Copper prices appear to be marching to the beat of their own drum. The industrial metal has decoupled itself from the market movements inherent in base metals as well as oil.

It’s not a divergence that has been occurring in the near term, but one that’s been brewing over the last few years. With the ongoing reliance on electricity, it might appear that copper should be moving almost in lockstep with other metals like lithium and cobalt. According to the CME Group, that hasn’t been the case.

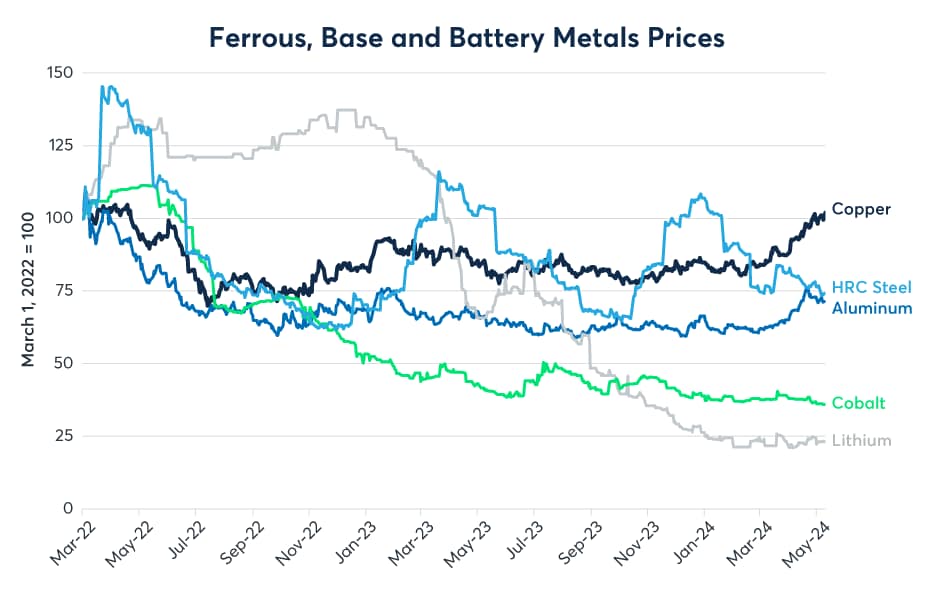

“Copper prices have charted their own course over the past two years, decoupling from base metals such as steel, battery metals lithium and cobalt, and ferrous metal aluminum,” noted Erik Noland, chief economist and executive director of CME Group.

“While copper prices have risen by about 2% from the end of Q1 2022, steel prices are 26% lower over that period, aluminum prices are down 29% and the prices for cobalt and lithium used in EV batteries have tumbled by 64% and 77%, respectively (Figure 1),” he added.

Figure 1: Copper has outperformed base, battery and ferrous metals

In addition, copper has been diverging from another commodity: oil. As the CME Group pointed out, this is somewhat of an aberration given that copper and oil price moves have typically mirrored one another in the past few decades.

“Since 2022, oil prices first fell and then traded in a range,” Noland said. “By contrast, copper prices rose significantly in late 2022, then dipped for a while, and are now on their way back towards record highs (Figure 2).”

Figure 2: The energy intensity of copper mining may explain its correlation with oil

Take Advantage of Copper’s Independence

While copper continues to make moves that are independent of base metals and oil, it’s an opportune time to get miners exposure. One way is via the Sprott Copper Miners ETF (COPP), which seeks to provide investment results that correspond generally to the total return performance of the Nasdaq Sprott Copper Miners Index (NSCOPP). It is designed to track the performance of a selection of global securities in the industry, including producers, developers, and explorers.

Additionally, investors who want to focus on even more aggressive growth prospects will want to consider the Sprott Junior Copper Miners ETF (COPJ). The fund seeks to provide investment results that track the total return performance of the Nasdaq Sprott Junior Copper Miners Index. The index incorporates mid-, small-, and micro-cap companies entrenched in copper-mining-related businesses.

With the S&P GSCI Copper index and Bloomberg Copper Subindex pushing past 20% year to date, this could have a spillover effect and benefit miners moving forward.

For more news, information, and analysis, visit the Gold/Silver/Critical Materials Channel.