Thesis

Eli Lilly (LLY) has just announced that it has managed to secure spots on China’s first innovative drug catalogue for private insurance. However, the bigger news for me is that Lilly is also set to add Mounjaro to the national reimbursement list. This list is completely different as China’s National Reimbursement Drug List is the official catalogue of medicines that are actually covered, fully or partially, by the country’s public health-insurance system. So, this changes things in terms of reachability. I expect that they have negotiated quite a discount on the drug treatment to get on this list. And whilst currently it is just for the treatment of diabetes, it is also tipped that obesity and sleep apnea (OSA) are also being discussed. My bull case sees Lilly getting Mounjaro as a treatment option for all three cases. And with the population being so large in China, even adoption rates as low as 0.5% yield addressable markets in the billions, as I will explain.

A ticket to China

As you’ve probably heard, China has just made the decision to include a few innovative therapies from Lilly, Pfizer (PFE), Johnson & Johnson (JNJ), and one or two others in its new private-insurance drug catalogue. Now, the drug market in China is a bit different. This catalogue is set to act as a kind of supplemental system for covering high-cost innovative medicines that are just too expensive for the country’s basic public insurance program. So, public insurance, which covers about 95% of the population, pays for any essential and negotiated drugs, while the commercial catalogue allows newer treatments, particularly those from the Western world, like advanced cancer drugs or therapies for diabetes, Alzheimer’s, and rare diseases.

Now, these are to be reimbursed only for patients who hold private insurance plans that choose to include those treatments. I think Lilly will negotiate a significant discount, possibly in the 15% to 50% to gain access to the plans. And yes, these prices are far lower than global levels, but they still allow manufacturers to maintain quite healthy margins simply because of the large market and volume potential in China. The flip side is that because commercial health insurance remains so limited, just covering only about 7% to 8% of total innovative-drug spending, most Chinese patients either just rely on public insurance or pay substantial amounts out-of-pocket.

Additionally, Lilly is also set to add Mounjaro to the national reimbursement list. This, on the other hand, is a major expansion of access in one of the world’s fastest-growing healthcare markets and here’s why. China’s National Reimbursement Drug List is the official catalogue of medicines that are actually covered, fully or partially, by the country’s public health-insurance system. So when a drug is included on this list, the government and the pharmaceutical company will negotiate a somewhat reduced price, and then the cost of that drug is heavily subsidised by China’s national insurance fund. This makes Mounjaro far more affordable for patients, since they technically pay only a small co-payment rather than the full retail price. Lilly is also tipped to have approvals also for obesity and sleep apnea in the works.

The potential in China

Now, for Eli Lilly, having Mounjaro reimbursed for type 2 diabetes sets the drug up quite nicely for rapid uptake. China would be a country with one of the highest diabetes/obesity burdens globally. And if you add Alzheimer’s therapy, Kisunla deepens Lilly’s footprint even more in high-value neurological care. It’s all part of China’s push to shift these high-cost speciality drugs off public budgets and into commercial plans with negotiated discounts.

From what I can tell so far, China actually updates this list annually, usually announcing changes in late November or December for implementation on January 1st of each year. So for Eli Lilly, the only drug confirmed to be added for 2026 is Mounjaro so far, and that’s only for its type-2 diabetes indication. However, Lilly’s tirzepatide is also approved in China for obesity and obstructive sleep apnea, but those uses are not reimbursed. So it means as of now, patients must pay the full cost out-of-pocket for those indications. Here’s where I see things getting interesting. Separately, Mazdutide, which is an obesity drug developed by Innovent under license from Lilly, was also approved in China this year and is actually eligible for reimbursement consideration. But so far, there is no evidence that it was accepted into either the basic national list or even the new commercial-insurance innovative drug catalogue. So in short, Mounjaro for diabetes treatment is on the list, and my bull case also sees the company negotiating for obesity or sleep-apnea to be included on that national insurance list also. This would be the best-case scenario for Lilly: they send one drug to China and can treat multiple health issues.

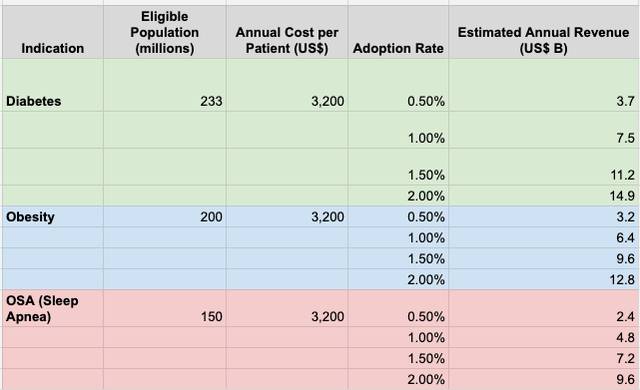

A word on the TAM

So, in my bull-case scenario where Lilly’s Mounjaro gains national insurance reimbursement in China for type 2 diabetes, obesity, and obstructive sleep apnea, the potential market could be enormous. China has roughly 233 million adults with diabetes, about 200 million adults with obesity, and another 150 million adults with OSA. Now, if we take a global list price of roughly $ 4,560 per year, and assuming a realistic 30% negotiated discount under national insurance, the annual cost per patient would be around $ 3,200. Now, realistically, with a very high-priced treatment, the price of the drug, even after the government subsidises it, will still be too high for many in the country. That’s why we would likely see a very small 0.5% to 2% adoption rate. Even the lower end of this range would be more realistic for early years post-reimbursement. With that said, Lilly would be looking at annual revenue that could reach roughly $ 3.7 to 18.7 billion for diabetes, $ 3.2 to 16 billion for obesity, and $ 2.4 to 12 billion for OSA. Now, whilst these figures are much lower than theoretical maximums, I think it’s realistic for the adoption rates to be that low. They may be even lower still, as you may have guessed, many of the treatments overlap. So those suffering from diabetes may also take the treatment to help with obesity. The 30% negotiated discount may even be higher. That said, they still represent substantial market potential, so even modest uptake could make China a meaningful growth driver for Lilly.

Petri Dish Reports

Risks

A challenge here is that Lilly may not actually secure reimbursement for obesity and sleep-apnea indications. This would limit market expansion somewhat, but with such an overlap between patient groups, I don’t see it being a major issue. The bigger issue will be the treatment cost, even after negotiated discounts; if prices are just too high, adoption rates would get compressed. We should also expect the competition from other GLP-1 or weight-management therapies to limit market share, which is why I was conservative in adoption rates.

Valuation

Lilly is currently trading at a forward price to earnings of 42.7x, quite a bit above the healthcare sector median of 19.2x. So there’s already a lot of high market expectations for continued growth. Its forward EV to EBITDA also screens as quite high at 32.7x. It similarly suggests the stock is richly valued relative to peers. Despite this, Lilly has some pretty strong earnings growth projections, with consensus EPS growth of 82% in 2025 and 36% in 2026, which support the premium.

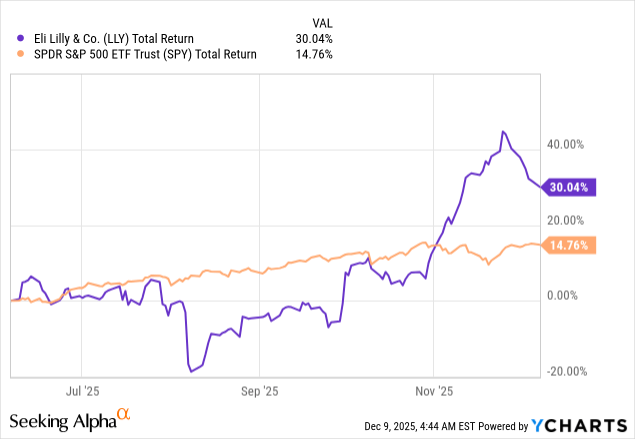

As for the stock price, since a pullback in mid-August, shares were gaining quite a bit of momentum until recently. On the 6-month chart, shares are up about 30%. However, since last November, shares have actually gone down 10%. I’m seeing this latest pull-back as a good buying opportunity ahead of 2026.

Seeking Alpha

Looking ahead

Moving forward, I would keep a close eye on whether Lilly secures reimbursement in China for Mounjaro’s obesity and sleep-apnea indications. I expect this to have a significant impact on the stock if it takes place. Essentially, it would significantly expand the drug’s addressable market. Key signals to watch are the official NHSA announcements. Pricing negotiations and uptake guidance are also going to play a big part going forward. However, having access to China’s public insurance drug market can’t be viewed as a bad thing as an investor and come next year, we should see more upside in China revenue.

Enjoyed this article? Sign up for our newsletter to receive regular insights and stay connected.