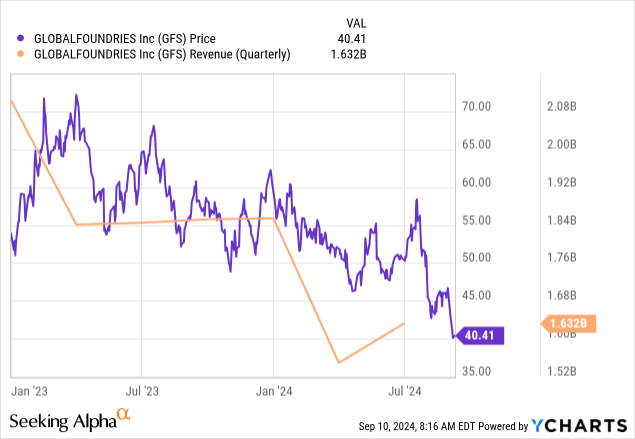

Since I last covered GlobalFoundries (NASDAQ:GFS) in January last year, it did rise by 24% two months later in line with my bullish thesis based mostly on expanding chip manufacturing in the U.S. However, a long slide followed, and it is now trading at around $40 caused by the normalization of the supply chain leading to declining sales as shown below.

Data by YCharts

However, the financial results for the second quarter of 2024 (Q2) hint at inventory stabilization, and, based on the AI opportunities, this thesis aims to show that it is a buy. To support my position, I provide an update on how this foundry operator selected to receive $1.5 billion of funding from the CHIPS Act is faring relative to its Taiwanese peer.

A Mixed Picture but One with Opportunities

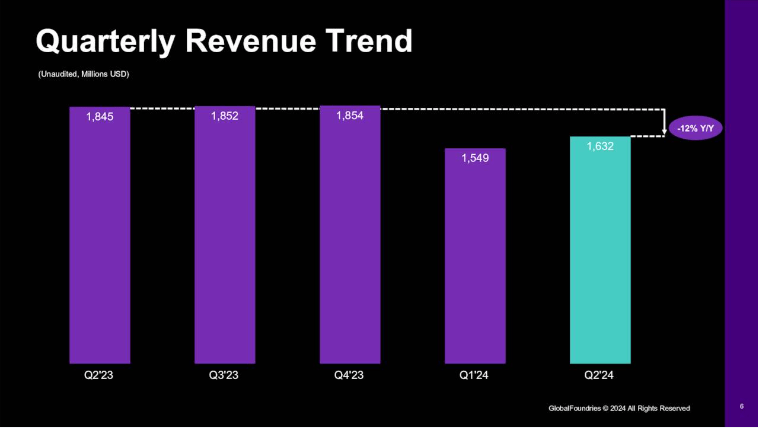

Q2’s revenues declined by 12% YoY, largely due to a weakness in global semiconductor demand compared to last year, when supply chains were still recovering from Covid-led disruptions. Nonetheless, sales progressed over Q1 as shown below, made possible largely by driving specialized products, also suggesting customer inventories may be getting depleted.

company presentation (seekingalpha.com)

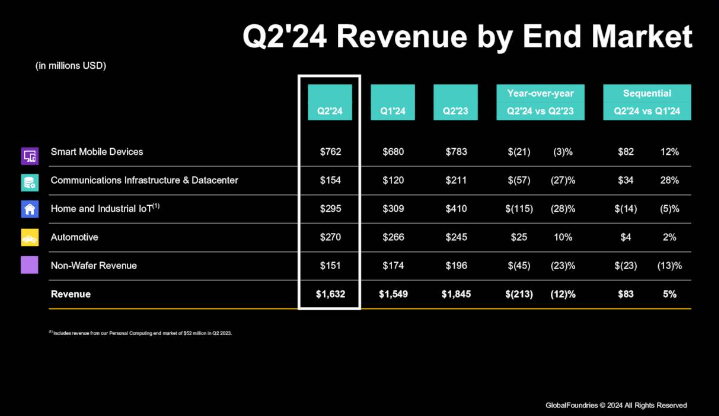

Digging deeper, the Automotive end market remains a bright spot with YoY revenue growth of 10% as pictured below, explained by previous design wins for power management and tire pressure monitoring systems driving more semiconductor content into vehicles.

Still, the car industry remains a cyclical one and the costs associated with vehicle ownership have gone up because of higher insurance premiums and elevated interest rates. Thus, the increase in sales volumes may not be sustained in the short term, but equipped with 12LP+ and 22FDX used in infotainment and radar applications respectively, GF has the enabling technologies to sustainably increase sales.

Company presentation (seekingalpha.com)

On the other hand, the IoT segment faced revenue declines of 28% YoY. The reason appears to be the rapidly changing IoT landscape now being more skewed toward edge computing (or Edge AI), which competes with GF. Thus, as device complexity increases, the cost efficiency and power management features embedded in its products may no longer suffice, needing an alteration of its foundry offerings to meet requirements for faster processing time and connectivity.

Still, design wins for certain high-speed wireless IoT devices point to longer-term potential, especially when it comes to AI-at-the-edge functionalities for smart-connected devices, namely in medical devices and card reader applications. Therefore, it is more of a mixed picture but one where there are also opportunities for GF thanks to its technology, and its largest end-market can benefit from AI.

Valuing the AI Potential both For Smartphones and Data Centers

Accounting for approximately 44% (762/1,632) of total sales, the Smart Mobile Devices end market has suffered a 3% YoY decline due to reduced consumer spending. Still, revenue grew on a QoQ basis, and emboldened by certain design wins in RF (radio frequency) front-end and wireless connectivity applications for smart mobile devices, the management is optimistic about the future.

In this connection, as a supplier of RF chips for smartphones, GF could benefit from Apple’s (AAPL) Intelligence or transform the iPhone and other devices into more AI-driven. This has necessitated the new A18 chip for the iPhone 16 to bear 40% faster GPU performance while consuming 35% less power than the previous model to satisfy the demand for AR (augmented reality) features. This would in turn require significantly more higher-performance RF components, a move comparable to when higher-speed connectivity was required when shifting from 4G to 5G. To this end, Apple has several RF front-end module suppliers including Qorvo (QRVO), which in turn relies on GF’s expertise in RF capabilities with SOI (Silicon on Insulator) technology. The company also manufactures high-performance chips for Qualcomm (QCOM).

Therefore, as Apple drives more intelligence and connectivity into its devices, GF’s manufacturing prowess puts it in a favorable position to benefit as Gen AI reshapes the mobile experience in a market where global Gen AI smartphone shipments are expected to surge by a CAGR of 78.4% from 2023-2028.

Now, in case of a delay in the iPhone supercycle because consumers hang on to their devices longer, there are opportunities for GF’s data center end market given the deal inked with Groq, a semiconductor company specializing in designing processors optimized for the inference part of machine learning. For investors, inference is about developing supersmart apps out of AI models, that would have been previously built during the training phase using the accelerated computing GPUs supplied by Nvidia (NVDA). Now, the chip giant’s GPUs are also used for inferencing and these accounted for more than 40% of its data center sales during its latest reported quarter, but given that demand is so high, there is scope for other players to join in the AI frenzy. Consequently, Groq is ramping up its language processing units, which will be manufactured on GF’s 14nm platform in Malta, New York.

This partnership positions the U.S. foundry operator as a player in the AI inference chip market whose size is expected to reach $90.6 billion by 2030, after expanding at a CAGR of 22.6% during the 2024-2030 period. Therefore, with two of its end markets likely to profit from AI, the company deserves better.

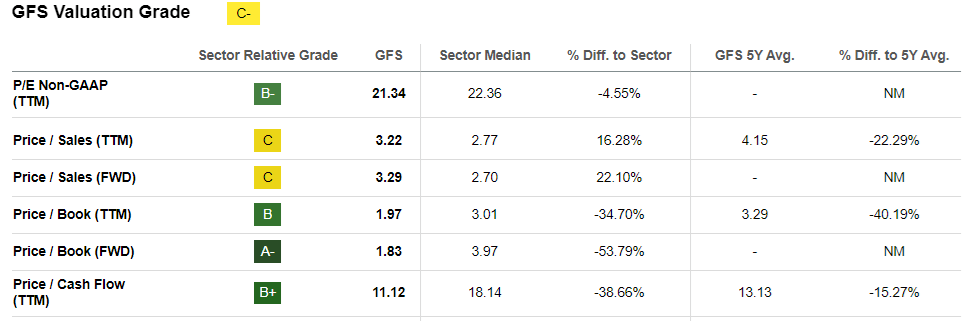

In this respect, its cash flow generated from operations exceeds the median for the IT sector by nearly 2000% while its trailing price-to-cash flow remains undervalued by 15%. Incrementing accordingly, I obtained a target of $46.5 (40.4 x 1.15) based on the current share price of $40.4.

seekingalpha.com

It is also an opportunity since its trailing price-to-sales, which remains below its five-year average by 22% and has dipped below 4.02x when I last covered it. Still, given the downside risks associated with demand-supply conditions deteriorating further in the short term, it is important to further justify this bullish position.

Comparing with UMC for Onshoring of the Semis Supply Chain

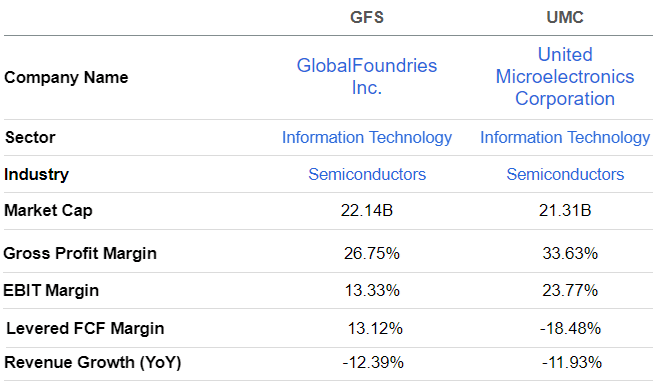

For this purpose, it can be compared with Taiwan’s United Microelectronics Company (UMC) which also operates in lagging (mature) nodes including 28nm and 22nm, rather than cutting-edge 5nm and below chips pursued by Taiwan Semiconductor Manufacturing Company (TSM) or Samsung (OTCPK:SSNLF). As shown below, both have suffered from a revenue decline since they more or less serve the same industries.

On the other hand, while the Taiwanese foundry specializes in high-volume manufacturing, GF focuses on specialized products across diverse mature nodes including aerospace and defense applications. This diversification means the U.S. company is disadvantaged in terms of economies of scale associated with producing a narrower range of nodes at higher volumes. This makes it harder to achieve optimal factory utilization rates, partly explaining its lower margins.

Comparison with a peer (seekingalpha.com)

However, it is important to consider other factors, namely reduced exposure to geopolitical risks and specialized products versus the traditional mass production rationale. Thus, as a provider of foundry services, GF has managed to carve out a niche for itself by offering unique solutions through its 22FDX platform and FD-SOI (Fully Depleted Silicon on Insulator) targeted at specific markets. These include IoT, 5G, automotive, defense, and now AI, all high-priority areas for U.S. semiconductor supply chain security, and explain the reason behind securing long-term agreements (called lifetime revenues) worth about $18 billion, or more than two times FY-2023 revenues.

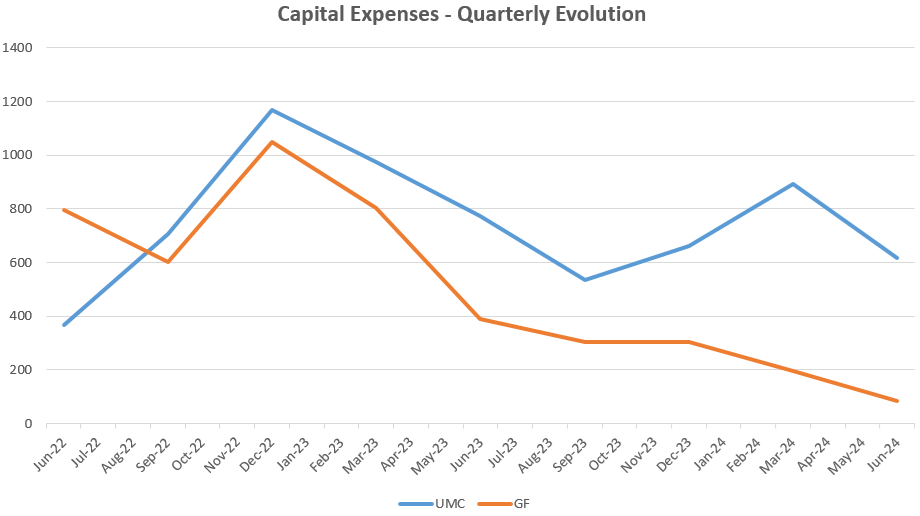

Looking further, in contrast to GF, UMC’s broader focus also makes its manufacturing process more aligned with TSMC, which also produces lagging edge nodes in addition to catering to HPC (high-performance computing) chips for data centers and mobile applications. As a result, the Taiwanese foundry has been investing more than GF in its manufacturing facilities, both to expand capacity and upgrade its technology with capital expenditures outpacing its cash flow from operations, resulting in negative FCF as shown above.

Charts built using data from (seekingalpha.com)

GF’s Specialty Products mean more Stability Amid Uncertainty and Improving Profits

In contrast, GF continues to generate positive FCF (above table) as it does not seek to compete directly based on volume manufacturing capability, but instead by providing specialized manufacturing for specialty electronics with a high dose of innovation. This approach allows it to serve clients that do not necessarily require leading-edge nodes (the latest technology) but still need reliable production.

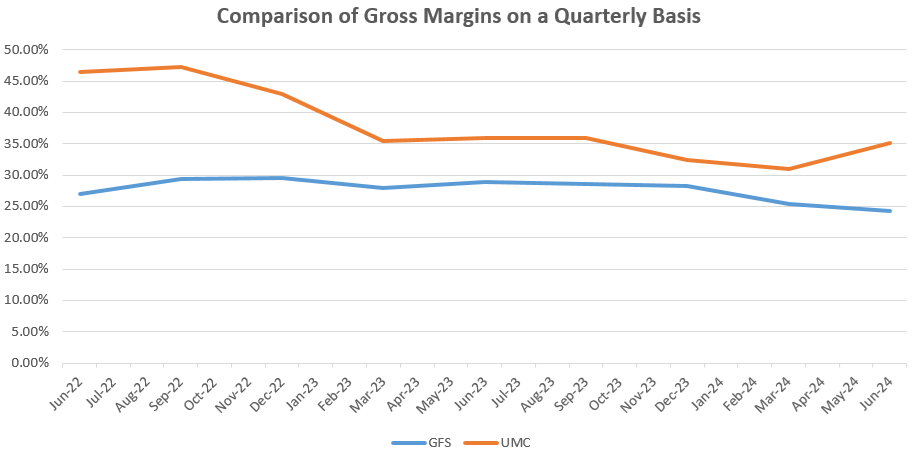

Thus, during the period of low demand, it has maintained a factory utilization rate in the low to mid-70s while for UMC, it fell to 65% and 68% in the first and second quarters of 2024 compared to historical highs of 85% to 90%. Now, since utilization has a direct correlation to gross profit margins, UMC has seen margins declining by more than 15% as shown below while for GF, it has been contained in the 25% to 30% range.

Charts built using data from (seekingalpha.com)

Consequently, this comparison shows that despite bearing relatively higher expenses for its foundry business, GF’s manufacturing process which revolves around specialty products can be credited with more stable margins, especially during periods of low demand. Also, its lower-intensity capital allocation strategy puts it in a better position to expand its manufacturing footprint while remaining FCF-positive.

Still, as shown above, GF’s margins dipped below 25% to 24.2% in Q2 because of certain long-term agreements with customers allowing for underutilization economics, or a situation where utilization was kept deliberately low to deliver chips on time. As a solution, two improvement measures have been initiated, consisting of reducing certain input costs and diminishing the degree of underutilization from $66 million in Q2 to about $33 million (or half) in the second half of the year. This should increase margins and to this end, analysts have revised its consensus EPS estimate for FY-2024 higher, from $1.33 to $1.39.

There are Risks but Inventory Appears to be Stabilizing

Switching to risks, the chip industry remains consumer-led and therefore intricately tied to macroeconomics, not only in the U.S. where semis stocks have undergone a sell-off during the last two weeks because of interest rate-related reasons but also in China, where GF sales have already been feeling the effects of the real estate overhang.

However, to GF’s credit, the market seems to be weighing in its onshoring strategy on U.S. soil rather than potential issues in China since it gained 7% on July 17 following news pointing to an escalation of geopolitical tensions with China. To this end, its acquisition of Tagore Technology’s GAN (Gallium Nitride) power business can be viewed as a strategic move to further move away from China for high-performance electronics and is not only aligned with the CHIPS Act but also grows its addressable market size by $1.6 billion.

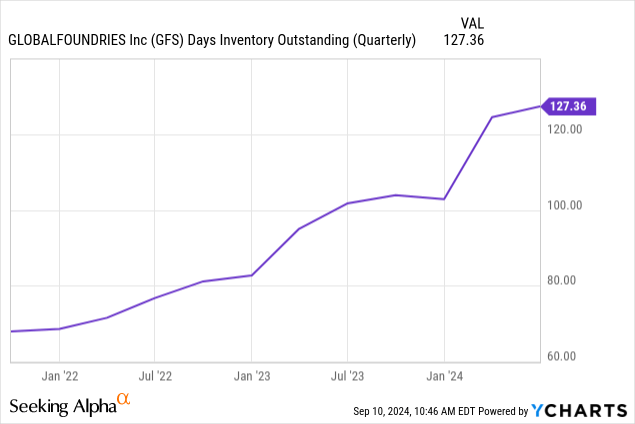

Finally, DIO or Days of Inventory Outstanding has been a deceleration as shown below, meaning it may be on the way to stabilizing the average number of days it holds the inventory before selling it, a possibility also evoked by analysts at Baird.

Data by YCharts

Last but not least, it has diversified its revenue base with the largest end market (smartphones) constituting less than 45% of its overall sales and has progressed on the profitability front while it holds more cash than debt in its balance sheet.

Enjoyed this article? Sign up for our newsletter to receive regular insights and stay connected.