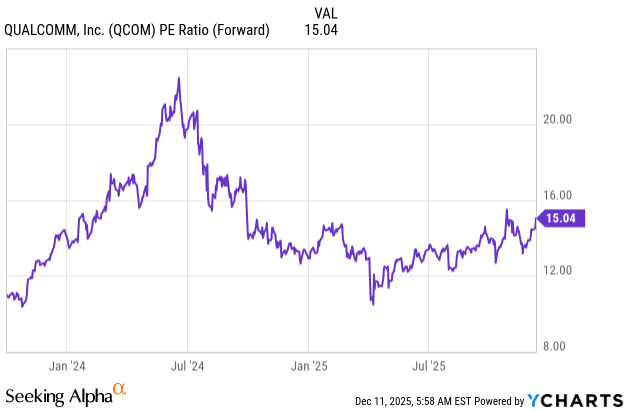

Qualcomm (QCOM) is up 16% on a year-over-year basis, yet the technology company remains significantly undervalued at a forward P/E of approximately 15. QCOM has a dominant position in the space of designing and manufacturing chips, including processors and radio frequency systems. The tech-enabled company also has a significant presence in the wireless device industry, including mobile communication.

I think the market undeservedly discounts the technology company. Over the past 12 months, it has delivered a 14% revenue growth, representing a 54% advantage versus the peers at 9%, although it trades at a 67% discount versus the sector median of 24x earnings multiple. This creates a significant disconnect in valuation, and I think this gap may narrow if solid momentum in demand continues.

I rate Qualcomm a Strong Buy with a $223 price target over the next 12 months. This highlights a 23% upside possibility and broader market outperformance. I think the company remains well-positioned to sustain a dominant stance in the field, which supports future bottom-line growth and improved sentiment.

Q4 2025: The 9th Consecutive Double-Beat Quarter

On November 5, the company delivered Q4 2025 results. This was a solid quarterly performance, supported by the 9th consecutive double-beat result, indicating excellent execution and solid momentum in demand. The market reacted to the results with a 4% upside on the earnings day, yet it gave it all back the following trading session.

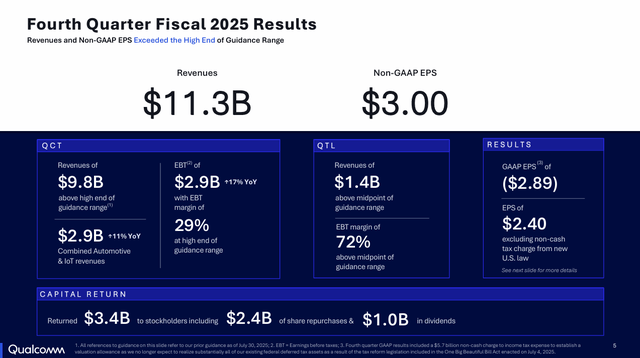

Qualcomm posted $11.27 billion in revenue, representing a 10% growth on a year-over-year basis and $509 million above what the market had anticipated. The bottom line came in at $3.00 in diluted EPS, signaling a 15% increase over the past 12 months versus $2.69 in diluted EPS in the same quarter last year and $0.12 above analysts’ estimates.

QCOM: Q4 2025 Results (Qualcomm Investor Relations)

In the earnings presentation, Qualcomm highlighted that the QCT segment, which reflects the business side that is tied to the design and manufacture of its high-tech chips, remained the core business of the company. It has delivered $9.8 billion in revenue, accounting for 87% of the total revenue in Q4 2025. It may appear that it comes with a revenue concentration risk, but the actual segment is well-diversified across end-use. For instance, its chips are used in cars, mobile phones, and other devices, and that is fueling a bullish outlook.

In addition to the below argument, the semiconductor company has announced it delivered $2.9 billion in combined IoT and automotive revenue. That is a solid 11% growth over the past 12 months. It also supports my previously mentioned argument of its operations being well-diversified, and that concentration risk may be minimal. Overall, the segment posted $2.9 billion in earnings before taxes, highlighting a margin of 29%.

Furthermore, its QTL business, which covers the licensing part, posted $1.4 billion in revenue. It accounted for roughly 12% of the total revenue and achieved an earnings before-tax margin of 72%. The segment is driven by royalty revenue; thus, that is heavily contributing to margin expansion. I think the top-line performance indicates business stability and strong momentum in demand. Qualcomm remains operating at premium margins and experiences a double-digit revenue growth, which argues for a closer-to-market valuation.

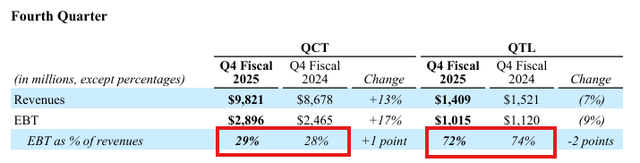

QCOM: Q4 2025 Results (Qualcomm Investor Relations)

I would also like to emphasize that in the earnings release, management indicated that in terms of EBT as of % of the total revenue, margins remained roughly flat. This highlights business stability. If margins were to erode, this could suppress sentiment. However, indicating that the semiconductor leader already trades at a significant discount to peers, this argues for a rebound and positive outlook if margins are sustained.

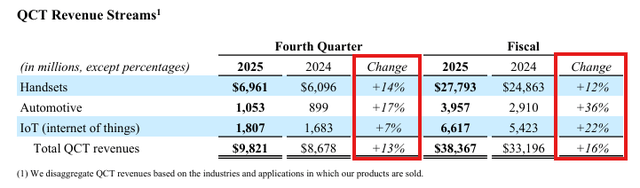

QCOM: Q4 2025 Results (Qualcomm Investor Relations)

Furthermore, QCOM indicated that operations ran on all cylinders. The snip above indicates a strong expansion across all categories within the QCT segment. For FY2025, automotive was the fastest-growing category, indicating a 36% surge versus FY2024. The core category of handsets delivered a 12% surge over the past 12 months, accounting for 70% of the total QCT revenue. This supports my bullish stance, indicating significant performance by the company.

The semiconductor company shared significant partnerships. To begin with, the company implemented an automated driving system with the German automotive heavyweight BMW, which will be available in its new iX3 model. The system is expected to be validated in roughly 100 countries by 2026. If it succeeds and receives positive feedback, the company may experience more partnerships in the automotive industry. Its Snapdragon Ride Pilot is now available to all global automakers, and that supports a bullish outlook.

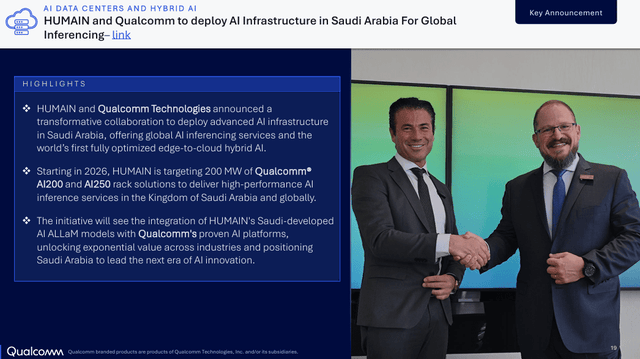

QCOM: Qualcomm To Deploy AI Infrastructure in Saudi Arabia (Qualcomm Investor Relations)

The company has also announced a partnership between them and HUMAIN to power AI infrastructure in Saudi Arabia to deliver high-performance AI inference services. Qualcomm solutions will be used for AI data centers in the region to enable AI-driven capabilities. HUMAIN is reaching a target of 200 MW of QCOM’s AI200 and AI250 rack solutions. I think this is a significant partnership, enabling a more diversified approach globally, and it’s strengthening its market position in the tech hub. This also supports a bullish outlook and my thesis arguing for a rebound from undervalued levels.

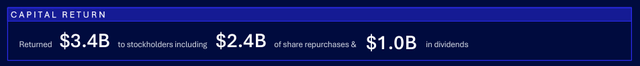

Qualcomm is also applying a shareholder-friendly capital allocation approach. The semiconductor company has announced it has returned $3.4 billion to its shareholders. It accounts for $2.4 billion in share buybacks and $1 billion in dividends. If such a shareholder-friendly capital strategy is continued, this may heavily contribute to the bottom-line expansion.

QCOM: Q4 2025 Shareholder-Friendly Capital Allocation Approach (Qualcomm Investor Relations)

To conclude, I think this has been a significant quarterly performance. Qualcomm strengthens its market position with solid partnerships. It also experiences strong top and bottom-line growth while sustaining stability in margins. QCOM applies a shareholder-friendly capital allocation approach through both share repurchase programs and dividends, and if that is sustained, investor confidence may improve, followed by bottom-line growth. I believe if Qualcomm can sustain a significant position in the field, it remains well-positioned to rebound from the current levels.

Qualcomm Is Undervalued And Deserves A Higher Premium

The leading semiconductor company is trading at a forward P/E of 15, highlighting a 67% discount versus the sector median of 25. In addition to this, the company is also trading at a 53% discount versus the average company in the S&P 500 at a 23x earnings multiple. The chart below reflects that the current valuation represents the lower trading range of the company, and there is room for multiple expansions if robust performance continues.

QCOM: Forward P/E (YCharts)

On forward EV/Sales and Price/Sales ratios of 4.39 and 4.27, respectively, Qualcomm trades at a 22% premium at the midpoint versus peers at 3.51 and 3.59. This actually signals that the market anticipates strong future revenue growth and that it may be partially priced in the stock price. This slightly offsets the bullish narrative, but I argue that the premium remains insignificant, and its top-line performance remains strong, and, accompanied by bottom-line growth, there is room for multiple expansions.

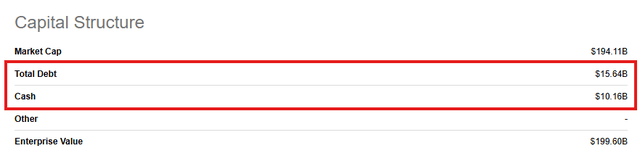

Qualcomm has a moderately leveraged capital structure, which supports a positive outlook. The semiconductor company has $15.64 billion in total obligations, which may appear elevated, but it also has $10.16 billion in cash, and that offsets the debt to a large extent. This also signals that management has financial flexibility.

QCOM: Capital Structure (Seeking Alpha)

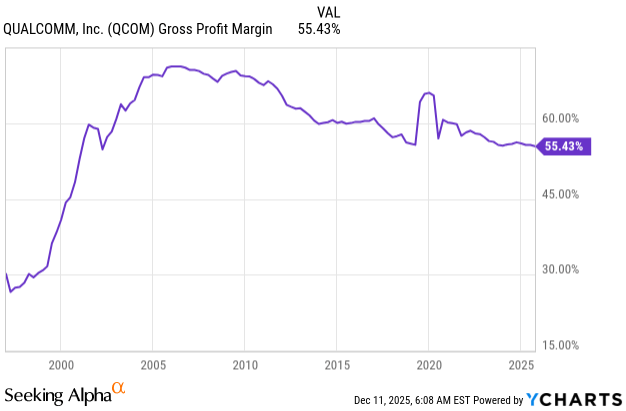

QCOM operates at premium, above-market margins, and that is another bullish argument supporting its outlook. The gross profit margin (TTM) of 55% indicates a 14% advantage versus peers at 49%. The net income margin (TTM) of 13% highlights a 2.5x outperformance versus the sector median of 5%. I think these margins indicate significant profitability metrics, arguing for a premium earnings multiple. This also contributes to my thesis, unveiling a significant gap in valuation versus both peers and the benchmark. If QCOM sustains such performance further, I think there is room for multiple expansion, and the market may reprice sooner rather than later.

QCOM: Gross Profit Margin (TTM) (YCharts)

Based on the chart above, it may be slightly concerning to see a multi-year downward momentum in the profitability metric. However, despite this, QCOM operates at a higher gross profit margin than its peers, although it trades at a substantial discount. I think investors remain overly pessimistic, while Qualcomm remains a high-quality company, with a leading position in the market and a profitable business model. To sum up, Qualcomm remains well-positioned to ride the momentum in significant demand further, and the analysis above supports my stance, indicating the company appears undervalued at the current levels.

Wall Street anticipates $12.11 in diluted EPS for fiscal FY2026 and $12.41 in diluted EPS for fiscal FY2027. I generally agree with the bottom-line expectations, especially if the robust performance and execution are delivered. I also anticipate that investor confidence may improve, and QCOM may rebound from these levels. This could also drive the earnings multiple higher, especially if QCOM becomes a diversified semiconductor play. I think the current forward P/E reflects a significant gap versus the sector median, although QCOM operates at better margins and delivers more rapid revenue growth.

Thus, if we apply an 18x earnings multiple, representing a 20% increase but still 39% discounted versus peers at 25x, it would signal a fairly conservative position, but leaving me room for error. So, if we apply it to the fiscal FY2027 EPS estimate of $12.41, we arrive at my price target of $223. This indicates strong price appreciation, supported by bottom-line expansion and improved investor sentiment.

Main Risks And Concerns

Qualcomm is tied to risks and concerns that could meaningfully impact stock price performance in the short term.

To begin with, QCOM trades at a suppressed valuation, and although I think it deserves a meaningfully higher valuation, it usually takes time for the market to rethink its thesis about the company. A 16% rally over the past 12 months may signal that the inflection point has occurred, and the company may continue its uptrend, yet I wouldn’t be surprised if sentiment remains discounted, especially if broader markets remain choppy.

The company remains heavily dependent on the smartphone segment. Although the business has become more diversified, it still experiences revenue concentration risk. The headset category accounted for 70% of total QCT top-line contribution, and that is significant. If demand meaningfully declines in the segment, this could heavily weigh on QCOM’s future outlook.

The pressured sentiment was mainly driven by the expectations of the Apple and Qualcomm partnership coming to an end. The semiconductor company heavily benefited from the tech heavyweight, and although it has become a more diversified business, especially underscoring strong demand in the automotive space, if the partnership is not extended, it will weigh on performance. However, this was a known risk, and given its undervalued stock price and only 17% increase in stock price over the past 5 years, I argue it may already be priced in the stock price.

On the other hand, if none of the above risks and concerns materialize, Qualcomm may rebound from undervalued levels, supported by strong top- and bottom-line growth and premium margins.

Qualcomm Is A Strong Buy

I think that Qualcomm may appear to be a compelling opportunity for long-term investors seeking diversification in the semiconductor space at an appealing price tag. The technology company delivers more rapid top-line growth than peers, operates at premium, market-beating margins, and has a low-leveraged capital structure. However, it also trades at a significant discount to peers, establishing asymmetry in valuations.

The sentiment around the company remains suppressed, and that could be due to the anticipation of collaboration with Apple coming to an end. Nevertheless, it has become a more diversified business model, offsetting the bearish narrative. In addition, this was already a known risk, and I argue it may already be priced in the stock price. Thus, I think tailwinds outweigh the headwinds.

I rate Qualcomm a Strong Buy with a $223 price target over the next 12 months. This highlights a 23% upside possibility and broader market outperformance. 36 Wall Street forecasts a $192 price target over the next year, implying a 5% upside potential. I feel more bullish, but it will be interesting to see whether forecasts materialize

Enjoyed this article? Sign up for our newsletter to receive regular insights and stay connected.