Introduction

We last covered iShares Russell Top 200 Growth ETF (NYSEARCA:IWY) in March 2023. At that time, we noted that the valuation is still expensive relative to the historical average. Since the article was written over a year ago, we think it is time for us to look at this fund again. In this article, we will analyze IWY and also compare it with other similar growth funds. We will provide our insights and recommendation.

ETF Overview

IWY owns a portfolio of the top 200 growth stocks in the Russell 1000 index. The fund includes almost all large-cap stocks with strong growth characteristics. IWY also has a high exposure to technology stocks. These two factors helps it to outperform the S&P 500 index and other growth funds. IWY has an expense ratio of 0.2%. This is not low relative to broader market funds that typically have expense ratios below 0.1%. Its valuation is not low but slightly above the historical average. Therefore it is not extremely expensive either. Given its long-term growth characteristics, we think it is safe to own this fund in the long run. However, conservative investors wanting a wider margin of safety may wish to wait for a pullback before initiating a position.

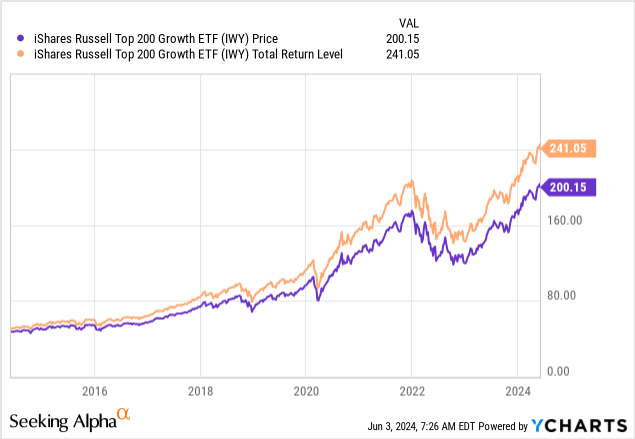

YCharts

Fund Analysis

IWY has done really well in the past 2 years

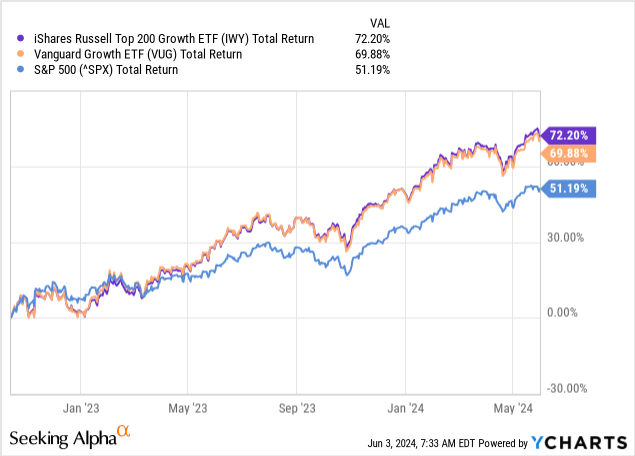

IWY had a spectacular run since reaching the cyclical low in October 2022. In fact, the fund has already surpassed the previous peak reached in early 2022. Since the cyclical low, IWY delivered a total return of 72.2%. This was much better than the broader market, namely the S&P 500 index’s 51.2%. It has also outperformed against its peer fund, the Vanguard Growth ETF (VUG). As can be seen from the chart below, IWY’s total return was 2.3 percentage points higher than VUG’s 69.9%.

YCharts

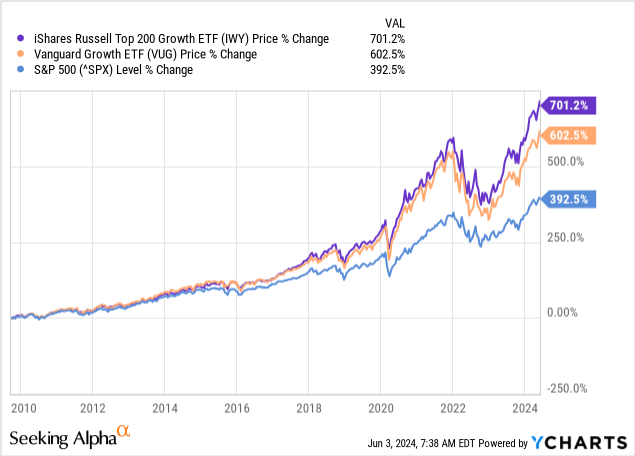

Given that the difference between the performances of IWY and VUG was only 2.3 percent, some may wonder whether IWY’s long-term performance still beat VUG. The answer is yes. As can be seen from the chart below, IWY’s total return since late 2009 was 701.2%. This was nearly 100 percentage points higher than VUG’s 602.5% and over 300 percentage points higher than the S&P 500 index’s 392.5%.

YCharts

The fund has a high exposure to technology sector

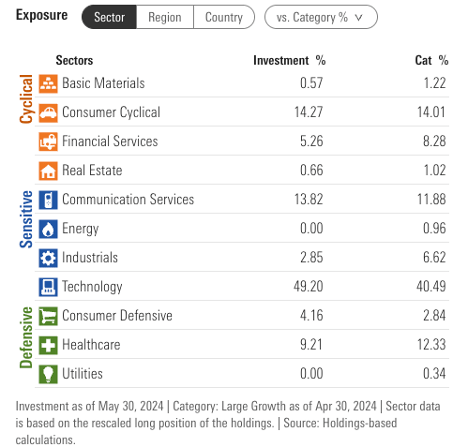

Why was IWY able to outperform its peers? Will this outperformance continue in the future? To answer the first question, we think there are two primary reasons. The first was due to IWY’s exposure to technology stocks. Below is a table that shows the allocation of different sectors in IWY’s portfolio. As can be seen from the table below, the technology sector represents about 49.2% of IWY’s total portfolio. This exposure is 2.2 percentage points higher than VUG’s 47% and much higher than the S&P 500 index’s 30.2%.

Morningstar

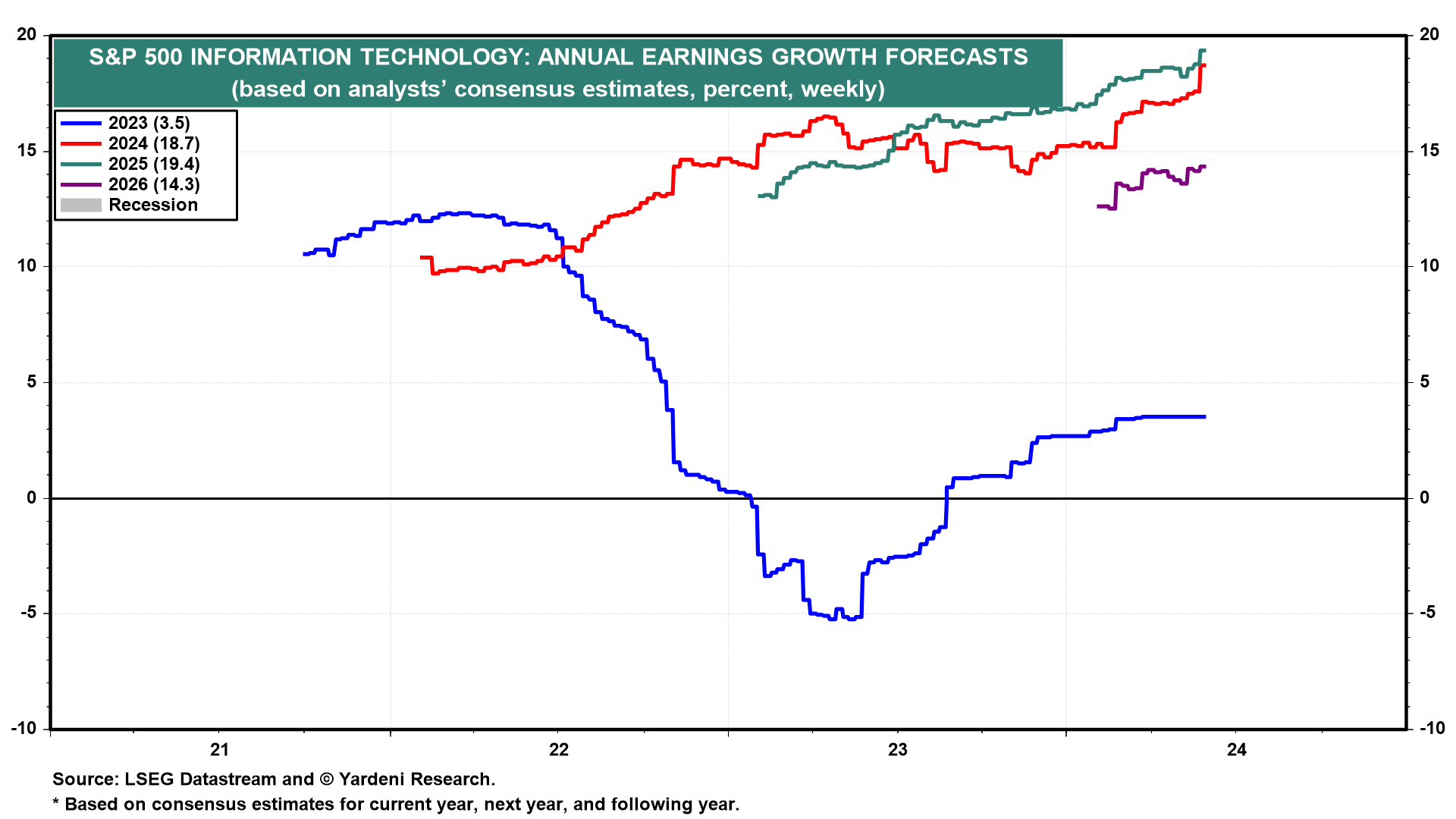

This exposure is critical as the technology sector has been one of the fastest growing sectors in the past few decades. This trend is likely going to continue in the foreseeable future as the industry is riding on the wave of several important megatrends such as artificial intelligence, cloud computing, AR/VR, Internet of Things, etc. Below is a chart that shows the consensus average EPS growth rates for technology stocks in the S&P 500 index through 2026. As can be seen from the chart, the average earnings growth forecasts for 2024 and 2025 are all in the high teens.

Yardeni Research

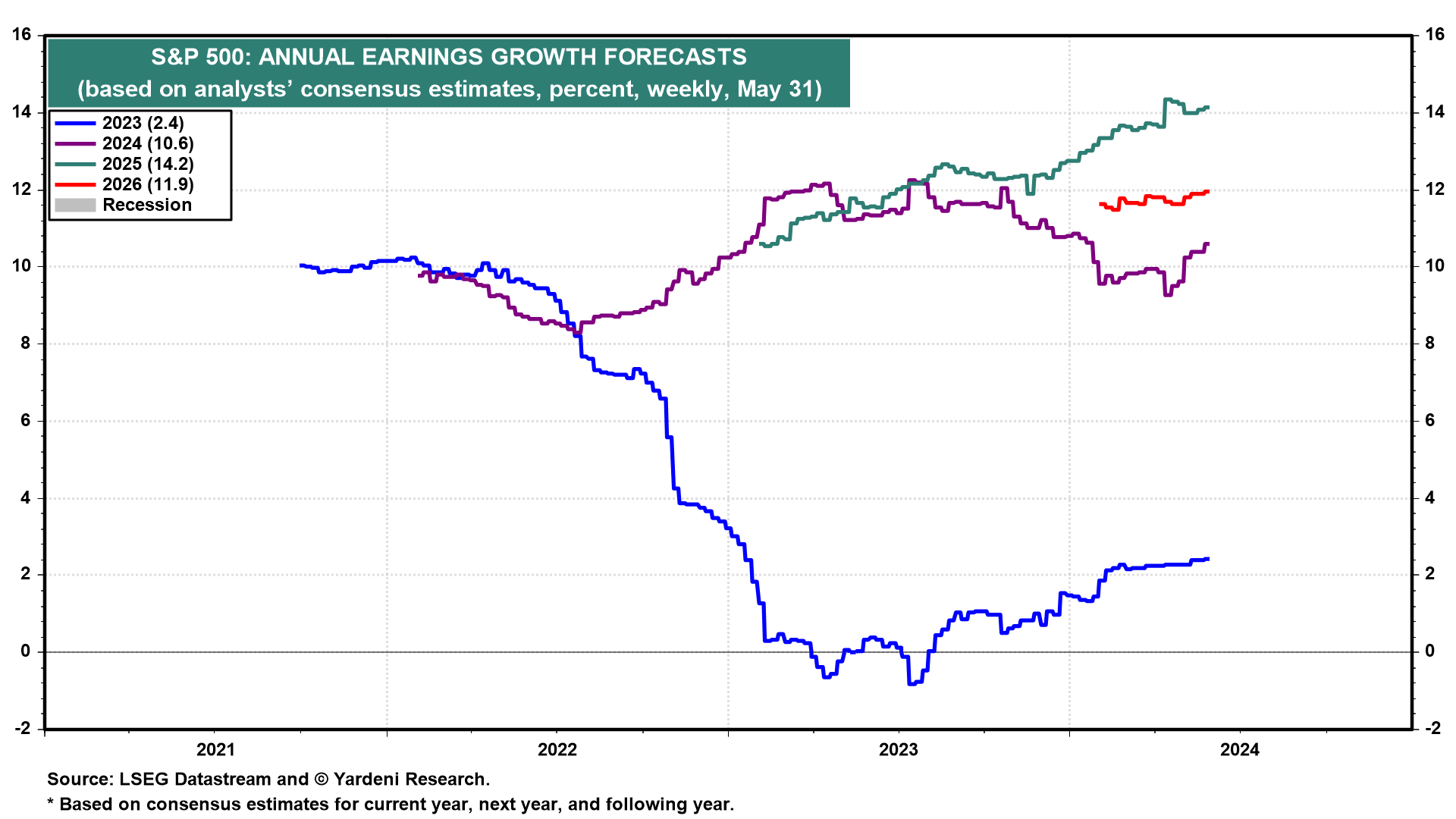

The technology sector’s growth rate is much better than the broader market. As the chart below shows, the consensus earnings growth forecasts for the S&P 500 index in 2024 and 2025 are in the low double-digits, about 5 percentage points lower than the technology sector. Therefore, it is likely that IWY’s high exposure to technology stocks will help it deliver better performance than the S&P 500 index.

Yardeni Research

IWY’s exposure to large-cap stocks is also very high

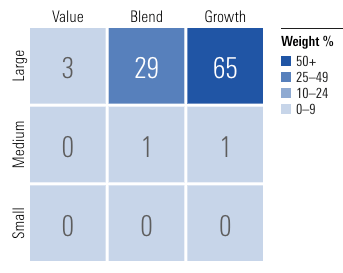

Another factor that has impacted IWY’s performance is its focus on large-cap stocks. Below is a stock-style chart of IWY. As can be seen from the chart, nearly all of IWY’s portfolio are large-cap stocks. In fact, only 2% of IWY’s portfolio belong to stocks in the mid-cap space. In contrast, VUG and the S&P 500 index’s exposure to large-cap stocks are about 89% and 81% respectively.

Morningstar

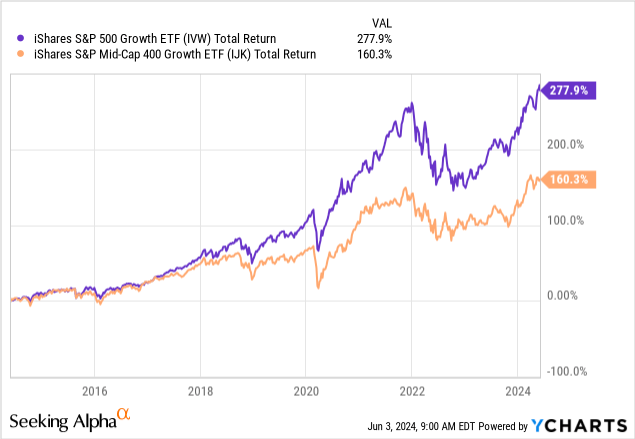

IWY’s focus on large-cap stocks is very beneficial as large-cap stocks tend to perform relatively well against mid-cap stocks in the long run. To illustrate our point, we invite readers to look at the chart below. This chart compares two growth funds, iShares S&P 500 Growth ETF (IVW) and iShares S&P Mid-Cap 400 Growth ETF (IJK). IVW has a tilt towards large-cap stocks and IJK focuses on mid-cap stocks. As the chart below illustrates, IVW’s total return of 277.9% in the past 10 years was much higher than IJK’s 160.3%.

YCharts

We think the reason there is a gap between mid-cap and large-cap funds is due to the fact that successful mid-cap stocks will eventually become large-cap stocks and they will not stay in the mid-cap space forever. Therefore, even if mid-cap ETFs include some really excellent stocks, these funds cannot enjoy the full benefit of the growth of these successful stocks as many of these stocks will eventually graduate from the mid-cap space. Hence, we think this is one major reason why mid-cap ETFs usually underperform large-cap ETFs in the long run.

IWY’s valuation is not cheap

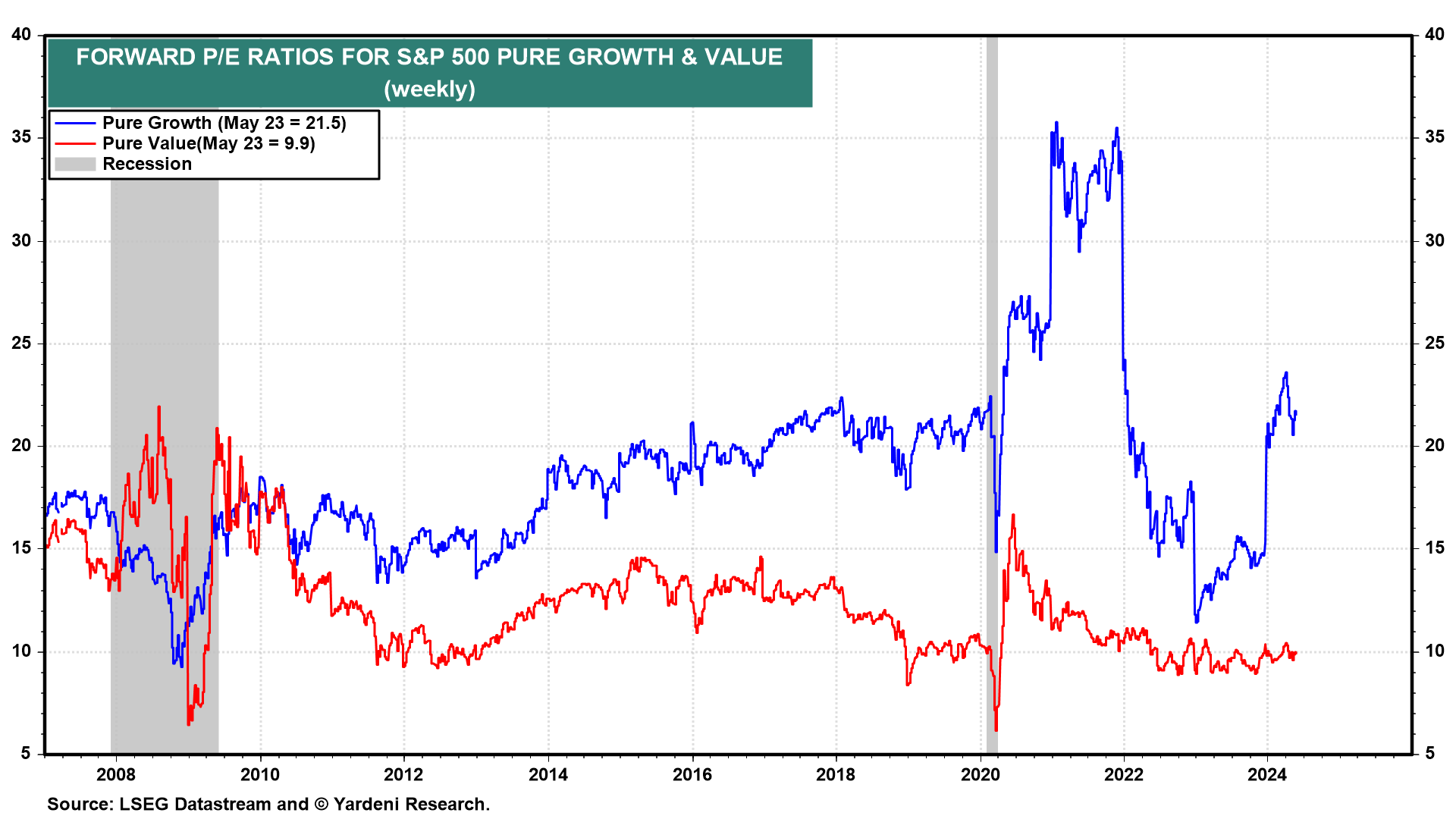

Since the Russell Top 200 index and the S&P 500 index both consists of large-cap stocks, there is quite a bit of overlap between the two. Therefore, we will look at the forward P/E ratio of the S&P 500 growth stocks in the past 10 years. As can be seen from the chart below, the average forward P/E ratio for growth stocks is currently at 21.5x. This is slightly above the average 10-year forward P/E ratio of about 20x. Therefore, the average 21.5x valuation of growth stocks is definitely not cheap, but also not extremely expensive. It is slightly above the average.

Yardeni Research

Investor Takeaway

IWY has the potential to outperform the S&P 500 index and VUG in the long run given its strong growth characteristic. Therefore, this is definitely a good fund to own for the long run. However, its valuation is not cheap. Conservative investors may want to wait for a pullback before initiating a position.

Additional Disclosure: This is not financial advice and that all financial investments carry risks. Investors are expected to seek financial advice from professionals before making any investment.

Enjoyed this article? Sign up for our newsletter to receive regular insights and stay connected.