monday.com Ltd. (MNDY) is a software company that has experienced a sharp, more than 40% decline over the past 12 months. MDNY operates in a high-growth, high-demand space, offering a Work OS solution for businesses to manage, create applications, and efficiently handle projects.

At a forward P/E versus FY2026 EPS estimate at around 33x, the SaaS company trades at approximately a 38% premium, yet I argue there is room for multiple expansion, if significant top- and bottom-line growth continues. MNDY has achieved a 29% revenue growth over the past 12 months, signaling a 3.2x more rapid top-line growth than peers at 9%. This creates a disconnect in valuation, arguing that monday.com deserves a meaningfully higher multiple.

Thus, I rate monday.com a “Buy” with a $186 price target over the next 12 months, a 16% upside potential. If tailwinds play out and substantial performance continues, I think MNDY may outperform the benchmark.

Q3 2025: The 18th Double-Beat Indicates Excellent Execution

On Nov. 10, the company posted Q3 2025 results. The excellent execution continues, indicating the 18th consecutive double-beat performance. Nevertheless, the market reacted to the results with a 12% decline on the earnings day.

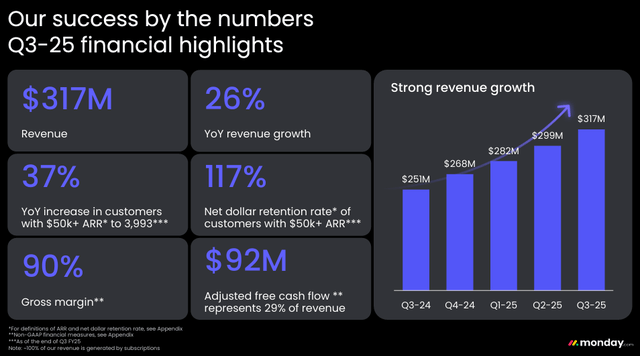

monday.com delivered approximately $317 million in revenue, representing a 26% growth on a year-over-year basis, and $5 million above analysts’ estimates. The bottom line arrived at $1.16 in diluted EPS, a 36% surge over the past 12 months, and $0.28 above what the market had anticipated. I think that such a significant performance, reflecting a high double-digit top- and bottom-line growth, deserves a premium, alongside well-managed execution. I also argue that the sell-off appears overly pessimistic.

MDNY: Q3 2025 Key Highlights (monday.com Investor Relations)

In the earnings presentation, monday.com highlighted that it has experienced a 37% surge in customers with more than $50,000 in ARR over the past 12 months, reaching 3,933 in total, and supporting the thesis of a sticky customer base. This also argues that MNDY’s services appear high-quality, and clients are favoring their software solutions rather than alternatives in the market.

Moreover, monday.com indicated a significant 117% net dollar retention rate of the above customers. In addition to this, the SaaS company achieved a 90% gross margin. This heavily contributes to a bullish narrative. Such an elevated profitability metric indicates an 83% advantage versus the sector median of 49%. If management can sustain operating at such margins further, this would support a bottom-line increase, and it may rebound from the recent sell-off.

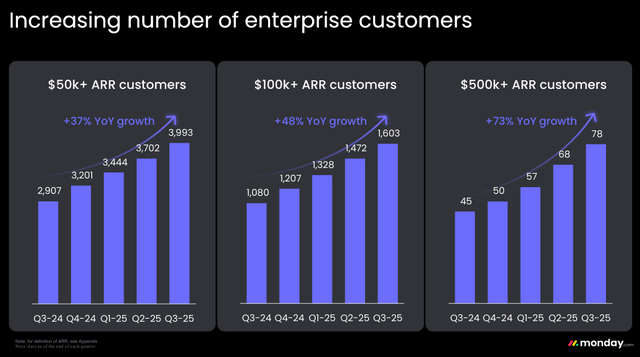

Furthermore, the company experienced a 48% surge over the past 12 months in customers with more than $100k in ARR and a 73% increase in clients with more than $500k in ARR on a year-over-year basis. If the company can sustain such performance further, this may support top- and bottom-line growth further.

The global productivity management software market was valued at $60 billion in 2023 and is anticipated to reach $150 billion by 2030. This reflects a 14% CAGR, and if monday.com can sustain its leading stance in the industry, I believe it remains well-positioned to benefit from broader market growth. This could also lead to an expansion of sticky customer growth.

MDNY: Q3 2025 Sticky Customer Base (monday.com Investor Relations)

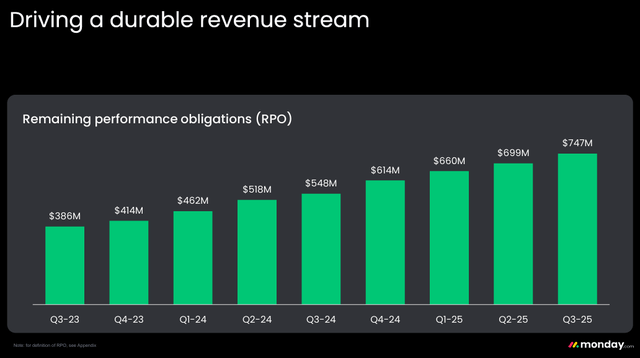

I would also like to emphasize that monday.com has a substantial amount in the remaining performance obligations. This underscores $747 million in Q3 2025 and represents a 36% surge on a year-over-year basis. Although this highlights execution and conversion risks, this also implies a strong market position and solid moat. If the uptrend of RPO continues further, monday.com may be repriced by the market at a more appealing valuation.

MDNY: Q3 2025 Remaining Performance Obligations (monday.com Investor Relations)

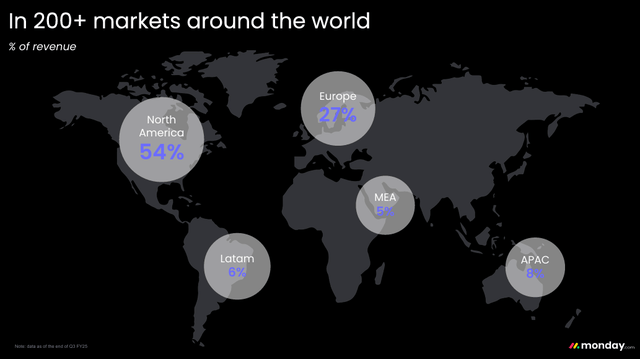

Although the software company appears to be well-diversified globally, revenue concentration risk remains. Roughly 54% of the total revenue comes from North America, with Europe taking the stance of second-largest market with 27% growth.

This also may represent a future tailwind for the company, if it succeeds in expanding outside the biggest regions. It has a presence in other markets, too, but none of them accounts for a double-digit share. This may slightly cloud the outlook, but I also think that if monday.com continues strong performance in the core markets, investors may overlook concentration risk, and it may be enough to sustain an elevated multiple.

MDNY: Q3 2025 Well-Diversified Globally (monday.com Investor Relations)

Overall, I think that monday.com remains a significant business. It has a solid position in the global productivity management software market and experiences substantial demand, supported by high double-digit top- and bottom-line growth. Due to high-quality services, it has a sticky customer base. Furthermore, it operates at market-beating margins, and that heavily contributes to its bullish outlook. I think that the recent sell-off appears overdone, and if phenomenal performance continues, MNDY appears well-positioned to rebound from these levels.

Premium Company Comes At An Elevated Price

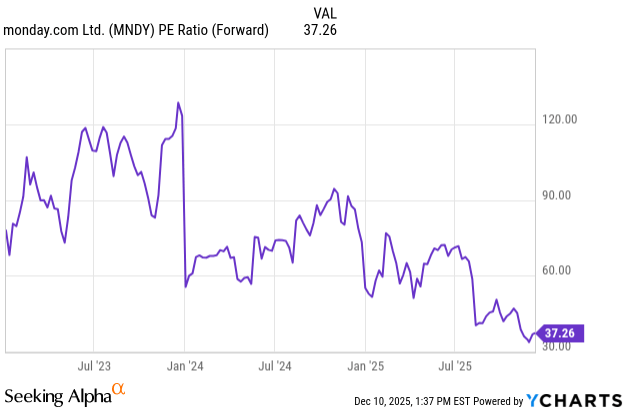

monday.com trades at a forward P/E of approximately 37.5x versus the FY2025 EPS estimate. This presents a 57% premium versus peers at a 24x earnings multiple. Although this appears elevated, I argue MNDY may actually be cheap at these levels if growth delivers. In addition, the forward P/E chart below highlights a multi-year low valuation.

MDNY: Forward P/E (YCharts)

To support my bullish thesis, on a forward PEG (non-GAAP) of 1.37, the software company trades at a 21% undervaluation versus peers at 1.74. This indicates that there is room for multiple expansions, and if management sustains an outstanding performance, it remains well-positioned to rebound from the recent sell-off.

On forward EV/sales and price/sales ratios of 5.50 and 6.82, respectively, monday.com trades at a 75% premium at the midpoint versus the sector medians of 3.49 and 3.55. However, I argue that it remains insignificant, and there is more room for multiple expansion. This also signals that the market anticipates strong top-line growth in the future.

Over the past 12 months, monday.com delivered approximately 29% revenue growth, highlighting a 3.2x premium at the midpoint versus peers at 9%. Therefore, if we compare the rapidness of top-line growth versus the valuation metrics, it actually reflects that monday.com is cheap at the current levels if such robust performance continues.

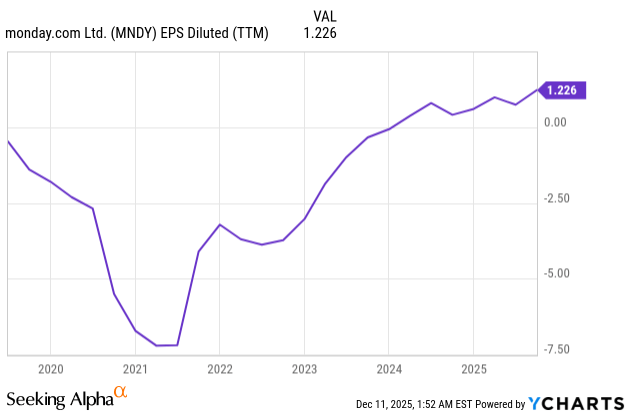

MNDY: EPS Diluted (TTM) (YCharts)

In addition to this, the software company delivered a significant bottom-line growth. Over the past 12 months, it has surged by 193%, representing a 15x outperformance versus peers at 13%. Moreover, management achieved a 20% operating cash flow growth on a year-over-year basis, signaling a 30% advantage versus peers at 15%. I think such robust performance deserves a higher premium, and it also supports my thesis that there is room for multiple expansion.

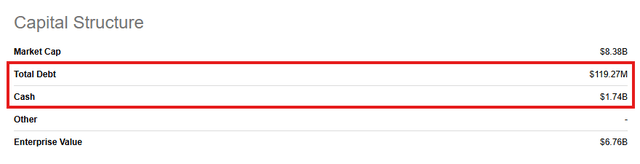

The SaaS company has a low-leveraged capital structure. monday.com has $119 million in total obligations and $1.74 billion in cash; therefore, it could pay its debt with ease. The company actually benefits from high-yield accounts, reflecting that the SaaS company generated $65.5 million in interest and investment income. This supports a bottom-line increase, and as long as the funding rates remain elevated, monday.com remains well-positioned to benefit from it.

MNDY: Capital Structure (Seeking Alpha)

To sum up, MNDY remains a high-quality SaaS company that is delivering significant top- and bottom-line growth and has a low-leverage capital structure. It benefits from a high-interest-rate environment, and due to low leverage, management has financial flexibility if needed. Furthermore, the Work OS company operates at above-market, premium margins, which supports my thesis that, at the current price tag, it appears relatively cheap.

Wall Street forecasts $4.90 in diluted EPS for FY2026. I think the software company may achieve the target, especially if strong momentum in demand continues. It has a strong market position, supported by sticky customer growth, which is also fueling a bullish narrative. If we apply the current earnings multiple of 38x to the FY2026 EPS estimate of $4.90, we arrive at my price target of $186. These highlights stock price appreciation supported by bottom-line growth, and if the top and bottom-line uptrend remains intact, it may achieve the estimate.

Main Risks And Concerns

monday.com is tied to risks and concerns that could meaningfully impact stock price performance in the short term.

The software company is down by more than 40% over the past 12 months, and that reflects a weak sentiment about the company. Usually, it takes time for the market to rethink its thesis about the stock, and if suppressed sentiment remains, this could result in continued underperformance versus peers.

Although it has experienced a sharp sell-off, the SaaS company still trades at a premium to both peers and the benchmark. If sentiment in the broader market dramatically changes, I believe this could continue discounting the stock, resulting in a correction closer to market valuation.

MNDY operates in a competitive industry. There are other well-known companies, such as Atlassian, Asana, and others, that operate in the field and compete for market share. I believe if investors feel that monday.com is losing market share to competition, sentiment may remain suppressed, and the stock could underperform further.

However, if none of the above risks and concerns materialize, I think the company remains well-positioned to sustain its solid growth and ride the momentum in demand.

monday.com Is A ‘Buy’

I think that monday.com may appear to be a compelling opportunity for long-term investors seeking diversification into the SaaS industry. The recent sell-off seems to be overdone, and if management sustains a robust performance and elevated margins, the software company may rebound from these levels.

It also has a low-leveraged capital structure, benefits from a high-yield environment, and delivers more rapid top- and bottom-line growth than peers. I think it remains relatively cheap at the current valuation, especially if significant performance continues. monday.com also has a strong market position and experiences a strong increase in its sticky customer base. This fuels a bullish narrative, positioning the stock to benefit from the trend of broader market growth.

I believe monday.com is a “Buy” with a $186 price target over the next year. This presents a 16% upside potential and broader market outperformance. 26 Wall Street analysts forecast a $235 price target over the next 12 months, reflecting a 48% upside opportunity. Although this is a possibility, I favor a more conservative approach.

Enjoyed this article? Sign up for our newsletter to receive regular insights and stay connected.