Investment Summary

My recommendation for Pure Storage (NYSE:PSTG) is a buy rating. The growth runway for PSTG is strong and visible as the world becomes more digitalized, creating a greater need for data storage. I believe PSTG is well placed to capture this growth given its product innovation, like Purity Software, which lowers the total cost of ownership and improves efficiency for enterprises. All these positive factors should continue to support PSTG trading at a premium valuation vs. its historical average.

Business Overview

PSTG competes in the computer storage industry, offering FlashArray to enterprises for high-performance workloads. The business sells to a wide range of customers, including cloud providers, enterprises, and governments. PSTG’s products and subscription services support customers' needs across structured and unstructured data in a wide set of use-cases and environments. PSTG derives 70% of its revenue from the US and the remaining from international. Its growth profile has shrunk drastically compared to the past, from high double-digit percentage growth to 2.8% in FY24. However, profitability has improved to 9% of EBITDA. The business is also generating positive FCF, having cumulatively generated more than $1 billion in FCF over the past 3 years. That said, stock-based compensation [SBC] represented a large part of this $1 billion FCF.

Large TAM

I believe PSTG is going to see a very long runway of growth ahead as the world becomes more digitized, which means more usage of digital data. Although there has been a shift in how data is being stored (from on-premise to cloud), the fundamental results are that more storage is needed and more sophisticated solutions to data management are needed. There are four key drivers that should drive total addressable market expansion.

Firstly, it is the increase in demand for storage globally, for which PSTG is well positioned to gain share, given that for 10 consecutive years, PSTG has gained recognition in the Magic Quadrant for Primary Storage. Secondly, Flash should continue to win share from the hard disk drive [HDD] because of the structural difference in technology. Since solid-state-drive [SSD] technology doesn't require constant movement, flash is frequently used interchangeably with SSD technology. Because of this, SSDs are more dependent, have better performance, and use less power than HDDs. While HDD has always had better pricing and made storage scalability easier for customers, Flash has started to close the gap. As this cost trend continues, the relative attractiveness of SDD will only continue to grow as it becomes cheaper but offers better technology. Thirdly, there is a growing demand for storage subscriptions and as-a-service. PSTG has a strong position in this vertical given that it pioneered this business model and should continue to capture share from legacy on-premise storage providers because of Evergreen. Due to the modular design of the Evergreen architecture, it is possible to upgrade without affecting other parts of the system. Customers can say goodbye to expensive turnover and the e-waste it causes thanks to the evergreen subscription model, which ensures they always have access to the most recent array of products, even after they become obsolete or require wholesale replacement. Finally, sophisticated solutions are needed for primary container storage and critical data workflows such as backup, disaster recovery, and migration due to the increasing use of hybrid cloud architecture.

Purity software is a key growth driver

The main driving force for PSTG to continue to capture share is its Purity Software, which works on native Flash and doesn't require the use of SSDs. There is an entire list of positives that you can find here. The most important thing is that it provides better data storage efficiency by removing duplicates that fixed-block architectures miss and by removing repetitive binary patterns before deduplication and compression, which speeds up data reduction. Aside from the better use of storage space, it also reduces the cost of power as the system is more efficient, providing huge cost-saving opportunities to clients. For reference, data centers use 10 to 50x more power per floor space than a typical office building, and according to management in the PSTG at the Morgan Stanley conference, PSTG flash solutions can be 8 to 10 times more power efficient than spinning disks, considering that flash only requires about half that amount of power to operate and that Pure's architecture can be 2 to 5 times more efficient than rivals. And that doesn't even account for the fact that flash can shorten the time it takes for an AI application or job to finish on the GPU, which in turn helps alleviate data center power constraints even more. This itself should be a strong value proposition for clients to switch over to PSTG.

There are other very important advantages, such as Flash being 5–10 times less space-consuming. In my opinion, this is another very important point as: (1) it allows hyperscalers to accelerate their pace of data center deployment as they solve the problem of physical limitation; (2) it is another area of cost savings as hyperscalers require less space to offer the same amount of storage capacity. Furthermore, flash offers a 20-30x (as per the Morgan Stanley conference) improvement in reliability, which is crucial for large enterprises. Additionally, it requires less labor to operate, which is yet another way to save costs. All in all, I think this positions PSTG well to gain share in the market and become increasingly relevant to cloud customers.

Valuation

- Sturdy and Durable: This OROPY wall mounted...

- Sleek Industrial Design: With its simple...

- Optimized Space Utilization: Expand your storage...

- Convenience at Your Fingertips: Hang your daily...

- Versatile Functionality: This multi-functional...

- 【Industrial Clothing Rack】 The clothing racks...

- 【Sturdy & Durable】 Our clothes racks are made...

- 【Height Adjustable】 The height of the lower...

- 【Multifunction Closet Rack】 Wall clothes rack...

- 【Multi-Scene Use】 Dimension: 115” L x87.5”...

- 【Safer Size/Style】: Whole sconces are UL...

- 【Outstanding Details】: Our high-quality black...

- 【NOTE】: Our bar lighting wall sconce include...

- 【Wide Application】: Vintage wall light...

- 【Tips】: As the tube bulb is a bit special, it...

Redfox Capital Ideas

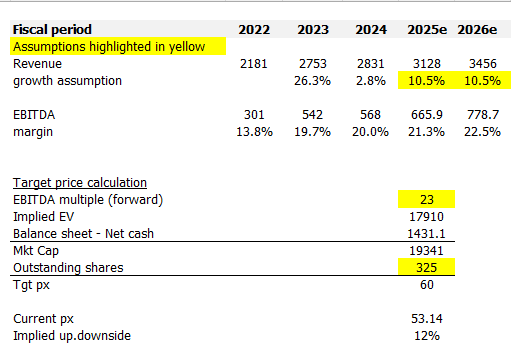

I model PSTG using a forward EBITDA approach, and using my assumptions, I believe PSTG is worth ~$60, which is a 12% upside potential. For revenue, I expect PSTG to grow 10.5% in FY25 (note this is management guidance), which is fair given that PSTG is expected to face ~400bps of growth headwind from a higher mix of subscription bookings. Being conservative, I assume PSTG will grow by 10.5% in FY26 (note we should see more than 10.5% growth as the 400 bps headwind unwinds). For margin, PSTG should see margin expansion as subscriptions take up a bigger mix of the business (lower OpEx profile). Using consensus estimates, which have typically underestimated PSTG reported EBITDA by 17% over the past 8 years, I assumed the EBITDA margin would improve from 20% in FY24 to 22.5% in FY26, compared to an compared to an existing FY26 with $778.7 million in EBITDA.

Over the past 5 years, PSTG traded at an average of 21 forward EBITDA, and I expect it to trade at a premium from this average given the strong secular tailwind and its Purity Software ability to capture share. Again, using a conservative approach, I assumed multiples to remain at the current level of 23x forward EBITDA.

Risk

While there are obvious benefits from switching to Purity Software, existing customers might not switch because of the hassle of migrating their digital real estate, which could disrupt their operations. Also, even though the switch will reduce the total cost of ownership, customers might be reluctant to spend today as they look to shore up cash in their balance sheet in light of the weak macro environment. These could lead to a slowdown in growth in the near term, impacting stock sentiment (which pressures valuation, as it is trading above average today).

Conclusion

My view for PSTG is a buy rating due to its strong position in the growing data storage market driven by digitalization. PSTG's innovative Purity Software offers superior efficiency and cost savings compared to traditional solutions, making it well-positioned to capture market share. Despite a premium valuation, I believe it is justified given the long-term prospects, supported by favorable industry trends and its technological edge. The risk is that potential customer hesitance to migrate, and a weak macro environment are short-term risks.