Coterra Energy Inc. (NYSE:CTRA) is a combination of what former were Marcellus natural gas company Cabot and Anadarko-Permian oil and gas company, Cimarex. The majority of the company’s 669,000 BOE/D of production (69%) is natural gas. However, it is steadily increasing its oil (16%) and natural gas liquids (15%) volumes.

Current market capitalization is $18.0 billion. Coterra’s capital return program comprises a fixed dividend now yielding 3.4%, a share repurchase program, and—as warranted—an optional additional variable dividend depending on the level of free cash flow.

In addition to this investor-friendly policy, other positive factors include the company’s clean balance sheet and ownership structure, improving gas prices, key counterweight Permian oil production, hyper-stable beta of 0.20, and affordable entry price.

I own Coterra shares and recommend Coterra as a buy. The company will report 3Q24 results on November 1, 2024.

Macro

Coterra’s results depend on natural gas prices (NG1:COM). These may stay limited for a while: LNG permitting—a big source of potential demand–has been paused. Permian gas production exceeds takeaway capacity, leading to negative prices in west Texas. The overall pressure on gas prices has also led Marcellus producers to shut in production.

On the demand (and positive) side, the increasing need for electricity due to artificial intelligence data centers favors increased use of natural gas as a generating fuel. Natural gas is also a backup for intermittent renewables.

Energy supply and demand regulation is likely to depend somewhat on the outcome of the US presidential election. However, there is considerable inertia in regulatory processes and drilling budgets are informed by the forward curve, which is trending up for natural gas. Nonetheless, a Kamala Harris win would be expected to continue the status quo, while a Donald Trump win may include encouragement for both supply (drilling) and demand (lifting the hold on LNG export terminal permitting.)

Because Pennsylvania—where the vast Marcellus formation is drilled—is a swing state in deciding the election, the subject of fracking has been important. Trump favors fracking; Harris’ position is unclear, as she has spoken both for and against fracking.

Areas of Operation

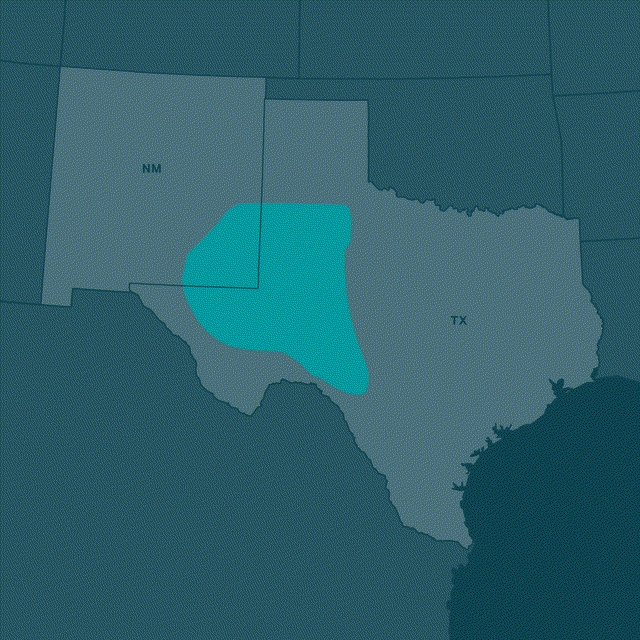

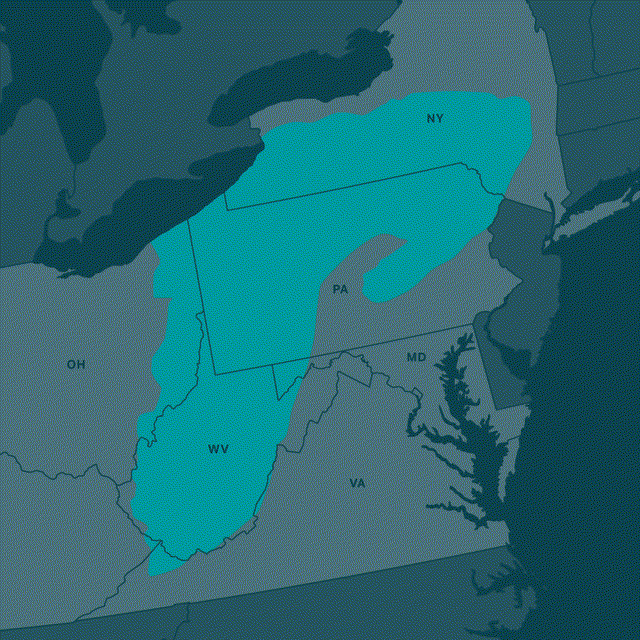

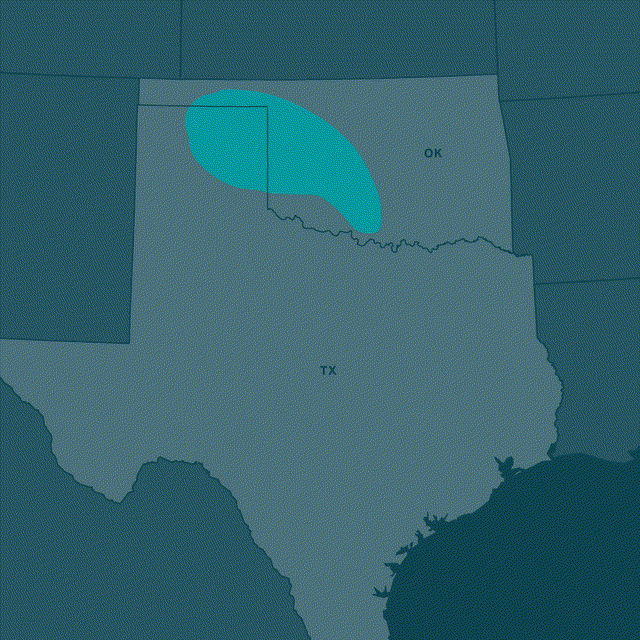

The three maps below illustrate the regions in which Coterra operates: the Permian, Appalachia, or the Marcellus/Utica, and the Anadarko.

Coterra has 296,000 Permian acres. Its 2023 Permian production represented 35% on a BTU basis, but 55% on an economic value basis. Targets are the Wolf Camp and Bone Springs shales.

Marcellus—Upper and Lower Marcellus

Coterra has 186,000 Marcellus acres. Marcellus production in 2023 represented 57% on a BTU basis but only 34% on an economical basis. Coterra targets the Lower and Upper Marcellus zones.

The company has 182,000 net Woodford acres targeting the Woodford Shale. In 2023, Woodford production accounted for 8% on a BTU basis and 11% on an economical basis.

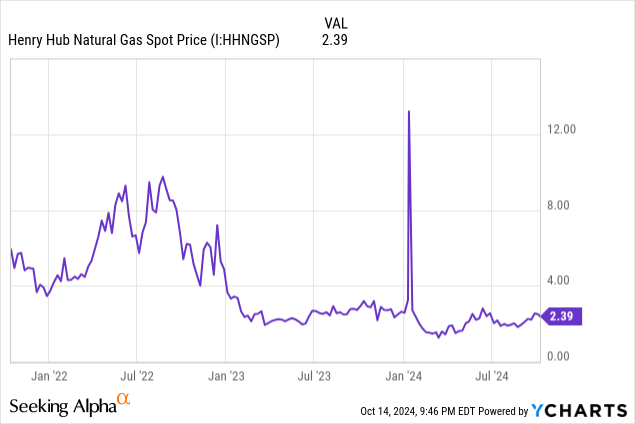

US Gas Prices

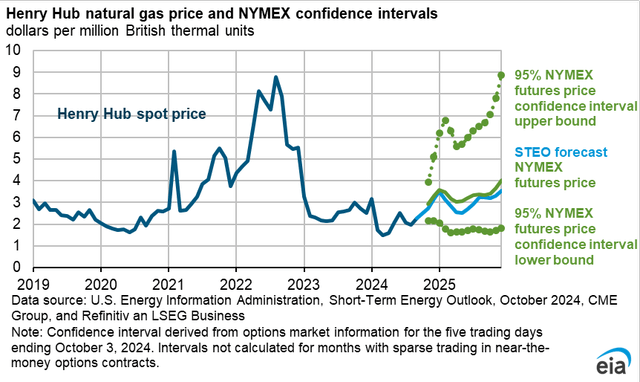

The October 14, 2024, natural gas futures price for November 2024 delivery was $2.47/MMBTU at Henry Hub, Louisiana.

As shown below, the EIA projects Henry Hub gas prices at year-end 2025 of between about $1.75/MMBTU and $9.00/MMBTU, with average prices for 2025 climbing to about $3/MMBTU.

As the EIA’s spot price information frequently illustrates, Appalachian and Waha (west Texas) prices are typically well below those for Henry Hub. For example, in last week’s natural gas report for the week ending October 9, 2024, (LLIN), the Louisiana reference price was $2.42/MMBTU, but the Appalachian gas price (Eastern Gas South) was $1.61/MMBTU and the Waha (west Texas) price was again negative at -$1.17/MMBTU. The negative Waha “price” means there was actually a cost to handle the gas, like a waste product. Negative prices result from insufficient gas pipeline takeaway capacity in west Texas, in this case due to maintenance on the westbound El Paso Natural Gas pipeline system.

Natural Gas Liquids

NGLs (ethane, propane, and butane) are used to make ethylene, a critical petrochemical building block, and for heating and drying. Coterra gets a price uplift from its NGL production.

Oil

The West Texas Intermediate reference November futures oil price closed on October 14, 2024, at $71.74/barrel. Because oil is so much more valuable, Coterra’s oil gives it a competitive advantage over gas-only producers.

Coterra Second Quarter 2024 Results and Guidance

For the second quarter of 2024 Coterra earned net income of $220 million, or $0.30/share. Operating cash flow was $558 million.

The company made $477 million of capital expenditures during the quarter.

Production was 669,000 barrels of oil equivalent per day (BOE/D), exceeding its high-end guidance. Of this, 16% was oil, 15% was natural gas liquids, and 69% was natural gas. Marcellus was entirely gas; Anadarko was natural gas liquids and gas, and Permian was majority oil and natural gas liquids and minority gas.

Including the effect of derivatives, it received*$79.37/barrel for oil

*$1.26/MCF for natural gas

*$19.53/barrel for natural gas liquids

For full year 2024, Coterra estimates

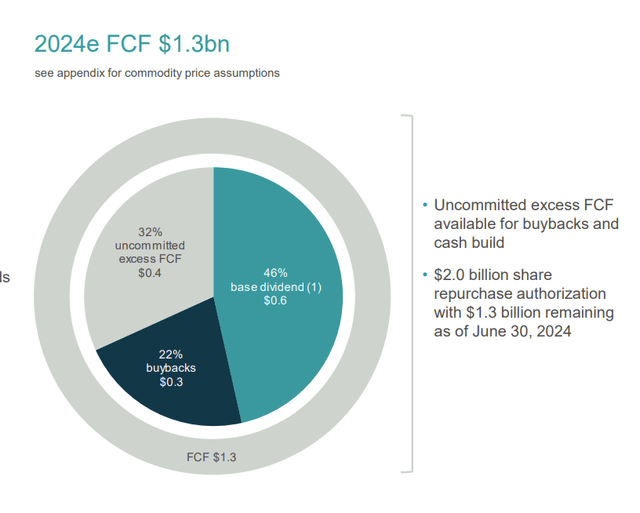

*free cash flow of about $1.3 billion

*discretionary cash flow of about $3.2 billion

*total production volumes of 645,000-675,000 BOE/D,

*oil production of 105,500-108,500 BOE/D,

*capital budget of $1.75 billion to $1.95 billion.

Reserves

Coterra’s SEC PV-10 reserve value at year-end 2023 was about 40% that of 2022 at $10.7 billion, compared to $26.1 billion for 2022. Note that the prices used for the calculation in 2023 were much lower than those used at year-end 2022.

Prices used at year-end 2023 for the calculation were $2.04/MCF for natural gas, $75.05/bbl for oil, and $18.39/bbl for natural gas liquids.

This compares to prices used at year-end 2022 for the calculation of $6.36/MCF for natural gas, $93.67/bbl for oil, and $41.76/bbl for natural gas liquids.

At year-end 2023, Coterra’s proved reserves were 2.32 billion BOEs.

Of these,

*oil was 10.7%

*natural gas liquids were 13.7%

*natural gas was 75.6%.

Competitors

Coterra’s headquarters are in Houston, Texas.

Gas producing companies with which it competes in Appalachia include Antero Resources (AR), Expand Energy (EXE), CNX Resources (CNX), EOG (EOG) with its Utica Combo play, EQT (EQT), Gulfport Energy (GPOR) in the Utica, National Fuel Gas (NFG), Ovintiv (OVV), and Range Resources (RRC).

With a history in infrastructure (pipelines), the Cabot predecessor of Coterra is better able to sell its natural gas than other producers: it more readily sells to industrial customers, power generation plants, local distribution companies, and gas marketers via its ownership of gathering systems and pipelines.

In Oklahoma, public-company competitors include Crescent Energy (CRGY), now-private Continental Resources, Devon Energy (DVN), Gulfport, Mach Natural Resources (MNR), Marathon Oil (MRO)—for which ConocoPhillips (COP) has bid, Ovintiv, Exxon Mobil (XOM), and some private companies.

Coterra also competes with companies in other US gas basins like the Eagle Ford in south Texas, the Haynesville in east Texas and Louisiana, the Fayetteville in Arkansas, and associated gas from the Bakken in North Dakota.

In the west Texas and eastern New Mexico Delaware sub-basin of the Permian, Coterra competes with virtually every producer.

Associated natural gas is a particularly strong competitor—this gas is produced in association with oil, hence the name—and so its production is driven by oil economics rather than gas economics. Moreover, with emphasis—and regulation–on reducing emissions and flaring by recovering and selling fugitive methane, it is likely even more gas will be produced from oily basins. Associated gas volumes are largest in the Permian Basin, particularly the Delaware sub-basin.

Governance

Institutional Shareholder Services (ISS) ranked Coterra’s overall governance on October 1, 2024, as a 6, with sub-scores of audit (9), board (7), shareholder rights (3), and compensation (8). In this ranking, a 1 indicates lower governance risk and a 10 indicates higher governance risk.

At September 30, 2024, shorts were 2.9% of float. Insiders owned 1.8% of the shares.

Coterra’s beta remains surprisingly small (doesn’t move as much as the overall market), particularly for a hydrocarbon producer, at 0.20.

On June 30, 2024, the five largest institutional stockholders, some of which represent index fund investments that match the overall market, were Vanguard (12.0%), Wellington (7.5%), BlackRock (7.2%), State Street (6.9%), and Aristotle Capital Management (4.7%).

All but Vanguard and Aristotle Capital are signatories to the Net Zero Asset Managers initiative, a group that manages $57.5 trillion in assets worldwide and which limits hydrocarbon investment via its commitment to achieve net-zero alignment by 2050 or sooner.

Financial and Stock Highlights

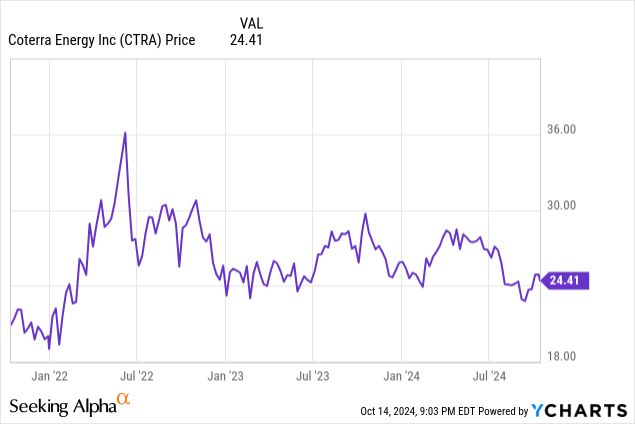

Coterra’s market capitalization is $18.0 billion at the October 14, 2024, stock closing price of $24.41/share. The company’s 52-week price range is rather narrow at $22.30-$29.89 per share, so its closing price is 82% off the 52-week year high. The price is 78% of the one-year target of $31.10.

Trailing twelve-months’ (TTM) EPS is $1.73, giving a current price-earnings ratio of 14.1. The averages of analysts’ EPS expectations for 2024 and 2025 are $1.75 and $2.49, respectively, for a forward price-earnings ratio range of 9.8-13.9.

TTM returns on assets and equity are 5.3% and 10.2%, respectively.

TTM operating cash flow was $2.93 billion and levered free cash flow was $795 million.

The base dividend yield, annualized and assuming no variable dividend, is 3.4%.

The company has a $2.0 billion share repurchase program with $1.3 billion of remaining authorization. Its policy is to return 50% or more of free cash flow to shareholders via regular dividend, share repurchases, and occasional (but not guaranteed) special dividends.

On June 30, 2024, CTRA had $7.7 billion of liabilities (link to 10Q) including only $2.1 billion in long-term debt and $1.7 billion in current liabilities. Assets are $20.8 billion for a healthy liability-to-asset ratio of 37%.

Coterra’s mean analyst rating is 2.1, or “buy” from twenty-seven analysts.

Notes on Valuation

Current book value is $17.61/share, below-market value and so indicating a potential investor bargain.

As noted, SEC PV-10 reserve value is $10.7 billion. Asset value is $20.8 billion. Market capitalization is $18.0 billion. Enterprise value is $20.1 billion.

The ratio of enterprise value to EBITDA is a bargain at 5.7, well below the maximum of 10.0.

The $18.0 billion market capitalization gives Coterra a metric of $30,000 per flowing BOE. This is on the low side because CTRA is a majority-natural gas company.

Positive and Negative Risks

Potential investors should consider their gas price, supply competition, and future gas market demand expectations—particularly for the Marcellus, Permian, and Anadarko basins–as the factors most likely to affect Coterra Energy.

Natural gas liquids and oil prices are also important to Coterra.

Other risks are political and regulatory and may change, depending on the outcome of the US presidential election.

Recommendations for Coterra Energy

I recommend Coterra Energy as a buy for energy investors interested in low-beta (0.20) natural gas exposure, with some uplift from liquids and oil.

The stock price is on the low side of its range, providing a good entry point, and stock price fluctuations are unusually small. The company has a clean balance sheet—welcome to see—with only a 37% liability-to-asset ratio.

Coterra pays a 3.4% dividend, regularly buys back shares, and has committed to returning more than 5o% of free cash flow to shareholders.

Coterra’s production is 69% natural gas, much of it in price-disadvantaged Marcellus (Pennsylvania) shale. However, it is steadily increasing its Permian oil and NGL production volumes and reserves. Moreover, in the sector generally, 2025 natural gas futures prices are stronger than 2024

Enjoyed this article? Sign up for our newsletter to receive regular insights and stay connected.