Thomas Barwick

People love to let their imagination run wild, and no sector allows for visualizing a fantastical future like Technology. Flying cars and robots cleaning my bathroom? Sign me up. We all know it’s never that simple, but for those who believe longer-term in disruptive technologies that can enable those futures, there are funds to consider. The ALPS Disruptive Technologies ETF (NYSEARCA:DTEC) is designed to invest in those companies at the forefront of technological revolution and innovation.

DTEC seeks to replicate the performance of the Indxx Disruptive Technologies Index (IDTEC) before fees and expenses. Launched on December 28, 2017, DTEC’s goal is to provide investors with exposure to companies that are pioneering, as per the name, disruptive technologies. The fund isn’t a big one, with net assets of just over $100 million. The ETF’s strategy revolves around identifying and investing in companies that are leveraging new digital forms of production and distribution, aiming to disrupt existing markets and value networks, and displacing established market leaders.

ETF Holdings

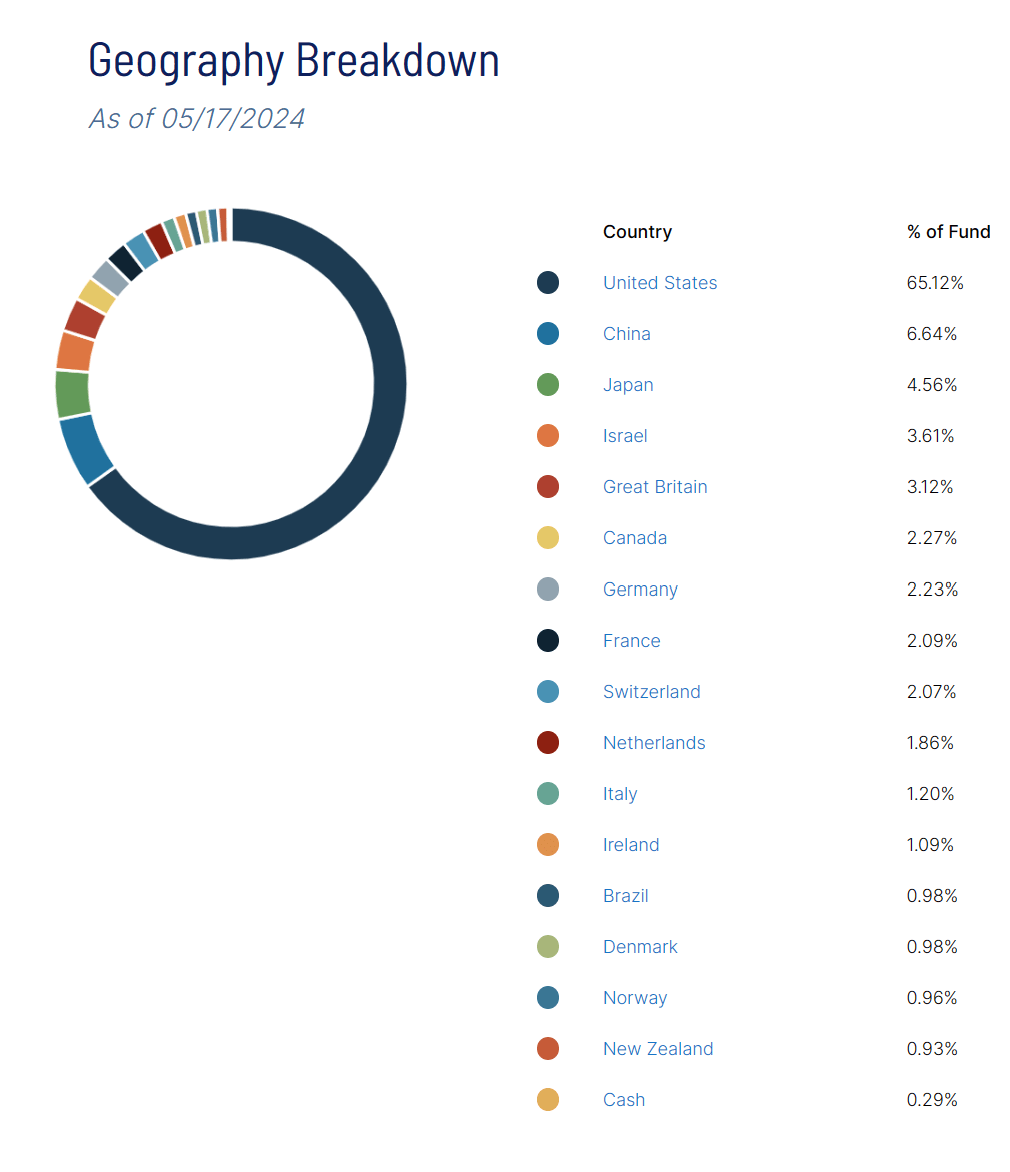

The holdings are fairly unique here when you look into them. No position makes up more than 1.71% of the fund, and you actually have a nice blend of global exposure.

alpsfunds.com

To that end, one of the big plusses when it comes to DTEC in my view is that global exposure. While still primarily a US allocated fund at 65%, I’m a fan of the other positions outside the US the strategy takes.

alpsfunds.com

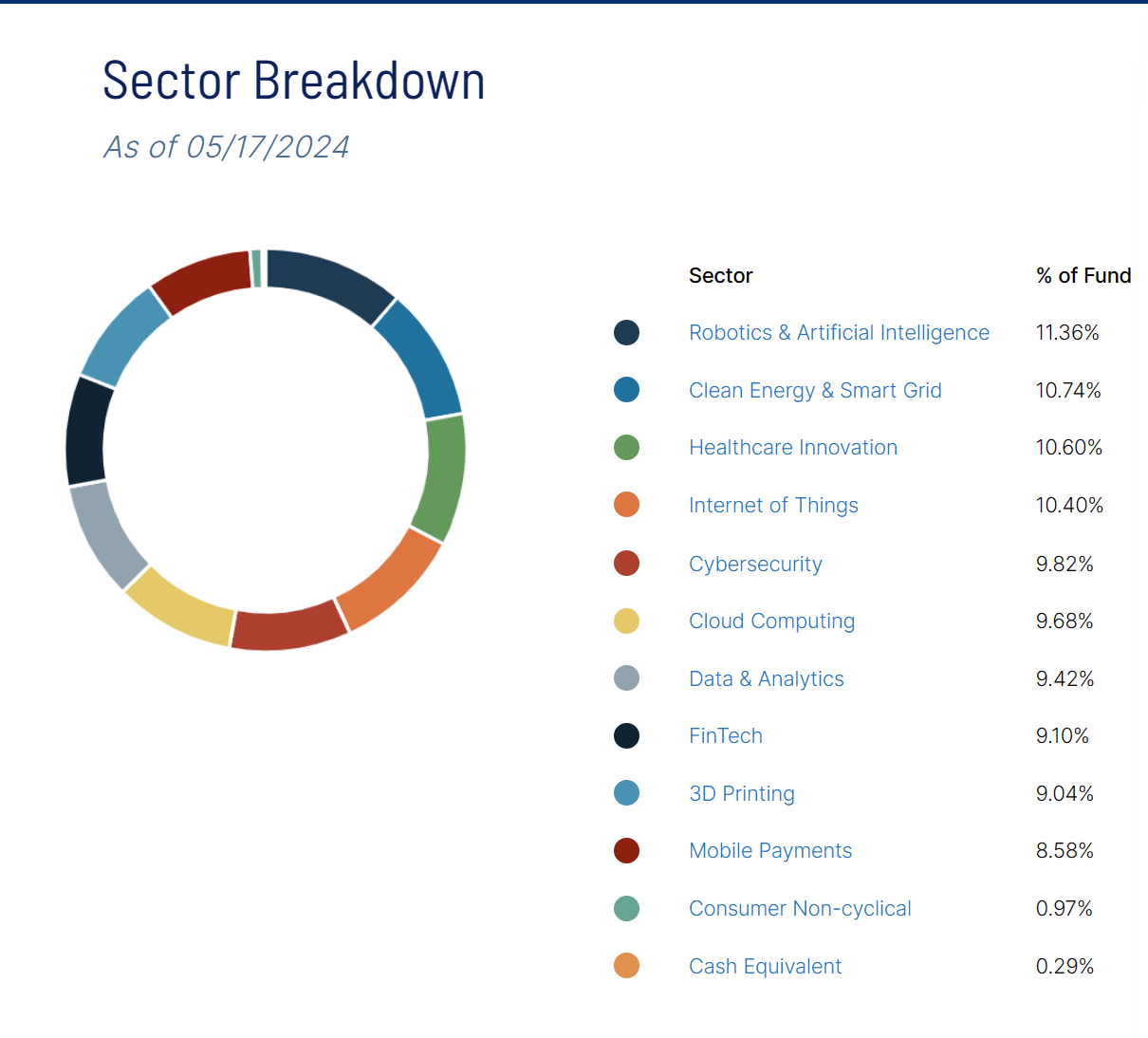

Sector Composition and Weightings

When we break down the holdings by industry/sector type, we find a nice mix of categories that stir the imagination over what the future could look like.

alpsfunds.com

Robotics and AI take the largest allocation at 11.36% with Clean Energy & Smart Grid (which are needed longer term for AI) coming in as the second largest overall allocation. If I were a big believer in investing in disruptive technologies, the categorizations here would only further my conviction that this is a fund to play that.

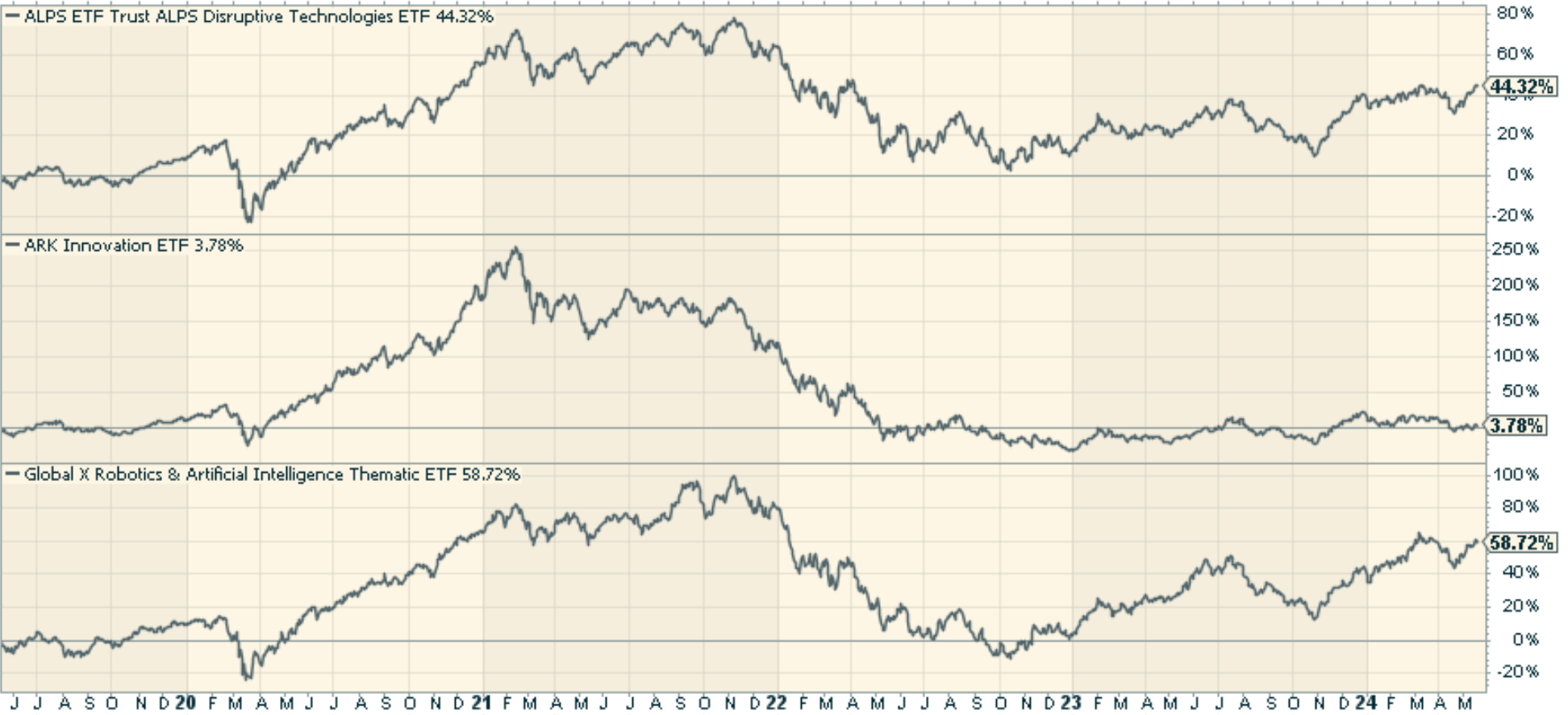

Peer Comparison

Comparable ETFs include the ARK Innovation ETF (ARKK) and the Global X Robotics & Artificial Intelligence ETF (BOTZ). ARKK focuses on companies that are poised to benefit from advancements in genomics, automation, energy storage, and fintech, while BOTZ targets firms involved in robotics and AI. While ARKK has gotten a lot of media attention for its high-conviction bets on disruptive innovators, it also carries higher volatility. BOTZ, on the other hand, offers a more concentrated exposure to robotics and AI. DTEC’s approach across multiple disruptive technologies is more diversified and broader, which I think can come in handy longer-term, since you never really know except with hindsight which companies will come out on top.

DTEC has outperformed ARKK solidly, but underperformed BOTZ due to DTEC’s more diversified approach. Overall, I would prefer DTEC to either of these funds for now, given the nice mix of companies and global exposure.

stockcharts.com

Pros and Cons of Investing in Disruptive Technologies

There’s some notable positives here. First, it provides exposure to high-growth companies that are at the forefront of innovation. These companies have the potential to deliver substantial returns as they reshape industries and create new markets. Second, disruptive technologies often lead to increased efficiency and productivity, driving economic growth and improving quality of life. Finally, investing in this theme aligns with long-term trends such as digital transformation, automation, and sustainability.

However, there are also inherent risks associated with investing in disruptive technologies. The rapid pace of innovation can lead to significant volatility, as companies may face challenges in scaling their technologies or navigating regulatory hurdles. Moreover, the competitive landscape is constantly fluid and changes with new entrants and technological advancements posing threats to established players. And let’s face it – many of these companies are still having a hard time recovering from their 2021 respective peaks.

Conclusion

I think the ALPS Disruptive Technologies ETF (DTEC) is a good fund for those seeking exposure to companies at the cutting edge of technological innovation. With a diversified portfolio that covers multiple sectors and a focus on high-growth companies, DTEC provides a balanced approach to investing in disruptive technologies, and with global exposure, over time, should help increase risk-adjusted returns.

Enjoyed this article? Sign up for our newsletter to receive regular insights and stay connected.