The Thesis

Moving into the second half of FY25, the leading semiconductor company, Advanced Micro Devices (AMD), reported another strong quarter, continuing its robust momentum across the consolidated topline. The company also looks well-positioned to sustain this growth further, with continued strength on the client and gaming side and robust demand for its 5th-gen EPYC processors and Instinct GPUs with rising adoption among hyperscalers and enterprises. However, margin prospects still look weak as the company continues to invest aggressively in R&D for product innovation and upgrades to stay competitive in this rapidly evolving AI-driven market.

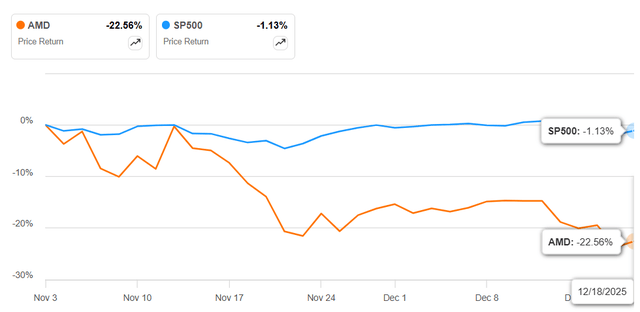

The AMD stock has declined in high teen percentages since my hold article earlier in November. Although the valuation multiple has slightly improved, it remains elevated, especially compared to its close peer, NVDA. Considering these factors, despite a favorable outlook in the short to medium term, I see limited justification to turn bullish at these levels. Hence, I am maintaining a neutral stance.

AMD’s Q3 2025 Highlights

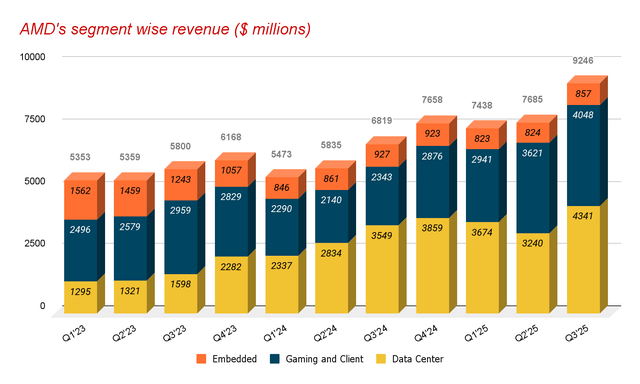

AMD reported its third-quarter results for FY25 a month ago in November, continuing the strong momentum into the second half of the year. The company’s consolidated topline expanded approximately 35.6% year on year to a record $9.25 billion. While results were solid across both the key segments, this consolidated growth was primarily driven by a strong 73% jump in the company’s Client & Gaming segment, with record demand particularly for its Ryzen offerings.

While the company’s core data center segment was also up about 22% versus the prior year to $4.34 billion, the embedded segment remains under pressure as it reported another quarter of single-digit decline in its sales in Q3 FY25.

AMD’s Quarter revenue (Research Wise)

Although topline momentum continued entering into the second half of 2025, the company’s overall profitability remains slightly under pressure due to elevated AI related R&D investments. As a result, the company’s adjusted EBITDA margin contracted about 140 bps year over year to 26.3% in the last quarter. However, with steady EBITDA growth, the company’s bottom-line performance remains strong, as the company’s adjusted EPS increased to $1.20 as compared to $0.92 a year ago, surpassing the consensus estimate by $0.03 during Q3 FY25.

Comments On Outlook

After a modest FY24, AMD has consistently reported strong double-digit growth across its consolidated topline throughout FY25, including the latest Q3, with broad-based strength across the key segments. With record demand levels across the company’s AI data centers and gaming portfolios, I expect this momentum to continue further.

In the data center business, AMD continues to see solid traction for its Instinct accelerator portfolio, along with rapid adoption of its 5th Gen EPYC processors, as hyperscalers continue to expand both AI and general-purpose compute capacity to support increasing AI workloads. Cloud-related demand also remains strong, as demonstrated by strong EPYC adoption in the cloud by large businesses, which nearly tripled as compared to a year ago. With many customers now planning for significantly larger CPU build-outs in the quarters ahead, AMD’s server business should continue to see steady demand in the quarters ahead.

EPYC adoption among enterprises also continues to broaden. AMD also had multiple large wins in the last quarter across Fortune 500 companies across sectors, including technology, retail, financial services, and telecom. These wins should further accelerate EPYC penetration among enterprises in the quarters ahead and support steady volume growth through FY26.

Recently, Oracle became the first hyperscaler to publicly offer AMD’s Instinct MI355X instances, expanding the availability of AMD GPUs in large-scale cloud environments. Although NVIDIA remains the dominant player in the AI accelerator space with the unmatched performance of its Blackwell B200, AMD’s MI355x also delivers competitive performance for certain workloads, with lower cost and better availability, making it a cost-effective alternative. Considering these factors, I believe AMD’s presence across hyperscalers should improve gradually and support demand for its Instinct portfolio over the coming quarters.

On the software front, AMD recently launched ROCm 7, its most advanced software stack to date. ROCm 7 delivers about 3x higher training performance, along with 4.6x higher inference, versus ROCm 6. While NVIDIA’s CUDA ecosystem remains far more mature in this space, I believe, with material improvement in performance and better stability, adoption barriers for AMD’s software stack should be reduced. With this, customers in the cloud and enterprise are likely to deploy AMD accelerators at scale, supporting broader adoption over time, benefiting the company’s data center business through FY26.

AMD’s Client and Gaming segment also continues to experience robust demand, with strong momentum across the company’s Ryzen portfolio. During the last quarter, AMD’s desktop CPU sales reached record highs due to robust adoption of its Ryzen 9000 series processors, which remain highly competitive in terms of performance across gaming, productivity, and content creation.

In my view, with increasing integration of AI capabilities and strong performance, demand for AMD’s PC processors should remain healthy, further helping the company gain share in the premium PC market. While the company’s AI-enabled PCs continue to gain traction, I expect this segment to remain a steady contributor to the consolidated topline in the quarters ahead.

Looking beyond FY26, AMD’s outlook remains favorable with the company’s continued focus on expanding participation across the AI infrastructure stack and its strong product roadmap. The company is set to launch its latest and most advanced accelerator series, MI400, and its Helios rack-scale AI platform in the latter part of 2026. These upcoming launches should further strengthen AMD’s position and enhance its competitiveness in large-scale AI deployments.

However, we can’t just ignore the fact that NVDA’s competitive moat remains significant due to its entrenched software ecosystem and dominant position, particularly in AI accelerators. I think this competitive pressure is likely to limit the pace at which AMD could capture its market share in AI GPUs. But it is also true that AMD has significantly improved its performance and expanded its AI portfolio over the past quarters. This, along with its differentiated strengths across CPUs and semi-custom chips and incremental contribution from the recent OpenAI deal, is likely to provide AMD with multiple growth vectors in the long term, which should continue to support it delivering steady growth across its consolidated top line over the coming years.

Valuation Update: Still Not Reasonable

I previously covered the AMD stock a couple of weeks back in November, ahead of its Q3 earnings results. I keep a neutral stance and gave this stock a hold rating ahead of Q3, primarily due to its premium valuation after a massive rally of over 200% after hitting lows in April this year. As the company posted its Q3 results, my concern materialized as the stock fell nearly 10% despite a double beat.

Although the stock tries to recover later, weakness in the broader market keeps the selling pressure continuing. As a result, since my hold article, the stock has slid nearly 20% by the time of writing this article, significantly underperforming the S&P 500, which has declined by just about 1% during the same period.

AMD’s stock performance since last article (Seeking Alpha)

Although the recent pullback has notably improved the stock’s valuation, it remains elevated. Currently, the company’s stock is trading at a forward non-GAAP P/E of 53.82, based on its FY25 consensus EPS estimate of $3.97. Based on next year’s (FY26) consensus estimate of $6.44, the company’s forward multiple of 33.05x appears more reasonable.

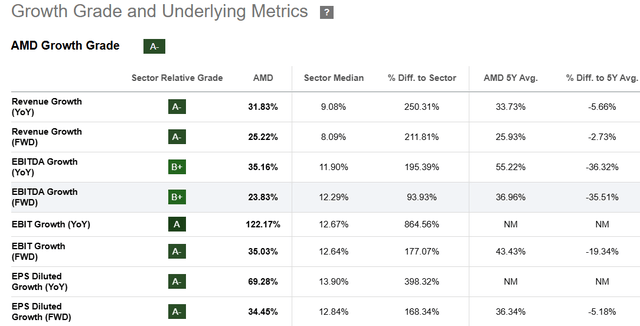

However, when compared with the forward multiple of its close peer NVDA, which trades at just around 24x its FY26 earnings, AMD’s stock appears slightly expensive. AMD’s premium looks even more unreasonable when we look at its forward growth expectation, which, apart from being significantly lower than that of NVDA, remains weaker than its own historical average, as can be seen in the company’s growth table below.

AMD’s growth table (Seeking Alpha)

Going ahead, I expect the continued strength across the company’s data center and client portfolios to support its consolidated topline growth in the quarters ahead. Meanwhile, overall profitability is expected to remain under pressure in the short term, as the company continues to make significant investments in R&D, particularly related to AI offerings, to capitalize on expanding AI opportunities across end markets. Although topline is expected to expand in double digits, pressures from massive R&D investments are likely to keep margins under pressure at least through FY26.

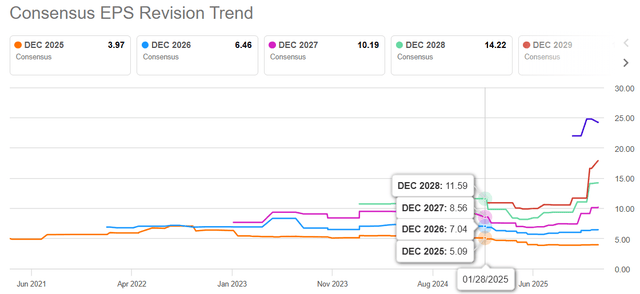

While the consensus EPS estimate was revised slightly upward from $3.94 to $3.97 after a double beat in Q3, the broader EPS revision trend remains negative, suggesting that Wall Street remains cautious about AMD’s medium-term earnings trajectory.

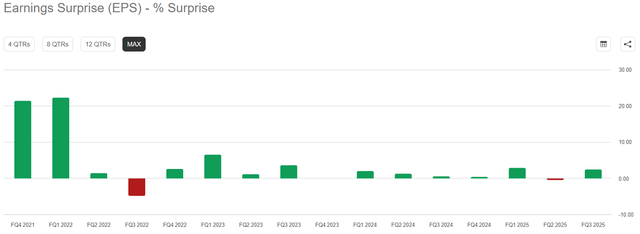

AMD’s consensus EPS revision trend (Seeking Alpha) AMD’s past earnings surprise (Seeking Alpha)

Although many supporters of the bull case argue that consensus estimates are too conservative and fail to reflect AMD’s longer-term growth potential, especially given its relatively smaller market cap and a huge TAM, the company has struggled to report any meaningful strong earnings beat in the past few years. For the past two years, AMD’s results have come in just slightly above expectations. I think this pattern indicates that, at the current valuation, much of AMD’s near-term growth is already priced in.

Overall, while margin softness is expected to continue in the short term, despite steady topline growth, AMD’s bottom-line performance might remain subdued in the quarters ahead. In addition to this, given a negative EPS trend, we can expect more downward revisions in the short term, which might further deteriorate the stock valuation in the future.

Final Verdict And Rating

As discussed above, despite the recent sell-off, the AMD stock continues to trade at a significant premium. While continuing demand momentum with strong adoption of AMD’s EPYC processors and its Ryzen portfolio positions the company strongly to sustain its topline growth in the quarters ahead, margin prospects remain weak in the short term due to significant R&D investments. Given these factors, I believe the risk-reward remains balanced, supporting a neutral stance until either the multiple becomes more compelling versus its peers or earnings momentum meaningfully improves. Therefore, I am maintaining a “HOLD” rating on the AMD stock for now.

Enjoyed this article? Sign up for our newsletter to receive regular insights and stay connected.