Overview

There are a ton of dividend focused ETFs out there to choose from but how do you know which one is best? Well, there are a few different metrics that we can look at, but it ultimately comes down to what your goal is. Maybe you want a diversified ETF that gives you a high starting yield. Or perhaps you are looking for an ETF that gives exposure to dividend paying companies and has a history of consistently increasing distributions? Do you want to focus on exclusively income capabilities, or are you looking for total return? These are some of the questions you have to ask yourself when looking for the perfect ETF.

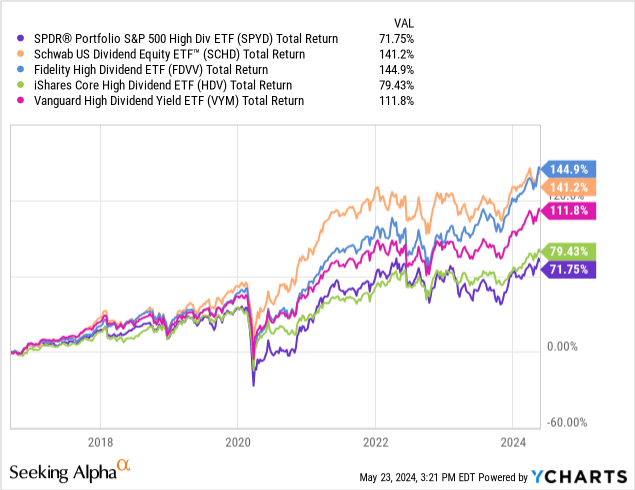

With that being said, there are a few ETFs that do not manage to check off any of these boxes. While they may contribute to your portfolio growing in size over time, it doesn't really outperform in any of these areas. I believe that SPDR Portfolio S&P 500 High Dividend ETF (NYSEARCA:SPYD) is one of these middle of the pack performers that doesn't really excel in anything specifically. However, SPYD does manage to still provide a total return, even if it pales in comparison to some alternatives. Just to prove this, I've included a total return comparison chart between SPYD and a few other high yield ETFs.

Data by YCharts

The current dividend yield of SPYD sits at 4.4% and gives exposure to a diverse range of companies across the US. There are a bit of nuanced differences of this ETF compared to others that I will be covering shortly. I believe that this difference in portfolio composition has ultimately held it back from capturing a better return. SPYD currently has about $6.95B in AUM (assets under management) while also having a very reasonable gross expense ratio of 0.07%. The fund's portfolio management is done by SSGA FM (State Street Global Advisors).

The fund's inception dates back to 2015 and has the primary objective to provide investment results that align with the total return of the S&P 500 high dividend index. However, because of the sector breakdown, the distributions received from SPYD are not classified as qualified dividends, adding a layer of tax considerations to make. So let's start by first digging into the holdings and strategy of the fund.

Holdings & Vulnerabilities

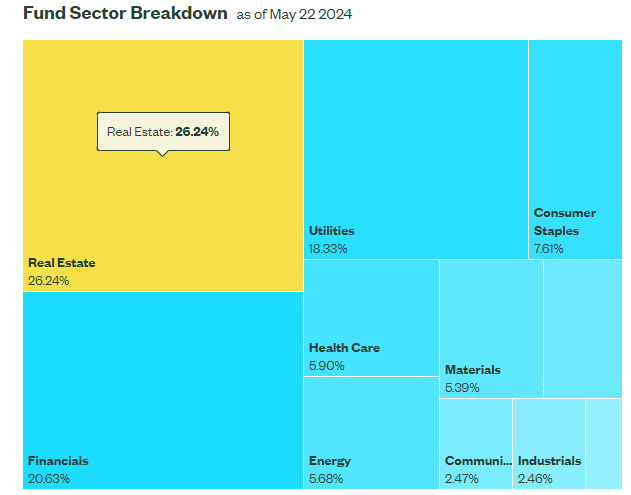

As part of SPYD's strategy, the fund invests at 80% of its total assets in securities that make up the high dividend yield index. As a result of following this method, the ETF holds about 78 individual holdings within the fund, and these are diversified across many different industries. As we can see, the leading sector allocation is Real Estate, which accounts for 26.24% of the net assets. This is closely followed by Financials at 20.63% and Utilities which make up 18.33%.

State Street SPDR

Additionally, I've compiled a table of the top ten holdings for visibility. We can see that the top ten holdings consists of some REITs, companies with lower starting dividends, but higher dividend increase streaks, as well as companies with high starting dividend yields.

| Top Ten Holdings | Weight |

|---|---|

| Public Service Enterprise (PEG) | 1.59% |

| Hasbro (HAS) | 1.53% |

| Dominion Energy (D) | 1.48% |

| Iron Mountain (IRM) | 1.47% |

| Citigroup (C) | 1.46% |

| The Williams Companies (WMB) | 1.46% |

| American Electric Power (AEP) | 1.45% |

| ONEOK (OKE) | 1.45% |

| Altria (MO) | 1.41% |

| Entergy Corporation (ETR) | 1.41% |

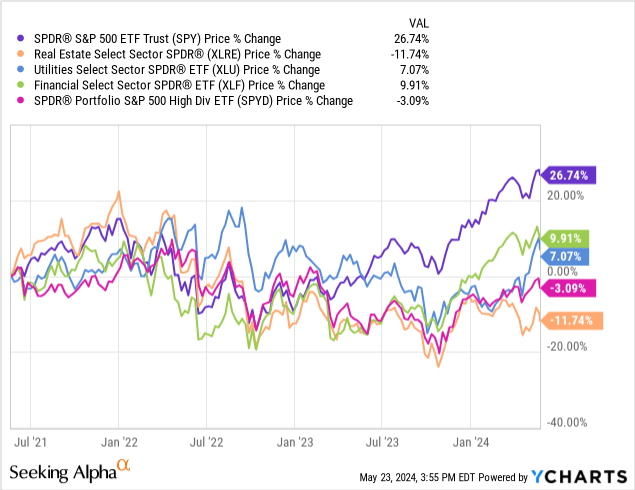

While diverse and spread across many different industries, the top three sector allocations leave some vulnerabilities to consider. The top three sectors are highly sensitive to interest rate changes, more specifically Real Estate and Utilities. Financial are a bit vulnerable to interest rate changes, but they've been able to still perform a bit better. At a quick glance, take a look at how each one of these sectors have performed over the last three year time period.

We can see how these sectors have all underperformed the greater S&P 500 index (SPY) over time due. The Real Estate sector has performed the worst of the group as this industry has seen increased pressure from interest rates rising rapidly at the midpoint of 2022.

Data by YCharts

Interest rates have a huge impact on these sectors because the companies in these sectors typically rely on the efficient use of debt. Since interest rates have risen, the cost of servicing and maintaining these debts have increased through higher interest payments. As a result, real estate companies have slowed down on acquisitions and expansion efforts since these higher debt levels chew into the profitability of taking on these endeavors. The exact same story can play out for utilities as these companies also rely on cheap debt levels to fund expansions of pipelines, plants, and acquisitions.

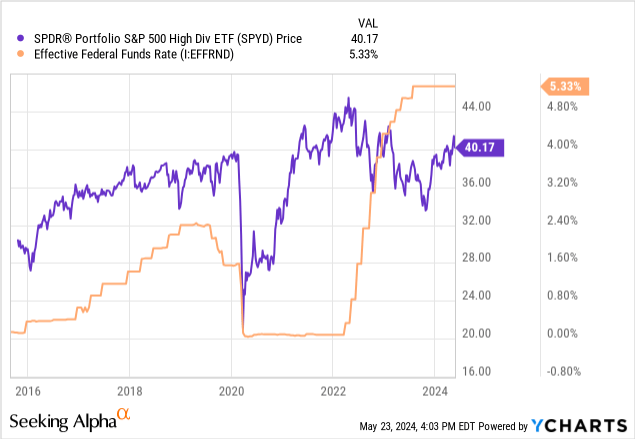

It's no coincidence that SPYD's price has shared a recent inverse relationship with the federal funds rate. Prior to 2020, SPYD's price remained pretty stable but once rates were cut to near zero levels, the price spiked upward after the initial downside reaction. Conversely, when rates started to rapidly rise in 2022, the price retracted a little over 10% before stabilizing to the current levels.

Data by YCharts

While there's a chance that interest rate cuts can happen as soon as September of this year, this is something I predict will always be a vulnerability with SPYD. Having a sensitivity to rates isn't necessarily a bad thing, but it's something to consider if you are planning to hold for the long term.

Dividend Comparison

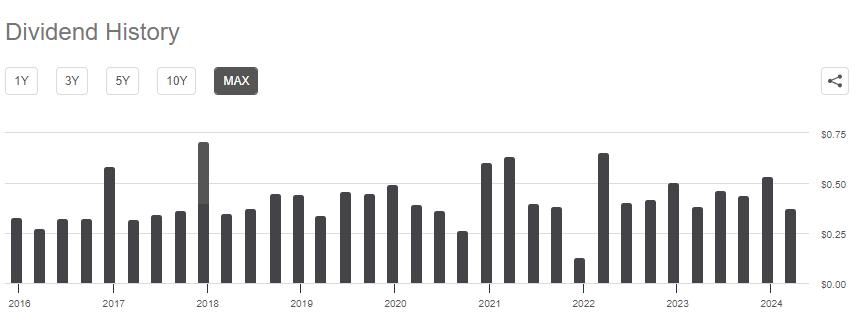

As of the latest declared quarterly dividend of $0.3729 per share, the current dividend yield sits at 4.4%. Something that SPYD really lacks is some meaningful dividend growth. While the dividend managed to increase at a CAGR (Compound Annual Growth Rate) of 2.4% over a five year time frame, this is pretty underwhelming for an ETF that yields 4%. Taking a look at the payout history, we can see a bit of a sporadic chart with wild swings in difference between payout amounts. This is another vulnerability when comparing against some alternative dividend ETFs. Despite the varied dividend history, the dividend yield has managed to float at an average between 4% to 5% through its history.

Seeking Alpha

While the divided yield here of 4.4% may be higher than some alternatives, there are other dividend focused funds that have proven to have a better track record of increasing dividends over time. With SPYD, you can technically create your own growth by reinvesting these dividends quarter after quarter, but if you're required to always reinvest those dividends to keep up with peers, this kind of defeats the purpose of the fund.

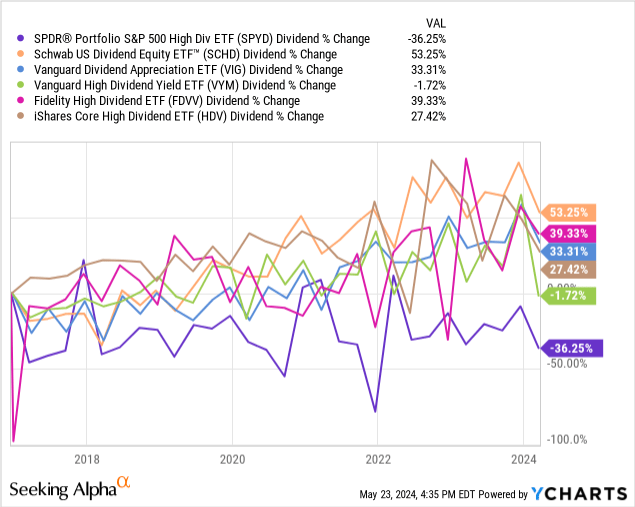

SPYD actually has the worst dividend growth when compared against the following dividend focused ETF alternatives:

- Schwab US Dividend Equity ETF (SCHD)

- Vanguard Dividend Appreciation (VIG)

- Vanguard High Dividend Yield ETF (VYM)

- Fidelity High Dividend ETF (FDVV)

- iShares Core High Dividend ETF (HDV)

Data by YCharts

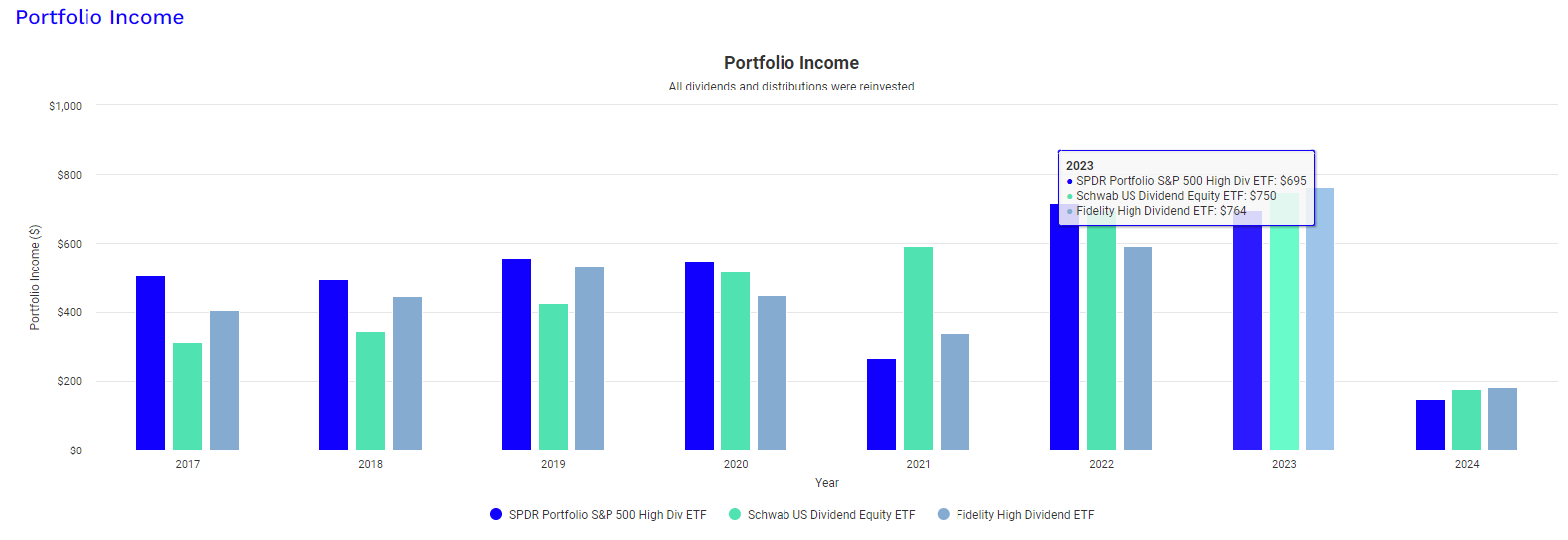

To better visualize this growth, I used Portfolio Visualizer to compare the dividend income received from some of these ETFs over time. This calculation assumes an original investment of $10,000 in 2017 and also assumes that no additional capital was ever deployed except for dividends being reinvested. SPYD's dividend income year by year is demonstrated by the blue bars. In 2017, SPYD would have netted you $507 in dividend income. This would have grown to $695 by 2023. In comparison, SCHD's dividend would have grown by over double, increasing from $312 in 2017 up to $750 in 2023.

Portfolio Visualizer

So dividend growth is what you're after, there are better alternatives out there to SPYD. One last thing to consider is that the dividend received from SPYD is not the most tax efficient income. This is due to the exposure to the real estate sector, as these dividends are typically classified as ‘ordinary' dividends and are taxed at less attractive rates than qualified dividends.

Performance & Risk Profile

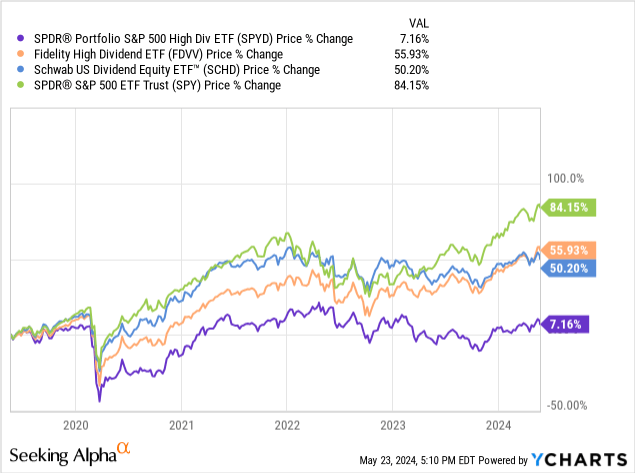

Over the last five year time period, SPYD's price has only appreciated by a little over 7%. Compared this to the S&P 500's price growth of over 84% and alternative funds like FDVV and SCHD, which have respective price returns of 55.93% and 50.20%. I think that a problem of SPYD's methodology is that the focus on staying aligned with the high dividend index shrinks the possible exposure that it has to growthier sectors such as technology.

Data by YCharts

You may risk continued underperformance with the lack of focus on technology companies. I believe this is what separates FDVV and SCHD from SYPD. I previously detailed these differences in my analysis of FDVV and why that is my preferred dividend ETF. Tech has exploded in value over the last twelve months with some huge strides of innovation happening across companies like Nvidia (NVDA), Amazon (AMZN), Microsoft (MSFT), and Apple (AAPL). This lack of technology exposure will likely be the continued contributor to the lack of performance here.

FDVV's dividend yield is only 3.1% and SCHD's dividend is only 3.3%. While SPYD's dividend yield of 4.4% does grant you to an instantly higher level of dividend income, I fail to see the benefit of this unless you are an investor that is at or nearing retirement age and depend on the income produced from your portfolio. If you need income from your portfolio, I can see how SPYD makes sense, but if this doesn't apply to you, you're likely better off investing your cash elsewhere. The trade off of a slighter higher yield is not worth the risk of continued underperformance in price appreciation and total return.

As previously mentioned, the current sector allocation also leaves a bit to be desired, as the top sectors remain sensitive to interest rate changes. The higher interest rates have suppressed sectors that are heavily dependent on affordable debt financing to fund operations, growth, acquisitions, or development, such as the real estate and utilities sector. As inflation remains higher than anticipated, interest rate cuts may be further delayed to next year. Therefore, the longer we remain in a high interest rate environment, the larger margin of underperformance from peers we may see.

Takeaway

While SPYD does give you instant exposure to a diverse group of dividend stocks, the reliance of real estate has suppressed the price level to underperform peers with better sector weightings. In addition, the lack of technology exposure will likely contribute to further underperformance since the technology sector has more exposure to these growthier companies. The dividend yield of 4.4% may sit higher than peer ETFs, but the trade off will likely continue to be underperformance because of this sector allocation.

Additionally, the dividend growth has been lackluster when compared to peers. So if you are looking for some sort of consistency when it comes to dividend growth, SPYD is not the best choice for you. The only instance that supports a decision to hold SPYD is if you are an investor that depends on the income from your portfolio. The higher starting yield would grant you a higher level of instant dividend income compared to peers.