

MBIA Corp vs National (Author’s Model)

We notice that this ratio stands at 17% for MBIA Corp and 8% for National, which seems to suggest that the former is actually better off. But gross par exposure is not the best measure to look at. We need to understand the exposure to claims that are most likely to deteriorate and give rise to losses. This is why we use two additional measures: CPR-to-Surveillance and CPR-to-Classified claims. Surveillance and Classified are to categorization of claims that aim at estimating the actual claims that may become distressed, and thus trigger a payment under the policy. For these two ratios, National has a significantly larger coverage, with 44% of the Surveillance credits covered, and 191% of the classified exposure covered. This is significantly better than MBIA’s 20% and 36% respectively, which highlights the severe undercapitalization of the company.

What’s the upside for the parent company and its shareholders?

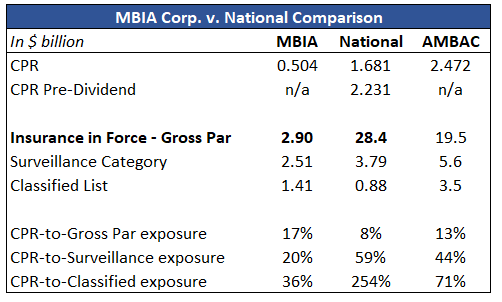

Now, we understand that this is a story in two parts, a failed insurance subsidiary full of toxic assets that will likely never recover, MBIA Corp, and a bright subsidiary with more than enough cash that it’s even able to upstream liquidity to its parent. But will this happen again? To try to answer this question and compute the upside potential we will run a comparison between the pre-dividend ratios and the current ones. This is to grasp an understanding of the regulators’ confidence levels that allowed for liquidity distributions. We also run a comparison between the three entities that were engaged in financial guarantees and are still publicly traded: MBIA, National, and Ambac Financial Group (AMBC).

MBIA Corp Comparison (Author’s Model)

This highlights a drastic difference at the CPR-to-Classified exposure level. Classified claims are the ones with the highest probability of actually defaulting. While surveillance credits are relevant but not immediately high-risk, it is very likely that classified exposures will indeed give rise to payments. The pre-dividend National had 250% of these exposures covered by cash, investments, and reserves. Both Ambac and MBIA fell short by several orders, stopping at 71% and 36% respectively.

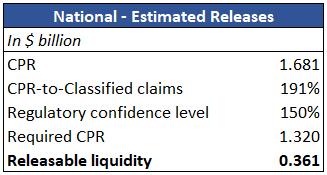

Now, to estimate the releasable liquidity, we make some assumptions. First, we plug in the required CPR-to-Classified ratio as a theoretical regulatory threshold to allow for liquidity distributions. This is an assumption and neither we nor the company (as per their communications in the filings) know the actual levels regulators look at when making such decisions. We start by assuming 150% of CPR-to-Classified claims is conservative enough.

Estimated Releases (Author’s Model)

This would translate into releasable liquidity of $360 million, or around 110% of the current market cap. We can see the outcome of different assumptions by extending the analysis using a sensitivity table.

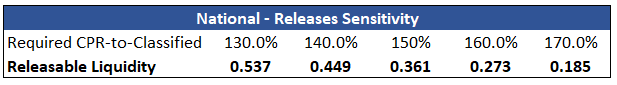

Sensitivity Analysis (Author’s Model)

We notice that the real upside is for distributions occurring at 130% and 140%, which amount to 136% and 160% of the current market cap. As upside potential, we feel confident taking the face value of these distributions as we believe they can be directly distributed to shareholders. The holding company is indeed facing some liabilities, like $600 million of long-term debt, but this is mostly covered by around $650 million of liquidity and investments at the parent company level.

Risks: many things can go wrong

While we feel very confident that the liquidity release that took place in December can be repeated in the future, this setup is not without risks. The main issue is around the performance of the assets. Both the classified and surveillance claims lists are provided by the company based on their own assumptions. It is rather hard to come up with external estimates as we lack crucial information at the asset level, which increases risk. Additionally, we do not know the regulators’ approach in determining possible releases, and thus also their timing.

However, not all is bad. The liquidity release signaled that also the regulators were confident that the estimated classified and surveillance claims were properly covered, and no additional exposure was likely affected.

Conclusion

MBIA Inc. has been able to distribute a very generous special dividend of $500 million, despite being in runoff since the GFC. We believe more liquidity releases may come in the future as the company continues to de-risk its book, and one of its insurance subsidiaries appears more than well-capitalized. While there is uncertainty over these distributions, we believe they could generate an upside potential for the shares between 10% and 60%.

Enjoyed this article? Sign up for our newsletter to receive regular insights and stay connected.