Investment Thesis

In my opinion, the Financials Sector offers investors a relatively large number of companies with attractive risk-reward profiles. For this reason, I generally suggest overweighting the Financials Sector for those investors who invest over the long term. Overweighting companies with attractive risk-reward profiles allows you to achieve positive investment outcomes with an increased likelihood. I am following the same strategy with my private investment portfolio and with The Dividend Income Accelerator Portfolio, in which the Financials Sector represents a relatively large proportion when compared to the overall portfolio.

Today’s article is about three companies from the Financials Sector which, I believe, are attractive value picks:

Each pick is not only at least fairly valued, but also has an excellent position within their industry, is financially healthy with strong balance sheets and has a wide economic moat, making it an attractive value pick for investors.

JPMorgan

Given JPMorgan’s broad and diversified product portfolio, strong brand image, enormous Profitability (Net Income Margin of 33.57%, which is significantly above the Sector Median of 23.18% and Return on Common Equity of 16.66%, which is above the Sector Median of 10.55%), and attractive Valuation, I believe the company is an attractive value choice for investors.

JPMorgan’s Current Valuation

JPMorgan’s P/E [FWD] Ratio of 11.64 stands below its 5-Year Average of 12.08, indicating that the company is at least fairly valued.

The same is indicated when comparing its P/E [FWD] Ratio of 11.64 with the Sector Median of 11.49. Given JPMorgan’s strong competitive advantages and financial health in addition to its reduced risk level when compared to other banks, I am convinced that the company should be rated with a premium. This further indicates that JPMorgan is presently at least fairly valued and confirms my investment thesis that the company is an attractive value pick for investors.

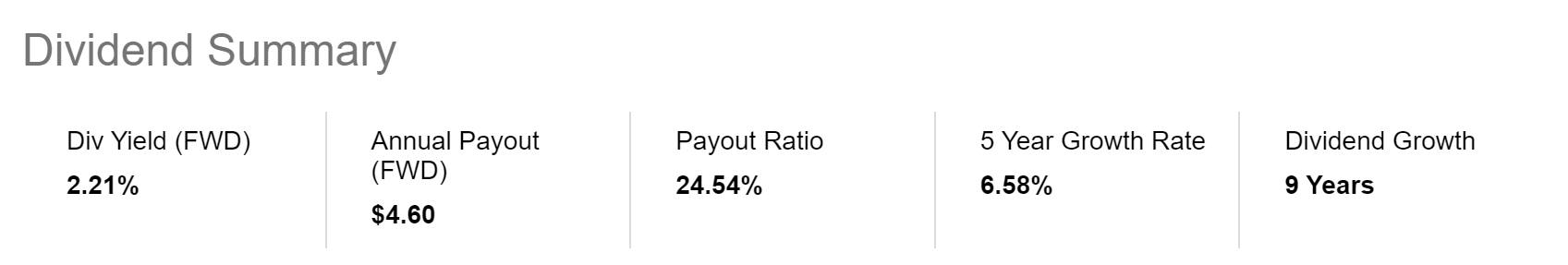

JPMorgan’s Dividend

JPMorgan’s dividend metrics indicate that the U.S. bank is not only an attractive value pick, but also an appealing choice to mix dividend income and dividend growth. It presently pays a Dividend Yield [FWD] of 2.21% while offering a 5-Year Dividend Growth Rate of 6.58% and a low Payout Ratio of 24.54%, which is 36.26% below the Sector Median of 38.50%. JPMorgan’s low Payout Ratio is a strong indicator that the bank should be able to raise its dividend to a significant degree in the future, further confirming my investment thesis that the company is an attractive value pick.

Source: Seeking Alpha

HSBC

On a worldwide basis, HSBC offers financial and banking services. The bank is headquartered in London, UK, and currently has 214,400 employees. HSBC’s current Market Capitalization stands at $150.94B, and it pays investors an attractive Dividend Yield [FWD] of 7.26%.

HSBC’s Current Valuation

Different metrics indicate that the London-based bank is presently significantly undervalued. Its current P/E GAAP [FWD] Ratio of 7.93 stands significantly below the Sector Median of 11.49 and below its 5-Year Average of 13.61.

In addition to that, HSBC’s Price/Book [TTM] Ratio of 0.93 is also below the Sector Median of 1.17, further indicating that the bank is undervalued.

All of these metrics strengthen my belief that HSBC is presently undervalued, confirming my investment thesis that the bank is an attractive value choice for investors.

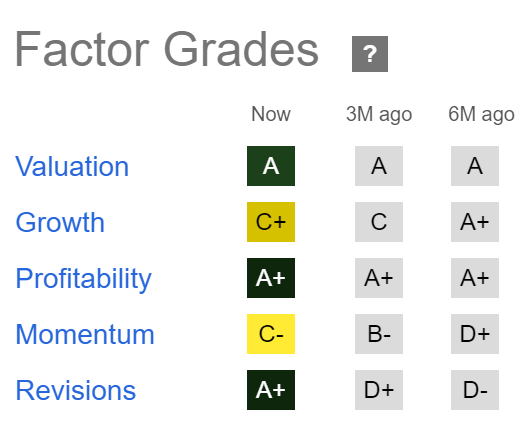

HSBC as according to the Seeking Alpha Factor Grades

The Seeking Alpha Factor Grades confirm my investment thesis that HSBC is presently an attractive choice in terms of value, with an A for Valuation. In addition to that, it can be highlighted that the London-based bank gets an A+ for Profitability, an A+ for Revisions, a C- for Momentum, and a C+ for Growth.

Source: Seeking Alpha

Berkshire Hathaway

From my point of view, the conglomerate of Warren Buffett is another attractive value play for investors.

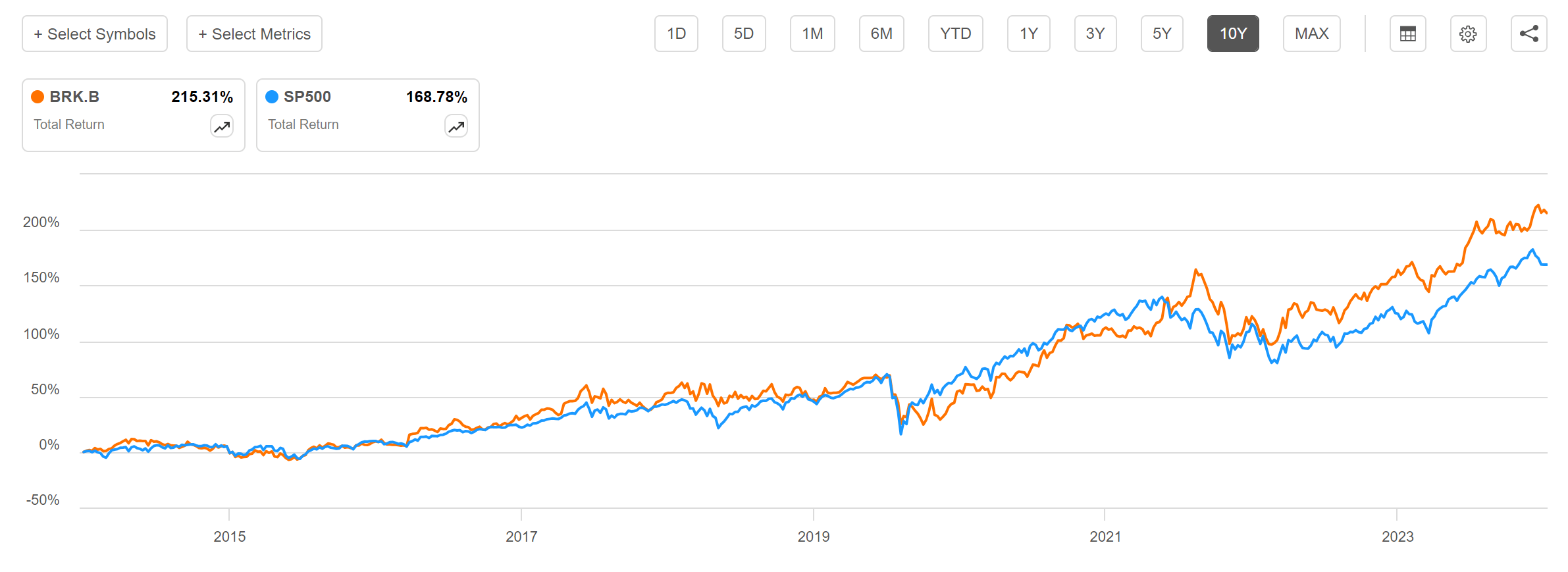

Considering the past 10 years, it can be highlighted that Berkshire Hathaway has significantly outperformed the S&P 500, illustrated by the chart below. While the performance of the S&P 500 is 168.78% within the mentioned period, Berkshire Hathaway’s performance stands at 215.31% within the same time frame.

Source: Seeking Alpha

Berkshire Hathaway’s Current Valuation

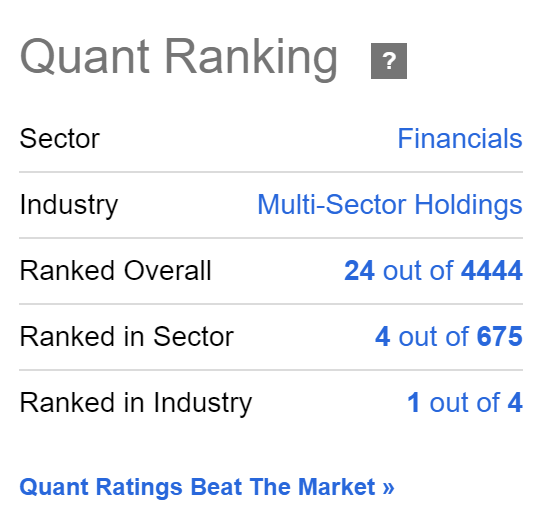

It is worth highlighting that Berkshire Hathaway’s current P/E Non-GAAP [FWD] Ratio of 20.67 stands below its 5-Year Average of 22.28, confirming that the company is an appealing value pick for investors. The Seeking Alpha Quant Ranking, which you will find in greater detail below, further confirms Berkshire Hathaway’s attractive Valuation, ranking the company 24th out of 4444 within the overall Seeking Alpha Quant Ranking.

The Current Largest positions of Berkshire Hathaway

The current largest position of Berkshire Hathaway is Apple (NASDAQ:AAPL) (28.9% of the overall portfolio). Despite the fact that Warren Buffett recently sold a significant proportion of his Apple shares, the company is still by far his largest stake. I continue holding Apple as the largest position within my personal portfolio, and the company remains the second-largest position within The Dividend Income Accelerator Portfolio (behind BlackRock (NYSE:BLK)). It is further worth highlighting that I have lately confirmed my buy rating for Apple.

Behind Apple, American Express (NYSE:AXP) (12.0%), Bank of America (NYSE:BAC) (11.9%), Coca-Cola (NYSE:KO) (8.9%), and Chevron (NYSE:CVX) (5.6%) are presently Berkshire Hathaway’s largest positions.

| Company | Symbol | Value | Percentage of portfolio |

| Apple | AAPL | $88,688,000,000 | 28.9% |

| American Express | AXP | $36,956,624,232 | 12.0% |

| Bank of America | BAC | $36,575,703,720 | 11.9% |

| Coca-Cola | KO | $27,432,000,000 | 8.9% |

| Chevron | CVX | $17,159,385,954 | 5.6% |

Source: https://www.cnbc.com/berkshire-hathaway-portfolio/

All the five largest positions of Berkshire Hathaway are companies with strong competitive advantages, excellent positions within their respective industries, and solid financial health. These characteristics confirm my investment thesis that Berkshire Hathaway is a strong value play for investors.

Berkshire Hathaway as according to the Seeking Alpha Quant Ranking

The Seeking Alpha Quant Ranking strongly confirms my investment thesis that Berkshire Hathaway is an attractive value choice for investors. The company is ranked in first position out of four within the Multi-Sector Holdings Industry, position four out of 675 within the Financials Sector and 24th out of 4444 within the overall ranking.

Source: Seeking Alpha

Conclusion

Berkshire Hathaway, JPMorgan and HSBC are three companies from the Financials Sector which, I believe, are attractive value picks for investors.

Of course, there are downside risks for investors in the short term, as none of these picks are immune to the volatility of the stock market. However, I am convinced that each company is an excellent value choice for investors that can help you reach an attractive Total Return when investing over the long term. This is the case since they all have strong competitive advantages, an excellent competitive position, strong financial health, and an attractive Valuation.

In addition, it can be highlighted that one of them (HSBC) pays an attractive Dividend Yield [FWD] of 7.26% while another (JPMorgan) offers attractive dividend growth rates (the bank’s 10-Year Dividend Growth Rate [CAGR] stands at 10.83%). By adding both to your portfolio, you can combine dividend income and dividend growth, a strategy that I follow with the construction of The Dividend Income Accelerator Portfolio and which allows you to annually increase your dividend income to a significant amount.

Berkshire Hathaway does not pay a dividend, however the company from Warren Buffett can be an excellent element of your portfolio to help you reach an attractive Total Return when investing over the long term.

By incorporating these three value picks in your investment portfolio, you can strategically position yourself for a combination of dividend income and dividend growth, and strong potential for long-term growth to steadily increase your wealth.

Enjoyed this article? Sign up for our newsletter to receive regular insights and stay connected.