Investment overview

I give a buy rating for Kanzhun Ltd. (NASDAQ:BZ), as its disruptive business model should enable it to continuously win share from incumbents. With the strong momentum so far, the BZ’s should continue to benefit from this flywheel effect, further enhancing its competitive advantage against incumbents, which in turn allows it to gain more share.

Business description

BZ

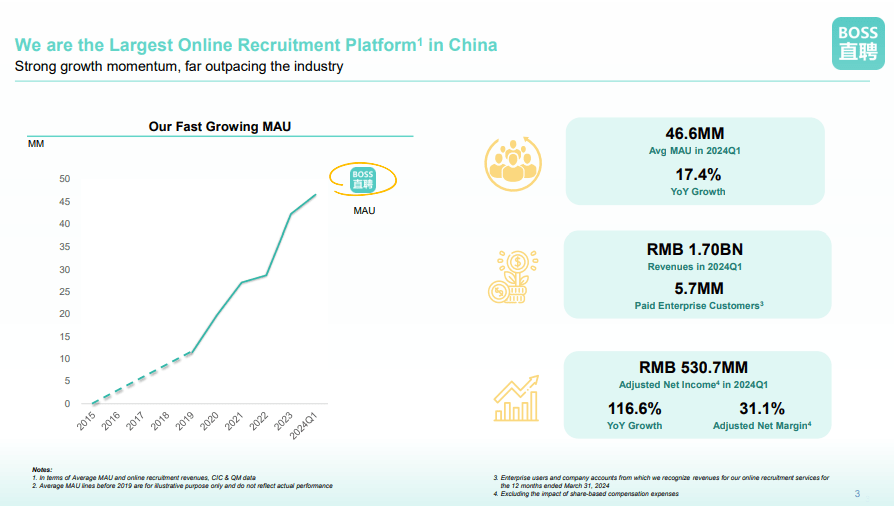

BZ is the largest online recruitment platform in China in terms of monthly average users [MAU], and it has a simple business model, which is to connect jobseekers to the right employers. The primary business units (segments) are online recruitment services to enterprise customers (this is 99% of the business revenue in FY23). In terms of MAU, BZ has 47 million MAU as of 1Q24, which is almost 4x the MAU seen in FY19.

Online recruitment penetration still has room to grow

BZ

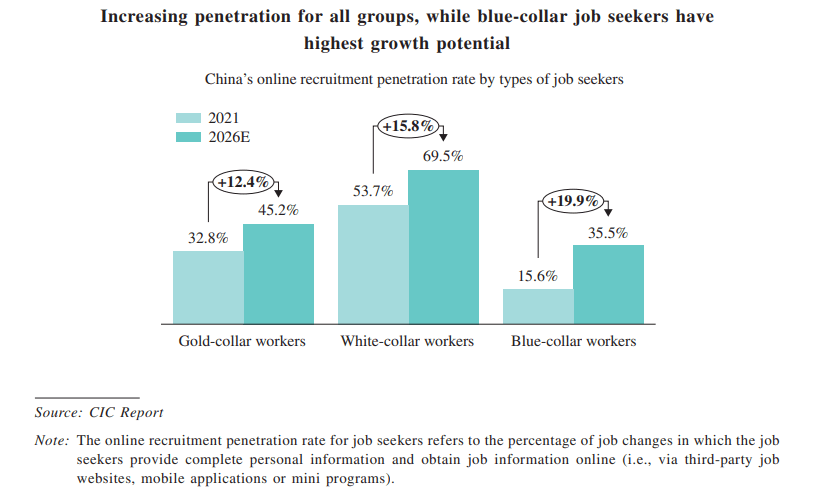

The online recruitment penetration rate in China still has plenty of room to grow. Based on the most recently available data (from BZ Prospectus, analyzed by CIC), the penetration rate varies across different groups of workers, and blue-collar workers have the most upside potential, which is where BZ has a huge market presence. While the data is slightly dated, it is good enough to show that there is plenty of room for BZ to continue growing. The main reason I believe online recruitment will continue to gain share is because it is just so much better than the traditional recruitment process (typically via newspaper, events, referral, walk-ins, etc., especially for blue-collar workers).

Online recruitment is simply much more cost-effective and efficient in that it:

- Enables a wider reach (the entire local internet vs. the known sites that the employers published);

- Improve efficiency as employers can post and respond to job postings quicker.

- Enhance decision-making by taking advantage of data analytics.

Moreover, I believe the current macro situation in China will further push employers to adopt online recruitment solutions as younger generations are seeking blue-collar work in light of the tough labor environment. This comes at a time when China’s main cohort of blue-collar workers is aging, and for this reason, I expect the competition for younger blue-collar workers to intensify over the coming years. As such, in order for these employers to become competitive in hiring and retaining talent, they need a more sophisticated approach than legacy methods, one that is more effective and efficient.

Disruptive business model

BZ

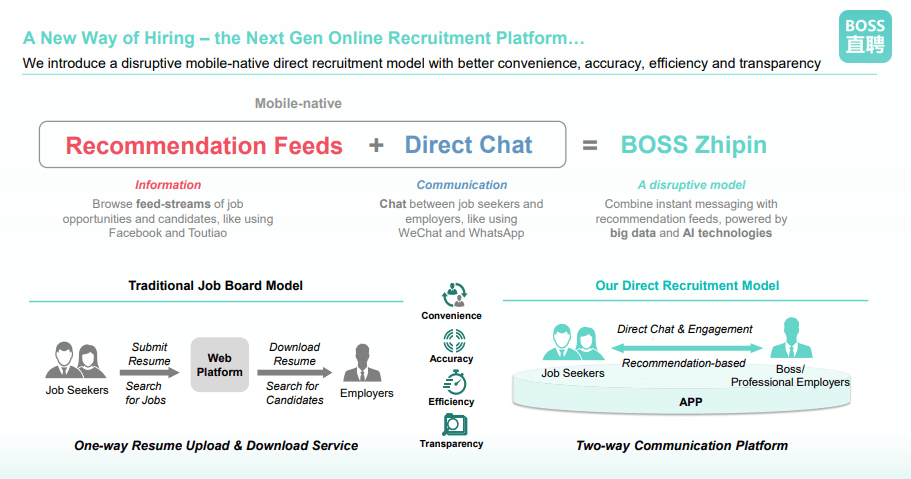

The way online recruitment platforms have always worked has been to separate the two parties involved: employers (the client) and jobseekers. Employers post ads for open positions, and jobseekers post their resumes. Hiring managers assigned to the task have to download and screen the resumes one by one and assess whether the candidate is a good fit. More often than not, it is impossible to know if the candidate fits what the employer is expecting, as the resume does not tell everything. As such, the process has to be replicated multiple times, with multiple interviews involved. In other words, this is a very inefficient business model, but because it is still better than handing out flyers or pasting job ads on physical notice boards, adoption has been healthy. I believe BZ’s disruptive business model is going to enable it to win share from legacy online recruitment platforms.

BZ platform allows direct chat between the direct hiring manager and jobseeker; hence, it enables both parties to find out more information before moving into the interview stage, which takes up a lot of time. Importantly, it needs both parties’ permission to share the complete resume and contact details, which protects the personal information of jobseekers. The latter point is important because it ensures that all jobseekers have a fair chance of being viewed through BZ’s recommendations, and employers are not being biased by filtering for the best resumes. From the employer’s perspective, the mundane process of “filtering” resumes is being done by BZ, and in a very positive way, as the recommended candidates are expected to be in line with the job description and company background provided by employers.

BZ

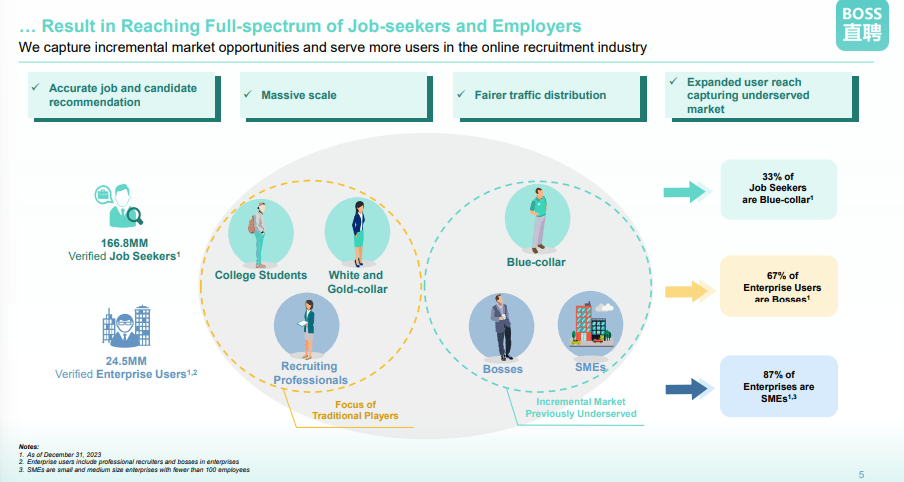

This essentially forms a strong flywheel effect for BZ as it scales. You could view BZ as a two-sided marketplace business: supply being employers and demand being jobseekers. For BZ to win, it needs to have sufficient volume on both sides, and once BZ establishes a big presence, it is hard for another player to disrupt (so long as it doesn’t screw up). Take, for example, successful two-sided business marketplace business models like Amazon in the US, Udemy and Coursera, Uber in the US, DoorDash in the US, etc. Once the platform reaches a point of critical mass, they tend to be winners in the market where subscale players have a hard time competing.

I believe this is the same for BZ. As BZ attracts more employers to use its platform, it attracts more jobseekers because there is a higher probability of being hired, which ends up attracting more employers to adopt the platform because of a growing pool of candidates. In the process of this virtuous cycle, BZ continues to refine its AI recommendations (the BZ AI system considers factors such as desired position, salary expectation, engagement behavior such as reviews, reach-outs, messaging, resumes, etc.) with all the data it gathers, which improves the recommendations to employers (better customer satisfaction that leads to more employers adopting BZ). This flywheel effect is well demonstrated in BZ operating metrics, where MAU went from 12 million in FY19 to 47 million in 1Q24 and the number of verified enterprise users went from 7 million in FY19 to 27 million in FY23.

Recent growth momentum is strong

Unlike what the China macro picture looks like, BZ’s growth momentum has remained very strong and is profitable. Total revenue grew by 33% to RMB1.7 billion in 1Q24, with cash billings growing 15% sequentially (24% annually) to RMB2.05 billion. 1Q24 adjusted operating margin saw 23%, a massive expansion from 10.6% in 1Q23. Underlying operating metrics also paint a very positive outlook for the business, as MAUs grew 17% y/y in 1Q24, with growth accelerating to 24% in March (setting a good base for 2Q24). In addition, BZ reported having 5.7 million enterprise customers, which means there is still plenty of room for BZ to penetrate here as there are over 50 million enterprises in China.

Valuation

May Investing Ideas

Based on my research and analysis, my expected target price for BZ is $25.

- Revenue should have no problem continuing at this strong rate of ~30% growth ahead (1Q24 grew 33%), as I expect BZ to continue gaining share from incumbents and that its scale advantage will continue to enhance as it grows.

- I modeled Adj EBITDA margin to stay flattish at 32% ahead, without any margin expansion, as I assumed that BZ would reinvest all excess profits into the business. This is very likely an underestimation, as FY23 adj EBIT margin is 23% vs. 1Q23 of 10.6%, indicating an impressive incremental adj EBIT margin of 60%.

- BZ should continue to trade at a premium to other listed recruitment firms such as Korn Ferry, PageGroup, Randstad, ManpowerGroup, and HRnetgroup, which trade at mid-to-high single-digit forward EBITDA multiples. The huge contrasts in expected revenue growth should support this premium (BZ trades at 17x forward EBITDA), where I expect BZ to grow at ~30% vs. peers expected growth (by consensus) or low single-digits (some of the peers are expected to see negative growth).

Risk

BZ’s ability to gain share could be heavily weighed by a prolonged slowdown in China’s economic growth. Fraud or other misconduct by jobseekers or employers could damage BZ’s brand recognition and reputation and may impact BZ’s ability to grow as users from both sides of the market become skeptical.

Conclusion

I give a buy rating for BZ as it has a disruptive business model that I expect will help it win share in China’s online recruitment industry. BZ platform facilitates direct interaction between employers and jobseekers, which helps to improve efficiency. As a result, it leads to a strong flywheel effect that attracts more jobseekers and employers to adopt the platform. BZ’s strong growth momentum also justifies its premium valuation against peers.

Enjoyed this article? Sign up for our newsletter to receive regular insights and stay connected.