With rapid urbanization and an increased focus on sustainable development, infrastructure investment has emerged as a crucial driver of economic growth and stability. Infrastructure is essential for the functioning and growth of cities, and it can include physical systems, facilities, and services that support the daily lives of people and businesses. The iShares Global Infrastructure ETF (NASDAQ:IGF) managed by BlackRock Fund Advisors invests in stocks of large-cap companies operating across energy, oil, gas and consumable fuels, industrials, transportation infrastructure, airport services, highways and rail tracks, marine ports and services, utilities, and transportation sectors.

As nations strive to modernize their economies and adapt to emerging challenges, the importance of infrastructure has never been more apparent. With global population growing and urban areas expanding, the demand for innovative infrastructure solutions will increase. There is also a huge role to be had for infrastructure with addressing the global challenge of climate change and sustainability.

Seeking Alpha

Seeking Alpha

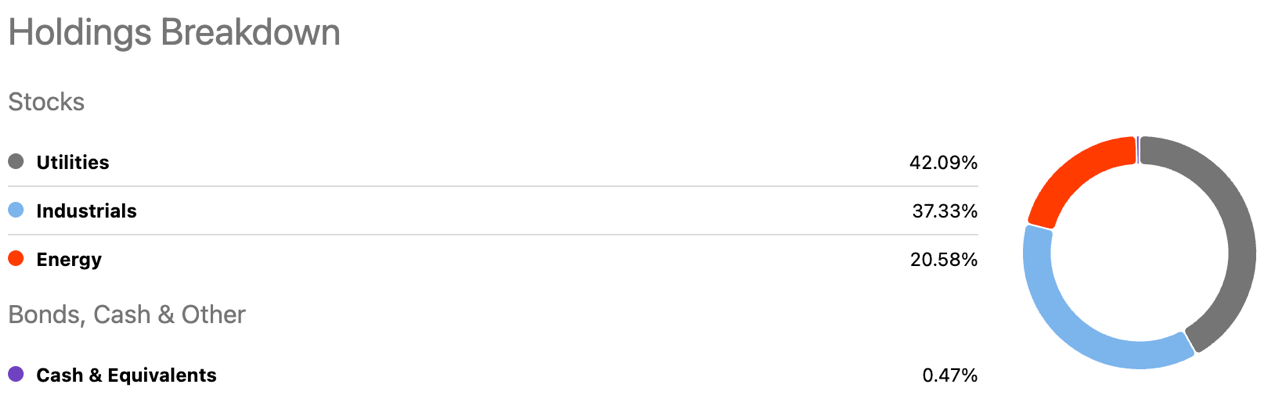

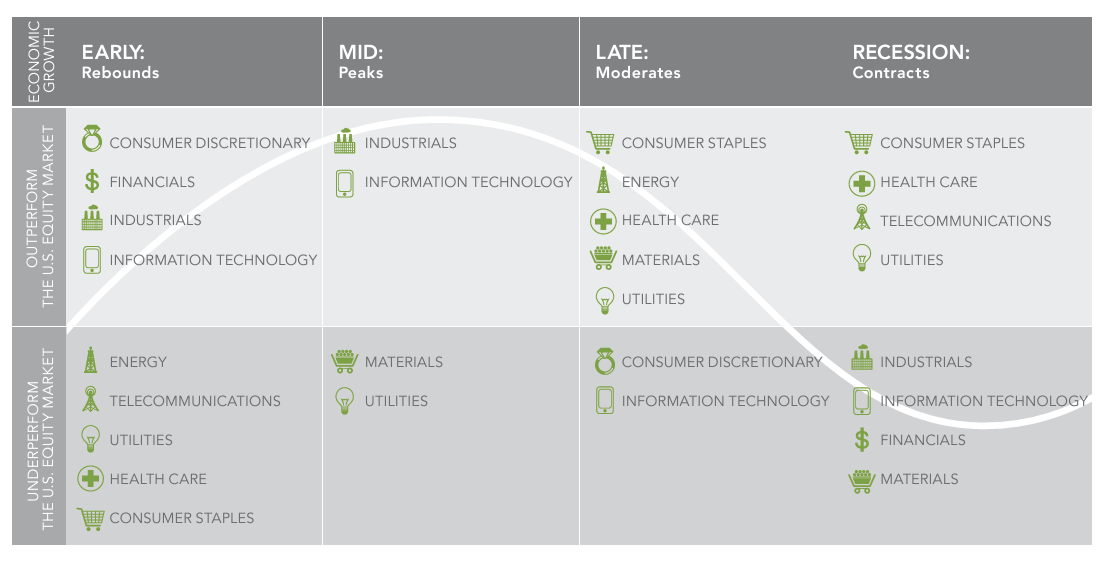

IGF consists strictly of stocks from the utilities, industrials and energy sectors. The ETF has 96 holdings, with companies from all corners of the globe. With the economic uncertainty, we are seeing worldwide today, the sector split for IGF is a great hedge to whichever direction individual countries or the global economy heads. In general, utilities and industrials perform opposite one another. This, of course, limits the growth potential for the ETF, but makes it a comfortable investment amidst the wars, elections, and inflation happening worldwide.

Fidelity

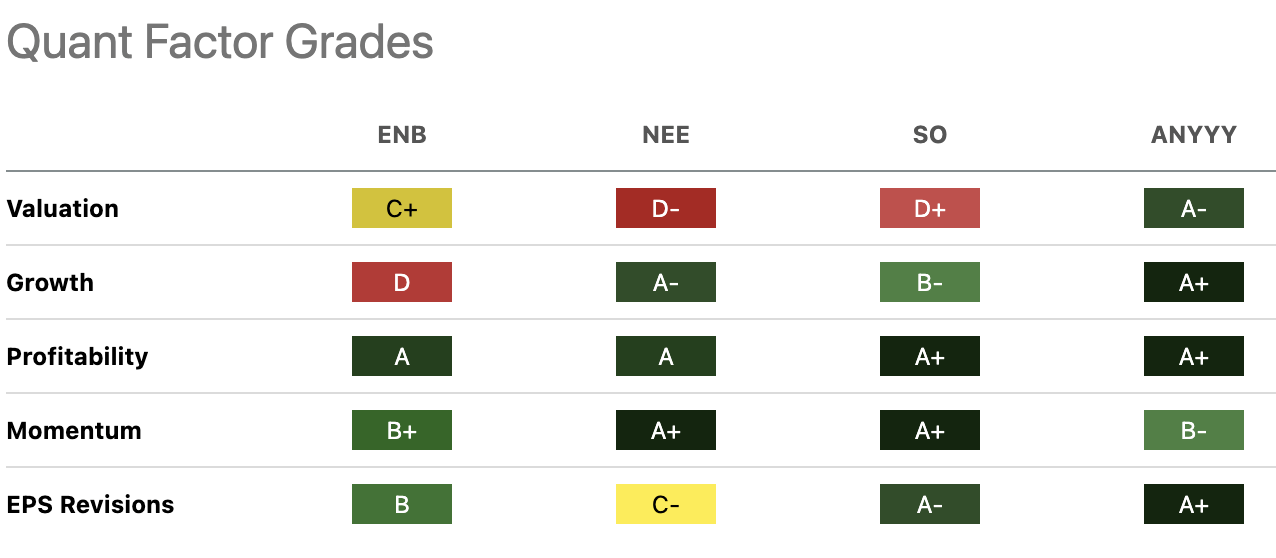

NextEra Energy, Inc. (NEE) is a diversified energy company headquartered in Florida, with a strong emphasis on renewable energy. It operates across various segments of the energy industry, including renewable and conventional energy generation, utility services, and energy storage.

Transurban Group (OTCPK:TRAUF) engages in the development, operation, management, and maintenance of toll road networks. It operates 22 toll roads in Australia, United States, and Canada.

Enbridge Inc. (ENB) operates as an energy infrastructure company through five segments: Liquids Pipelines, Gas Transmission and Midstream, Gas Distribution and Storage, Renewable Power Generation, and Energy Services. They have processing facilities in Canada and the United States.

Outside of valuation, grading among several of IGF’s leaders are very positive and a good sign moving forward.

Seeking Alpha

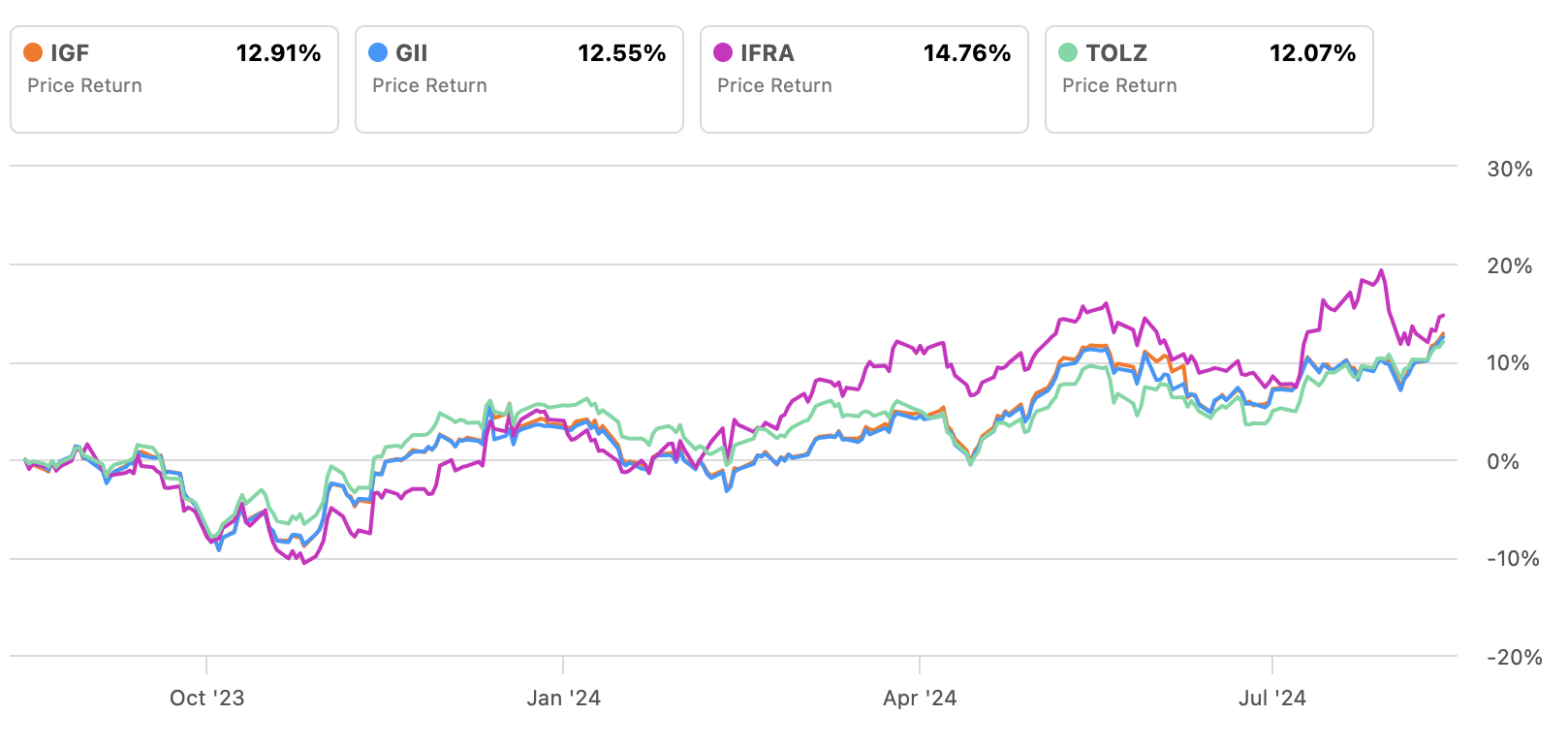

IGF has a respectable 3.39% dividend yield paid semiannually and has seen dividend growth for three consecutive years. Liquidity is another strong suit for IGF. Average daily share volume, higher than any competitor ETF’s and $3.77 billion in AUM, gives the investor a comfortable feeling. Although 96 total holdings are less than many other infrastructure ETF’s, so there are more diversified and watered-down indexes available.

Almost all infrastructure index funds are seeing a P/E ratio hovering right around the market average, and IGF is right on pace at 22.53. Performance over the last year is remarkable and similar as well among these peers. The only fund outperforming IGF is the United States specific iShares U.S. Infrastructure ETF (IFRA).

Seeking Alpha

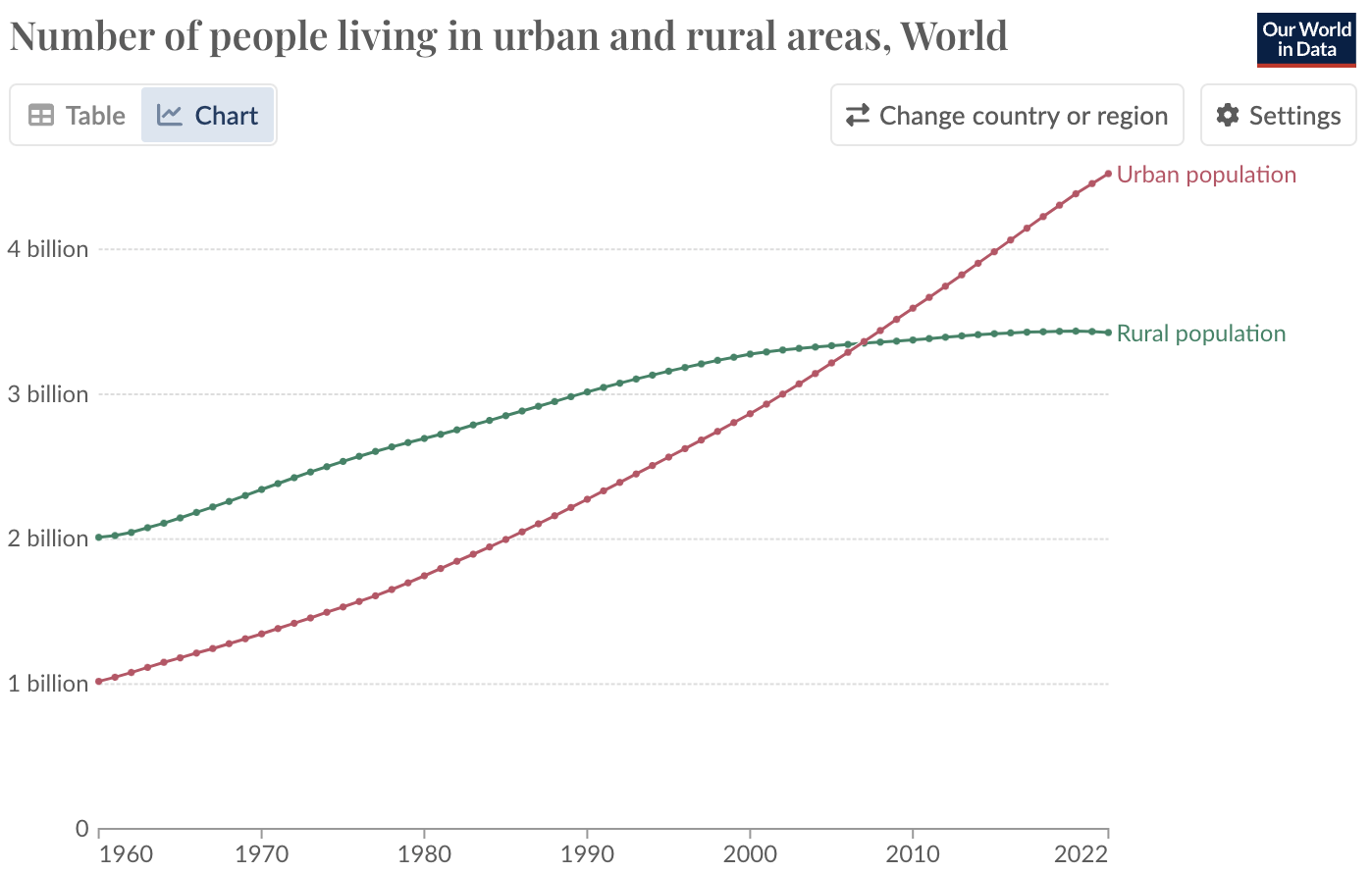

Infrastructure development is driven by a combination of factors like economic growth, population trends, government policies, and sustainability efforts. Urbanization is hard to keep pace with at the moment in many huge cities worldwide. Today, 4.4 billion people, over 55% of the world population, lives in cities. This trend is expected to continue, with the urban population more than doubling its current size by 2050, at which point nearly 7 of 10 people will live in cities.

World in Data

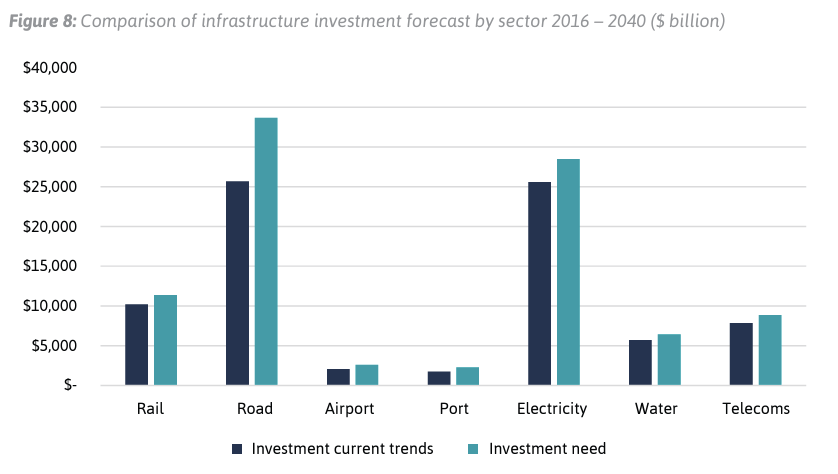

Outlook projects that global infrastructure investment needs to reach $94 trillion by 2040 to keep pace with profound economic and demographic changes, and to close infrastructure gaps. The investment gap in the infrastructure industry is presenting the largest threat toward the inner-city population growth. The electricity and road sectors show the largest gaps by a wide margin. IGF consists of many industry leaders toward infrastructure energy and road development, like the aforementioned NEE, TRAUF, and ENB. Finding the funding remains a challenge in the infrastructure industry, but the room for growth and expansion is substantial.

Global Infrastructure Hub

We like IGF as a buy right now. As global demands evolve and infrastructure needs expand, IGF positions investors to participate in the ongoing progression of infrastructure around the world. Providing diversified exposure to a wide variety of global infrastructure assets, like utilities, transportation, and energy, IGF allows investors to tap into both the growth and stability side of infrastructure investment. All signs point to increased demand for infrastructure for decades to come. IGF is not going to produce overly large gains in the near future, but has great possibility for considerable gain in the long run.

Enjoyed this article? Sign up for our newsletter to receive regular insights and stay connected.