Gilnature

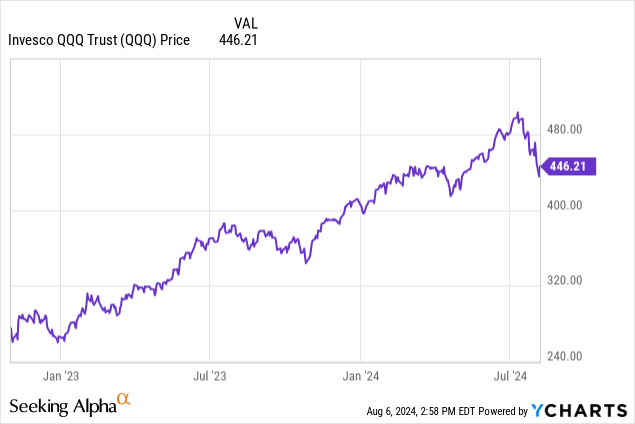

Since I last covered the Invesco QQQ Trust ETF (NASDAQ:QQQ) in March 2024 in my bearish thesis entitled “No Bubble Due To Productivity Surge, But Downside Likely”, it did fall by nearly 5% to $418 before rising as big tech outperformed during the first quarter earnings season. Subsequently, it reached $502 on July 10, but volatility made a resounding comeback during the last three weeks, contributing to the downside shown below, with the ETF trading at around 445.42 at the time of writing.

Data by YCharts

My objective with this thesis is to show that the AI bubble has not burst, but also warn that investors are increasingly likely to scrutinize how the billions of dollars poured into building super-smart infrastructures are paying off before putting their money into tech. I will also identify a target price for dip buyers.

I start by highlighting the six out of seven Magnificent 7 stocks that reported earnings and the reasons for the sell-off.

AI Hype Days Are Over for the Mag 7 As Focus Turns To Returns

As a reminder, the first signs of weakness were sparked when Tesla (TSLA) reported a 45% drop in quarterly profits and Alphabet’s (GOOG) (GOOGL) advertising business suffered from a slowdown through YouTube. This was followed by Amazon (AMZN), whose online marketplace showed signs of consumer stress. On the other hand, Meta Platforms (META) displayed strength in its online advertising business while Microsoft (MSFT) continued to showcase strength in its Azure cloud business and gaming, helped by the Activision Blizzard acquisition. As for Apple (AAPL), its shares were up after reporting better-than-expected fiscal third-quarter results, helped both by product sales and the services business offsetting weakness in China.

Still, the Nasdaq 100 Index tracking QQQ retreated by 3.6%, its largest single-day decline since October 2022, which was only one month before the launch of ChatGPT, a chat-based interactive tool driven by Generative AI, which has enjoyed immense popularity, namely by enabling millions throughout the world to search for information on the web more intelligently. Tellingly, OpenAI’s ChatGPT also resulted in galvanizing QQQ from January last year, as shown in the above chart, but this was mostly based on the billions of dollars poured into buying accelerated computing GPUs from Nvidia (NVDA) which will report earnings later this month.

Thus, more than one and a half years later, it is normal for investors to look for returns.

However, this could not be found in Alphabet’s second-quarter earnings call, where, despite some strong management rhetoric about the “tremendous momentum” in AI investments continuing, more precise questions as to the monetization aspect remain unanswered, especially as to how artificial intelligence can move the needle compared to traditional search.

Along the same lines, both Microsoft and Amazon have been investing money to purchase accelerated GPUs to beef up their cloud-computing product offerings, but they are just buying GPUs before leasing them to system integrators and software companies. The problem is this is a lower-margin business model than SaaS, where a company develops vertically integrated applications on top of hardware before selling it to customers. To this end, they have developed products like Microsoft Copilot and Amazon Bedrock, but these are not individually monetized yet.

Looking further, Meta has publicly released AI models for embedding chatbots on Facebook, and Instagram, but the problem is that these have not enjoyed ChatGPT’s success, prompting some to question the financial viability of the AI spending frenzy.

In this regard, according to analysts at BofA, the expected capital expenditures in AI by hyperscalers such as Microsoft, Meta, and Amazon have been revised upwards by $18 billion. This compares with only a $2 billion increase in revenue forecasts, signifying that for every dollar of sales, AI capex is expected to surge by 9 times.

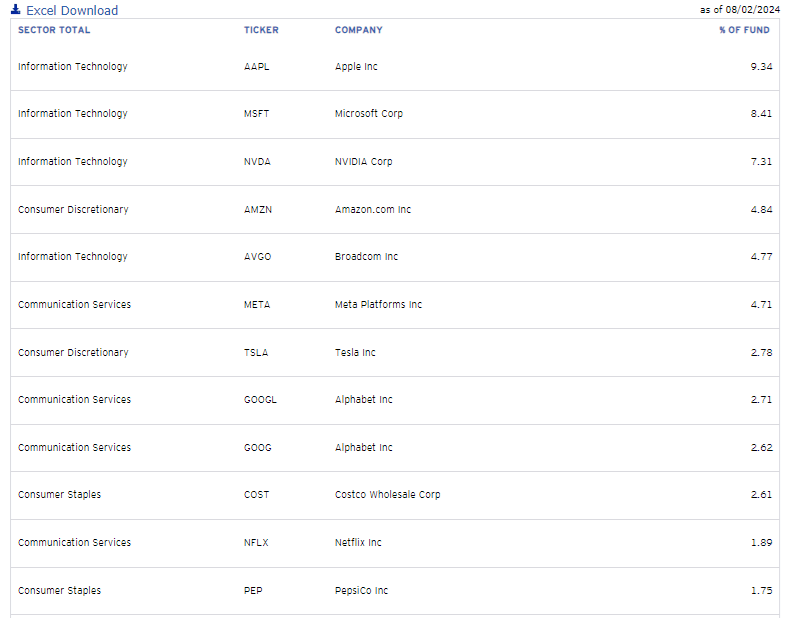

The ETF’s Top 12 Holdings (www.invesco.com)

Moreover, BofA cautions that investors are more likely to be prudent when it comes to artificial intelligence and focus on the monetization aspect. Thus, the days of AI hype may be over, but, this tech sell-off does not look like the bursting of the AI bubble.

Putting the Sell-Off into Perspective and Factoring in Apple and Nvidia in the AI Equation

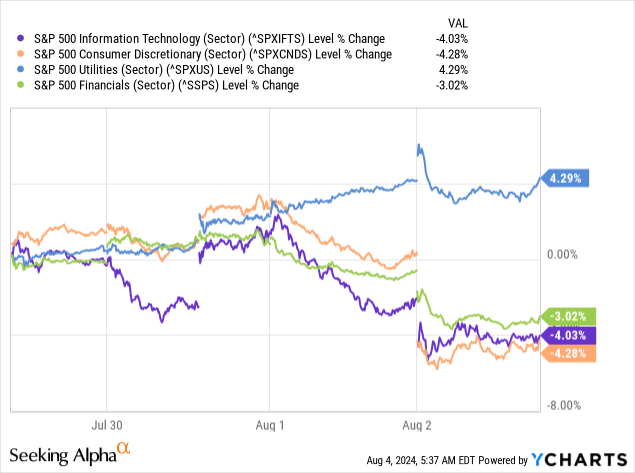

The reason is not only tech that has suffered, especially in the last week, as shown in the chart below, which shows that in addition to the IT sector, Consumer Discretionary, and Financial suffered as well.

Data by YCharts

Moreover, the fact that Utilities, which is more of a defensive sector, has gone up suggests that the market may have become apprehensive about the economy and investors are opting for names that are supposed to do well in tough times. This follows an unexpected increase in unemployment numbers for July, which suggests that fears about the U.S. economy have emerged in the face of above 5% interest rates.

Thinking aloud, the broader market suffering suggests that investors are not necessarily rotating away from tech stocks, which is further justified by Apple’s countertrend move as it gained 0.8% last week while QQQ lost 3.8%. This has mostly to do with Apple Intelligence or new AI features that are expected to spur iPhone upgrades, thereby helping the company reemerge on the growth front. Thus, by tapping into personal data while considering the context, Siri, the iPhone’s private assistant, should provide more intelligent answers to queries, positioning the company to benefit from about 270 million upgrades out of its total device base of 1.5 billion.

Noteworthy, while Microsoft and Amazon are investing billions of dollars, Apple’s more capital-light approach makes more sense from the return on investment perspective, but, for QQQ to outperform, a lot will depend on Nvidia when it releases its second-quarter results for fiscal 2025 on August 28. In this respect, while QQQ’s holdings are spending money on AI, Nvidia is making money selling advanced chips to run Gen AI language models, not only for the cloud, and metaverse but also for automobiles, as seen by the billions of dollars being spent by Elon Musk for X’s AI just to train its Grok conversational AI chatbot.

Talking about past performance, the semiconductor giant has beaten topline expectations in the last twelve quarters and is likely to beat revenue expectations of $28.5 billion for its forthcoming quarter. Also, the Godfather of AI, Jensen Huang may provide guidance that will exceed analysts’ estimates as has been the case in the previous quarters, but investors are more likely to focus on its customer base, more precisely the degree to which it is broadening away from hyperscalers to enterprises.

This is the only way to know if the AI wave is gaining wider adoption, but in the meantime, volatility is likely to persist.

Risks of Further Downside Subsists And Identifying a Point of Entry

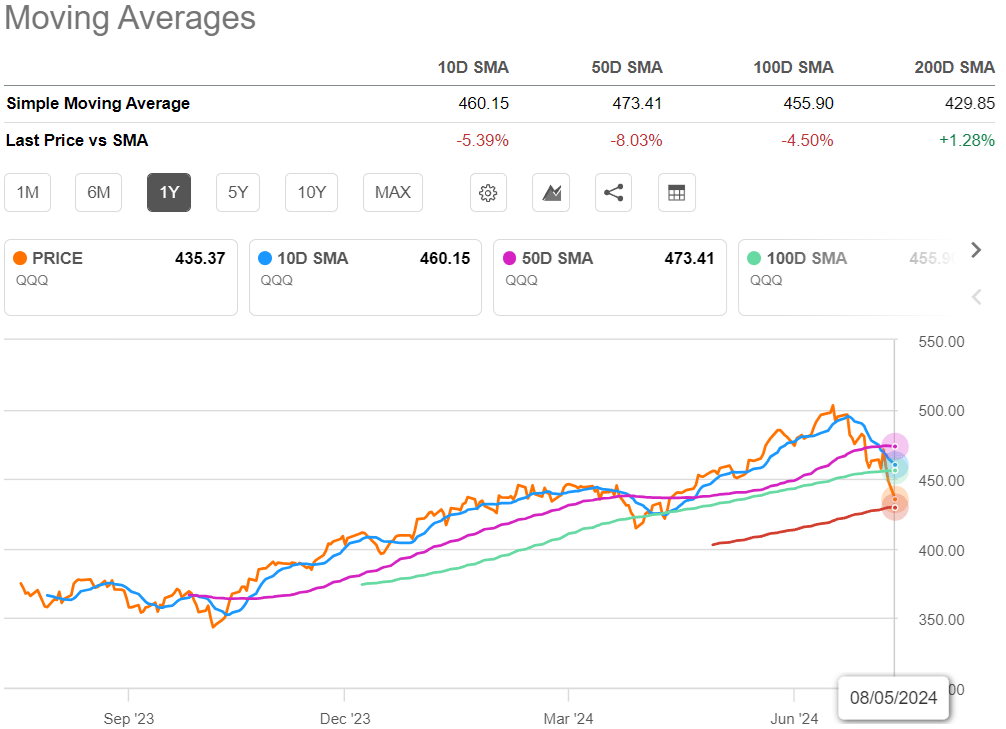

In this case, as pictured below, the 7% drop during the last two weeks has pushed QQQ below both its 50-day and 100-day moving averages for the first time since early May, and now sits just 1.28% above its 200-day average. It currently trades at 27.33x, or 8% below the category average of 29.72x.

However, this does not constitute an opportunity, as in the absence of upside-led catalysts, the sell-off may continue, especially amid recession fears in the U.S. and escalating geopolitical tensions in the Middle East. Additionally, the IT sector which makes up nearly 50% of QQQ’s weight and consists of Application Software names like Adobe (ADBE) and Intuit Systems (INTU) will also determine the ETF’s performance as investors scrutinize their ability to monetize AI out of all the costly infrastructure being built.

In this context, artificial intelligence is not only about selling advanced chips and building cutting-edge infrastructures, but also about developing apps that can cost three times more than one of Nvidia’s supercomputers. In addition to costs, investors’ expectations are also running high, which implies that delay in delivering results may result in the stocks being punished as was the case with Salesforce (CRM), which, by the way, does not form part of QQQ’s holdings.

There is also the negative impact of Intel (INTC) and CrowdStrike (CRWD) whose stocks have lost 31% and 44% respectively during the last month alone and the damage could continue. In these circumstances, QQQ could fall further, possibly to $429.85 or the 200-day moving average, constituting an opportunity to buy for two reasons.

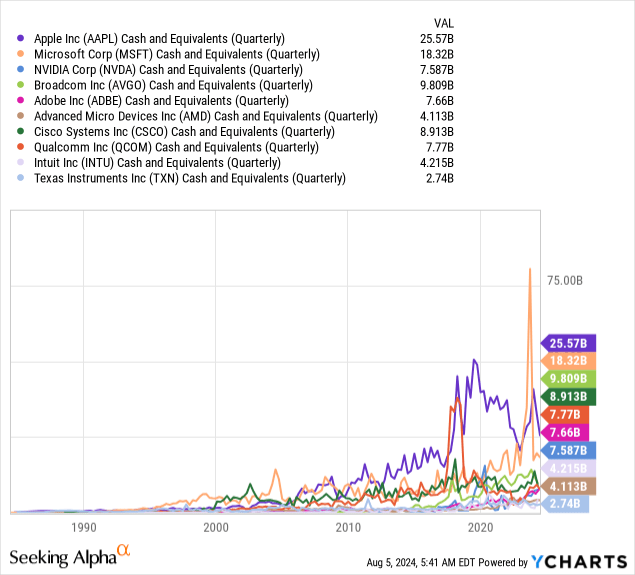

First, according to research firm Gartner, global IT spending for 2024 is expected to accelerate by 8% over last year, driven mostly by software, services, and data center systems as service providers support large-scale Generative AI projects. Second, as I had detailed in a previous thesis last year, big tech demonstrated its potential to act as a beacon of safety during the banking crisis of March 2023, largely because they are profitable, and their balance sheets boast a lot of cash as shown below. This is unlike the Dot Com bubble of 1999-2000, when there was a lot of fiscal irresponsibility.

Data by YCharts

In conclusion, I have a Hold position, as the downside should continue, as volatility should persist for some time. Subsequently, comes the buying opportunity as the application of AI can potentially increase productivity by about 25% meaning a strong rationale to deploy innovative solutions is there, and to quell recession fears, the U.S. services sector activity has rebounded from a four-year low in July on the back of new orders.

Enjoyed this article? Sign up for our newsletter to receive regular insights and stay connected.