Summary

- Microsoft faces elevated expectations driven by AI and cloud growth, but current valuation appears stretched, and risks are mounting.

- Microsoft’s capex is surging, potentially outpacing cash flow, raising concerns about sustainability if growth targets are missed.

- The company’s large stake in OpenAI is risky, given inflated valuations and uncertain monetization, which could impact goodwill and future earnings.

- Given high capital spending, optimistic forecasts, and OpenAI risks, MSFT is currently a risky investment unless growth and monetization exceed expectations.

The market continues to hold a positive outlook for the Magnificent Seven Shares, including Microsoft (MSFT). The primary drivers for Microsoft stock are increasing demand for AI and cloud computing and stable digital services revenues. However, we believe that the company’s valuation is close to becoming overheated. And in the foreseeable future, Microsoft shareholders need to take into account a number of certain risks.

For starters, let’s go over some of Microsoft’s fundamentals:

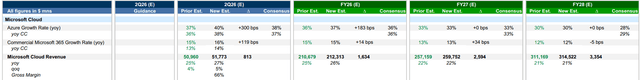

– Revision of profit and revenue forecasts. Consensus forecasts have been rising every quarter. Currently, the market expects 2026 EBITDA to reach around $200 bln, according to Finbox consensus data – a 28% y/y increase compared with 20% in fiscal year 2025 (ended in June 2025) and 30% in 2024. In 2023, expansion was in the single digits, meaning there was a low base for growth in 2024.

– Based on this forecast and our calculations, we assume a FWD EV/EBITDA ratio at around 19x, while the data from the valuation section on Seeking Alpha shows ~18x. The average FWD EV/EBITDA for the past five years is 21.7x, according to SA data. That means the company is valued below its historical average, which in theory should be positive for the investment case, but there are nuances.

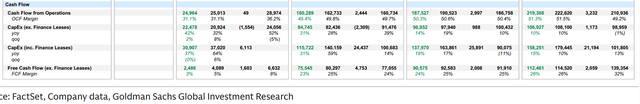

– The company continues to raise its capex forecasts. The latest estimate is at least $94 bln for fiscal year 2026, excluding leasing (to put this into perspective, the forecast at the beginning of CY 2025 was $63 bln). On the one hand, this is an investment in growth and could add positive sentiment. On the other hand, if capex surges but the company struggles to increase operating cash flow in the future, then MSFT’s FCF could slip into negative territory in the near future when the leasing agreements come into effect. For example, now Goldman Sachs expects capex to exceed $137 bln in 2027, including data center leasing. This is more than the company’s entire operating cash flow for the latest fiscal year (FY 2025). Although GS also forecasts FCF growth in 2025-2027, we’re intentionally comparing 2027’s capex to 2025’s cash flow only to highlight the risk: if Microsoft doesn’t increase cash flow at the same pace as capex by 2027, FCF will suffer.

To summarize all the abovementioned, the market values the company at roughly its historical average (even with some discount), implying accelerated growth in fiscal year 2026 from the already high base of 2025. That’s amid expectations of an economic slowdown in 2025-2026 despite the AI-related investments continuing to surge.

Furthermore, in Q1 2026, EBITDA rose 27% y/y, which was already slightly below the average forecast. In this light, the forecasts for the full year seem a little too high. There are some doubts here: If the optimistic outlook does not come true, there will likely be a correction.

CapEx problem

It should also be noted that the market is no longer unequivocal about perceiving capex growth as a positive development: Meta shares, for example, fell on the back of an increased estimate for capital expenditures. Its guidance for higher capex came alongside an announcement of a $25 bln loan to expand investments. In addition, its cash balance fell to a two-year low of around $10 bln ($44.4 bln including short-term investments – but also a two-year low). Both Meta and MSFT can come close to starting to burn cash, that is, eating into the windfall profits they earned in 2023 and 2024. If this year they fail to deliver the growth expected by the market, it could be perceived very negatively.

OpenAI represents another sore point

First, the startup is signing inflated deals worth hundreds of billions of dollars. That’s even though the company doesn’t earn a profit and, in the last quarter, brought Microsoft a loss of $523 mln. Second, the market’s assessment of the situation, in our opinion, seems to be that OpenAI has no competition in AI. However, it is definitely there: DeepSeek, Grok, Gemini, and others. Some of them are even free for basic use. MSFT’s stake in OpenAI can now be valued at $135 bln, assuming a $500 bln OpenAI valuation and 27% Microsoft’s share. Moreover, the hype surrounding OpenAI in early calendar year 2024 presumably caused goodwill on Microsoft’s balance sheet to almost double to $119 bln. If it is really so and if OpenAI’s growth will disappoint market, the value of Microsoft’s stake in it will be revised, so goodwill could suffer as a result of its potential write-off. OpenAI itself is valued at a staggering $500 bln, with annual revenue estimated at ~$13 bln, of which about 70% is regular subscriptions ($20 that people pay to interact with ChatGPT). Many believe OpenAI will grow into $100+ bln in sales, but nobody knows how exactly. We think that current business model does not look revolutionary, and we do not see any specific forecasts or plans for further monetization of the service with clear assumptions.

Risks to our sell thesis

1) If EBITDA grows at or above expectations, Microsoft’s current estimate can be called justified.

2) If OpenAI really comes up with new effective ways to monetize its multi-billion-dollar investments, this will lead to an upward revaluation of the company, including Microsoft.

Bottom Line

Basically, these arguments (high capital spending, optimistic forecasts, and OpenAI’s inflated deals) are the reason for our skepticism regarding the current market valuation. We believe that the forecasts could be a bit too high, and there are also risks in the form of rising capital expenditures and the unstable valuation of Microsoft’s stake in OpenAI, as the latter is not even publicly traded. And it is not a given that the average investor will value it at $500 bln in the event of an IPO. Thus, we think that right now Microsoft is a risky investment.

The key risk is if the EBITDA forecast is met, meaning that Microsoft will be able to accelerate growth from its current high base, and OpenAI’s revenue will grow exponentially. In that case, the current valuation could even be considered too low, and Microsoft would still hold the potential to grow to at least the average five-year EV/EBITDA, or by about 15%.

Enjoyed this article? Sign up for our newsletter to receive regular insights and stay connected.