Overview

The world’s ecological challenges are often referred to as the twin crises: climate change and biodiversity loss. According to the World Bank, “the twin crises of climate change and biodiversity loss are interlinked: climate change could result in significant biodiversity loss, and such biodiversity loss will impact the climate change dynamic.”[1]

The compounding health and environmental problems we are facing globally warrants quick action and unparalleled investment. Increasing education is critical to understand not only the risks we are facing, but also the solutions that are in reach to solve our twin crises. These facts highlight the risks:

- According to PwC, roughly 55% of the world’s GDP is exposed to material nature risk[2].

- It is estimated that roughly 1 million of global species are at risk of extinction[3].

- It’s not just animals: plants face similar risks as animal species. Most notable to the healthcare, pharmaceutical, and insurance industries, researchers estimate that at least one important undiscovered drug is lost every two years from biodiversity loss[4].

It is imperative that we understand the global economic commitment it will take to reduce the physical impacts of climate change and preserve the existing ecosystems, given their co-dependence. In this paper, we:

- Define the nine planetary boundaries designed to keep the planet in balance.

- Share the key frameworks and standards in place that drive the fight against climate change.

- Identify the vehicles and tools being used to catalyze investments in nature and biodiversity.

Distinguishing Between Nature and Biodiversity

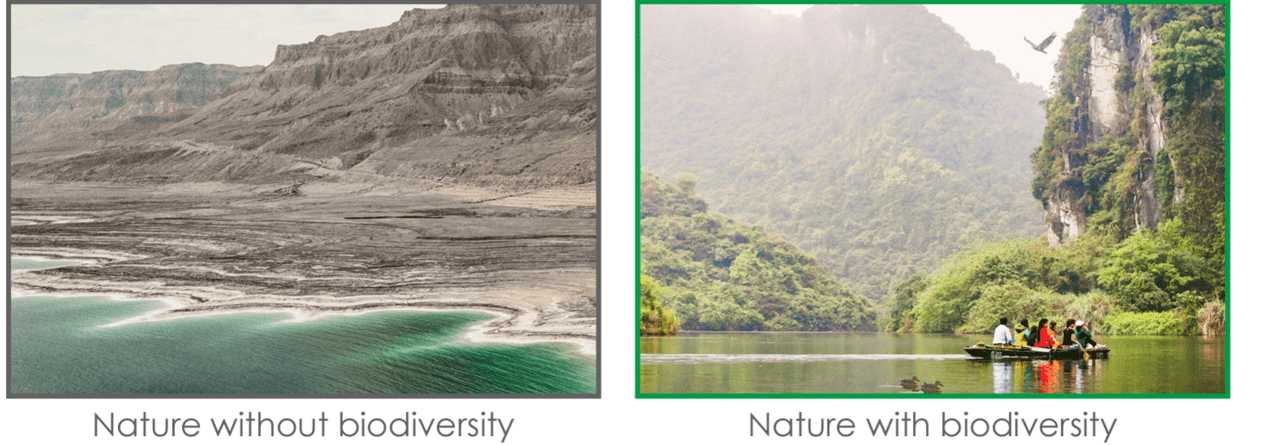

Nature and biodiversity are linked but distinct concepts. Nature is all life on Earth together with the geology, water, climate and all other inanimate components that comprise our planet. Biodiversity, meanwhile, concerns the subset of nature involving all living things.[5]

Source: http://www.cbd.int

Biodiversity is the diversity of life that underpins the ability to make life possible. Without it, we would not be able to function as a society. Biodiversity loss is one of the most significant risks in our lifetime since it is directly tied to economic activity including our food supply, medicines and jobs.

The Nine Planetary Boundaries

In 2009, 28 internationally renowned researchers identified and quantified a set of nine planetary boundaries within which humanity and human society can continue to develop and thrive. If we cross these limits, abrupt or irreversible environmental changes can occur with serious consequences for humankind.[6] These planetary boundaries are interconnected and mutually reinforcing, highlighting the complex interactions and feedbacks within the Earth system. Exhibit 1 provides an overview of each of the boundaries.

Exhibit 1: The Nine Planetary Boundaries

| Category | Description |

| Climate Change | Refers to the concentration of greenhouse gasses, particularly carbon dioxide (CO2) in the atmosphere. |

| Biosphere Integrity | Relates to the focus on biodiversity and the rate of species extinction and the loss of biodiversity caused by human activities. |

| Land System Change | Relates to the conversion of natural habitats, such as forests, grasslands, and wetlands, into agricultural land, urban areas, or other human-dominated landscapes. |

| Freshwater Change | Refers to the extraction and consumption of freshwater resources from rivers, lakes, aquifers, and other sources. |

| Biogeochemical Flows | Relates to the release of synthetic chemicals, pollutants, and waste into the environment, including air, water, and soil. |

| Ocean Acidification | Refers to the increase in acidity of seawater due to the absorption of carbon dioxide from the atmosphere. |

| Nitrogen and Phosphorus Cycles | Relates to how the nitrogen and phosphorus cycles are crucial for ecosystem functioning, agricultural production, and human well-being, but human activities are altering their natural balance and impacting environmental degradation and biodiversity loss. |

| Atmospheric Aerosol Loading | Refers to the accumulation of particulate matter and aerosols in the atmosphere from human activities. |

| Stratospheric Ozone Depletion | Refers to the depletion of the ozone layer in the Earth’s stratosphere due to the release of ozone-depleting substances, such as chlorofluorocarbons (CFCs) and halons. |

Taskforces, Frameworks and Standards

To solve the issues associated with climate change, we must define goals and objectives, and then measure progress toward these. Below are a number of key taskforces, frameworks and standards that provide this structure.

- Taskforce on Nature-Related Financial Disclosures (TNFD) – The TNFD provides disclosure recommendations for companies to assess their assets, vulnerabilities, dependencies, and overall opportunities for halting or reversing biodiversity loss. TNFD is broken down into four components: governance, strategy, impact & risk management, and metrics & targets.

- Kunming-Montreal Global Biodiversity Framework (GBF) – Dubbed as the “Paris Agreement for climate”, the GBF sets four goals for 2050 and 23 action-oriented milestone targets for 2030 to halt and reverse biodiversity loss. The GBF is the newest, best-in-class framework for outlining ways in which companies and countries alike can restore, halt, and reverse biodiversity loss.

- GRI Biodiversity Standard – The GRI is arguably one of the most comprehensive ESG standards, with a history spanning well over two decades. The newest Biodiversity Standard describes the reporting processes for companies in various industries as it relates to their interactions with natural resources and provides sample metrics.

- Science-Based Targets Network (SBTN) – Similar to the Science-Based Targets Initiative (SBTi) that aids corporations in setting commitments towards net-zero, the SBTN is the first of its kind framework that maps out ways in which companies can set targets for assessing their both risks and positive contributions to restoring nature.

- Carbon Disclosure Project (CDP) – CDP is one of the most established global environmental disclosure non-profits that compartmentalizes reporting into three segments, climate change, forests, and freshwater. Known to have the most widely reported framework, CDP is also rooted in transparency by allowing the public to have full access to information reported by thousands of companies, while also providing company scores.

Tools to Catalyze Investments in Nature and Biodiversity

The financing needs associated with addressing climate change are staggering, fortunately there has been innovation in this area. The tools highlighted below can be broad-based and apply across sectors, or be tied to a specific area of focus.

- Biodiversity Credits – All Sectors – Biodiversity credits are a market-based mechanism designed to mitigate the negative impacts of development projects on biodiversity and ecosystems. These credits function similarly to carbon offsets but focus specifically on biodiversity conservation and restoration. Biodiversity credits provide a mechanism for balancing economic development with biodiversity conservation objectives, enabling projects to proceed while minimizing or offsetting negative environmental impacts. However, similar to the difficulties that carbon credits face, biodiversity credits have challenges regarding the integrity, monitoring, and verification of such credits.

- Biodiversity-Linked Bonds – All Sectors – Biodiversity-linked bonds represent an innovative financing mechanism for mobilizing private capital towards biodiversity conservation and sustainable development goals. By aligning financial incentives with biodiversity outcomes, these bonds have the potential to drive positive environmental impact while providing investors with financial returns. However, the success of biodiversity-linked bonds depends on robust governance frameworks, transparent reporting standards, and effective monitoring and verification mechanisms to ensure that biodiversity objectives are achieved, and investor interests are protected.

- Investing in Nature-Based Solutions – All Sectors – Companies can invest directly in nature-based restoration projects, such as reforestation, afforestation, wetland restoration, and habitat conservation initiatives. These projects contribute to biodiversity conservation, carbon sequestration, water management, and ecosystem restoration while providing social and economic benefits to local communities.

- Data Tools and Insights – All Sectors – Alternative data sources have been a growing area within the investment landscape, and this applies to sustainability related investment as well. Alternative or non-traditional data is important in evaluating and monitoring investment decisions and can be broken into the three categories described below.

Products or Service Economic Classification Data: Before any actions are taken to invest in biodiversity and nature, investors need to identify the companies that are engaged in nature-positive revenue generating activities. Many countries are establishing their own classifications of sustainable activities, such as the EU Taxonomy and Colombia’s Green Taxonomy. Syntax is uniquely positioned as a data provider to capture innovative companies that are engaged in nature and biodiversity conservation.

Geospatial and Natural Resources Data: An essential feature of protecting biodiversity is measuring the existing species, landscape, and resources that are present within the ecosystem today.

Risk Management Data: Paired with both datasets mentioned above, biodiversity and nature investing is still not holistically understood. It is essential to incorporate risk assessments into the equation in order to quantify losses and potential benefits.

Biodiversity Net Gain Targets – Real Estate, Viable for More Sectors

A newly adopted mode of enhancing biodiversity is setting biodiversity net gain targets. Most applicable to the real estate sector, or those that own and manage buildings, biodiversity net gain targets are goals set by organizations to achieve a measurable increase in biodiversity as a result of development or land use activities. The concept of biodiversity net gain involves ensuring that the biodiversity value of a site is maintained or enhanced following development, rather than simply mitigating biodiversity losses.

Nature Debt Swaps – Financials

Banks are fundamental to closing the financing gaps for protecting nature and biodiversity loss. Nature debt swaps are financial mechanisms designed to address both sovereign debt and conservation goals by restructuring a country’s debt in exchange for commitments to invest in nature conservation and sustainable development projects.

Summary

In this paper, we highlight the frameworks that have been developed to address the twin crises of climate change and biodiversity loss. The nine planetary boundaries speak to what needs to be protected for the planet to remain in balance from an ecological perspective. The taskforces, frameworks and standards discussed help define goals and objectives and measure outcomes, which is crucial to measuring progress against the twin crises. Lastly, we touched on some of the innovative financing options which provide access to capital to fund projects which reduce our impact on the environment. While these frameworks will not solve the twin crises alone, they provide critical structure necessary to power real solutions.

Footnotes

[1] Insuring Nature’s Survival, The Role of Insurance in the Financial Need to Preserve Biodiversity

[3] One million species are on the brink of extinction

[5] Biodiversity and Nature, close but not quite the same

[6] Planetary Boundaries – Sustainability Guide

Original Source: Author

Enjoyed this article? Sign up for our newsletter to receive regular insights and stay connected.