The consumer is dead. Long live the consumer. Let’s face it – as long as there is a credit card limit that hasn’t been hit, consumers will keep spending and be a big driver of the economy. Sure – unemployment rising should impact them, but who knows when. Consumer Discretionary stocks have been significant underperformers relative to the S&P 500 since 2022, but perhaps the sector is now due for leadership. If you’re in that camp, you may want to consider the Fidelity MSCI Consumer Discretionary Index ETF (NYSEARCA:FDIS).

It has 283 holdings and has total AUM of $1.456 billion. FDIS uses representative sampling technique to track the MSCI USA IMI Consumer Discretionary 25/50 Index. Now to be clear – I’m concerned about an economic slowdown and strength of the consumer overall, and the sector isn’t cheap with a P/E ratio of 24.89x, but I’d rather be in this than Tech.

A Look At The Holdings

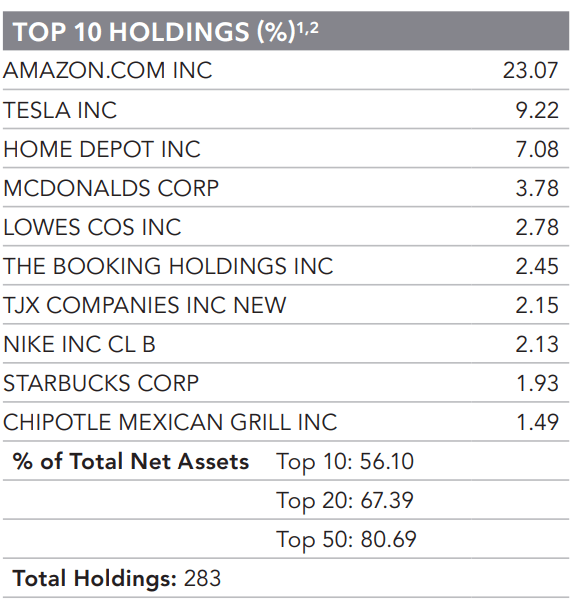

This is a fairly top-heavy fund. Amazon makes up 23% of the fund overall, followed by Tesla at 9.22% and Home Depot at 7.08%.

fidelity.com

The fund is definitely top-heavy, with the top 10 positions making up 56% of the portfolio. You certainly know all of these stocks, as they range from Amazon to TJX to Starbucks and Chipotle. Economic slowdown? Sure – these companies will see decreased revenue. Economic boom and/or rising credit card limits? Spend spend spend.

Sector Composition and Industry Diversification

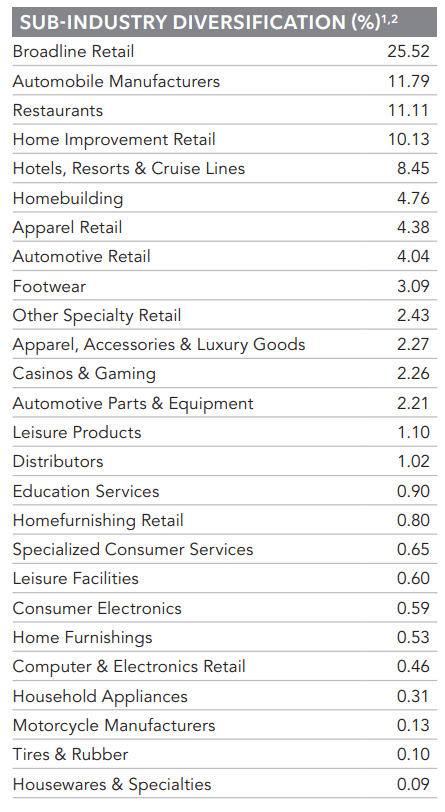

It always amazes me how many sub-industries exist in the Consumer Discretionary catch-all. Retail makes up a quarter of the fund, followed by Automobile Manufacturers and Restaurants.

fidelity.com

This furthers the point that the sector is going to be very sensitive to the broader economic outlook, as those top 3 industry groups will be among the first to get hit if unemployment really kicks in.

Peer Comparison

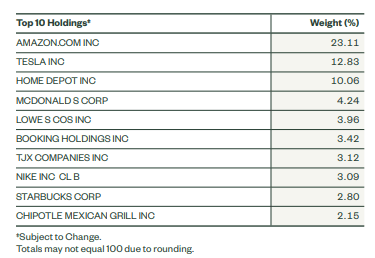

The fund that is closest to this for comparison purposes is the Consumer Discretionary Select Sector SPDR Fund (XLY). This fund delivers more or less the same consumer discretionary exposure as FDIS. The top 10 positions and weightings are pretty much identical.

ssga.com

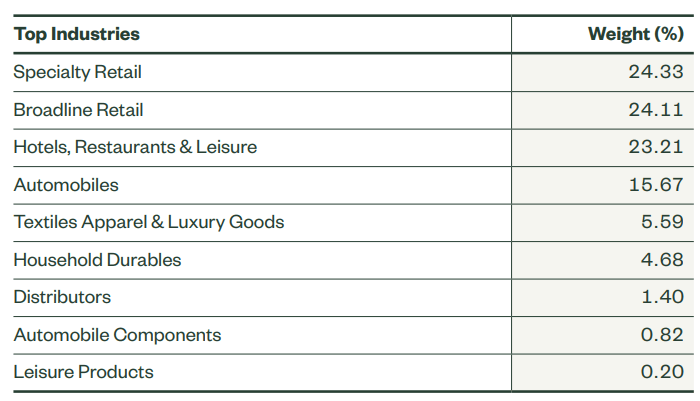

The real difference between the two funds lies in the aggregate industry makeup. Retail and automobiles make up a larger portion of XLY.

ssga.com

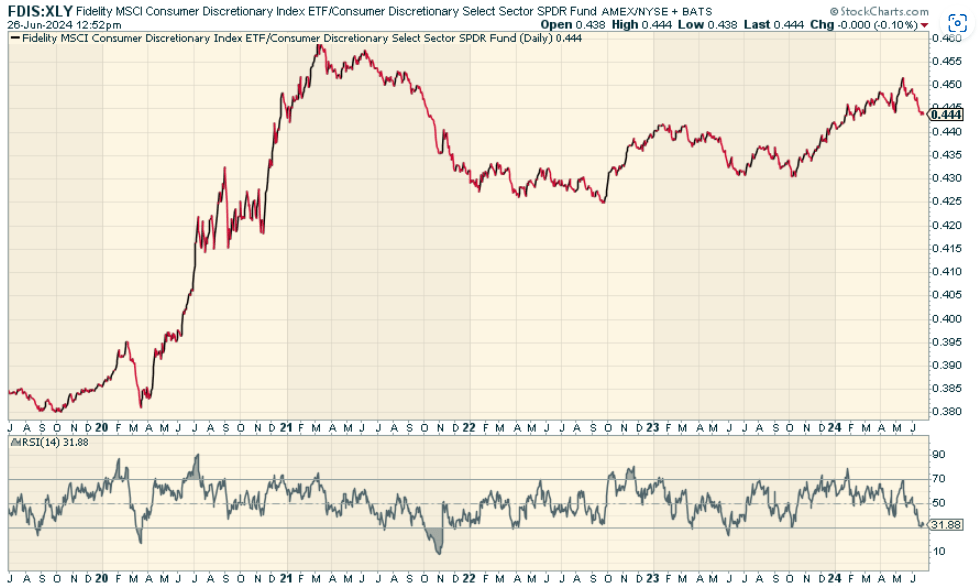

So which is the better fund? As is usually the case, it depends. When we look at the price ratio of FDIS to XLY, we find that since the 2020 low, FDIS has substantially outperformed, but on a relative basis the two funds are neck and neck to relative to late 2021. I’m not sure why one would choose FDIS over XLY, other than perhaps because of some relative bullishness on industry overweights that XLY has relative to FDIS.

stockcharts.com

Pros and Cons

Want to bet on the consumer? Then bet on discretionary stocks, and do so broadly with a fund like FDIS. It has not performed anywhere near as well as other cyclical parts of the stock market, which is something I actually like on a potential mean reversion cycle where it goes either up more or down less than broader markets. Consumers are still spending, people are still eating out, and yes, credit card debt keeps on rising as a result.

The risk is the business cycle, and Amazon, which makes up such a large portion of the fund. FDIS’s constituents might lag if consumers slow their spending during an economic contraction or turn more-cautious. The Amazon risk is big just because it will have an outsized impact on total return (and yes, I obviously know how dominating Amazon is). It’s a question of portfolio construction, in my view, which makes this not ideal to me.

Conclusion

Those interested in targeted exposure to the consumer discretionary sector and to the risks and potential rewards of changing consumer tastes would likely appreciate Fidelity MSCI Consumer Discretionary Index ETF. But that exposure does come with more volatility and risk to the business cycle, consumer confidence and industry disruption. I like the fund overall though, prefer it over other sectors like Tech, and think it’s worth considering so long as the Fed has indeed stuck the soft landing, and we avoid a recession.

Anticipate Crashes, Corrections, and Bear Markets

Are you tired of being a passive investor and ready to take control of your financial future? Introducing The Lead-Lag Report, an award-winning research tool designed to give you a competitive edge.

The Lead-Lag Report is your daily source for identifying risk triggers, uncovering high yield ideas, and gaining valuable macro observations. Stay ahead of the game with crucial insights into leaders, laggards, and everything in between.

Go from risk-on to risk-off with ease and confidence. Subscribe to The Lead-Lag Report today.

Enjoyed this article? Sign up for our newsletter to receive regular insights and stay connected.