Summary

I am positive on Paymentus (NYSE:PAY). My summarized thesis is that PAY offers a solution that disrupts a large market, and with just less than 3% market share today, the growth runway is extremely long. The strong value proposition of a modern payment platform to billers and consumer demand for flexible payments should continue to drive adoption of PAY.

Company overview

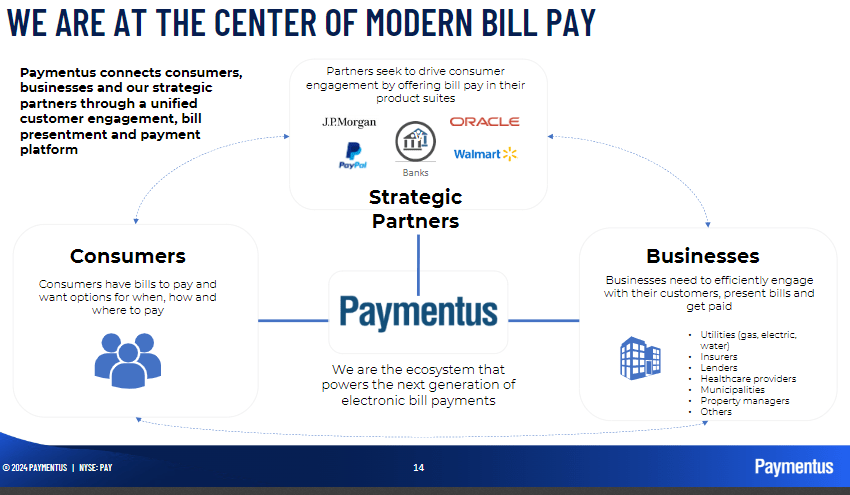

PAY provides cloud-native payment solutions that is utilized by over 2,200 businesses. Its platform basically connects billers to consumers via multiple preferred payment types and channels. In order to achieve all this, PAY leverages its own Instant Payment Network [IPN], which connects its integrated billing, payment, and reconciliation capabilities to its biller network. As of 1Q24, PAY processed 135 million transactions.

Payments is a large market

PAY competes in a massive market that enables it to continue growing for a very long time. Based on Datos Insights (source: PAY investor presentation in April), billers in the US paid 16.8 billion in bills annually. Based on PAY FY23 total number of bills (~458 million), this implies that PAY only has less than 3% of market share, and I believe PAY can continue to capture share because of the industry dynamics.

Billers in the US are generally concentrated in industries like utilities, government, insurance, and banks. These industries have generally been slower to adopt modern bill payment technologies due to multiple reasons, including high switching costs, lengthy implementation timelines, regulatory concerns, etc. Consequently, billers still use labor-intensive, error-prone, and time-consuming manual processes to reconcile transactions, while consumers mostly use antiquated payment methods like paper checks to pay their bills. I think PAY is in a good position to capture a portion of a mostly untapped market opportunity as the demand for flexible payment solutions among consumers grows and billers learn about the advantages of modern platforms.

Putting things into perspective, according to the report by Datos Insights, payments made through checks neared 1.9 billion in 2023, which represented ~11% of total bills in the US (more than 3x PAY’s market share). I have high confidence that this entire 1.9 billion of transactions are going away in the near-to-medium term, and these are market shares up for grabs for players like PAY.

Partnership is a competitive advantage

PAY

Given that the market is so huge, having the right go-to-market strategy to achieve maximum distribution is key. In this aspect, I believe PAY has a solid strategy in place. This strategy revolves around PAY’s IPN, which is a proprietary bill payment ecosystem that connects billers with PAY’s integrated billing and automated reconciliation capabilities and enables consumers to pay bills through their preferred channel. Giving consumers the ability to pay using their preferred channel is a huge advantage because it significantly reduces adoption friction (e.g., consumers don’t need to download another app, they don’t need to key in their credit card details again, etc.). Some of these channels include PayPal (PYPL), the JPMorgan Chase app (JPM), in-store at Walmart, etc.

This results in a win-win situation for all stakeholders: billers save time and money, while consumers enjoy more convenience and flexibility in paying their bills. IPN partners see increased engagement, and collection rates improve. There are a number of reasons why I believe IPN adoption will drive PAY’s transaction growth over the long term. First, it allows it to handle payments for billers who aren’t directly connected to the PAY system. Furthermore, it expands the reach of PAY’s platform by leveraging key partners and driving customer acquisition.

In particular, I believe that partnerships with PayPal and JPMorgan Chase provide PAY with long-term growth opportunities. For PYPL (427 million accounts as of 1Q24), it was a founding partner of the IPN, which it joined to drive further engagement with its users by gaining exposure to recurring subscription-like bill payments. This makes sense for PYPL because it would increase its users’ payment frequency (which increases its revenue because of its take rate model). As such, I expect this partnership relationship to last for a long time. As for JPM, PAY is the preferred provider powering its Digital Bill Payment solution. In my opinion, this is a huge opportunity that will drive growth for PAY in the medium to long term, especially considering the JPM global reach. Additionally, given the size and scope of JPM’s business clientele, I also think it provides PAY with more exposure and access to larger billers, a market segment that management is attempting to further penetrate (it also makes sense economically as large billers will have more transactions that have a high incremental margin for PAY). Furthermore, I think that by tapping into JPMorgan’s worldwide client base, PAY will be able to expand internationally, thus extending its growth runway in the long run. As a last point, I think the partnership strengthens PAY’s platform reputation, as it basically means that JPM has verified and trusted PAY.

Valuation

Source: Author’s calculation

I believe PAY is worth 31% more than the current share price of $23. My target price is based on FY26 $1.07 billion in revenue and 2.5x forward revenue.

Revenue bridge:

There should be no issues with PAY continuing to grow by at least 20% moving forward, given the large TAM, strong value proposition, and partnership strategy. Management also has a solid track record of delivering against its guidance (my FY25 estimate is based on management guidance). In fact, PAY has beaten its quarterly revenue guidance by 4.5% on average over the past five quarters.

Valuation justification:

PAY deserves to trade at a 2.5x forward revenue multiple, a discount to its historical average because of the lower growth profile today. Also, when compared to peers, I do expect PAY to trade at a discount given its lower margin profile. For instance, despite having mid-teens revenue growth profiles (~half of PAY), Paylocity (PCTY) and Paycom Software (PAYC) trade at >4x forward revenue multiples, which I believe is due to the higher EBITDA margins (PCTY at 19% and PAYC at 34%). PAY’s EBITDA margin currently stands at low teens as of 1Q24, and hence, because of this margin gap, PAY valuation is likely to stay at this level (similar to where Flywire Corp is trading at: 2.5x forward revenue with >20+% growth profile but negative EBITDA margin).

Investment Risk

Consolidation in the market poses a threat to PAY if its larger, well-capitalized competitors start to introduce modern capabilities that close the solution gap with PAY. In addition, PAY depends on its strategic partners to bring in new billers through referrals, should any of the major partnerships end, it could be a major hit to PAY growth outlook.

Conclusion

My positive view on PAY is because of its long growth runway in a large market. PAY offers a modern payment platform that addresses the need of both billers and consumers. Given that it has less than 3% market share, there is significant room for growth. PAY’s IPN is a key differentiator, facilitating transactions for unconnected billers and driving customer acquisition through partnerships. Management also has a good track record of hitting guidance, as such, I believe 20% growth in FY25 and ahead is possible.

Enjoyed this article? Sign up for our newsletter to receive regular insights and stay connected.