Tempus AI (NASDAQ:TEM) provides an end-to-end diagnostic platform that connects clinical, molecular and image data. Tempus’s solutions have the potential to be utilized by physicians and pharmaceutical companies to gain data insights on millions of patients. While the company is still in the early stages of deploying AI in precision medicine, its proprietary software and dedicated data pipelines could potentially create significant competitive advantages for the company. I am initiating a ‘Buy’ rating with a one-year price target of $77 per share.

AI in Precision Medicine

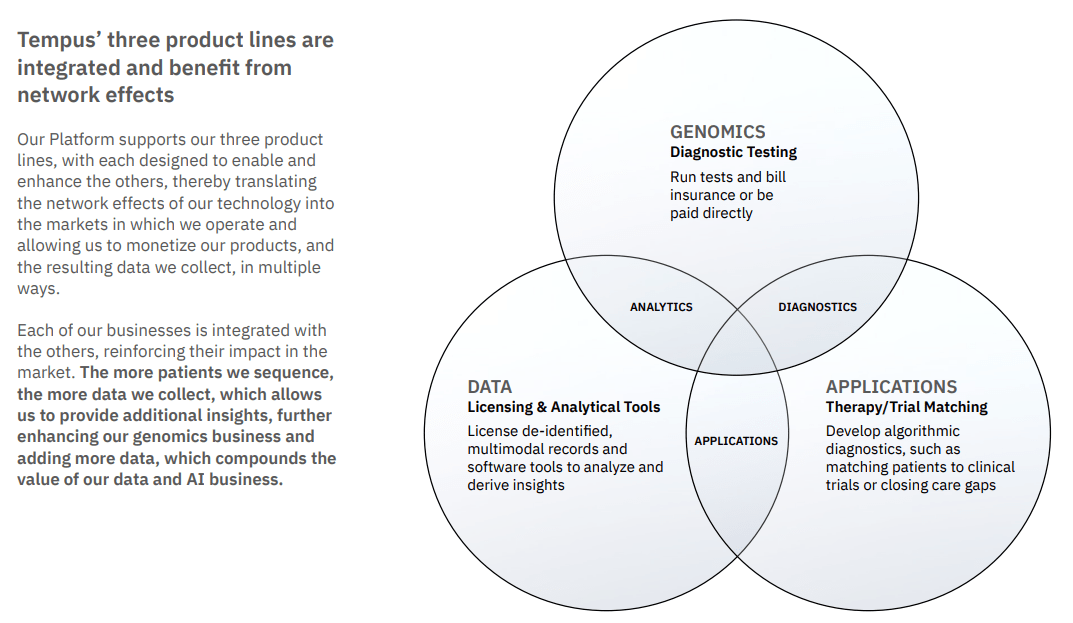

Tempus develops their platform under three major product lines: Genomics, Data and AI Applications, deploying AI technology for doctors and drug development companies. As illustrated in the slide below, the three product lines are integrated and benefit from network effects of data collections and algorithmic diagnostics.

Tempus AI Investor Presentation

As a small high-growth company, Tempus possesses some unique competitive advantages:

- Broad Data Collection: Tempus’s platform connects more than 2,000 institutions, collecting real-time clinical data, molecular and imaging data directly from patients. The multi-modal data from healthcare institutions enables Tempus to perform large-language machine learning and deploy AI for training and inference. The outcomes from these platforms could provide recommendations for physicians and pharmaceutical companies.

- Genomics: Tempus Genomics platform can help physicians match and update recommended therapies for cancer patients. Physicians can utilize Tempus’s platform to review all patients with similar treatments/therapies. Additionally, Tempus operates three laboratories that provide NGS diagnostics, PCR profiling, and other anatomic and molecular pathology tests. The results from these laboratories feed directly into their Genomics platform, offering valuable data insights for physicians.

- Intelligent Diagnostics: The management believes the deployment of Intelligent Diagnostics could potentially have a substantial impact on patient care. The multimodal data could make precision medicine possible, by providing personalized therapies for patients. Again, the key to success is the multimodal real-time data stream. Machine learning can only be effectively performed when Tempus’s platform acquires sufficient data from a wide range of healthcare institutions.

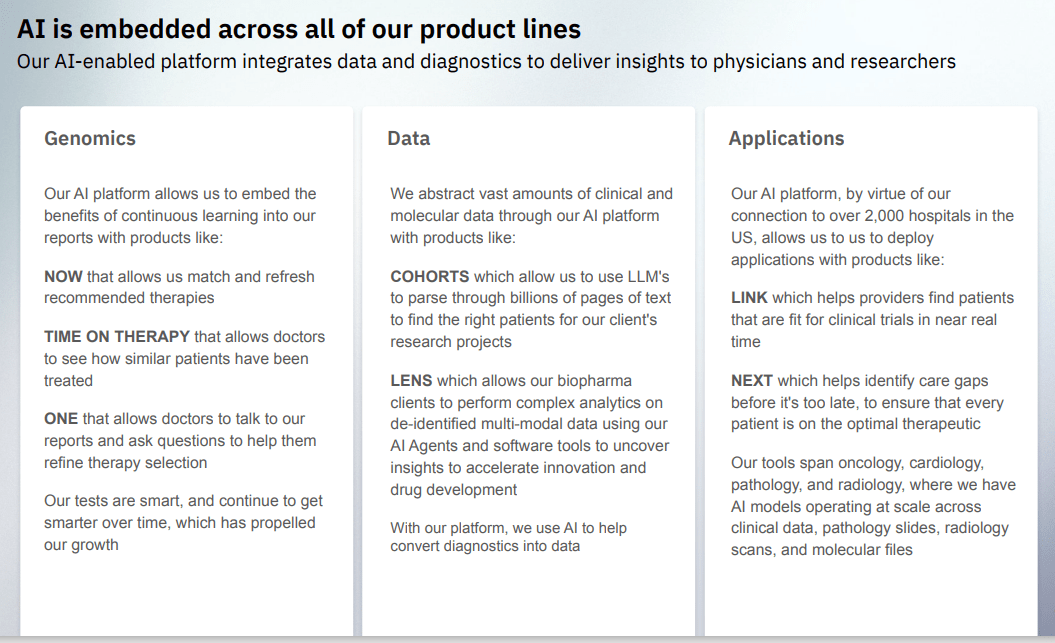

As detailed in the slide below, AI is embedded across all of Tempus’s product lines, making Tempus uniquely positioned in the healthcare technology industry.

Tempus AI Investor Presentation

Recent Financials, Outlook and Valuation

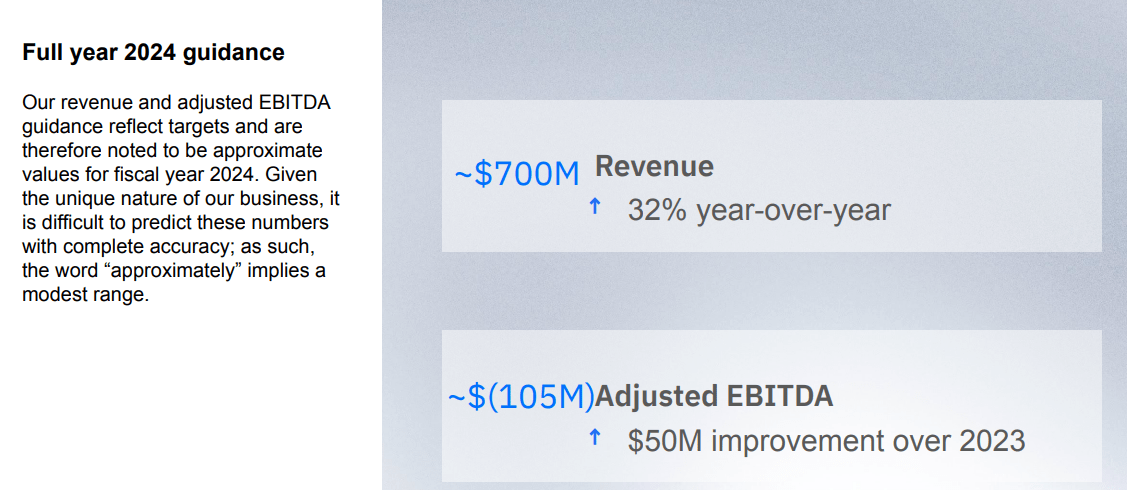

As Tempus went public in June 2024, the company doesn’t have a long-term public financial track record. Tempus announced its Q2 result on August 6th, reporting 25% year-over-year growth in revenue. The company guides a 32% year-over-year growth in revenue for FY24, as detailed in the slide below.

Tempus AI Investor Presentation

According to Softbank’s latest SEC filing, Softbank added Tempus AI to its portfolio, acquiring approximately 5.41 million shares. In August 2024, SB TEMPUS began its operations as a JV between Tempus AI and Softbank to provide services in Japan. Softbank’s investment in Tempus indicates that Tempus’s technology is disruptive to the overall healthcare diagnostics and precision medicine industry.

For the growth in FY24, I am considering the followings:

- Market Growth: Tempus is still a very early-stage company, with only $700 million in revenue anticipated for FY24. The company is still in the process of building its data sets and connecting healthcare institutions. Market Data Forecast anticipates that global precision medicine will grow at a CAGR of 11.5% from 2024 to 2029. I think AI technology makes it possible for pharmaceutical companies to analyze and leverage various data streams, and get deeper insights from patient and diagnostic information.

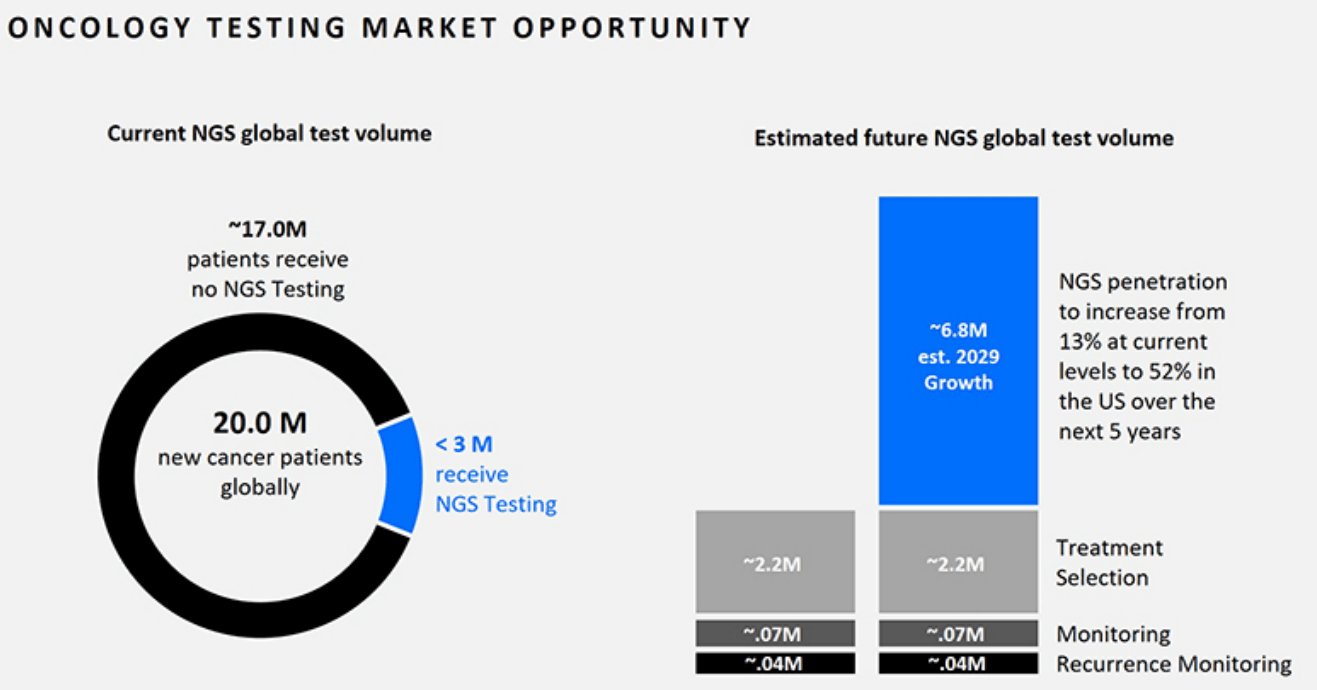

- NGS Testing: Next-generation sequencing (NGS) is anticipated to grow substantially over the next few years, primarily driven by penetration growth and industry adoption, as illustrated in the slide below. Tempus’s automated lab infrastructure will enable the company to address a wide range of emerging testing applications including NGS.

Tempus AI IPO Prospectus

As such, I estimate Tempus’s revenue will grow at above 30% in the near future, then moderate to 25% from FY29 onwards as the company scales its business.

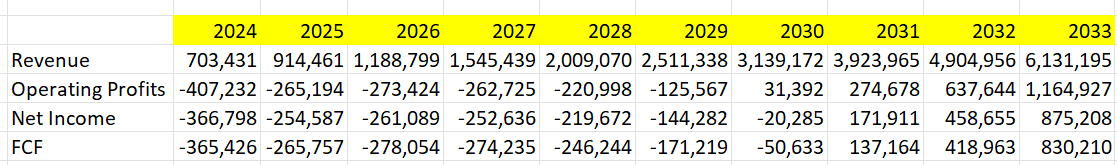

As an early-stage growth company, Tempus has not generated any profits and free cash flow yet. Specifically, Tempus spent more than 55% of total revenue on SG&A. It is quite expensive to build up these platforms, collect data sets from various healthcare institutions and connect physicians, patients and pharma companies. I don’t expect Tempus will generate positive operating margin before FY30, although the company will expand its margin driven by SG&A improvement and gross profits. I anticipate the company will achieve 19% of operating margin by FY33, driven by operating leverage of R&D and SG&A expenses.

With these parameters, the DCF model can be summarized as follows:

Tempus AI DCF

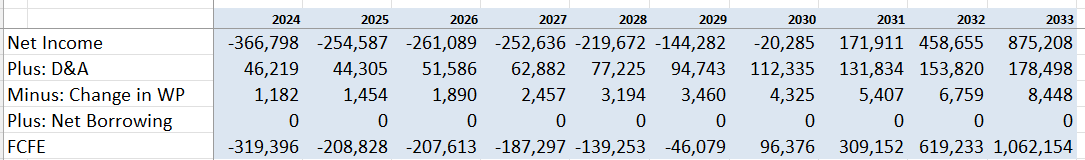

I calculate the free cash flow from equity as follows:

Tempus AI DCF

The cost of equity is calculated to be 14% assuming: risk-free rate 3.8% (US 10Y Treasury); beta 1.5; equity risk premium 7%.

Discounting all the future FCFE, I estimate the one-year price target of Tempus AI to be $77 per share.

Key Risks

- Free cash flow: Tempus generated -$248 million in free cash flow in FY23, and the company is still burning the cash for now. During the IPO, Tempus raised $410 million in equity capital and has $261 million in debts on their balance sheet. Given these factors, Tempus might have to raise capital in the near future, either via issuing common share, or raising debts, which could potentially impact their stock price.

- Aircraft for Business Travel: Tempus entered into an agreement with 346 Investment Partners to use an aircraft for business travel. In 2024, Tempus paid $0.2 million pursuant to the agreement. Although it is not a huge amount, I believe it is unnecessary for such a small company to use a dedicated aircraft for business travel.

- Competition From Technology Companies: In the future, Tempus might face competition from technology companies such as IBM (IBM) and Alphabet (GOOG) (GOOGL) etc. These large tech companies possess tremendous technology resources in AI and talents, which could pose a challenge to Tempus.

End Note

I believe Tempus AI is well poised to capture the future growth in the precision medicine market. I favor the company’s AI platforms and diverse data streams that could potentially disrupt the precision medicine market. I am initiating a ‘Buy’ rating with a one-year price target of $77 per share.

Enjoyed this article? Sign up for our newsletter to receive regular insights and stay connected.